The time period doesn’t actually matter, however about half of households will not be doing so effectively.

Reporters all the time wish to know “disaster” or “no disaster.” I don’t assume the time period is especially vital with respect to retirement safety, however commentary after commentary paints the identical image – roughly half of households will not be in good monetary form in retirement.

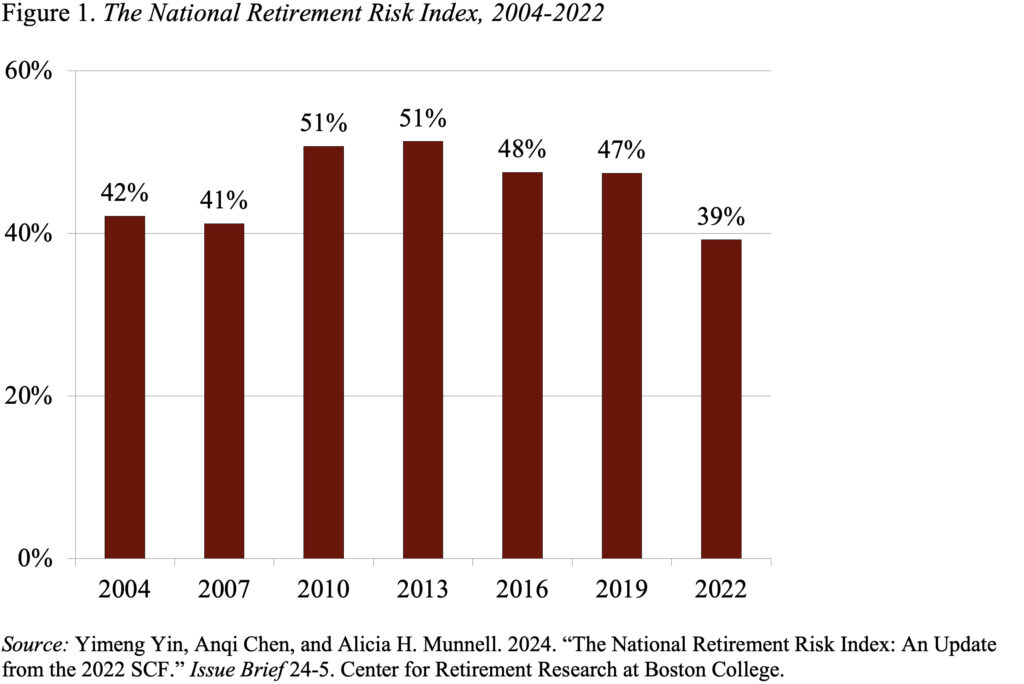

My finest gauge of how effectively households are doing is the Heart’s Nationwide Retirement Threat Index, which relies on the Federal Reserve’s Survey of Client Funds. The latest estimate reveals that 39 p.c of at this time’s working-age households won’t be able to keep up their lifestyle in retirement (see Determine 1). Distinctive components led to the bottom degree for the reason that NRRI first began – specifically, quickly rising house costs, new financial savings throughout the pandemic, and robust inventory market features. As a few of these extraordinary components fade, the Index will most certainly return to fluctuating between 40 p.c and 50 p.c.

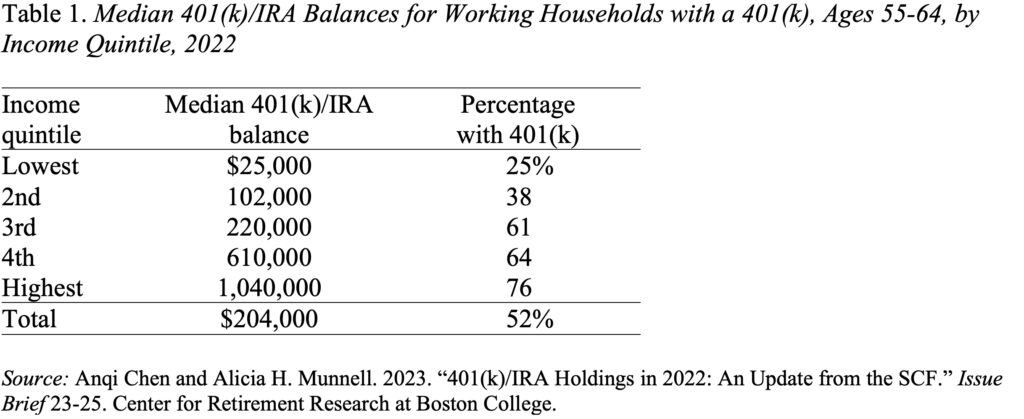

Reinforcing the notion that roughly half of households are in danger is the truth that solely half of working households ages 55-64 have any 401(okay)/IRA saving. Sure, some have outlined profit plans, however most with outlined profit plans even have a 401(okay). Furthermore, the quantities in 401(okay)s/IRAs are fairly modest, apart from the highest quintile of the revenue distribution (see Desk 1). If the couple within the center quintile makes use of their $220,000 to purchase a joint-and-survivor annuity, they may obtain about $1,200 per 30 days. Since this quantity isn’t listed for inflation, its buying energy will decline over time. Furthermore, this $1,200 is more likely to be the one supply of extra revenue, as a result of the everyday family holds just about no monetary property exterior of its 401(okay).

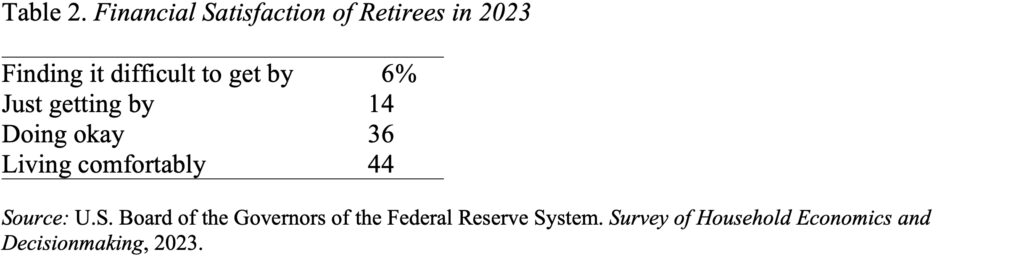

Regardless of the proof on the contrary, when older households are requested about how they’re faring, the overwhelming majority – 80 p.c – say they have the funds for to be doing okay or residing comfortably (see Desk 2). Some interpret the excessive satisfaction ranges as proof that retirement financial savings are enough. My guess has all the time been that older individuals are reluctant to say they’re doing poorly and simply modify to their monetary scenario, no matter it’s.

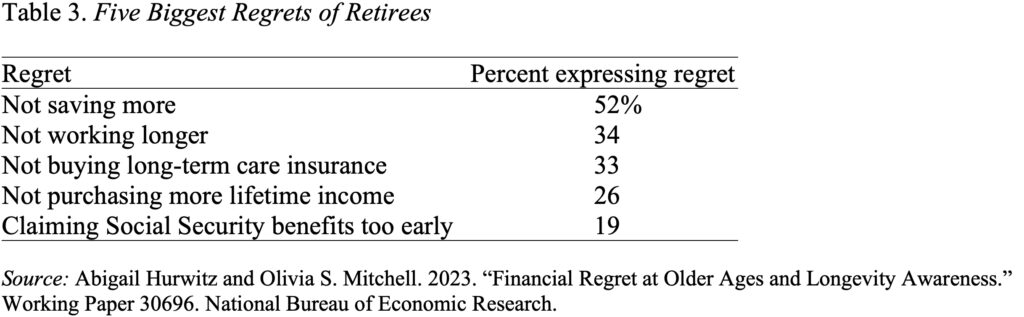

Some proof that individuals are placing on a very good face when requested about their well-being comes from a latest examine of regrets. Truly, the authors intentionally averted the time period ‘remorse” and slightly requested: “Occupied with your saving over your life: do you assume what you saved was too little, about proper, or an excessive amount of?” The outcomes confirmed that 52 p.c felt that they’d saved too little. The most typical causes for inadequate saving had been that they lived everyday (29 p.c) and didn’t plan forward (27 p.c). The opposite areas of remorse are additionally fascinating (see Desk 3).

The underside line right here is that each one the target proof signifies that between 40 and 50 p.c will not be saving sufficient and, when the query is put to retirees in a non-threatening style, about half admit they wished they’d saved extra. So, sure, undersaving for retirement is a critical concern.