Together with incapacity advantages gives a extra full image.

The Social Safety actuaries simply launched a examine that takes a brand new take a look at the progressivity of the Social Safety program – that’s, the extent to which it pays comparatively extra beneficiant advantages to low earners than to excessive earners. The same old story focuses on “cash’s value” of retirement advantages, highlighting the offsetting results of two components. On the one hand, Social Safety helps these Black employees and others with low schooling – and subsequently low earnings – by means of the progressive profit construction. Alternatively, the worth of lifetime advantages inherently will increase for people who are likely to dwell longer, who’re usually more-educated, White employees with larger earnings.

The brand new examine straight addresses this situation – progressive profit components vs. longer life expectancy – by utilizing completely different life expectations for high and low earners. It goes a step additional, nonetheless, by together with Social Safety’s incapacity insurance coverage within the evaluation. Whereas low earners have shorter life expectations, they’re extra more likely to qualify for incapacity insurance coverage. The foremost discovering is the distinction in life expectancy by earnings is roughly offset by the distinction in incapacity by earnings ranges.

Earlier than trying on the outcomes, the authors of the brand new examine acknowledge that their “cash’s value” method doesn’t replicate the extra worth that Social Safety advantages supply by way of “peace of thoughts.” This insurance coverage reduces the monetary dangers related to excessive outcomes resembling loss of life or incapacity at a younger age or survival to very outdated ages. As famous in an earlier weblog, my colleagues examined the distributional facets of 1 “peace-of-mind” element – specifically, the longevity insurance coverage related to retirement advantages. As a result of Social Safety gives a life annuity, it presents households safety towards outliving their assets. The worth of this safety will increase with the unpredictability of their lifespan. It seems whereas low earners have decrease common lifespans than others, they face better uncertainty round these averages.

Turning again to Social Safety’s new cash value’s evaluation, the primary train entails calculating the inner charge of return for 4 sorts of hypothetical employees, born in 11 completely different years, at 5 factors within the earnings distribution. Furthermore, as a result of the Social Safety program’s projected revenue is not going to cowl scheduled advantages after 2034, the outcomes are proven below 3 financing eventualities – present legislation, elevated payroll tax, and diminished advantages. Lastly, the outcomes contain 2 variations of every desk – one with none adjustment for the various life expectancy and variations in incapacity incidence and one with out. In all, the entire is 6 tables, every containing 220 inside charges of return.

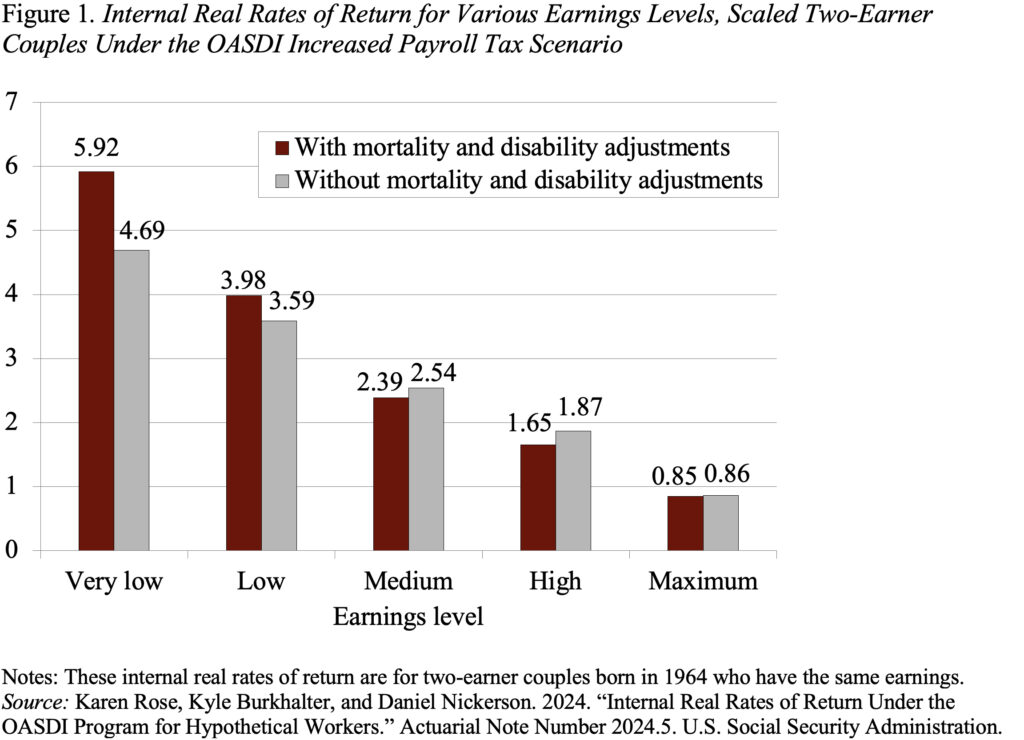

As a result of the story is constant throughout eventualities, the essential discovering might be summarized by one group of earners – two-earner {couples} – born in 1964 below the state of affairs that assumes that the payroll tax is elevated to cowl promised advantages. The outcomes present that this system is progressive – charges of return decline as earnings improve – and that the sample could be very related with and with out accounting for variations in life expectancy and the incidence of incapacity (see Determine 1). That’s, as famous at first, the distinction in life expectancy by earnings is roughly offset by the distinction in incapacity by earnings.

The one consideration so as to add again is the latest proof in regards to the “peace-of-mind” that Social Safety presents by lowering the danger related to excessive occasions. No less than on the retirement facet, the advantages of longevity insurance coverage are additionally progressive as a result of the worth of this insurance coverage will increase with the unpredictability of lifespans, and low earners face better unpredictability. Thus, Social Safety advantages are much more progressive than the Social Safety actuaries’ new examine would recommend.