Although opinions range on particular person shares vs. index funds, my very own investments replicate a mix of each, from dividend and progress shares to index funds, ETFs, and managed mutual funds.

Although opinions range on particular person shares vs. index funds, my very own investments replicate a mix of each, from dividend and progress shares to index funds, ETFs, and managed mutual funds.

My uncle gave me one share of Chevron for my twentieth birthday in 1995, and I constructed a person inventory portfolio from there.

A retirement mutual fund portfolio spawned from my first job in 1998, and I contributed to employer tax-advantaged accounts till I left my company profession in 2022.

As I method my fiftieth birthday, I’ve been fascinated by what I would like my complete portfolio to appear like in 10, 20, and 30 years.

Its present state shouldn’t be the longer term state.

For years, I purchased particular person shares to construct funding revenue by way of the dividend progress investing technique. I focused high-quality corporations with a protracted historical past of paying and rising dividends.

Not like market fluctuations, dividend revenue is predictable. I like predictable, steady revenue streams. That’s what attracted me to dividend progress shares for therefore lengthy.

Nevertheless, it requires choosing shares, and it’s difficult to beat the market indexes over prolonged durations.

Most actively managed fairness mutual fund managers can’t beat the market indexes. So why hassle making an attempt?

For most individuals, shopping for particular person shares:

- Is loads of work

- For inferior returns in comparison with index funds

- With higher threat

Once you’re unwilling to place within the analysis time, the chance of underperformance will increase.

A decade in the past, I’d spend many hours per week researching shares. Shares had been an escape from a profession I didn’t love.

However what I’ve discovered since leaving my company profession is that I now not wish to spend time researching shares. I favor to work on my enterprise, spend time with household and associates, and journey.

But, I nonetheless personal a considerable variety of particular person shares. So, I’m slowly simplifying my portfolio to scale back particular person inventory holdings and transfer cash into mutual funds and ETFs.

Resulting from tax planning, the transition to a perfect portfolio state will take a decade or extra.

The Present State

Mrs. RBD and I’ve two Constancy Roth IRAs, two Constancy Conventional IRAs, a SEP IRA, a former employer-sponsored account, and two taxable brokerage accounts.

These accounts primarily maintain fairness index funds and ETFs but additionally particular person shares, bond funds, and a few managed mutual funds.

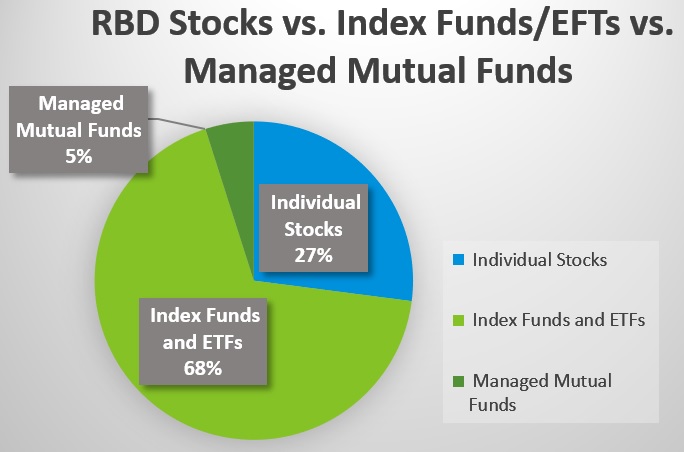

In 2018, I analyzed all our accounts to find out the allocation of particular person shares vs. index funds + ETFs, and managed mutual funds.

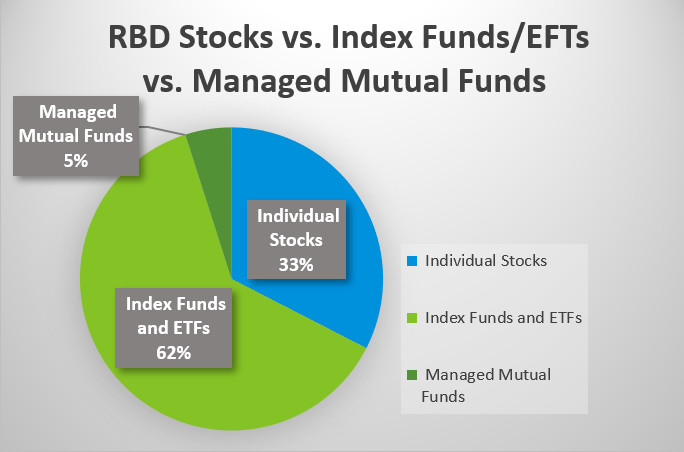

In October 2024, I analyzed our portfolio once more. Right here’s what I realized:

March 2018

October 2024

Since 2018, our particular person inventory holdings have elevated as a proportion of our complete portfolio, from 27% in 2018 to 33% in 2024.

This was shocking, as I’ve already began transitioning away from particular person shares.

I can assume of some the reason why my particular person inventory holdings have elevated.

First, I aggressively purchased particular person shares from 2018 into 2022. However I used to be additionally maxing out retirement accounts throughout that interval, placing extra money to work in index funds than particular person shares.

So why is there a higher allocation towards particular person shares?

Throughout that point, our retirement accounts advanced from a 100/0 inventory/bond ratio to 90/10. That decreased the index fund efficiency towards the person inventory holdings.

I additionally purchased small cap, mid cap, giant caps, REITs, and worldwide and rising market index funds. These have all underperformed home large-cap shares. Most of my particular person inventory holdings are home giant caps, which have risen with the tide.

I additionally dabbled in progress shares. Just a few holdings took off since 2018, together with Apple (AAPL), The Commerce Desk (TTD), Meta (META), CrowdStrike (CRWD), and Costco (COST). I nonetheless personal all of them.

I purchased loads of losers, too! However these holdings absolutely contributed to the present imbalance.

Causes to Purchase Particular person Shares vs. Index Funds

I’m professional index fund, and I favor them as we speak over particular person shares.

So for those who’re all in there, that’s nice. The case for less than investing in a handful of index funds and ETFs could be very sturdy.

In my case, choices I made years in the past imply I’ll proceed to carry particular person shares for years, and I’m OK with that.

The fantastic thing about index investing is it requires little or no analysis. Merely select a couple of low-cost index funds with broad holdings and frequently put money into them for the long run. Experience out the market fluctuations and don’t promote when it declines.

The low-cost nature and ease of investing in them has pushed money to Vanguard and Blackrock (iShares), now the 2 largest U.S. cash managers.

Nevertheless, investing in particular person shares nonetheless has benefits and is a legitimate technique. Listed below are a couple of advantages.

Create a Portfolio of Dependable Earnings

This is the reason I spent years shopping for particular person shares. Proudly owning dividend progress shares is a solution to construct a predictable and sustainable revenue stream that’s primarily passive after the preliminary analysis.

Select shares that traditionally pay and develop their dividends to earn revenue higher than the inflation fee. The secret is to purchase corporations which are well-managed, have a aggressive benefit, and are resistant to financial cycles.

Index funds pay dividends, too, however the yields are low, and cost quantities are inconsistent. Some low-cost funds and ETFs concentrate on dividend-paying corporations, and I like these too.

Simply know that the consolation of perpetual revenue of dividend shares might enhance your taxable revenue and decrease returns.

Personal Solely the Firms you Like

I’ve by no means owned two standard dividend progress shares: McDonald’s (MCD) and Walmart (WMT). I don’t personal them as a result of I favor to eat and store elsewhere.

I’ll go to Goal (TGT) or Costco (COST) any day over Walmart. If I don’t just like the buying expertise, I shouldn’t personal the inventory (although I do personal it not directly by funds).

Investing in shares individually lets you select the businesses you want or don’t like. That is useful for folks loyal to a sure model or make investments primarily based on their values (setting, faith, and so forth.).

Watch out of bias. You could have most well-liked buying at Sears, however the inventory was awful.

Don’t Personal the Firms You Don’t Like

Complete U.S. market index funds personal inventory in all of the publicly traded corporations within the U.S. That features the so-called vice shares reminiscent of cigarettes, playing, alcohol, and firearms shares.

Should you purchase your shares individually, you may keep away from the businesses you don’t wish to personal.

This matter has come to mild within the aftermath of a number of faculty shootings. Some buyers don’t wish to personal firearms shares or those who negatively influence the setting greater than different corporations.

Potential to Outperform the Market

Investing solely in index funds will underperform the markets by the expense ratio in your funds. For many buyers, that could be a very acceptable return.

By shopping for particular person shares on high of index funds, you’re prone to cut back returns and enhance threat over a number of years.

Nevertheless, you permit open the potential to beat the markets. However you’re unlikely to crush market returns with a diversified portfolio of dividend shares.

I’m an advocate for utilizing a small proportion of your portfolio (5% to 10%) for hypothesis to try to extend returns.

Speculative investments may be invested in progress shares, choices contracts, crypto-currencies, IPOs, enterprise capital, a enterprise, or no matter floats your boat.

Taking larger dangers provides you the potential to outperform, one thing you’re assured not to get from indexing.

Younger folks, particularly, can afford to lose and should profit from making a dangerous funding. That is particularly worthwhile when you’ve got some type of benefit, reminiscent of a background in a sure occupation or self-discipline that will make you aware about trade developments or a rising know-how.

Should you’re going to invest, investing cash or time into actual property or beginning a enterprise is a extra controllable endeavor than choosing shares.

The mechanics of investing in shares are easy and tempting, however choosing the following Nvidia ten years earlier than it explodes requires extra luck than onerous work.

Guess on your self earlier than betting on another person.

Barely Decrease Price

Relying on the way you assemble your portfolios, it can save you on charges by particular person inventory investing.

Particular person shares haven’t any charges.

Alternatively, index funds and ETFs carry a recurring annual charge referred to as the expense ratio. The bottom-cost funds have an expense ratio of round 0.03%.

Should you put $10,000 in a fund, the annual charge taken out shall be about $3. Because the fund worth will increase, so do the charges. You additionally might pay buying and selling charges for those who purchase an index fund or ETF by an account that doesn’t present free trades.

Inventory ETF dividends are handled the identical as particular person shares.

Mutual funds usually distribute capital positive factors greater than ETFs, so goal to personal them solely in tax-advantaged accounts.

We’re speaking small quantities right here for learners, so expense ratios aren’t a serious ding on indexing. However low charges are one of many fundamental arguments for index funds, and shopping for particular person shares is definitely cheaper, particularly because the numbers develop.

However the decrease price of shopping for and proudly owning particular person shares can rapidly be eroded by subpar returns.

Arguments In opposition to Shopping for Particular person Shares

Sure, there are fairly a couple of arguments towards shopping for particular person shares. I’ll begin with the apparent.

You might be Unlikely to Beat the Market

It’s not inconceivable to beat the market as a person investor. But it surely takes some talent and luck. Luck tends to run dry as funding horizons broaden.

The time funding required to spend on analysis to beat the market yr after yr would in all probability detract from the standard of your life.

You may nonetheless attempt to decide a profitable progress inventory by hypothesis. Simply preserve your expectations low. You in all probability gained’t win over the long run except you decide one or two large winners and maintain them for a few years.

Emotional Bias

Feelings are the weak point of buyers. Investing in shares is the proper discussion board for emotional bias. I like buying at Costco, and the one close to me is all the time busy.

Ought to that imply I purchase the inventory too? For me, it did play an element in my resolution. I take pleasure in buying there, however I researched the basics and valuation, too.

Understanding bias and continually taking part in satan’s advocate towards your self is essential for investing in particular person shares. It may be tiresome.

Generally, bias is inconceivable to keep away from as a result of it’s subliminal. A pure index fund technique, by thick and skinny, avoids any ill-placed bias that would hurt your returns.

Larger Threat

Since there’s no approach you’ll individually personal as many shares which are in a broad complete market index fund, your particular person inventory portfolio is at higher threat of volatility.

Extreme declines as a result of a chapter, a Lehman Brothers-style disaster, or one thing unknown as we speak would have a higher influence in your portfolio as a proportion of the entire portfolio in comparison with a broad index fund.

Not Good at Choosing Shares

When you have no expertise and haven’t learn any books on investing in shares, you gained’t select good shares.

Following the recommendation of an adviser might show you how to, however the charges will offset positive factors. Alternatively, you may heed the recommendation of TV personalities or subscribe to a inventory publication, however for those who don’t know what you’re doing, it would ultimately catch as much as you.

I like to recommend a couple of inventory newsletters for individuals who already personal particular person shares and must preserve tabs on them or are in search of alpha by way of progress shares.

Don’t Have the Time

Merely put, for those who don’t have the time to analysis and choose shares, don’t put money into particular person shares. With out analysis, you’ll not carry out effectively. Go along with index funds as a substitute.

Taxes on Dividends

Index funds, ETFs, and a few particular person shares pay dividends. When paid a dividend, that cash is taxed. Most dividends are certified, that means they’re taxed on the long-term capital positive factors fee of 15% for most individuals.

Should you’re allergic to taxes, use a conventional IRA or Roth in your dividend investing. Or purchase non-dividend paying shares in a taxable account.

For tax effectivity, ETFs are a greater possibility in a taxable account than mutual funds as a result of they pay out fewer capital positive factors.

Nonetheless, ETFs normally pay a dividend, which is topic to tax in a non-retirement account.

Even when You may Beat the Market, it is probably not Well worth the Time

The S&P 500 was up 26.29% in 2023, together with dividends. Should you spent numerous hours researching shares and your returns beat the market by 2%, was the time value it?

If you’re going for complete return, making an attempt to squeak out an additional p.c or two will take up loads of your time that could possibly be higher spent having fun with your self.

Conclusion — Particular person Shares vs. Index Funds

This weblog began primarily as a inventory investing web site. Now, I write extra about broader investing and private finance themes. I take pleasure in writing about these matters greater than inventory evaluation, they usually attraction to a wider viewers, bringing extra readers to RBD.

Mutual funds have been on the core of my retirement financial savings since I began my profession in 1998. At Constancy, I’ve all of the funds and ETFs I must create an age-appropriate portfolio utilizing the minus-your-age rule of thumb.

Nevertheless, particular person shares will stay part of my technique for years, at the same time as I cut back my holdings and simplify my portfolio. I benefit from the dividend revenue, however I acknowledge I’ll wish to spend much less and fewer time researching shares as I age.

As a substitute, I can make the most of dividend ETFs to decrease my threat whereas persevering with to earn dividends. Or convert shares to low-dividend ETFs to scale back my tax burden and sure enhance long-term returns.

What’s your opinion on particular person shares vs. index funds?

Picture credit score: PublicDomainPictures by way of Pixabay

Disclosure: Lengthy all investments talked about on this article.

Craig Stephens

Craig is a former IT skilled who left his 19-year profession to be a full-time finance author. A DIY investor since 1995, he began Retire Earlier than Dad in 2013 as a artistic outlet to share his funding portfolios. Craig studied Finance at Michigan State College and lives in Northern Virginia together with his spouse and three kids. Learn extra.

Favourite instruments and funding providers proper now:

Boldin — Spreadsheets are inadequate. Construct monetary confidence. (overview)

Positive Dividend — Analysis dividend shares with free downloads (overview):

Fundrise — Easy actual property and enterprise capital investing for as little as $10. (overview)