Wants could also be unmet or bigger burdens might fall to households.

Medicaid is the nation’s publicly financed well being and long-term care program for low-income individuals. It was initially established to supply advantages to these receiving money help or “welfare.” Within the case of older Individuals, that supply of money advantages was – and stays – the Supplemental Safety Revenue (SSI) program. Over time, nonetheless, Congress and the states have expanded Medicaid to achieve a broad array of uninsured Individuals dwelling close to or beneath the poverty degree.

Medicaid is financed collectively by state and native governments. The federal authorities units some fundamental necessities, however states have the pliability to design their very own variations of Medicaid inside the federal statute’s fundamental framework. Spending on Medicaid has grown considerably over time as a proportion of GDP and as a proportion of federal and state budgets.

Attempting to know Medicaid truly made my mind harm. It’s loopy sophisticated with an array of advanced pathways to advantages. However, it seems that Medicaid is a extremely essential program for these 65+.

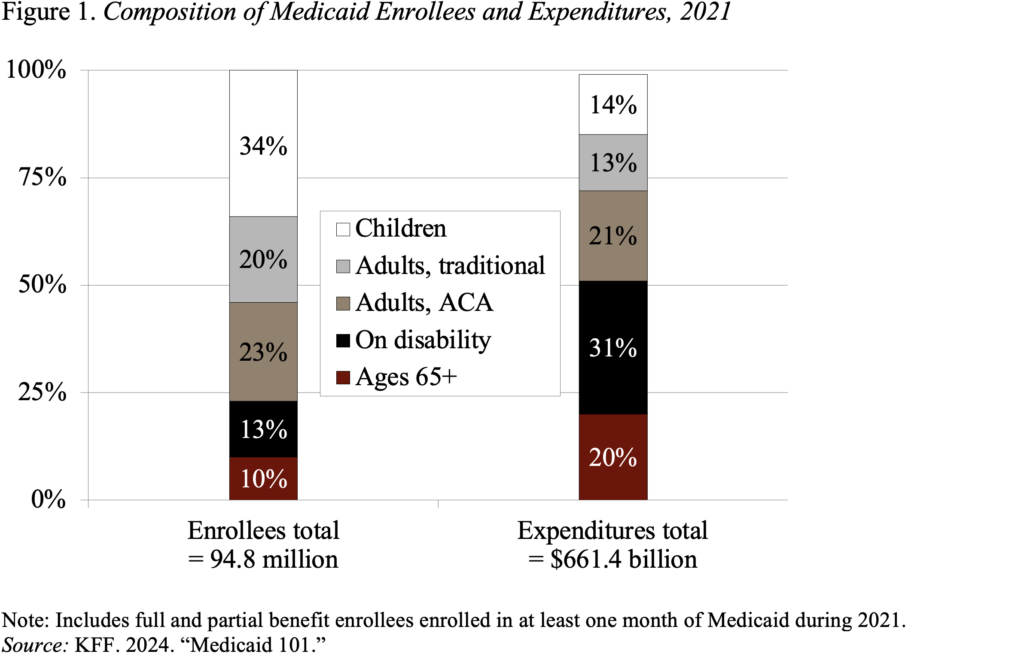

Medicaid offers advantages to 5 primary teams of low-income people – youngsters, adults (below 65) in households, adults (below 65) with out youngsters included below the Inexpensive Care Act (ACA), people with disabilities, and people who qualify based mostly on age (65+). In accordance with the newest information obtainable – 2021 – the aged 65+ group accounted for 10 p.c of beneficiaries and 20 p.c of spending (see Determine 1).

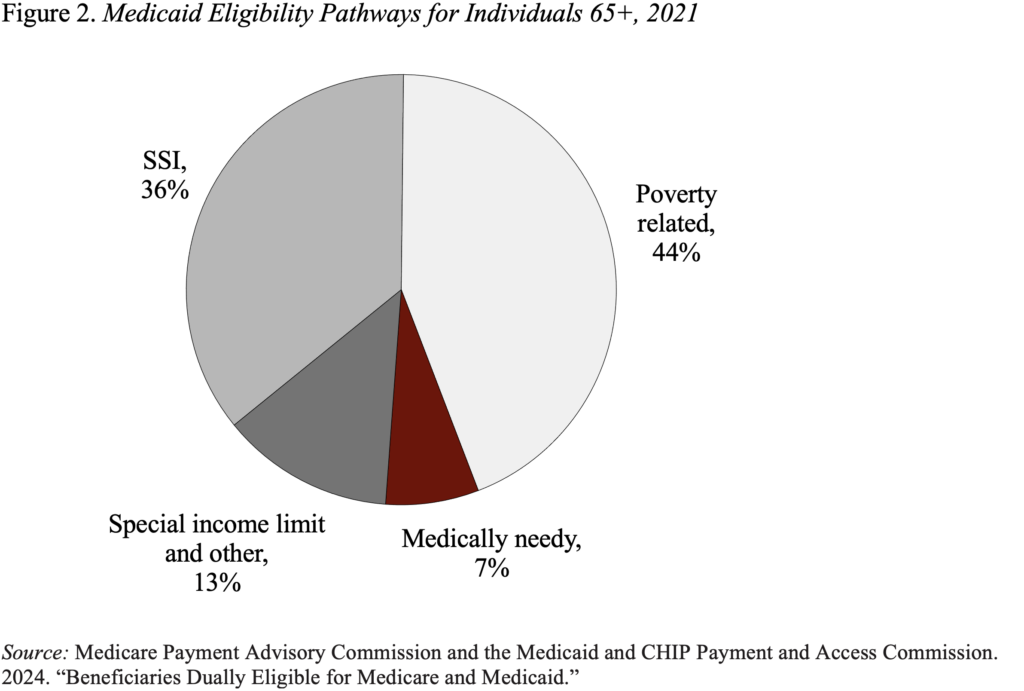

Throughout the Age 65+ group, Medicaid beneficiaries will be categorised as “categorically needy” and “medically needy.” As proven in Determine 2, most Medicaid beneficiaries are enrolled via categorically needy pathways – SSI, Particular Revenue Restrict, or Poverty Associated.

Medicaid offers two main varieties of advantages for these 65+. The primary – for each these eligible via SSI and the poverty-related paths – is Medicare Financial savings Applications to cowl some or all of their Medicare out-of-pocket prices. As well as,states are allowed to supply protection particularly for individuals who want long-term providers and helps, together with nursing residence care. One pathway to those advantages – provided by 42 states – is the “particular revenue rule,” which permits people with revenue as much as 300 p.c of the SSI limits to qualify for advantages. In 2004, the utmost month-to-month SSI profit is $943 per 30 days for a person and $1,415 for a pair, which is 75 p.c of the federal poverty degree. SSI beneficiaries are additionally topic to an asset restrict of $2,000 for a person and $3,000 for a pair.

Some states additionally lengthen Medicaid to “medically needy” people. Recipients should once more have belongings beneath limits that fluctuate by state however, below the fundamental guidelines, are usually just like the SSI asset limits. The revenue take a look at, nonetheless, is revenue web of out-of-pocket medical bills. Not all states provide this pathway, and medically needy people account for under 7 p.c of Medicaid beneficiaries ages 65+.

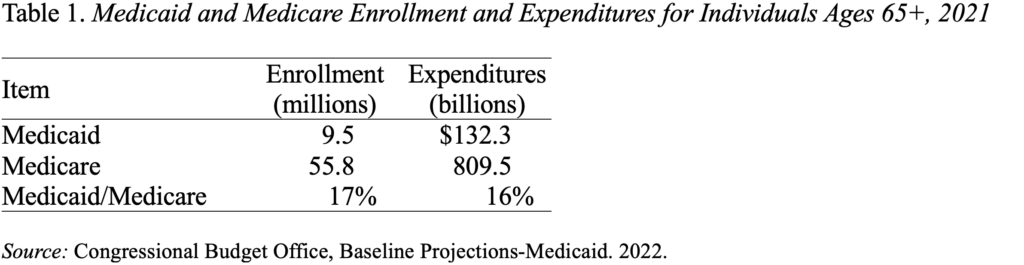

To get some thought of the significance of Medicaid to retirees, Desk 1 compares enrollees and expenditures for these 65+ below each Medicaid and Medicare. When it comes to each metrics, Medicaid accounts for 16-17 p.c of the Medicare determine.

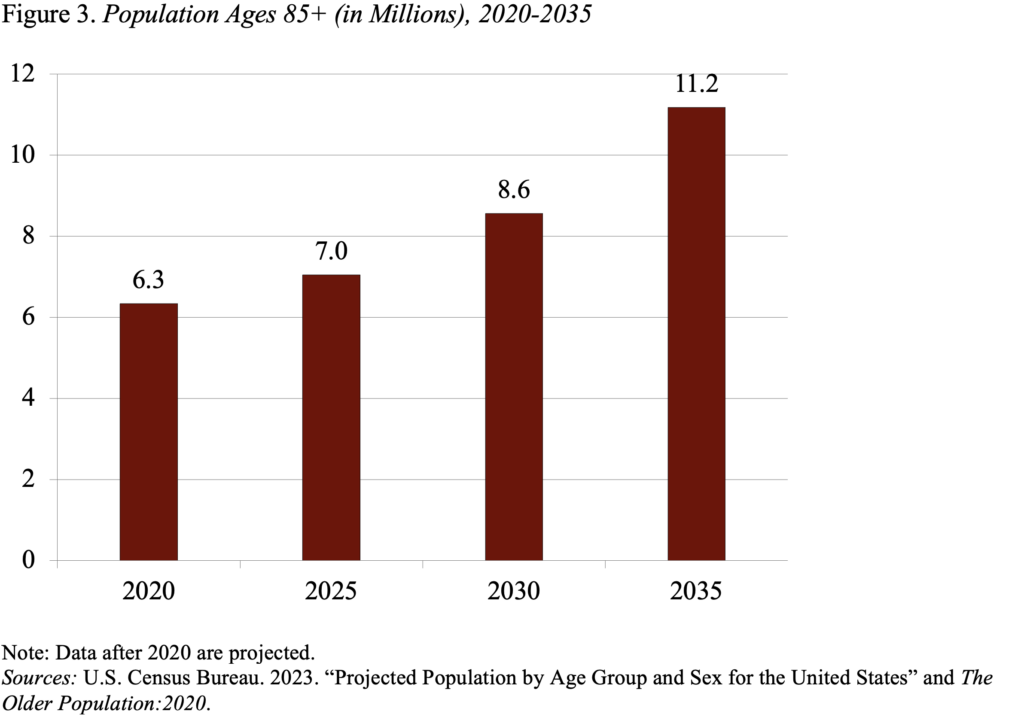

The extra essential query is what does future Medicaid spending seem like, provided that the variety of individuals 85+ – a bunch with substantial wants for long-term care – is projected to extend from about 7 million right now to 11 million in 2035 (see Determine 3).

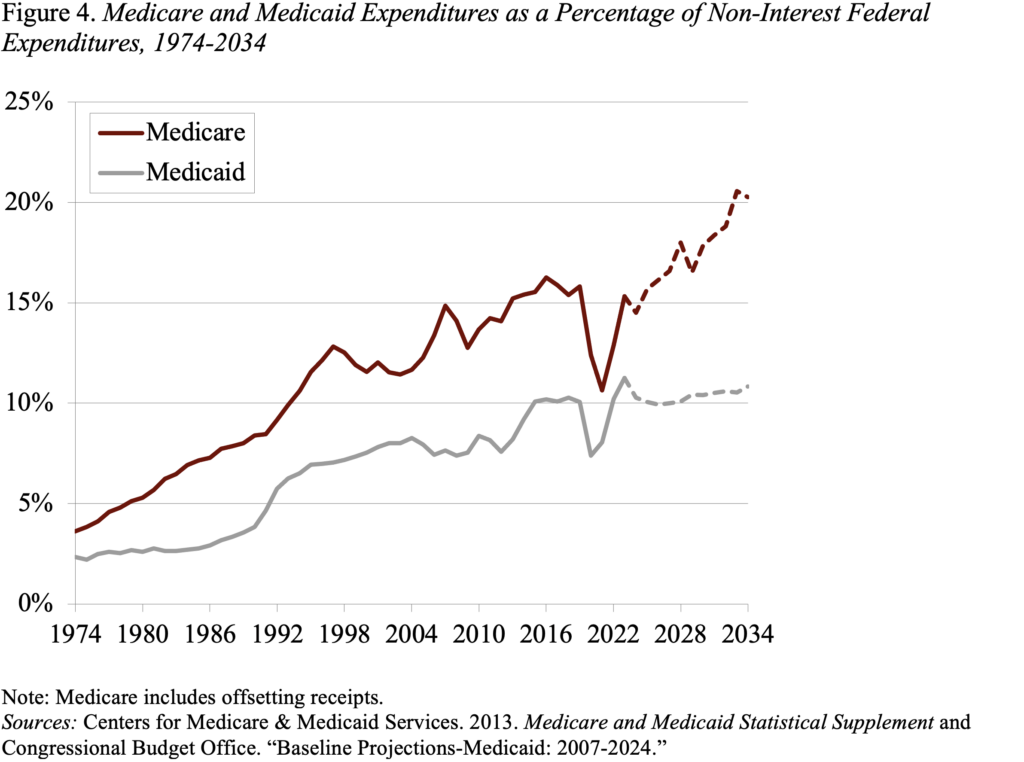

The Congressional Finances Workplace initiatives that Medicaid – in contrast to Medicare – is scheduled to carry regular at 10 p.c of non-interest federal spending (see Determine 4). For these 65+, it initiatives solely a 1-million improve in enrollment in comparison with the 4-million improve for these 85+ and solely a comparatively modest improve in prices per enrollee – maybe reflecting the saving on room and board as care strikes from nursing amenities to people’ properties.

The underside line, nonetheless, is that, regardless of the getting old of the inhabitants, Medicaid just isn’t projected to play a bigger function sooner or later than it does right now. The flipside of fiscal restraint could also be unmet wants or a bigger burden on households.