The Chinese language authorities instructions the economic system to develop

Many individuals prefer to type nations’ economies as both communist, socialist, capitalist or free markets. However lately, each nation has some model of a combined economic system. The sensible implementation of fiscal and financial coverage is turning into more and more extra gray than our previous black-and-white economics textbooks would have us consider. But, even inside the gray, China’s strategy for its financial system is uniquely troublesome to outline.

Again in 1962, when requested about constructing a socialist market economic system, future China chief Deng Xiaoping famously mentioned, “It doesn’t matter whether or not the cat is black or white, as long as it catches mice.”

Nicely, the present China leaders have let the fiscal and financial cats out of the bag, they usually’re hoping these cats are hungry.

We wrote about China’s housing issues a few yr in the past, warning about rising deflation fears. These points appear to have gotten worse, and the largest information in world markets this week was that China’s authorities determined sufficient was sufficient. And in a “command” economic system (which might be probably the most correct option to describe its strategy), the federal government has a really excessive diploma of management over financial levers. Consequently, markets reacted swiftly and positively to this information.

Listed here are the highlights of the multi-pronged fiscal and financial stimulus that the Chinese language authorities has determined to implement:

- Banks lower the amount of money they want in reserve (this is named the reservation requirement ratio) by 0.50%. It will incentivize banks to lend more cash (mainly “creating” 1 trillion yuan, USD$142 billion).

- The Individuals’s Financial institution of China (PBOC) Governor Pan Gongsheng mentioned one other lower might come later in 2024.

- Rates of interest for mortgages and minimal down funds on houses have been lower.

- A USD$71 billion fund was created for purchasing Chinese language shares.

That final level is fairly attention-grabbing to me. Right here you have got a supposedly communist authorities primarily creating a giant pot of cash to spend inside a free inventory market. The fund is to immediately buy shares, in addition to offering money to Chinese language firms to execute inventory buybacks. Good luck defining that motion in conventional financial phrases.

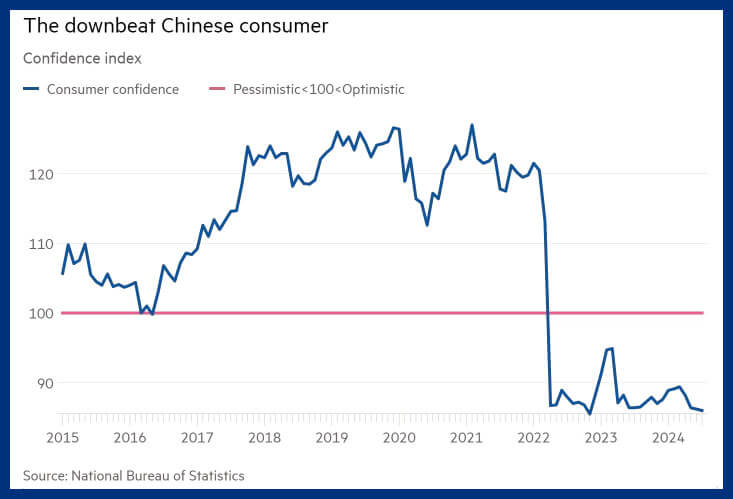

The concept is to present buyers and customers religion that they need to go on the market and purchase or put money into China’s increasing economic system. Clearly one thing main needed to be achieved to jolt Chinese language customers out of their malaise.

Early stories are speculating that the Chinese language gross home product (GDP) may fail to rise by lower than the 5% goal set by the federal government. If that’s the case, we’re about to see what occurs when the commander(s) behind a command economic system resolve that the GDP will rise it doesn’t matter what.