Infographic: Taxability of Scholarships

![]() By Scholarship America

By Scholarship America

Updated May 2023

Students and their families are often surprised to realize some colleges reduce their financial aid packages when the student earns private scholarship dollars—a practice called financial aid displacement or award displacement. Colleges that practice displacement say it helps free up more funds for more students; students and families say it unfairly punishes those making the effort to earn scholarships. Whatever your perspective, it’s a complicated issue without easy answers, and COVID-related upheaval has only added to the confusion.

The most accurate description we’ve seen of displacement is “the Catch-22 of financial aid”—and because it’s so controversial and has a major impact on students and schools, it is increasingly at the forefront of education discussions. Here’s a look at recent developments.

In 2017, Maryland became the first state to bar public colleges and universities from practicing displacement. The state legislation passed in response to a two-year-long campaign led by the nonprofit Central Scholarship, who grew frustrated with the number of times “they would award a student money and a university would reduce that student’s financial aid by the same amount.”

According to the Baltimore Sun, the law does “allow reductions when a student’s aid exceeds the cost of college or with permission from a scholarship provider.” These provisions, allowing a very limited form of displacement, are designed to address colleges’ concerns that funds will be directed to students who don’t need them, at the expense of those who do.

In 2021, New Jersey joined Maryland, becoming the second state to ban displacement; Washington followed in March of 2022, when Governor Jay Inslee signed a bill into law that “prevents scholarship displacement for Washington college students who receive state-sponsored financial aid.”

With support from Scholarship America and Dollars for Scholars, legislation preventing displacement has been signed into law in California and Pennsylvania; legislation is currently pending in Arizona, Illinois and Wisconsin as well.

As legislatures slowly begin to work on displacement issues, some scholarship providers are working to take matters into their own hands. At the forefront of financial aid innovation is The Michael and Susan Dell Foundation, whose Dell Scholars program is managed by Scholarship America. They take unique approaches to scholarship aid that reduce the chance of displacement. (They also committed $100 million to help communities around the world deal with COVID-19.)

Longtime Dell Scholars Program leader Oscar Sweeten-Lopez told the Baltimore Sun “‘[t]he majority of the students that we work with will face some kind of a displacement.’” To ensure that those students—around 3,800 in the program’s 14-year history—get the most out of their awards, the Dell Foundation allows students who face displacement to defer their scholarship money until they graduate. At that point, they can claim the full value of the scholarship and use it to pay off loans.

In the wake of COVID-19, Dell Scholars is working to ensure students don’t lose out due to cancelled or deferred classes—including creative solutions like using 529 college-savings plans, which are not susceptible to displacement in the way scholarship funds are. (For a deep dive on 529 plans and scholarships, check out this detailed Mark Kantrowitz article.)

There are no real definitive numbers as to how many colleges practice displacement, although one recent survey indicates up to half of private scholarship recipients faced some reduction in institutional financial aid (grants, loans or workstudy.) If you’re facing, or think you may be facing, displacement, this fact sheet from the National Scholarship Providers Association covers many of the potential questions. These are the three to start with:

By Matt Konrad

Around two million new freshmen enrolled in college as part of the rising class of 2027. Those students’ high school careers were thrown into disarray by the COVID pandemic. But, as higher education settles into its post-pandemic reality, what can those students expect to face—and how can private-sector scholarships help as they work toward their associate’s, bachelor’s and graduate degrees?

It’s not news to anyone that college keeps getting more expensive. As Forbes reports, “Between 1980 and 2020, the average price of tuition, fees, and room and board for an undergraduate degree increased 169%,” thanks to a well-documented confluence of factors. Sharp cuts in state and federal funding, especially after the 2008 recession, led to a need to bring in more tuition revenue, and competition for enrollment has led schools to spend more on administration, services and amenities.

The good news is that some states are beginning to reinvest in higher education. According to the same Forbes piece, “As of 2020, average public higher education funding increased for eight years in a row, according to [a] report from the State Higher Education Executive Officers Association (SHEEO), and 18 states have brought funding up to pre-2008 levels.”

But it hasn’t stopped costs rising on a national scale. “[I]n 2020, average education appropriations per full-time equivalent student were still 6% lower overall than in 2008, according to [the] report.” What does that mean for the class of 2027? Public four-year in-state costs rising from $23,000/year to $26,000/year (or private four-year costs rising from $55,000 to $60,000/year) over the course of their bachelor’s program.

With the ever-rising cost of college, plenty of recent high school graduates are wondering whether it’s all worth it. The Seattle Times reports “The proportion [of graduates] who enroll in the fall after they finish high school is down from a high of 70% in 2016 to 63% in 2020, according to the National Center for Education Statistics.” And while the pandemic exacerbated that dip in enrollment, the decrease has continued even after returning to “normal.”

However, in spite of skepticism that’s growing along with tuition bills, the numbers are still clear: attending and completing college is a solid investment. As reported by Third Way, “The typical college graduate will earn roughly $900,000 more than the typical high school graduate over their working life. … Even after controlling for potential biases and risks, it’s still worth it. The net present value of a college degree is $344,000 for the average person.”

The caveat to that value, of course, is that students who start college, accrue debt, and leave before graduating can end up worse off than if they’d never gone at all. The Third Way piece goes on to quantify: “While the students with six-figure levels of debt are often the focus of stories in the popular press, they are the exception rather than the rule. These students make up only 5%of the population that takes out student loans, and many of them are in high-return graduate programs like medical school or law school. Arguably the much bigger problem are students who take out some—often smaller amounts— of debt, but never graduate.”

Unfortunately, the students most likely to find themselves in that situation are those from low-income, high-poverty and historically marginalized communities. According to the 2022 NSC Benchmarks study:

Persistence rates were higher for higher-income high school graduates than their low-income high school counterparts (86% vs 76%) … Completion rates were much higher for students from higher-income schools versus low-income schools (52% vs 30%). Similarly, completion rates were higher for students from low-poverty schools versus high-poverty schools (61% vs. 25%).

In short, if you graduated from a school in an affluent community in 2023, you’re much more likely to be a debt-free member of the college class of 2027.

That’s especially true for those who go directly to four-year schools rather than starting at community colleges—and that means an uphill road for Black and Hispanic students, and an even steeper hill for women of color. As reported by the Seattle Times:

While four out of five students who begin at a community college say they plan to go on to get a bachelor’s degree, only about one in six of them actually manages to do it. That’s down by nearly 15% since 2020, according to the clearinghouse.

These frustrated wanderers include a disproportionate share of Black and Hispanic students. Half of all Hispanic and 40% of all Black students in higher education are enrolled at community colleges, the American Association of Community Colleges says.

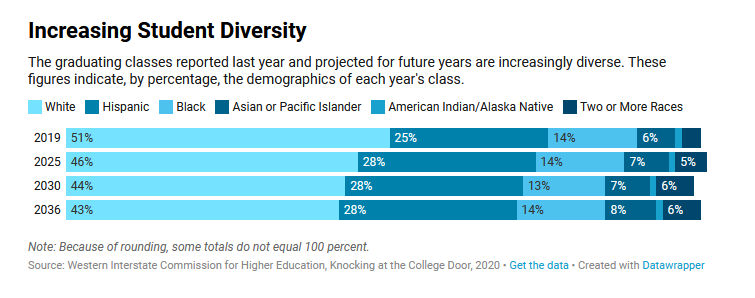

As future graduating classes become more and more diverse, this gap threatens to widen.

As Demaree Michelau, president of the Western Interstate Commission for Higher Education (which produced the chart above), told the Chronicle of Higher Ed, “These data just put the exclamation point on what we need to do as an education system, from beginning to end. That includes better serving all of our students, in particular students of color, low-income students, and first-generation students.”

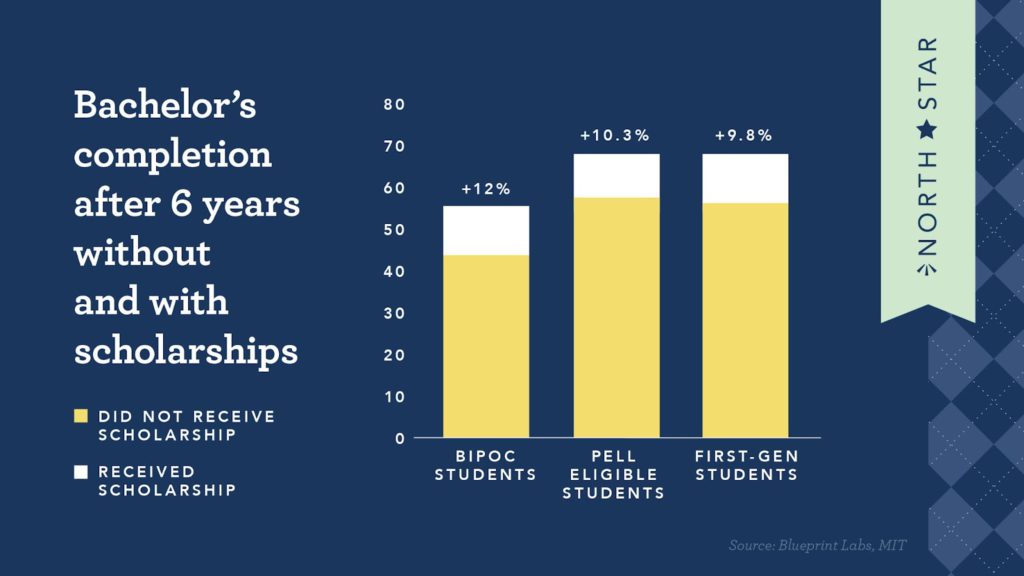

Private-sector scholarships can, should and will play a major role in that service. Research done by Scholarship America in conjunction with MIT’s Blueprint Labs shows that first-generation, BIPOC and Pell Grant-eligible students who receive private scholarships see their chances of graduation grow by 10-12%—the biggest boost for any population. That’s why we’re working with our partners to designate more scholarship dollars to the people who need them most: our goal, by the time the Class of 2027 graduates from college, is to award at least half of our scholarship dollars to students from historically marginalized populations who are facing financial need.

By making a conscious, data-driven effort to support these students in need, we can truly move the needle on college graduation rates. And that’s why supporting and partnering with Scholarship America can ensure you’re making the biggest impact possible as the high school Class of 2023 works to become the college Class of 2027.

![]() By Scholarship America

By Scholarship America

For students from low-income families, college can be a massive catch-22: higher education has never been more important, but it’s also never been more expensive. If college were accessible and affordable, students with high financial need would have a better chance to break the cycle of generational poverty; instead, the struggle to pay for higher education can leave them in dire financial straits.

At Scholarship America, our mission is to eliminate barriers to higher education, and to ensure those with the most need have the opportunity to thrive through equitable pathways to education and training. Private-sector scholarships can make a huge difference when it comes to filling the affordability gap for low-income students. Here’s how, and why, that effort is so crucial.

At Scholarship America, our mission is to eliminate barriers to higher education, and to ensure those with the most need have the opportunity to thrive through equitable pathways to education and training. Private-sector scholarships can make a huge difference when it comes to filling the affordability gap for low-income students. Here’s how, and why, that effort is so crucial.

Despite the cost, despite student struggles, despite the difficulty, one thing remains true: the more education you get beyond high school, the better your prospects are.

The numbers are stark. Georgetown University’s Center for Education and the Workforce reports: “Bachelor’s degree holders earn a median of $2.8 million during their career, 75% more than if they had only a high school diploma.” In other words, a bachelor’s degree makes a million-dollar difference. (A postgrad degree is still more; even an associate’s degree makes an impact in earning power.)

The benefits of higher education extend beyond the balance sheet as well. Nearly 90 percent of employed, college-educated millennials see their current job as part of a career path, while more than 40 percent of high-school-only millennials consider it “just a job.” Those with higher education report better health; they volunteer and vote more; they have longer life expectancy. In short, education makes lives better.

Unfortunately, too many of the students who could most benefit from higher education are finding it harder and harder to afford.

The National College Attainment Network (NCAN) released a landmark study in 2018 seeking to answer a simple question: can low-income students afford college? The study, entitled “Shutting Low-Income Students Out of Public Four-Year Higher Education,” assessed more than 500 four-year residential public colleges across the United States. These schools are traditionally the backbone of American higher education; they are the flagship, land-grant, research-oriented universities that people from all walks of life have long aspired to attend.

And they’re being priced out of reach.

According to NCAN’s research, when considering “the affordability of four-year public institutions for an average Pell Grant recipient who receives the average amount of grant aid, takes out the average amount of federal loans, and collects reasonable work wages … an astounding 75 percent of residential four-year institutions – including 90 percent of flagships – failed NCAN’s affordability test.”

Students, especially those whose family income qualifies them for Pell Grant aid, are increasingly unable to afford the benefits of a bachelor’s degree without going into debt—and that debt impacts them disproportionately. Seven in 10 graduates with federal loan debt also received a Pell grant, and Pell graduates have about $4,500 more in debt than higher-income students when they finish their degrees.

The NCAN model takes into account every avenue of public-sector assistance available to most students. It also reflects the reality that virtually all students work while in college. It states, clearly, that those sources of aid aren’t currently enough, especially for low-income, Pell Grant-eligible students.

Something besides student loans needs to fill the gap, and private scholarships are uniquely positioned to do so.

Scholarship America’s assessment of current research shows us that Pell-eligible, first-generation and BIPOC students who receive scholarships see their chances of graduating go up by 10-12% compared to their peers who don’t. That’s the largest boost of any population.

In California, a ten-year longitudinal study of the College Futures program, providing scholarships for students from low-income communities, showed similar results: “Approximately 95% of the California State University freshmen who received [College Futures] scholarships … returned for a second year of study, while only 82% of CSU freshmen from the same class statewide returned.”

Though scholarships can boost graduation rates and reduce debt for students from low-income families, the scholarship industry isn’t doing enough to connect those students with the dollars they need.

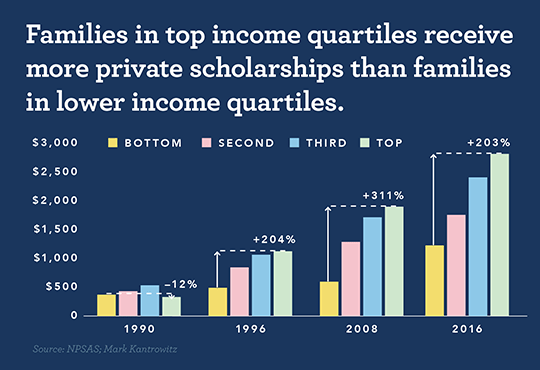

Research from the National Postsecondary Student Aid Study and financial aid expert Mark Kantrowitz indicates that families from the top income quartile receive, on average, more than double the private scholarship aid than families in the lowest quartile—a gap that has only grown larger over the last three decades.

What’s more, since Black, Hispanic and Indigenous students are much more likely than their white peers to be Pell-eligible, this inequitable distribution of scholarships can actually exacerbate the inequity of higher education financing.

But it doesn’t have to be that way—private scholarships, when thoughtfully managed, can be a huge part of the solution. The Gates Millennium Scholarship has helped more than 20,000 students of color since 1999, and the Jackie Robinson Foundation has provided assistance for more than 40 years. The Dell Scholars program, created by the Michael and Susan Dell Foundation, provides a unique form of wraparound support to low-income students who are often the first in their families to go to college. Since 2004, its combination of financial, social and mentoring support has helped more than 5,000 Dell Scholars, who “are 25 percent more likely to earn their bachelor’s degrees within four to six years of high school graduation compared to students of similar socioeconomic backgrounds.”

Whether scholarships are coming from a student’s school, a private-sector provider or a local foundation, they are a vital way for learners from low-income backgrounds to afford higher education. That education is a potential ticket out of poverty for those who complete their degrees—and that means scholarships matter now more than ever.

By Matt Konrad

Whether you’re in high school, college or just thinking about the next steps in your education, it can be tough to know where to start. Applications, admissions, financial aid and scholarships all have their own deadlines – and they happen while you’re also trying to balance your regular schoolwork, your job, your family and your social life.

To help keep you organized and on track, we’ve compiled some important and useful resources to use on your journey toward your educational goals.

The Free Application for Federal Student Aid (FAFSA) is a vital part of your financial aid search, and it’s undergoing its biggest changes in decades—and opening for applications later than usual for the 2024-25 school year.

The “Better FAFSA” initiative is designed to be simpler and more accessible. As SavingforCollege.com says, the FAFSA overhaul “will not only make the form easier to fill out by eliminating two-thirds of the questions, but it will also affect the determination of financial need for low-, middle- and high-income students.”

Because of delays in implementing the new system, the FAFSA won’t open until December 2023. When it does, applicants should find it simpler to complete the form, access Pell Grants and qualify for need-based financial aid. (NerdWallet and USA Today run down many of the details for students and families; NCAN has a huge library of helpful resources for advisors, counselors and parents.)

One thing you need to do before you start the FAFSA in December is to create a Federal Student Aid (FSA) ID on the studentaid.gov website. This username and password is required to log in and access all Federal Student Aid websites, including the FAFSA. If you don’t yet have an FSA ID, uAspire has an easy guide to creating one, even if you or your parent or guardian don’t have a Social Security Number.

Finally, don’t forget that you have to update your FAFSA every year if you want to continue receiving the aid you qualify for! In the meantime, if you have income or life changes, here’s the Department of Education’s guide to updating the information you’re reporting.

Do’s and Don’ts for Your Scholarship Search: Hear directly from one of Scholarship America’s program designers about what to do (and not do) as you start looking for private scholarships – and download our Knowledge is Power quick-start guide for reference!

Scholarship America’s Scholarships: We’re not the only provider of private scholarships, but we are the largest! Browse more than 100 programs here on our website, including the impactful and renewable Dream Award and Barry Griswell Scholarship. (We also partner with more than 1,100 companies to manage scholarships, so check your and your parents’ workplaces for opportunities!)

The Common App: New and transferring college students can explore and apply to more than 900 partner colleges with a single application using the Common App, which opens August 1 each year. The Common App website also helps you plan your college road map and learn about ways to pay for college.

BigFuture: A program of the College Board (the folks who bring you the SATs), BigFuture is a one-stop college planning resource for high schoolers, transfer students, parents and adult learners – and your application to colleges automatically enters you into a scholarship drawing!

Get Schooled: This free (and advertising-free) resource was founded by Paramount and the Bill and Melinda Gates Foundation, and provides students with tools to help you get into college, plan your path and secure your first job. You can access everything from personalized essay help to one-on-one texting with a financial advisor to résumé and job hunting advice. Did we mention it’s all free?

Getting College Credit for Life/Work Experience: Whether you took a semester off during the pandemic, or a decade off to raise a family, getting back to your education is both difficult and rewarding. CollegeTransfer.net has a valuable guide to changing or returning to school, and assessments like the College Board’s CLEP test can help you turn your life and work experience into college credit.

Keeping Your Study Skills Sharp: Anki offers a free, downloadable flash-card app and website that you can customize for all kinds of study areas. Whether you’re in college or you’re working your way back into academic shape, it’s a great way to use your free time to stay sharp.

Who’s Who On Your Campus: College is a big change from high school—especially if you’re the first in your family to attend. Fortunately, there are all kinds of people on campus who can help you, and successful students take full advantage of the many campus support resources available to help. Never again will you have access to so much in one place—and most of it at no additional cost!

Swipe Out Hunger: Food insecurity is a real issue for millions of high school and college students, and a lack of good nutrition can derail your educational path. Swipe Out Hunger is a network of anti-hunger resources at more than 450 partner colleges. If your school isn’t one of them, there are still plenty of options out there; check this roundup, Google “food pantries” in your town or connect with your student services office.

Emergency Grants for Financial Setbacks: If you’re balancing work, school and family life, an unexpected expense can force you into some tough decisions. Emergency grants, provided by your school or a local nonprofit, can help keep you on track when setbacks strike; here’s an overview, and be sure to check with your advisors on campus for options that can help you.

Financial Aid Displacement Could Cost You: While a number of states have made it illegal, and many schools have stopped doing it, your private scholarships could fall victim to the practice of “displacement,” in which students’ institutional aid packages are reduced when they earn outside scholarships. Here’s what you need to know (and what you need to ask).

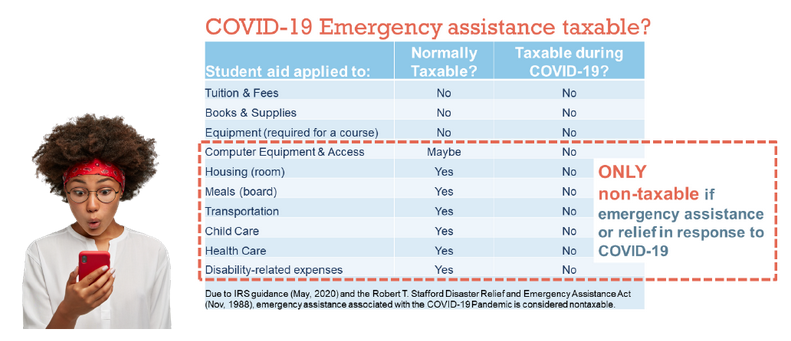

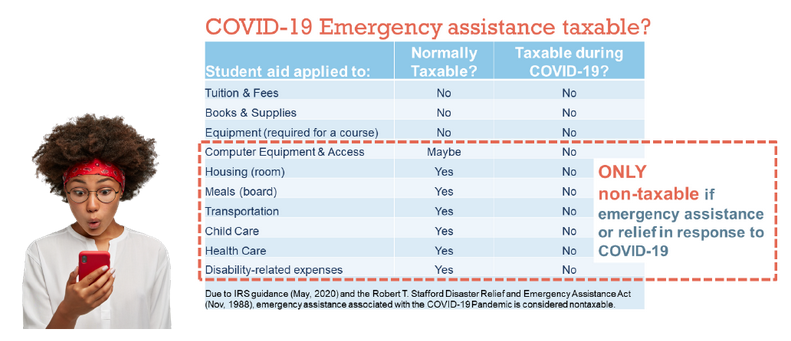

Some Scholarship Funds Can Be Taxed: It’s rare, but in certain cases, scholarship and emergency grant funds can be treated as taxable income. This infographic can help you and your family avoid an expensive surprise at tax time.

Fitness Resources (for Free): Staying active doesn’t have to drain your bank account! Blogger Casey the College Celiac has a roundup of 13 excellent free fitness resources that college students can take advantage of.

Explore the Art World From Your Laptop: Want to get a little culture in between scrolling TikTok and hanging with your roommates? Google Arts & Culture started their free virtual museum collection to help people explore during the pandemic, and you can use it to check out everything from the Uffizi to the Met.

Get Involved in Campus Activities: Whether it’s a sport, a club, a game night or a volunteer trip, there are a million ways to stay involved and meet others. The linked guide has 100 activity ideas to organize, and your school’s office of student life or campus activities can point you to your people!

It’s a big deal to embark on your higher-ed journey, whether you’re a high school senior ready to move to your dream college, or a single parent looking to earn a new certification. These resources can help you navigate the tough questions and thrive on the way.

![]() By Pam Carlson

By Pam Carlson

At age 14, Jake Neill’s life was changed forever.

Jake noticed that a girl in his class was isolating herself and seemed lonely. “I just knew something was off – she needed help,” Jake said. He reached out to her and took time to listen to her about her feelings. Then, one day she came to school and Jake noticed cuts on her arms.

“I didn’t know what to do,” Jake said. He went to the school counselor and asked for help. She guided him through it.

“Having this discussion was difficult. I was only 14!” Jake said. “I told her, ‘I see you are struggling, you don’t have to walk alone. You deserve to be happy.’ Through that, she got the help she needed. That happened six years ago and her mental health is a lot better now – not perfect, but I’m not worried about her trying to kill herself.”

When a second friend expressed similar thoughts, Jake again connected her with help—and the experience of almost losing two friends to suicide inspired him to begin researching the psychological challenges teens face.

As a student at Health Careers High School, a magnet school in San Antonio for students interested in pursuing careers in health professions, Jake had unique opportunities to pursue his new calling. As a sophomore, he was matched with a mentor from the University of Texas Long School of Medicine, who invited him to work with him on a project researching teen mental health.

Jake learned about writing grant proposals to support the research, and the team received a $5,000 grant. He also played a key role in crafting research questions to get authentic data. It was one of the first times that research questions were developed by teens for teens.

The field took notice of the research project. Jake and his mentor were invited to speak at the American Psychiatric Association Conference in 2020; at the American-Canadian Academy of Child and Adolescent Psychiatry Conference in 2022; and at the Society for the Study of Psychiatry and Culture Conference in 2022.

“We just got word that our work will be published in a medical journal too,” he said.

While Jake was taking steps toward his future career, he also faced significant responsibilities at home. His parents got divorced during his freshman year, and Jake took on a big role in helping with his two younger brothers and sister. He often made dinner and helped his siblings with their homework.

“Mom had been a stay-at-home mom,” Jake said. “It was a big adjustment.”

Then his mother lost her teaching position. Jake worked long shifts to help supplement her loss of income, working as a certified pharmacy technician and a medication technician at an assisted living facility.

“The older population are my people,” he says. “I have a very old soul. Honestly, I get along better with them than my own people. They improve my life so much.”’

“I am a relatively anxious person,” Jake went on. “While I struggle with anxiety, it doesn’t stop me from moving forward. There was no money for therapy, so I just went to the school counselor for someone to talk to. I had the mentality that I needed to hold the family together, to the extent I was burning out.”

Receiving the Scholarship America Dream Award has “granted me the privilege of focusing on my academics instead of working so much,” Jake—a 4.0 student at Abilene Christian University— said. “I have the grades, I have the determination and I have the commitment. With this generous award, my goals are made more attainable.”

Now a junior at Abilene Christian University, Jake’s interests have broadened. He took an architecture class and realized he really wanted a career that combined hands-on work with research. A college counselor encouraged him to shadow a dentist.

“I could never have predicted that I would be interested in dentistry,” he said, noting it brings together all his interests – psychology in terms of alleviating dental anxiety, the artistic and technical hands on-work of dental surgery, and helping people, while leaving time for family life.

“My journey has not been linear. I would never had made it to dentistry if I didn’t follow a twisty path. It’s ok to change your mind.”

“Worrying doesn’t add another day to your life, today has enough worry in itself,” Jake said, paraphrasing the Bible verses Luke 12:25-26. And his advice to his younger self? “Jake, chill!”

By Matt Konrad

Updated February 2024

Everyone knows what a scholarship is. It’s free, no-strings-attached money to help a student pay for their higher education.

Right?

Usually. But not always.

In some cases, there are significant strings attached—including a few situations in which scholarship funds may be treated as taxable income. While it’s unusual, it’s also important for both students and scholarship providers to know how this can happen, and how it can be avoided.

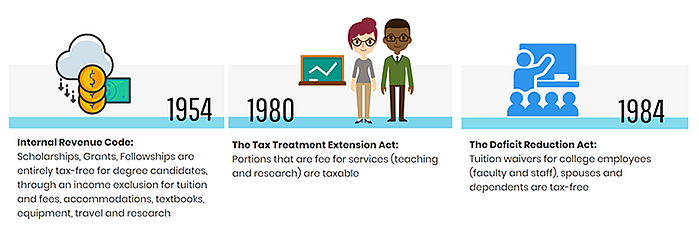

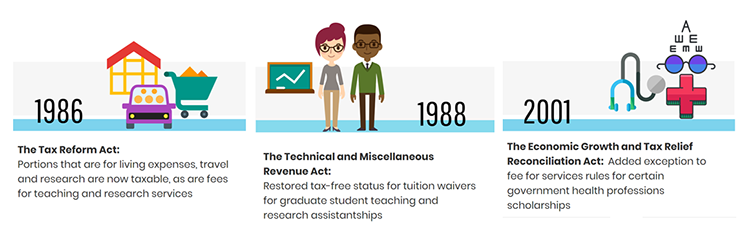

The tax status of scholarships was first codified in 1954, and until 1980 it was exceedingly simple: for students pursuing a degree, all scholarships, fellowships and grants were tax-free, no matter what the funding was used for.

The first major change to this system came in 1980, when the Tax Treatment Extension Act was passed. This amendment to the tax code specified that scholarships, grants or fellowships could be taxed if they could be considered “fees for services.” In IRS terms, that means “[money] received as payments for teaching, research, or other services required as a condition for receiving the scholarship or fellowship grant.” Exceptions were later added for teaching and research assistantships and for certain federal student aid programs, but this represented the first time any income related to scholarships was regarded as taxable.

The 1986 Tax Reform Act added significantly more potential taxation to scholarship and grant funds. For the first time, the new law specified that portions of scholarship aid used for living, travel or research expenses would be treated as taxable income. While later amendments eased some of the tax burden (especially for graduate student teachers), this law remains on the books today—meaning that stipends or cash payments received for non-tuition expenses will be considered taxable. (These payments should be accompanied by a 1099 tax form, making it easier to include them in your taxable income calculations.)

Finally, current law also states that scholarships for non-degree-candidates are taxable. As professional certifications and certificate programs become more popular—and even vital, to industries like software development and engineering—those laws put more and more nontraditional students at risk of a heavy tax burden from scholarships.

As outlined by financial aid expert Mark Kantrowitz in this whitepaper for the National Scholarship Providers Association (NSPA), “There are several harmful consequences of the government taxation of scholarships, grants and fellowships.The harmful impact affects the ability of students to complete their education and graduate.Taxing financial aid prevents students from making full use of their scholarships, fellowships and grants.Scholarships, fellowships and grants are the only form of generosity that is taxed by the federal government.”

Those consequences are most stark for the student: when more of their scholarship funds go to taxes, they have less available to pay for their education. Making matters worse, most federal financial aid calculations are based on the pre-tax value of the scholarship, meaning they risk a shortfall in aid when they can least afford it.

There are also powerful drawbacks for scholarship providers. As Kantrowitz says, “Private scholarship providers are reluctant to create new scholarship and fellowship programs and to expand existing programs because taxation makes the programs less effective than other charitable purposes.” In addition, while innovative scholarship funders may want to help students with the onerous costs of rent, board and transportation, the taxable nature of these funds blunts their impact.

The impact is especially disproportionate on low-income students. Those from the bottom income quartile spend, by far, the largest percentage of family income on higher education; almost half of that money is spent on the non-tuition costs for which scholarship awards are taxable. (Under current law, emergency financial grants could also be considered taxable income—and those grants are most vital for low-income students.)

Those attempting to save money by attending two-year colleges are also likely to be hit hard. According to The College Board, living expenses for students at community colleges can make up more than 70 percent of the cost to attend. Taxing scholarships that are used for those expenses adds a huge burden to those who can least afford it, even if they’re attending school on a full-ride scholarship or in a tuition-free state.

While taxing scholarship funds may increase government revenue in the short term, it is also short-sighted. As Kantrowitz explains, “Scholarships, grants and fellowships help students graduate from college. The federal government benefits financially from the increased federal income tax revenue attributable to higher educational attainment. So, it is in the federal government’s best financial interest to stop displacing scholarships, grants and fellowships through taxation.”

Scholarship America and analyst Mark Kantrowitz have made these four recommendations for doing so:

These four steps will ensure that new forms of certification and new models of payment aren’t punished for being “nontraditional.” They will also ensure qualified scholarships are available to pay for the full cost of education at eligible colleges and universities—and that will allow scholarships to be used, tax-free, to pay for room and board, transportation to and from college, and disability- and other college-related expenses.

As we work toward this goal, it’s important for all education stakeholders to clarify the current situation, and to support financial aid innovation and student support.

This post is based on research originally presented at the National Scholarship Providers’ Association Conference by Mark Kantrowitz of SavingForCollege.com and Despina Costopolous Emerson of Scholarship America. This post was updated Feb. 19, 2024 to reflect new statistics about living expenses.

By Matt Konrad

Updated February 2024

The doors of higher education have never been open to more people. But it’s increasingly clear that many of those students are struggling to meet their own basic needs even as they work to change their lives with a degree or certificate.

As reported by the NSPA Programs Blog, the 2023 National Postsecondary Student Aid Study discovered that “22.6% of undergraduate students and 12.2% of graduate students are food insecure, and 8% of undergraduate students and 4.6% of graduate students experience homelessness. These rates were even higher at Historically Black Colleges and Universities (HBCUs) and Tribal Colleges and Universities (TCUs), as well as for-profit institutions.” Inside Higher Ed also reported that both food and housing insecurity are greatest among Black and Hispanic students, students who are parents and those who received Pell Grants.

This was the first time NPSAS respondents had been asked about basic needs insecurity, and the findings corroborated the years of research into the issue done by Temple University’s Hope Center for College, Community and Justice. The Hope Center’s annual #RealCollege Survey, focused largely on community colleges, found the same thing year after year, as reported via Inside Higher Ed: college students face higher rates of food and housing insecurity than the general population.

“The really big reason this is so important is these are experiences that are affecting millions of students and have been, I firmly believe, for the whole time,” Hope Center founder Sara Goldrick-Rab told IHE.

For students who are already in a precarious financial position, a single unexpected financial setback can be devastating. A sudden medical expense, rent increase or car repair can derail their path to a degree—and, once a student leaves school, getting back becomes exponentially more unlikely, no matter how much they might benefit in the long term.

So what can we do to help?

With 70% of full-time college students juggling work and school, and college costs (including room and board) continuing to increase, the scramble to make ends meet often leaves students without the free time or energy to look for help. After a full-time work week and a full credit load of classes, fueled by little sleep and a fast-food diet, the complex realms of financial aid and student advising can seem inaccessible and overwhelming. If they do manage to seek help, many are shut out from financial aid due to bad credit or lack of a co-signer—making their attempts to break out of poverty via education that much more difficult.

In order to assist homeless and hungry students, it’s vital for campus, state and national programs to work on meeting them where they are, and provide aid when they need it most.

As Brookdale Community College’s Matt Reed put it in Inside Higher Ed, that’s often easier said than done: “Many of our basic operations are predicated on the assumptions that students are well-prepared, live at home with families that support them economically, have reliable cars, don’t work many hours for pay, know what they want, and can devote themselves full-time to their studies if they’d just buckle down. … But those aren’t most of our students. That doesn’t make our students defective. It means we need to be willing to rethink some of our basic assumptions.”

Fortunately, more and more colleges are doing the work to discover these gaps in students’ basic needs, and taking steps to meet them.

NSPA highlights a few of the “numerous community- and institution-based programs already in existence. These include businesses and nonprofits like Rent College Pads, which works with local landlords to list available housing options for students and Swipe Out Hunger, which allows students to donate food swipes at their dining hall and engages in national advocacy efforts focused on student hunger on campus.”

Programs like Single Stop, which currently operates at seven community colleges, offer another example of how support can work efficiently. Using a combination of online tools, organizational partnerships and in-person resources ranging from free meals to tax assistance, Single Stop provides “wrap-around” support tailored to the needs of each student.

And Single Stop isn’t the only model that provides these kind of wrap-around services. Many campuses have their own independent offices, and the National Association for the Education of Homeless Children and Youth (NAEHCY) also provides help and resources for students, families and admissions officers. Whatever the platform, though, the idea remains the same: getting time- and money-crunched students the right support at the right time.

In conjunction with these services to keep students learning, emergency grants from both colleges and private-sector funders can play a vital role.

The concept behind emergency grants is simple: when students incur an unexpected expense that threatens their ability to stay in school, they can apply for a small ($1,000 or less), one-time grant to help pay the bill and keep them afloat.

Over the last two decades, Scholarship America has partnered with colleges and private-sector funders to provide these kinds of grants. And while the average grant amount of $741 may not seem like a life-changing dollar amount, it can be a lifeline for those facing tough choices—95% of Scholarship America emergency grant recipients complete the term they are enrolled in and 88% enroll the next term.

Emergency grant programs have the benefit of flexibility in the face of crisis. At the beginning of 2020, we partnered with Achieve Atlanta to pilot a community-focused emergency grant program. Our initial launch awarded 23 students with almost $10,000 in emergency grants. But when COVID-19 struck, the program suddenly had to grow.

With campus closures across the country, students were forced back home; many lost their jobs. The urgent needs of Achieve Atlanta Scholars were growing and changing daily; Achieve Atlanta immediately responded by making emergency funds available to a larger group of students and securing additional funding, to increase the available funds from $25,000 to $170,000. Through our efficient distribution system, students are getting the funds they need when they need them, giving them one less thing to worry about.

Grants can also be targeted to those whose needs might be overlooked. For example, Scholarship America administers the Wells Fargo Veterans Emergency Grant Program, which provides one-time grants up to $1,000 for veterans in college or vocational school who encounter undue financial hardship.

Whether it’s wraparound support or emergency grants, there are a few guidelines to follow to ensure students are getting the most support with the least friction. Our work in the emergency aid sector has shown these best practices:

As we begin to understand more about the struggles many students face with homelessness, food insecurity and school/work balance, we can continue to evolve and innovate our supports. What we know is that emergency grants can make a big difference—and that they work best when they’re a component of a comprehensive support system that includes food pantries, housing assistance, vouchers and financial guidance/mentorship.

With the right safety nets in place, students have the ability to keep working toward their educational goals, ultimately helping to secure a better future for themselves and their families.

By Matt Konrad

Scholarship season is as busy as it gets—and even if you’re still waiting on FAFSA information, you can apply right now for all of the open programs on Scholarship America’s Browse Scholarships page! There are lots of great options; today we’re featuring a program to help students from low-income communities pursue financial services careers, and a nationwide scholarship for veterans from Wells Fargo.

CME Group Foundation strives to empower future generations through education—equipping today’s students to meet tomorrow’s challenges. Their specific focus is on preparing students from low-income and historically underserved communities for careers in financial services, and they work with a prestigious group of partner schools that provide evidence-based support programs for this group of students majoring in fields related to the financial services and technology industries.

Each year, a new cohort of 15 CME Group Foundation Scholars are able to pursue their college dreams thanks to support from this program. Aiko Castrejon, a member of the Class of 2023 at the University of Illinois-Chicago and a CME Group Foundation Scholar, said of her award: “The CME Group Foundation Scholarship means I can relieve the financial burden and stress of my education on my family as I become a first-generation college graduate. I am also beyond grateful for the networking opportunities and other resources.”

Eligible students can now apply for renewable scholarships of up to $20,000 to be used toward a degree in finance, computer science, math, cybersecurity, data science, financial engineering, accounting, information technology or statistics at one of eleven CME Group Foundation partner schools (located in Illinois and New Jersey).

CME Group Foundation Scholars must come from a low-income and historically underserved community, and must be current or rising sophomores, juniors or seniors who plan to enroll full-time at one of the specified partner schools for the entire upcoming academic year. Students enrolled in a 4+1 MS program are eligible. Applicants must have a minimum GPA of 2.5 on a 4.0 scale (or its equivalent).

In addition to receiving a scholarship, CME Group Foundation Scholars will earn an expenses-paid trip to attend a one-day market education program at CME Group in Chicago in August 2024.

Applications are open until April 4. Apply now >

While military service comes with education benefits, many veterans returning to school still face gaps in funding – especially when it comes to unexpected costs and living expenses. The Wells Fargo Veterans Scholarship and Wells Fargo Veterans Emergency Grant programs are designed to help veterans complete the postsecondary education or training they need to return to — and succeed in — civilian life and work.

The Wells Fargo Veterans Scholarship provides scholarships up to $5,000 per year, helping veterans and the spouses and widows of service-disabled veterans cover costs that remain after they’ve used their military benefits and other grants. Scholarships are renewable each year, to help recipients focus on completing their degrees rather than worrying about paying for future costs.

Thanks to the Wells Fargo Veterans Scholarship, students like Carmelos Brown have been able to pursue their post-service career goals. Carmelos is a U.S. Army veteran and serves as the president of the Student Veterans of America (SVA) chapter at Florida’s Santa Fe College.

“Receiving a scholarship has been a game-changer for me,” he said. “I can’t express enough gratitude for the support that’s eased the financial burden. It’s not just about the funds; it’s about the doors of opportunity that have opened up. “Of course, the college journey isn’t always smooth, and that’s why the Emergency Grant component of the program is there to help when financial setbacks strike. Veterans enrolled in higher education can apply for emergency grants when faced with unexpected bills or costs. Ranging up to $1,000, these immediate, one-time grants are designed to keep recipients in school and on track without creating undue financial hardship.

If you or a family member are a veteran, you may be able to benefit. If not, please take a moment to share the link with veterans and military families you know. The more we can spread the word, the more veterans we can help get through college!

Wells Fargo Veterans Scholarships are open through April 10. Emergency grant applications are open via the same link as long as funds are available. Apply Now >

The Scholarship America Dream Award is designed to help you keep moving toward a degree, by providing a scholarship that sticks with you for up to four total years. College undergraduates can earn renewable awards of up to $10,000 per year.

We believe in tearing down the barriers to a college degree — and that’s why the Dream Award is a scholarship open to all. Your ethnicity, family history, school access, gender, sexual orientation or immigration status should not be an impediment to attending college and pursuing your dreams.

If you’re at least 17, a current college undergraduate* in the U.S. with a minimum cumulative GPA of 3.0 on a 4.0 scale (or its equivalent), and plan to enroll in full-time undergraduate study next year, you’re invited to apply.

The Dream Award is open to U.S. citizens, U.S. permanent residents (holders of a Permanent Resident card), or individuals granted deferred action status under the Deferred Action for Childhood Arrivals program (DACA).

Our Dream Award Scholars have overcome incredible challenges ranging from family tragedies to physical struggles to systematic inequities. We are proud to support their educational dreams — and if you’re struggling to pay for college, we encourage you to learn more about eligibility details and apply.

(*High school seniors or graduates from Bayfield, Wisconsin and Cleveland, Minnesota are eligible to apply for the Jon G. Carlstrom Dream Award scholarship, using the standard application.)

By Matt Konrad

Updated April 2024

Students who receive financial aid may have an unexpected bill to pay—a tax bill. While most scholarship awards are not taxed, there are a number or circumstances in which they can be, and many students and parents may not know the details. Here are some of the most pressing questions we’ve heard regarding scholarships and taxation right now.

If a student’s taxable income exceeds $12,950, they are required to file a tax return – even if their parents still claim them as a dependent. If a student’s taxable income is less than that threshold, it can still be a good idea to file – they may be eligible for a refund of federal taxes withheld by their employer, or may qualify for the Earned Income Tax Credit.

In general, scholarship funds cannot be treated as taxable income as long as you’re (a) pursuing a degree and (b) using the funds for tuition, fees or anything else that the IRS considers a “qualified education expense.” Those include books and supplies that are required for your program of study.

However, if you’re using all or part of your scholarship funds to cover room and board, travel, tutoring services or optional supplies, that money will be treated as taxable income.

Since private scholarships are often lenient about how funds can be used, it’s important to know in advance that you might face tax penalties if you’re using private scholarship funds to pay for extra living expenses, technology or travel costs. In addition, stipends or cash payments received in addition to the scholarship and used for non-tuition expenses will be considered taxable. (These payments should be accompanied by a 1099 tax form, making it easier to include them in your taxable income calculations.)

Here’s more on scholarship taxability from TaxSlayer, including a guide to the necessary IRS forms and worksheets. Keep reading for our tips on reducing your potential tax burden.

If you’ve received an emergency grant from your school or a nonprofit, those funds are generally treated the same way as scholarships: funds used for qualified education expenses are not likely to be taxable, while funds used for other purposes (transportation, child care, medical bills) will be.

The exception to this rule is funding received as a result of a federally declared state of emergency—this is a broad category of federal assistance that helps people recover in the face of natural disasters, and part of its legal definition is that it is not considered taxable income. For example, when the federal government declared a state of emergency related to COVID-19, it meant that stimulus checks and COVID relief payments would be non-taxable. If you’re displaced by a hurricane, earthquake or fire and you receive money from the federal government, it would fall into that category as well.

(Note, however, if you receive emergency aid funds in the form of a grant or scholarship from your state or a private provider, the tax rules outlined above may apply. As always: be aware of tax implications when you receive your funds, and avoid surprises later.)

While much is up in the air about student loan forgiveness, we do know that all student loans forgiven by December 31, 2025 will not be taxed. The tax-free status is also extended to employer provided student loan repayment assistance programs. Previously, employers were able to provide up to $5,250 of tax-free aid to assist employees with student loan payments. The $5,250 cap has been lifted and employers can now provide student loan repayment assistance without limitations until December 31, 2025.

Graduate student funding tends to be more of a gray area in terms of taxation. The same basic rule applies—scholarship funds used for tuition or required supplies are not taxable—but teaching stipends and fellowships can come with their own tax burdens.

Intuit, makers of TurboTax, offer a useful example:

In some cases, a scholarship is really more of a stipend, providing compensation for services while you’re in school or for services you’ll provide in the future. If, for example:

You receive a $5,000 scholarship with $1,500 of it designated to pay for your teaching services.

The $1,500 counts toward your taxable income for the year.

If you receive a scholarship with the condition that you provide services in the future, you’ll need to count the scholarship as income in the year you receive it. Payment for services at a military academy also count toward your taxable income.

This is obviously contingent on how your funding is structured, so it’s important to talk with your financial aid office before committing to an offer. (The same is true for any work-study funds, but teaching stipends are most likely to be bundled together with nontaxable scholarship funding.)

Postgraduate fellowships fall into a similar category, as you can hear in this episode of the Personal Finance for PhDs podcast. Since these funds are often used for living or traveling expenses, they’re among the most likely type of financial aid to be taxed—especially if you’re receiving them for a discrete research project rather than part of a degree program.

In addition to staying aware, it is also important to keep track of your scholarships and grants. For example, did it cover tuition and fees or other expenses, and what semester was it applied to?

Typically, at the end of January, your campus should issue a summary (Form 1098-T) of what financial aid was applied to your tuition, and, a total of all scholarships and grants received on your behalf. If you do not receive this document through your financial aid portal, via email or mail, please contact your financial aid office. You can share all of this information with your tax preparer; if you or your family don’t have a tax preparer you may qualify to work with one free through the IRS Volunteer Income Tax Assistance Program.

If you receive private scholarships that can be used for living expenses, let your college financial aid office know. You can talk with your financial aid advisor about deferring part or all of your scholarship to a year when your taxable income may be lower.

Finally, you and your family may also want to explore putting funds into your state’s 529 college savings plan. Setting this up may require a professional financial adviser, but 529 funds also avoid some of the tax penalties that can affect scholarships.

To help you figure out the taxability of your scholarships or emergency grants, consult our infographic.

Before you go, subscribe for daily updates.