Infographic: Taxability of Scholarships

![]() By Scholarship America

By Scholarship America

Special Guest Author Nicole Alexander

Not surprisingly, colleges and universities across the board experienced steep declines in enrollment during the pandemic, and the anticipated recovery has been slow and uneven. According to the National Student Clearinghouse Research Center’s annual enrollment report, the largest enrollment growth is being fueled by certificate programs.

Scholarship America’s community-based Dollars for Scholars are offering much-needed support to their local students who opt to attend community colleges, vocational-technical schools and similar institutions to pursue certifications. Last year, 39% of Dollars for Scholars offered scholarships explicitly for two-year and vo-tech schools. They include North Tama Dollars for Scholars (Traer, Iowa) and Eatonville (Washington) Dollars for Scholars, who both sat down to talk with us about the growth of their two-year scholarship programs.

North Tama Dollars for Scholars has provided these types of scholarships from the start. When board member Marilyn Bauch and her husband Jared, the chapter president, established the chapter in 2019 one of their primary values was to provide impactful scholarships for students who needed them the most, particularly those going to community colleges.

“I recall attending awards ceremonies and seeing that all the scholarships were going to the same 4 or 5 top students who were getting institutional aid from the universities they were planning to attend as well. When Jared and I first considered providing scholarships, we talked with the superintendent and the high school principal to learn what students needed. They told us there was a need for scholarships for a greater range of students and in amounts large enough to be impactful,” Marilyn said.

From that conversation, their mission was clear. When their Dollars for Scholars awarded their first scholarships in 2020, renewable awards were a key component, and five of the initial ten scholarships were for students attending vo-tech programs at community colleges. To this day 48% of their scholarships are specifically for students pursuing certifications.

“Things have changed fundamentally in less than ten years. State universities were becoming cost prohibitive and our community has seen an increasing need for more electricians, mechanics, medical technicians and similar professions” she explained.

And the response from the community has been tremendous. According to Marilyn, they’ve received $50,000 from their American Legion Post, and a local farmer anonymously provided the same amount to specifically fund vocational-technical scholarships. Small business owners, entrepreneurs, and even the mayor have supported these scholarships financially. One of North Tama Dollars for Scholars’ key fundraisers is a matching donation challenge held during high school class reunions. One of those donors expressed how excited he was to see that the chapter was providing vocational scholarships and reflected, “I can only imagine what I could have done if someone would have given me a leg up like that.”

In Washington, Kelli Bacher, treasurer of Eatonville Dollars for Scholars, is a professional educator who knows this story all too well.

“As a counselor I’m aware that for many years we’ve pushed kids to go to four-year institutions. But not every student wants to take that path,” she said. She was introduced to Dollars for Scholars when her own children started high school, has been actively involved ever since and says, “it’s one of the most fulfilling things I do.”

Kelli has witnessed donors’ enthusiasm for supporting a variety of types of scholarships for students in their small community of Eatonville, WA. Their Dollars for Scholars, established in 1994, was funded by a large founding endowment from a local family. More recently, donors have entrusted the chapter with funds to support students attending vo-tech schools in the area—a $1,500 award funded by a retired teacher in memory of her brother; a scholarship provided by a mother in honor of her son, who was involved in Future Farmers of America (FFA); and a scholarship for students pursuing construction trades supported by an alumnus in the construction industry.

According to Kelli, Eatonville Dollars for Scholars’ general scholarships are open to students attending four-year institutions and community colleges, and they have five awards focused specifically on students attending vo-tech schools. She recalled the chapter awarding funds to a student in an apprenticeship program and enabling him to purchase the tools for his trade which costs upwards of $900.

“I want a good plumber, electrician, and carpenter, so we need to support students going into these types of hands-on occupations,” she said.

Despite the community support of these generous awards, both Kelli and Marilyn admit that their Dollars for Scholars have had to proactively promote their vo-tech scholarships—since most of the students they were designed for didn’t believe there was an opportunity for them.

“It was a slow, hard process to get the students to apply, but with community support we’ve definitely made strides. The assistant principal at our high school actively promotes the opportunities to our students and we have a Career Center where they receive information about our scholarships as well. And a retired school official helps students go in and set up their student profiles in ChapterNet, [our online scholarship management system],” Kelli said.

Fear of completing the FAFSA was initially a barrier for some of the North Tama Dollars for Scholars students and their families. Similar to Eatonville Dollars for Scholars, they’ve engaged teachers, guidance counselors, and others in the community help ease those concerns and point families to helpful resources to aid with FAFSA completion. And it has been well worth the effort.

“Some of our scholarships have a minimum 2.0 GPA requirement and I’ve found it rewarding to see students who initially thought there was no way they’d be ‘good enough’ to get a scholarship get one and go on to achieve success. It builds their self-esteem, increases employability and some kids even come out with no debt because they’re willing to work while in school,” Marilyn said.

Nicole Alexander is the Director of Student Success Programs at Scholarship America.

By Matt Konrad

As the world of higher education faces an uncertain future, there are two things we know for sure: education will be a key to our recovery, and students will need our support more than ever as they return to school.

Support for students can take many forms; starting a scholarship program can ensure you have an impact now, and well into the future. Getting started can be a challenge – but partnering with an experienced nonprofit like Scholarship America ensures you the simplest setup, the greatest financial flexibility and the most trusted management you can get.

The first step toward establishing a scholarship program is determining where the funds will come from – and there are as many options available as there are donors.

The most straightforward way to fund any scholarship, of course, is through a cash transfer. You have liquid assets, and you transfer them to a school, foundation or nonprofit for the purpose of creating a scholarship fund. In the case of a nonprofit partner like Scholarship America, that contribution can be tax-deductible, provided you follow certain criteria.

But cash is only the start. Scholarship America can create scholarship funds with gifts of stock; with grants from Donor Advised Funds; with bequests or planned gifts; and with IRA charitable rollover dollars. (As of the 2022 tax year, investors who have reached 70.5 years of age can transfer up to $100,000 per year to charity and avoid a sizable tax bill.)

What’s more, Scholarship America can create a scholarship fund on your behalf that can receive donations from others – helping you take your own passion for education and inspire others to make an even bigger impact.

Our team works with all kinds of individuals, foundations and companies to design scholarships, and that includes determining the best way to structure the investment, management and disbursement of your funds.

The most common type of scholarship fund that our partners create is an endowed scholarship fund, also known as a permanently restricted fund. This type of fund uses the interest earned on the principal to pay out scholarship awards (as well as our program management fee), while leaving the principal invested for future earnings. A temporarily restricted fund allows for both the principal and the earned interest to be distributed.

Our partners have an array of choices when it comes to investing. We offer a range of investment portfolio options to choose from, ranging from conservative to growth-oriented. Funds are managed in partnership with Graystone Consulting, a part of Morgan Stanley with over 40 years of investment advisory experience; the firm was selected and approved by our Board of Trustees.

Starting small but making big plans for the future? The principal of a scholarship fund can be built up to any specified level before earnings are spent, and we often work with partners on deferred investments, bequests and other ways to increase fund levels over the life of the scholarship program. All scholarship funds established with Scholarship America are protected from creditors, and investors receive periodic reports from our Finance team.

Due to IRS regulations, most scholarship programs are legally required to be operated by a registered 501(c)(3) organization. Creating a scholarship through Scholarship America saves you from having to set up your own foundation and get IRS approval.

Because of Scholarship America’s 501(c)(3) nonprofit status, the funds you use to start a scholarship program may be tax-deductible, provided Scholarship America is given exclusive legal control over the assets: funds are permanently transferred to one of our portfolios, and Scholarship America is responsible for the selection of scholarship recipients, based on the criteria you define.

Funds cannot be returned once transferred, but all of our scholarship fund agreements include a sunset clause.

Scholarship America’s decades of experience designing scholarship programs give us an edge when it comes to getting your funds into the right hands.

We will work with you to identify the kinds of students you want to support, and to develop a custom program designed to reach them. Our team collaborates with each and every partner to establish award amounts, selection criteria and evaluation metrics that ensure you’re making a real impact on what matters to you.

Your Scholarship America scholarship fund isn’t a one-size-fits-all charitable donation. It’s a custom, purpose-built program that helps you make educational dreams come true for the next generation of learners.

Note: This information is not to be considered legal advice. Please consult with an attorney, wealth advisor or tax consultant to learn how investing in a scholarship can work with your personal finances.

![]() By Scholarship America

By Scholarship America

Updated May 2023

Students and their families are often surprised to realize some colleges reduce their financial aid packages when the student earns private scholarship dollars—a practice called financial aid displacement or award displacement. Colleges that practice displacement say it helps free up more funds for more students; students and families say it unfairly punishes those making the effort to earn scholarships. Whatever your perspective, it’s a complicated issue without easy answers, and COVID-related upheaval has only added to the confusion.

The most accurate description we’ve seen of displacement is “the Catch-22 of financial aid”—and because it’s so controversial and has a major impact on students and schools, it is increasingly at the forefront of education discussions. Here’s a look at recent developments.

In 2017, Maryland became the first state to bar public colleges and universities from practicing displacement. The state legislation passed in response to a two-year-long campaign led by the nonprofit Central Scholarship, who grew frustrated with the number of times “they would award a student money and a university would reduce that student’s financial aid by the same amount.”

According to the Baltimore Sun, the law does “allow reductions when a student’s aid exceeds the cost of college or with permission from a scholarship provider.” These provisions, allowing a very limited form of displacement, are designed to address colleges’ concerns that funds will be directed to students who don’t need them, at the expense of those who do.

In 2021, New Jersey joined Maryland, becoming the second state to ban displacement; Washington followed in March of 2022, when Governor Jay Inslee signed a bill into law that “prevents scholarship displacement for Washington college students who receive state-sponsored financial aid.”

With support from Scholarship America and Dollars for Scholars, legislation preventing displacement has been signed into law in California and Pennsylvania; legislation is currently pending in Arizona, Illinois and Wisconsin as well.

As legislatures slowly begin to work on displacement issues, some scholarship providers are working to take matters into their own hands. At the forefront of financial aid innovation is The Michael and Susan Dell Foundation, whose Dell Scholars program is managed by Scholarship America. They take unique approaches to scholarship aid that reduce the chance of displacement. (They also committed $100 million to help communities around the world deal with COVID-19.)

Longtime Dell Scholars Program leader Oscar Sweeten-Lopez told the Baltimore Sun “‘[t]he majority of the students that we work with will face some kind of a displacement.’” To ensure that those students—around 3,800 in the program’s 14-year history—get the most out of their awards, the Dell Foundation allows students who face displacement to defer their scholarship money until they graduate. At that point, they can claim the full value of the scholarship and use it to pay off loans.

In the wake of COVID-19, Dell Scholars is working to ensure students don’t lose out due to cancelled or deferred classes—including creative solutions like using 529 college-savings plans, which are not susceptible to displacement in the way scholarship funds are. (For a deep dive on 529 plans and scholarships, check out this detailed Mark Kantrowitz article.)

There are no real definitive numbers as to how many colleges practice displacement, although one recent survey indicates up to half of private scholarship recipients faced some reduction in institutional financial aid (grants, loans or workstudy.) If you’re facing, or think you may be facing, displacement, this fact sheet from the National Scholarship Providers Association covers many of the potential questions. These are the three to start with:

![]() By Scholarship America

By Scholarship America

For corporate, community and private foundations, scholarships are fundamental programs. After all, you’re trying to make a positive impact in the world, and very few things have as much positive impact on students and families as a college degree.

A successful foundation scholarship needs to carefully balance the goals of your donors with the needs of students, all in the context of a rapidly evolving world of higher-education funding. Even if you’ve been awarding scholarships for years, there are still new challenges that crop up with every school year. To ensure that your programs make the biggest impact where it’s needed most, it’s crucial to think about these big-picture struggles.

For donors, foundations are often perfectly simple giving vehicles. They endow a scholarship, advise you on the award criteria and smile for a photo on Awards Night with the student they’ve helped.

But when your foundation has 25 or 50 or 100 supporters like this, life can get complicated pretty quickly. Each donor may want to reward wildly differing kinds of students, and even slight differences in eligibility criteria can create big headaches when it comes to evaluating applications. Your donors rely on you to find the student who best fits their wishes, and getting that right means a lot of staff or volunteer time spent checking and rechecking applications.

Having a variety of scholarship criteria also means finding students that fit those criteria. If they’re wide enough—public-school students with financial need and a 3.5 GPA, for example—that may not be difficult.

But what if a donor wants their funds to go only to someone attending their alma mater, or playing the same instrument that they played, or pursuing an uncommon major? To ensure you have qualified applicants, you’re going to have to do a little more focused outreach. This means researching department contacts at colleges, email lists, message boards and social media accounts for all sorts of groups, so that each of your donors’ funds go to the best possible candidate.

Contact Scholarship America for more information on scholarship foundation services.

This outreach is the prologue to all the hard work that starts when your application deadline closes. Evaluating applications, reading essays and checking references can all be full-time jobs in and of themselves. If any of your scholarships are need-based, financial evaluation and verification will take more time. And there aren’t many shortcuts you can take when disbursing funds and working with college admissions and financial aid offices.

On the other hand, when the scholarship process is closed, your program won’t need the same level of staffing that it will at crunch time. It’s a tough choice: do you add the administrative work of scholarship management to someone’s more strategic full-time duties? Rely on volunteers or temp staff that you need to re-train every year? Or outsource the nitty-gritty details to a third-party manager?

Today’s high school and college students live online. It’s where they talk with friends, engage with class assignments and find news and information. And it’s where they’ll be looking for scholarships. So, while it may be easier for you to mail posters and paper application forms directly to high schools and colleges, you’ll be missing out on a huge part of your outreach if you’re not offering an application directly to students online.

Of course, that can create complications as well. An online application needs to be engineered, programmed and tested. Someone needs to be on hand to fix problems when they crop up. And data-security regulations around student information are extremely strict. In general, online applications require a bit more forethought, even though they’ll make your scholarship more popular and your evaluation job easier.

These challenges are daunting, but they’re not insurmountable. And with scholarships becoming an ever-more-important component in the struggle to pay for college, your foundation can’t afford not to focus on awarding deserving students.

At Scholarship America, nearly 40 years of experience has taught us plenty about creating and managing scholarships with an impact; as you consider these challenges, we invite you to contact us here for a free, no-obligation consultation with our program design experts!

![]()

By Matt Konrad

Around two million new freshmen enrolled in college as part of the rising class of 2027. Those students’ high school careers were thrown into disarray by the COVID pandemic. But, as higher education settles into its post-pandemic reality, what can those students expect to face—and how can private-sector scholarships help as they work toward their associate’s, bachelor’s and graduate degrees?

It’s not news to anyone that college keeps getting more expensive. As Forbes reports, “Between 1980 and 2020, the average price of tuition, fees, and room and board for an undergraduate degree increased 169%,” thanks to a well-documented confluence of factors. Sharp cuts in state and federal funding, especially after the 2008 recession, led to a need to bring in more tuition revenue, and competition for enrollment has led schools to spend more on administration, services and amenities.

The good news is that some states are beginning to reinvest in higher education. According to the same Forbes piece, “As of 2020, average public higher education funding increased for eight years in a row, according to [a] report from the State Higher Education Executive Officers Association (SHEEO), and 18 states have brought funding up to pre-2008 levels.”

But it hasn’t stopped costs rising on a national scale. “[I]n 2020, average education appropriations per full-time equivalent student were still 6% lower overall than in 2008, according to [the] report.” What does that mean for the class of 2027? Public four-year in-state costs rising from $23,000/year to $26,000/year (or private four-year costs rising from $55,000 to $60,000/year) over the course of their bachelor’s program.

With the ever-rising cost of college, plenty of recent high school graduates are wondering whether it’s all worth it. The Seattle Times reports “The proportion [of graduates] who enroll in the fall after they finish high school is down from a high of 70% in 2016 to 63% in 2020, according to the National Center for Education Statistics.” And while the pandemic exacerbated that dip in enrollment, the decrease has continued even after returning to “normal.”

However, in spite of skepticism that’s growing along with tuition bills, the numbers are still clear: attending and completing college is a solid investment. As reported by Third Way, “The typical college graduate will earn roughly $900,000 more than the typical high school graduate over their working life. … Even after controlling for potential biases and risks, it’s still worth it. The net present value of a college degree is $344,000 for the average person.”

The caveat to that value, of course, is that students who start college, accrue debt, and leave before graduating can end up worse off than if they’d never gone at all. The Third Way piece goes on to quantify: “While the students with six-figure levels of debt are often the focus of stories in the popular press, they are the exception rather than the rule. These students make up only 5%of the population that takes out student loans, and many of them are in high-return graduate programs like medical school or law school. Arguably the much bigger problem are students who take out some—often smaller amounts— of debt, but never graduate.”

Unfortunately, the students most likely to find themselves in that situation are those from low-income, high-poverty and historically marginalized communities. According to the 2022 NSC Benchmarks study:

Persistence rates were higher for higher-income high school graduates than their low-income high school counterparts (86% vs 76%) … Completion rates were much higher for students from higher-income schools versus low-income schools (52% vs 30%). Similarly, completion rates were higher for students from low-poverty schools versus high-poverty schools (61% vs. 25%).

In short, if you graduated from a school in an affluent community in 2023, you’re much more likely to be a debt-free member of the college class of 2027.

That’s especially true for those who go directly to four-year schools rather than starting at community colleges—and that means an uphill road for Black and Hispanic students, and an even steeper hill for women of color. As reported by the Seattle Times:

While four out of five students who begin at a community college say they plan to go on to get a bachelor’s degree, only about one in six of them actually manages to do it. That’s down by nearly 15% since 2020, according to the clearinghouse.

These frustrated wanderers include a disproportionate share of Black and Hispanic students. Half of all Hispanic and 40% of all Black students in higher education are enrolled at community colleges, the American Association of Community Colleges says.

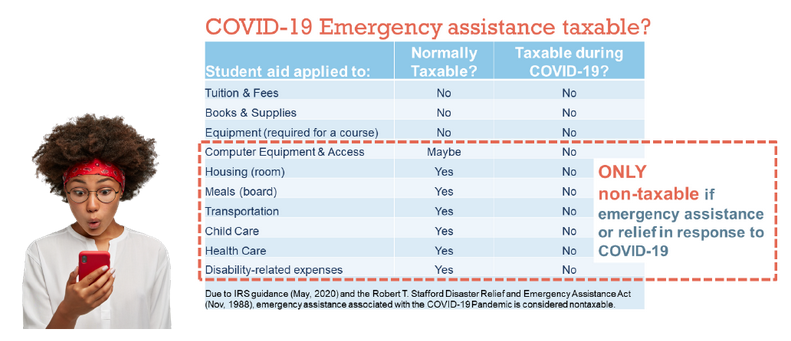

As future graduating classes become more and more diverse, this gap threatens to widen.

As Demaree Michelau, president of the Western Interstate Commission for Higher Education (which produced the chart above), told the Chronicle of Higher Ed, “These data just put the exclamation point on what we need to do as an education system, from beginning to end. That includes better serving all of our students, in particular students of color, low-income students, and first-generation students.”

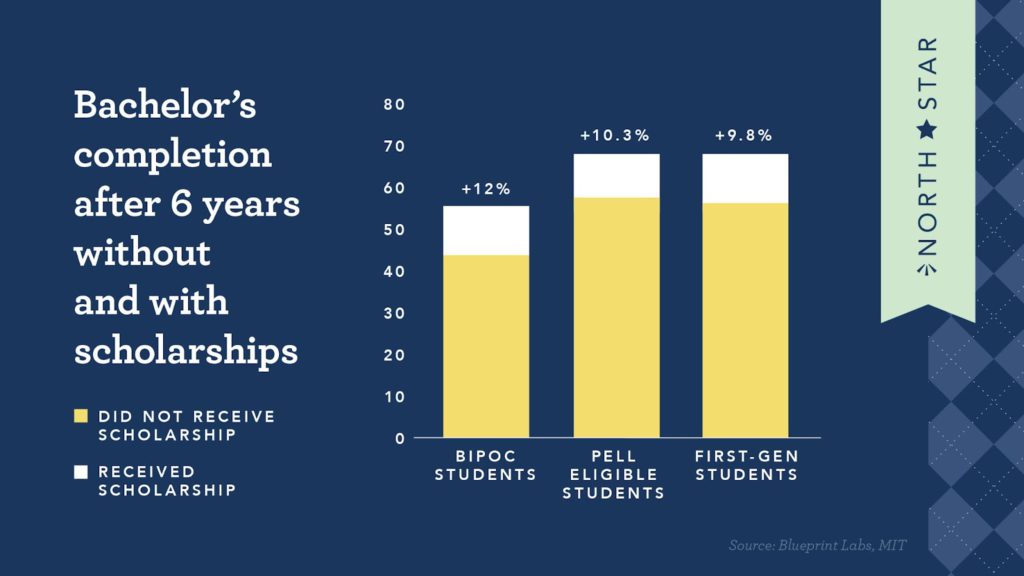

Private-sector scholarships can, should and will play a major role in that service. Research done by Scholarship America in conjunction with MIT’s Blueprint Labs shows that first-generation, BIPOC and Pell Grant-eligible students who receive private scholarships see their chances of graduation grow by 10-12%—the biggest boost for any population. That’s why we’re working with our partners to designate more scholarship dollars to the people who need them most: our goal, by the time the Class of 2027 graduates from college, is to award at least half of our scholarship dollars to students from historically marginalized populations who are facing financial need.

By making a conscious, data-driven effort to support these students in need, we can truly move the needle on college graduation rates. And that’s why supporting and partnering with Scholarship America can ensure you’re making the biggest impact possible as the high school Class of 2023 works to become the college Class of 2027.

![]() By Scholarship America

By Scholarship America

For students from low-income families, college can be a massive catch-22: higher education has never been more important, but it’s also never been more expensive. If college were accessible and affordable, students with high financial need would have a better chance to break the cycle of generational poverty; instead, the struggle to pay for higher education can leave them in dire financial straits.

At Scholarship America, our mission is to eliminate barriers to higher education, and to ensure those with the most need have the opportunity to thrive through equitable pathways to education and training. Private-sector scholarships can make a huge difference when it comes to filling the affordability gap for low-income students. Here’s how, and why, that effort is so crucial.

At Scholarship America, our mission is to eliminate barriers to higher education, and to ensure those with the most need have the opportunity to thrive through equitable pathways to education and training. Private-sector scholarships can make a huge difference when it comes to filling the affordability gap for low-income students. Here’s how, and why, that effort is so crucial.

Despite the cost, despite student struggles, despite the difficulty, one thing remains true: the more education you get beyond high school, the better your prospects are.

The numbers are stark. Georgetown University’s Center for Education and the Workforce reports: “Bachelor’s degree holders earn a median of $2.8 million during their career, 75% more than if they had only a high school diploma.” In other words, a bachelor’s degree makes a million-dollar difference. (A postgrad degree is still more; even an associate’s degree makes an impact in earning power.)

The benefits of higher education extend beyond the balance sheet as well. Nearly 90 percent of employed, college-educated millennials see their current job as part of a career path, while more than 40 percent of high-school-only millennials consider it “just a job.” Those with higher education report better health; they volunteer and vote more; they have longer life expectancy. In short, education makes lives better.

Unfortunately, too many of the students who could most benefit from higher education are finding it harder and harder to afford.

The National College Attainment Network (NCAN) released a landmark study in 2018 seeking to answer a simple question: can low-income students afford college? The study, entitled “Shutting Low-Income Students Out of Public Four-Year Higher Education,” assessed more than 500 four-year residential public colleges across the United States. These schools are traditionally the backbone of American higher education; they are the flagship, land-grant, research-oriented universities that people from all walks of life have long aspired to attend.

And they’re being priced out of reach.

According to NCAN’s research, when considering “the affordability of four-year public institutions for an average Pell Grant recipient who receives the average amount of grant aid, takes out the average amount of federal loans, and collects reasonable work wages … an astounding 75 percent of residential four-year institutions – including 90 percent of flagships – failed NCAN’s affordability test.”

Students, especially those whose family income qualifies them for Pell Grant aid, are increasingly unable to afford the benefits of a bachelor’s degree without going into debt—and that debt impacts them disproportionately. Seven in 10 graduates with federal loan debt also received a Pell grant, and Pell graduates have about $4,500 more in debt than higher-income students when they finish their degrees.

The NCAN model takes into account every avenue of public-sector assistance available to most students. It also reflects the reality that virtually all students work while in college. It states, clearly, that those sources of aid aren’t currently enough, especially for low-income, Pell Grant-eligible students.

Something besides student loans needs to fill the gap, and private scholarships are uniquely positioned to do so.

Scholarship America’s assessment of current research shows us that Pell-eligible, first-generation and BIPOC students who receive scholarships see their chances of graduating go up by 10-12% compared to their peers who don’t. That’s the largest boost of any population.

In California, a ten-year longitudinal study of the College Futures program, providing scholarships for students from low-income communities, showed similar results: “Approximately 95% of the California State University freshmen who received [College Futures] scholarships … returned for a second year of study, while only 82% of CSU freshmen from the same class statewide returned.”

Though scholarships can boost graduation rates and reduce debt for students from low-income families, the scholarship industry isn’t doing enough to connect those students with the dollars they need.

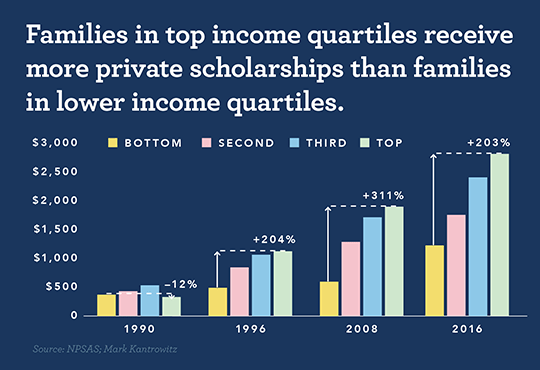

Research from the National Postsecondary Student Aid Study and financial aid expert Mark Kantrowitz indicates that families from the top income quartile receive, on average, more than double the private scholarship aid than families in the lowest quartile—a gap that has only grown larger over the last three decades.

What’s more, since Black, Hispanic and Indigenous students are much more likely than their white peers to be Pell-eligible, this inequitable distribution of scholarships can actually exacerbate the inequity of higher education financing.

But it doesn’t have to be that way—private scholarships, when thoughtfully managed, can be a huge part of the solution. The Gates Millennium Scholarship has helped more than 20,000 students of color since 1999, and the Jackie Robinson Foundation has provided assistance for more than 40 years. The Dell Scholars program, created by the Michael and Susan Dell Foundation, provides a unique form of wraparound support to low-income students who are often the first in their families to go to college. Since 2004, its combination of financial, social and mentoring support has helped more than 5,000 Dell Scholars, who “are 25 percent more likely to earn their bachelor’s degrees within four to six years of high school graduation compared to students of similar socioeconomic backgrounds.”

Whether scholarships are coming from a student’s school, a private-sector provider or a local foundation, they are a vital way for learners from low-income backgrounds to afford higher education. That education is a potential ticket out of poverty for those who complete their degrees—and that means scholarships matter now more than ever.

By Matt Konrad

For companies of all sizes, leading with purpose—that is, working toward a mission and considering corporate social responsibility (CSR) in decision-making—has never been more important. 78% of Americans “believe companies must do more than just make money; they must positively impact society as well,” and companies that put their corporate responsibility goals front and center are more likely to recruit and retain employees, create consumer loyalty and build trust across all types of stakeholders.

Of course, leading with purpose requires investing in the people, programs and initiatives that make it possible. And when it comes to that investment, there’s no better way to make a lasting and targeted impact than with a scholarship program.

No matter what your company does, one thing is always true: your success comes down to the people doing the work. Whether you’re a family plumbing company, a regional retailer or a Fortune 500 finance firm, you’re relying on a trained, skilled and committed workforce to be at your best—and finding and maintaining that workforce is historically challenging right now.

The Bureau of Labor Statistics reports that there are nearly 10 million job openings in the United States, and only around 6 million unemployed workers. Thanks to the COVID-19 pandemic and its follow-on effects, economists predict that the current labor shortage may last for several years, leaving companies struggling to find staff.

Investing in education can make an immediate difference, helping your current employees or others in your industry boost their skills and advance their careers, like the United Health Foundation’s Diversity in Health Care Scholarship. And it also means you’re creating a pipeline of diverse talent for the future, by identifying and supporting the next generation of makers, doers and leaders in your industry or community, as is the goal of the Amazon Future Engineer Scholarship. As companies look for sustainable ways to create diverse talent pipelines, there’s no smarter way to do so than by investing in education.

Of course, there are lots of ways to make your educational investment—and many corporations and foundations have traditionally done so by supporting colleges and universities.

But while a gift or an endowment can help leave your mark on your community or alma mater, the truth is that giving directly to a single school doesn’t allow your dollars to make the biggest possible impact. Those funds can only go to a student who opts to attend that school, and are distributed at the college’s discretion. The student who receives them may or may not ever have a connection to your company, and they may not even need the support in the first place.

On the other hand, funding a private scholarship ensures that your dollars support the exact population of students you care about. Scholarship dollars follow the student who earns them, wherever their academic journey takes them. And that means you follow that student, and can provide them with access to mentoring, internships or other supports as they move from college to the workforce.

As a result, the connection you build with students through scholarships goes much deeper than a check and a handshake. By investing directly in the communities you care about, you’re putting your company’s money where it matters. And by making a commitment to students in need, you’re telling those students and their families that you’ve got their backs—an investment that means so much more than a company logo on a plaque at your local college.

The world of higher education stands at an inflection point right now. Schools are settling into new post-pandemic realities; the Supreme Court’s decisions on affirmative action and student loan forgiveness are reverberating through historically marginalized communities; upcoming changes to the FAFSA will impact how students in need access federal help.

As students begin and continue their college careers in the face of this generational change, the generosity, flexibility and impact of private scholarships are more vital than ever. Together, we have the chance to lead with purpose, build the future workforce and change lives for the better. If you’re ready for your dollars to make the biggest impact they can, get in touch and let’s talk about making an investment in students.

By Matt Konrad

For companies across America, the struggle to find and retain qualified employees is more difficult than ever. There are nearly 10 million job openings in the United States but only 5.8 million unemployed workers, and economists predict that our current labor shortage may last for years. According to the Harvard Business Review:

“Between 2011 and 2021, nearly every county in the U.S. saw its working-age population decline. … The Pew Research Center estimates that 1.1 million more people retired than expected in 2020, while Bureau of Labor Statistics data show that 2.4 million women dropped out of the workforce during the first 12 months of the pandemic. The number of 18 year olds joining the workforce is also shrinking, which portends even less availability ahead.“

Filling that labor gap will require plenty of different strategies—but the best way to create a sustainable talent pipeline is to ensure that the three million Americans who graduate from high school every year can follow their chosen path to become trained, skilled and certified members of the workforce.

Unfortunately, the high school-to-career pathway is littered with barriers, especially for those from historically marginalized populations and those who come from the lowest income quartile. The cost of college—including community college and trade school—is out of reach for many, and attending school can easily lose out to work, family or caregiving priorities.

Even when students have the drive, determination and plans to achieve their educational goals, it’s far too easy to slip through the cracks. Only 64% of students who start a bachelor’s degree program graduate within six years, with Black, Pacific Islander and American Indian/Alaska Native students experiencing the highest dropout rates. At community colleges, less than 40% of those who start an associate’s degree ever complete it.

So what can we do, and how can scholarships help?

The HBR article cited above makes a key point: “If employers want to ensure that they have the workers they need not only for the present but also the future, they’re going to have to get better at sourcing their own talent and actively developing their employees’ skills.” In other words, talent pipeline development isn’t just an issue for higher ed, but for employers as well.

To kickstart the private-sector side of the discussion, the Biden administration’s Talent Pipeline Challenge is putting federal funds and infrastructure behind a program to encourage employers to invest in equitable recruitment and training initiatives, particularly in the fields of construction, EV and battery development and broadband infrastructure.

At colleges across the country, career-focused education partnerships are also helping those students who are able to access them, as pointed out in this article from NSPA: “In a recent survey, ‘88% of students feel prepared to enter the workforce, and 81% said that’s thanks to their school’s career development office, resources or programs.’”

But in spite of these successes, there’s still a missing piece. Every year, American high school graduating classes are getting more diverse—but neither college graduating classes or corporate C-suites are reflecting that shift, and the potential chilling effect of the Supreme Court’s affirmative action ruling threatens to widen the gap even further. Already, Black, Indigenous and Latino/a students are more than 25% less likely to complete a college degree than their white and Asian peers; when they do, they’re more likely to face mountains of debt, making it still more difficult to settle into good careers and begin building generational wealth.

For employers who want to get a step ahead in developing a sustainable talent pipeline and a diverse future workforce, equity-focused private scholarships are a perfect tool.

One of the points the HBR authors make is that “our education and training system, the market’s primary pipeline of talent, also isn’t in sync with demand.” The skills students are learning, particularly in technical and digital courses, aren’t always keeping up with employers’ current and anticipated future needs, and that means even a decorated college grad isn’t always prepared for life on the job.

By funding scholarships geared toward specific fields or skill sets, private-sector companies can do much more to cultivate graduates with the skills that really matter—and by coupling those scholarships with mentoring, internship or work-shadowing opportunities, they’re able to give students an invaluable insight into real world operations while they’re still in school.

In addition, private scholarships can be targeted to the exact population that companies want to recruit. Organizations who fund scholarships aren’t just giving dollars to an institution to parcel out. Instead, they’re reaching out to their ideal candidates, whose barrier to success may simply be a few thousand dollars in unmet need or potential loan debt.

By ensuring those students don’t have to give up on their dreams, private scholarships provide a massive benefit to companies, their communities and their talent.

The PepsiCo S.M.I.L.E. program is a powerful example: administered by Scholarship America, the scholarship is open to Black and Hispanic students at community colleges who plan to transfer to four-year schools. These are the future members of a more diverse workforce, but only about 1 in 6 community college enrollees ends up successfully pursuing this path to a bachelor’s degree.

To boost that percentage, PepsiCo S.M.I.L.E provides financial support, and this year they brought recipients together for a summit at PepsiCo HQ to do professional development work, network, take headshots and meet company leaders—all the things that more privileged students may have had the chance to do before, and that can make a candidate stand out as they transition from college to work.

If every company in America created a program like this, there’s no telling how much we could boost the next generation of talent, and that’s a boost to us all. As Lumina Foundation CEO Jamie Merisotis pointed out in a recent piece for Forbes, “the more we increase our nation’s educational attainment, the more we boost national prosperity and global competitiveness. That means if we make higher education fairer for those who have been shut out of the system, we’ll all be better off, not just them.”

By Matt Konrad

Whether you’re in high school, college or just thinking about the next steps in your education, it can be tough to know where to start. Applications, admissions, financial aid and scholarships all have their own deadlines – and they happen while you’re also trying to balance your regular schoolwork, your job, your family and your social life.

To help keep you organized and on track, we’ve compiled some important and useful resources to use on your journey toward your educational goals.

The Free Application for Federal Student Aid (FAFSA) is a vital part of your financial aid search, and it’s undergoing its biggest changes in decades—and opening for applications later than usual for the 2024-25 school year.

The “Better FAFSA” initiative is designed to be simpler and more accessible. As SavingforCollege.com says, the FAFSA overhaul “will not only make the form easier to fill out by eliminating two-thirds of the questions, but it will also affect the determination of financial need for low-, middle- and high-income students.”

Because of delays in implementing the new system, the FAFSA won’t open until December 2023. When it does, applicants should find it simpler to complete the form, access Pell Grants and qualify for need-based financial aid. (NerdWallet and USA Today run down many of the details for students and families; NCAN has a huge library of helpful resources for advisors, counselors and parents.)

One thing you need to do before you start the FAFSA in December is to create a Federal Student Aid (FSA) ID on the studentaid.gov website. This username and password is required to log in and access all Federal Student Aid websites, including the FAFSA. If you don’t yet have an FSA ID, uAspire has an easy guide to creating one, even if you or your parent or guardian don’t have a Social Security Number.

Finally, don’t forget that you have to update your FAFSA every year if you want to continue receiving the aid you qualify for! In the meantime, if you have income or life changes, here’s the Department of Education’s guide to updating the information you’re reporting.

Do’s and Don’ts for Your Scholarship Search: Hear directly from one of Scholarship America’s program designers about what to do (and not do) as you start looking for private scholarships – and download our Knowledge is Power quick-start guide for reference!

Scholarship America’s Scholarships: We’re not the only provider of private scholarships, but we are the largest! Browse more than 100 programs here on our website, including the impactful and renewable Dream Award and Barry Griswell Scholarship. (We also partner with more than 1,100 companies to manage scholarships, so check your and your parents’ workplaces for opportunities!)

The Common App: New and transferring college students can explore and apply to more than 900 partner colleges with a single application using the Common App, which opens August 1 each year. The Common App website also helps you plan your college road map and learn about ways to pay for college.

BigFuture: A program of the College Board (the folks who bring you the SATs), BigFuture is a one-stop college planning resource for high schoolers, transfer students, parents and adult learners – and your application to colleges automatically enters you into a scholarship drawing!

Get Schooled: This free (and advertising-free) resource was founded by Paramount and the Bill and Melinda Gates Foundation, and provides students with tools to help you get into college, plan your path and secure your first job. You can access everything from personalized essay help to one-on-one texting with a financial advisor to résumé and job hunting advice. Did we mention it’s all free?

Getting College Credit for Life/Work Experience: Whether you took a semester off during the pandemic, or a decade off to raise a family, getting back to your education is both difficult and rewarding. CollegeTransfer.net has a valuable guide to changing or returning to school, and assessments like the College Board’s CLEP test can help you turn your life and work experience into college credit.

Keeping Your Study Skills Sharp: Anki offers a free, downloadable flash-card app and website that you can customize for all kinds of study areas. Whether you’re in college or you’re working your way back into academic shape, it’s a great way to use your free time to stay sharp.

Who’s Who On Your Campus: College is a big change from high school—especially if you’re the first in your family to attend. Fortunately, there are all kinds of people on campus who can help you, and successful students take full advantage of the many campus support resources available to help. Never again will you have access to so much in one place—and most of it at no additional cost!

Swipe Out Hunger: Food insecurity is a real issue for millions of high school and college students, and a lack of good nutrition can derail your educational path. Swipe Out Hunger is a network of anti-hunger resources at more than 450 partner colleges. If your school isn’t one of them, there are still plenty of options out there; check this roundup, Google “food pantries” in your town or connect with your student services office.

Emergency Grants for Financial Setbacks: If you’re balancing work, school and family life, an unexpected expense can force you into some tough decisions. Emergency grants, provided by your school or a local nonprofit, can help keep you on track when setbacks strike; here’s an overview, and be sure to check with your advisors on campus for options that can help you.

Financial Aid Displacement Could Cost You: While a number of states have made it illegal, and many schools have stopped doing it, your private scholarships could fall victim to the practice of “displacement,” in which students’ institutional aid packages are reduced when they earn outside scholarships. Here’s what you need to know (and what you need to ask).

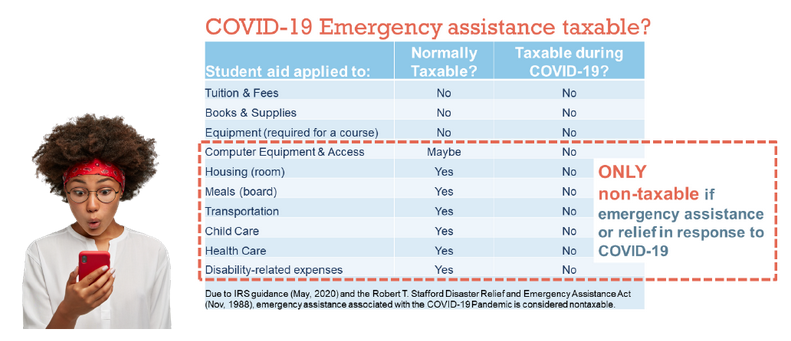

Some Scholarship Funds Can Be Taxed: It’s rare, but in certain cases, scholarship and emergency grant funds can be treated as taxable income. This infographic can help you and your family avoid an expensive surprise at tax time.

Fitness Resources (for Free): Staying active doesn’t have to drain your bank account! Blogger Casey the College Celiac has a roundup of 13 excellent free fitness resources that college students can take advantage of.

Explore the Art World From Your Laptop: Want to get a little culture in between scrolling TikTok and hanging with your roommates? Google Arts & Culture started their free virtual museum collection to help people explore during the pandemic, and you can use it to check out everything from the Uffizi to the Met.

Get Involved in Campus Activities: Whether it’s a sport, a club, a game night or a volunteer trip, there are a million ways to stay involved and meet others. The linked guide has 100 activity ideas to organize, and your school’s office of student life or campus activities can point you to your people!

It’s a big deal to embark on your higher-ed journey, whether you’re a high school senior ready to move to your dream college, or a single parent looking to earn a new certification. These resources can help you navigate the tough questions and thrive on the way.

Before you go, subscribe for daily updates.