An extended look lowers estimates of its affect, however making saving simple stays important.

The identical analysis crew that documented the affect of auto-enrollment and auto-escalation in 401(okay) plans has returned to the subject to evaluate how real-life occasions have an effect on the longer-run impact of those computerized provisions. I feel it’s actually cool for researchers to return and kick the tires on earlier outcomes. My studying is that the authors nonetheless assume these computerized provisions are useful – and so they do little hurt – however the magnitude of the constructive impact on financial savings is far smaller than they’d initially thought.

Some background. As 401(okay)s began to switch conventional outlined profit plans within the Nineteen Nineties, critics famous the burden positioned on would-be members. They needed to determine whether or not or to not be part of the plan, how a lot to contribute, make investments these contributions, change asset allocations and their contribution price as they aged, deal with accumulations once they modified jobs, and the way to attract down investments in retirement. That’s rather a lot. In response, educational and trade of us tried to determine how altering plan design may make the method simpler and thereby improve participation charges and balances.

The foremost innovation capitalized on inertia. It concerned shifting the enrollment mechanism from opt-in, the place workers needed to proactively signal as much as take part, to opt-out, the place workers have been mechanically enrolled within the plan at a specific contribution price. In a 2001 examine, one member of the “gang” confirmed that when a big U.S. company launched auto-enrollment the share contributing to the plan elevated from 37 p.c to 86 p.c. This impact was a lot greater than that from employer matching contributions. Furthermore, later work discovered that it didn’t rely on the default contribution price, be it 3 p.c or 6 p.c. Noticeably, individuals have a tendency to stay with the default price.

Lots of this early work contributed to provisions within the Pension Safety Act of 2006, which inspired computerized enrollment and auto-escalation within the default contribution price. (The laws additionally sanctioned goal date funds.) And SECURE 2.0 requires most new 401(okay) pans to implement each auto-enrollment and auto-escalation.

Whereas the impact of the auto provisions on participation is obvious and sturdy, the impact on contributions is a little bit trickier. Auto-enrollment will improve the contribution price of those that would by no means have joined the plan and people who would have joined at a decrease price, however will lower contributions of those that would have contributed greater than the default. On common, the research confirmed that auto-enrollment elevated contributions. This discovering raises the query of the place the extra contributions come from. Did members cut back their spending or tackle extra debt? Whereas a examine of latest civilian hires within the federal Thrift Financial savings Plan confirmed little to no damaging credit score results, an evaluation of obligatory auto-enrollment in the UK, with a a lot bigger pattern measurement, discovered that the constructive impact of auto-enrollment on retirement plan saving was partially – about 20 p.c – offset by a rise in unsecured debt.

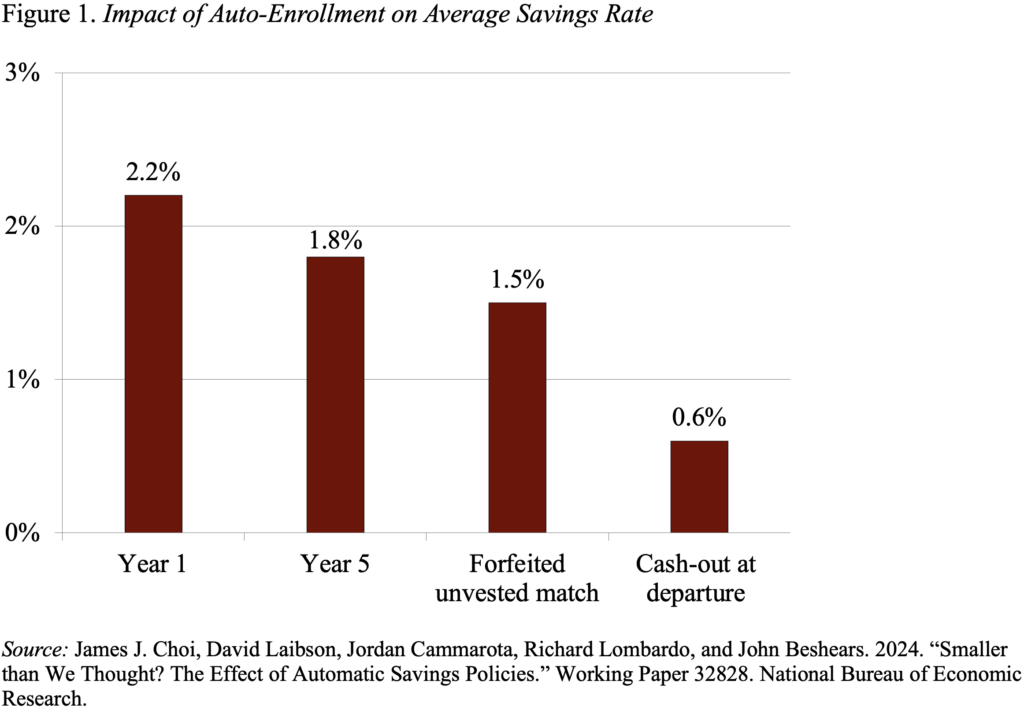

All that is background to the gang’s most up-to-date paper, which seems at different elements – past elevated debt – which may undermine the constructive impact of auto-enrollment. For his or her pattern, the first-year expertise means that auto-enrollment elevated the financial savings price by 2.2 proportion factors (see Determine 1). (For simplicity, this dialogue focuses on auto-enrollment, however incorporating auto-escalation produces an identical sample.) After 5 years of employment, nonetheless, this proportion drops to 1.8 proportion factors, as a result of many people not topic to auto-enrollment actively improve their contribution charges, which erodes a few of the financial savings hole. As well as, worker turnover is excessive, and lots of depart earlier than their employer matching contributions are totally vested, which additional reduces the increment within the saving price to 1.5 proportion factors. Lastly, as a result of these mechanically enrolled have comparatively small balances, their cash-out price at departure is increased than those that decide in, which additional reduces the increment within the saving price to 0.6 proportion factors.

So the place does that depart us? Auto-enrollment considerably will increase participation and has a constructive web impact on saving. And whereas taking a look at solely the first-year affect overstates the long-term increment to saving, specializing in the real-world problems overstates the damaging affect on worker well-being. Certainly, a number of thousand {dollars} could also be welcome help for an worker transitioning from one job to a different. So even when not good, making saving computerized and straightforward ought to proceed to be our objective.