Share this

Our lives are basically made up of subscriptions as of late. We subscribe to streaming providers like Netflix, Hulu, HBO GO, and extra to get our leisure repair. Spotify for music. The New York Occasions for information. We subscribe to family fundamentals like bathroom paper and vitamin dietary supplements from Amazon. We get subscriptions for our espresso (Loss of life Want Espresso), razors (Greenback Shave Membership), clothes (Sew Repair), and for even weirder issues like keto snacks, socks, dive bar shirts, menstrual gadgets, and extra.

Mainly, we stay within the Age of the Subscription.

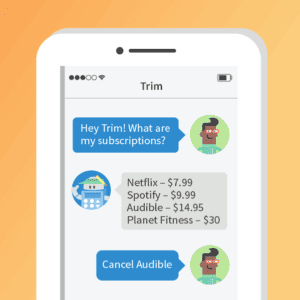

Generally we’d like a daily reminder to audit what we really use, what we’d like, and the way we are able to save ourselves cash every month—and typically the Web even offers us what we wish and want. Trim, “An Assistant That Saves You Cash,” is aiming to supply us with simply that reminder. Trim needs to automate saving cash for its customers, and one technique of doing that’s itemizing our subscription providers: Trim present us what we spend, the place we spend it, and empowers us to save lots of our cash from stuff we don’t use. It’ll even cancel these providers for us if it might.

Right here’s what Trim does: you join an account, and join your financial institution and bank card accounts to your Trim account. Then your private monetary assistant (it’s an AI) goes to work. Trim will analyze your transaction historical past line by line to establish recurring subscription prices. After it goes by means of all of your knowledge, you obtain a textual content message with an inventory of your subscriptions and their numerous prices. (You may as well obtain Trim messages by way of Fb Messenger.) If you wish to cancel one thing, merely textual content Trim a command—pro-tip, the command is “Cancel _____”. You fill within the clean with the identify of the service. If their computerized system can do it, it would – by sending both a type e-mail or making a telephone name. It would even ship licensed mail in some instances! (Word that, typically, Trim would possibly require further data to cancel a service.)

There are events when Trim can’t automate the cancellation for you – everyone knows that some firms need particular data from its clients earlier than they cancel, and Trim can’t at all times reply these questions for you. They’ll let you understand when that’s the case, in fact.

You don’t ever need to manually schedule a overview of your subscriptions both. Trim will frequently scan your accounts, and message you when it notices a brand new subscription.

Trim might signify a terrific financial savings device for these snug with sharing their monetary knowledge with the corporate. On their FAQ web page, Trim states that they won’t promote your knowledge, share it with third events, or use it for another objective than to investigate it with their private monetary assistant. Additionally they use 256-bit SSL encryption, encrypted databases, and two-factor authentication while you log in. Mainly, Trim is saying that in the event you’re snug logging into your checking account on-line, you have to be snug utilizing their service.

Sounds too good to be true, proper? Like, how is Trim earning money in the event that they’re doing all this totally free AND not promoting your data? Effectively, Trim does greater than cancel your undesirable subscriptions. They activate money again offers, and flag worth drops on Amazon. Additionally they negotiate decrease payments for you on some providers—most notably, for now, your cable and Web invoice. After they efficiently scale back your cable invoice for you, they take a share of the cash you save. They’re automating that course of too, and hoping to develop the service to embody scholar mortgage funds, automobile insurance coverage, and extra sooner or later.

I extremely suggest giving your spending an in depth look, whether or not it’s personally or by means of a service like Ask Trim. We lately got here to the conclusion we had been spending nearly $150 a month on subscriptions we actually didn’t want or use any longer. And if that’s cash you actually aren’t lacking anyway – clearly, because you haven’t taken the time to cancel up thus far – that’s cash that may simply be rerouted into some kind of retirement financial savings. In line with Begin Late, End Wealthy – certainly one of my all-time favourite books for freshmen desirous to create wealth – investing simply $150 a month for 30 years might accumulate to nearly $340,000. How will you cross that up? Should you might squeeze out $450 in financial savings and canceled subscriptions, it’s possible you’ll be taking a look at over $1 million over the course of 30 years.

Give Trim a attempt if this feels like one thing which may profit you and your pockets – and you should definitely let me know the way the expertise goes! If Trim efficiently saves you cash, all of us need to hear about it.