Once I began freelancing, I wasted hours on guide invoicing. Then I found invoicing software program—a game-changer for my enterprise. Now there are numerous choices, making it powerful to decide on. That’s why I’ve created this record of my high freelance bill sofware.

These instruments do extra than simply invoicing, typically together with time-tracking and challenge administration options and extra… Let’s discover which could work finest to your freelancing wants.

Finest Invoicing Software program for Freelancers

| Model | Description | Ranking | Worth | Hyperlinks |

|---|---|---|---|---|

|

Finest Total |

Freshbooks• FreshBooks is an easy-to-use accounting software program designed for enterprise house owners and accountants. It simplifies invoicing, funds, expense tr… |

|

Begins at $19/moAttempt free for 30 Days |

|

|

Writer Choose |

Moxie• All the pieces it’s essential to thrive as a freelancer. From contracts, proposals, and shopper administration to invoicing, branded shopper portal, and a t… |

|

Begins at $16/moAttempt free for 14 days |

|

|

Bloom• Handle your artistic enterprise in a single place. Bloom gives a robust enterprise administration and progress toolset, that can assist you launch your side-g… |

|

Begins at $7/moAttempt free for 7 days |

|

|

Bonsai• The enterprise and invoicing administration answer that provides you peace of thoughts and lets you focus in your work. Utilized by 500,000+ freelance… |

|

Begins at $21/moAttempt free for 7 days |

|

|

Honeybook• A device with all the pieces it’s essential to get enterprise finished. Over 100K freelancers belief HoneyBook to handle initiatives, e book purchasers, ship invoices,… |

|

Begins at $16/moAttempt free for 7 days |

|

|

Quickbooks• Smarter enterprise instruments designed for small companies, freelancers, and self-employed people. Save time with computerized expense categoriz… |

|

Begins at $20/moAttempt free for 30 Days |

|

|

Sq. Invoicing• Simplify invoicing with customizable templates, seamless fee acceptance, and real-time monitoring. Ship invoices, estimates, and contracts… |

|

Begins at $0Use primary options utterly free. |

|

|

Harpoon• A forward-looking time-tracking and invoicing software program to plan and forecast a worthwhile future. Will your freelance enterprise be worthwhile … |

|

Begins at $9/moAttempt free for 14 days |

Our Finest Choose Total

Freshbooks

FreshBooks is an easy-to-use accounting software program designed for enterprise house owners and accountants. It simplifies invoicing, funds, expense monitoring, and extra, serving to you save time and look skilled. Excellent for freelancers, self-employed professionals, and companies with groups, FreshBooks presents a 30-day free trial to get you began with no danger.

Why we like Freshbooks ‣

FreshBooks stands out as a wonderful alternative for freelancers and small companies who need to develop. Its user-friendly interface and seamless onboarding course of permit customers to arrange their accounts and begin working shortly. FreshBooks presents a variety of options tailor-made to service-based companies, together with limitless invoicing, time monitoring, and shopper retainer choices even in its most simple plan.

The software program’s flexibility is especially interesting, permitting customers to simply improve as their enterprise grows with out dropping performance. FreshBooks additionally excels in buyer help, offering readily accessible cellphone and e-mail help, which demonstrates their dedication to consumer satisfaction.

Freshbooks Professionals & Cons ‣

Professionals:

- Person-friendly interface with simple onboarding

- Versatile pricing plans that develop with what you are promoting

- Limitless invoicing, time monitoring, and estimates on all plans

- Glorious buyer help with available contact choices

Cons:

- Restricted to five billable purchasers on the essential plan

- Extra value for every staff member added ($10/month)

Writer’s Choose

Moxie

All the pieces it’s essential to thrive as a freelancer. From contracts, proposals, and shopper administration to invoicing, branded shopper portal, and a ton extra.

Why we like Moxie ‣

Moxie stands out as an all-in-one answer designed particularly for freelancers, addressing their distinctive wants and challenges. Its complete suite of instruments covers all the pieces from challenge administration and invoicing to time monitoring and accounting, all inside a single, user-friendly platform.

Moxie’s affordability, mixed with its concentrate on simplifying the executive aspect of freelancing, makes it a horny choice for each new and seasoned unbiased professionals. The software program’s means to develop with the consumer, from solo freelancer to small company proprietor, provides to its enchantment as a long-term enterprise administration answer.

Moxie Professionals & Cons ‣

Professionals:

- Completely nice customer support—you’ll be able to even attain the CEO

- All-in-one platform combining a number of important freelance enterprise instruments

- Reasonably priced pricing with no hidden charges or upsells

- Designed particularly for freelancers’ wants

Cons:

- Some options could also be too simplistic for extra complicated enterprise necessities

- Comparatively new product, which can imply fewer integrations or superior options

Different Nice Invoicing Choices

Bloom

Handle your artistic enterprise in a single place. Bloom gives a robust enterprise administration and progress toolset, that can assist you launch your side-gig or freelance enterprise.

Why we like Bloom ‣

Bloom.io is an actual powerhouse for freelancers and artistic professionals. It packs a ton of helpful instruments into one platform – you’ve got obtained invoicing, challenge administration, CRM, and even web site constructing multi function place. What actually units it aside is the way it takes all these annoying admin duties off your plate. As a freelancer, you’ll be able to lastly concentrate on the work you truly love doing. We’re huge followers of their cool options like instantaneous reserving and the way in which you’ll be able to customise the way you ship your work to purchasers. Plus, it is tremendous simple to make use of and will not break the financial institution. They even provide a reasonably beneficiant free plan. For those who’re a freelancer seeking to develop what you are promoting with out drowning in paperwork, Bloom.io may very well be simply what you want.

Bloom Professionals & Cons ‣

Professionals:

- Complete all-in-one answer for freelancers

- Revolutionary options like instantaneous reserving and customizable workflows

- Free invoicing and reserving options

- Reasonably priced pricing with a beneficiant free plan choice

Cons:

- Lacks e-mail advertising capabilities

- No multi-user performance for staff collaboration (although coming quickly)

- Could also be too centered on solo freelancers for these with bigger groups

- Some customers could discover sure options overly simplified

Bonsai

The enterprise and invoicing administration answer that provides you peace of thoughts and lets you focus in your work. Utilized by 500,000+ freelancers globally.

Why we like Bonsai ‣

Bonsai caught our eye as a strong device for freelancers who need to spend much less time on paperwork and extra time creating. It is like having a private assistant who handles the boring stuff – contracts, invoices, time monitoring – all rolled into one neat package deal.

What’s cool is the way it connects the dots: you’ll be able to whip up a proposal, flip it right into a contract, after which growth – your invoices are able to go. It is not making an attempt to be all the pieces to everybody, however for solo freelancers who want the fundamentals coated with out fuss, Bonsai hits the candy spot.

Plus, with options like auto-payment reminders, it is like having a well mannered however persistent collections division working for you 24/7.

Bonsai Professionals & Cons ‣

Professionals:

- Seamless circulation from proposals to contracts to invoices

- Constructed-in authorized templates save on lawyer charges

- Time monitoring that integrates straight with invoicing

- Nifty auto-follow-up for unpaid invoices

- Bitcoin fee choice for tech-savvy purchasers

Cons:

- Venture administration options are fairly primary

- Expense monitoring might use some beefing up

- Reporting instruments are extra bare-bones than data-rich

- Is likely to be too easy for bigger companies or complicated initiatives

Honeybook

A device with all the pieces it’s essential to get enterprise finished. Over 100K freelancers belief HoneyBook to handle initiatives, e book purchasers, ship invoices, and receives a commission.

Why we like Honeybook ‣

HoneyBook is just like the Swiss Military knife for freelancers who’re able to degree up their sport. It is not nearly maintaining your geese in a row; it is about reworking your kitchen desk operation right into a smooth-running enterprise machine. What actually caught our eye is how HoneyBook connects all of the dots in your workflow – from the primary “howdy” with a shopper to the ultimate “ka-ching” in your checking account. It is obtained that excellent mixture of automation (howdy, instantaneous follow-ups!) and customization (model these invoices, child!). Plus, at $9 a month to begin, it is like hiring a mini-assistant for lower than the price of a elaborate espresso. For solo acts seeking to hit the massive time with out drowning in admin work, HoneyBook would possibly simply be your ticket to the freelance huge leagues.

Honeybook Professionals & Cons ‣

Professionals:

- All-in-one answer: proposals, contracts, invoices, and scheduling in a single place

- Slick automated workflows that make you look tremendous skilled

- Customizable templates save time and mind energy

- Reasonably priced entry level for solopreneurs

- Constructed-in fee processing (together with auto-payments for retainer purchasers)

Cons:

- Preliminary setup could be time-consuming

- Some customers discover the interface might use a luxurious improve

- Is likely to be overkill for freelancers with only a handful of purchasers

- Studying curve could be steep for tech-averse customers

Quickbooks

Smarter enterprise instruments designed for small companies, freelancers, and self-employed people. Save time with computerized expense categorization, mileage monitoring, and seamless tax preparation.

Why we like Quickbooks ‣

QuickBooks is a sturdy accounting answer that caters effectively to established and quickly rising companies. Its in depth characteristic set consists of superior capabilities like stock administration, detailed challenge profitability monitoring, and built-in mileage monitoring. QuickBooks presents superior connectivity, boasting over 700 third-party app integrations, which permits for seamless incorporation into numerous enterprise ecosystems. The software program additionally gives choices for extra complete monetary help, together with the power to companion with a stay bookkeeper for skilled help. QuickBooks’ scalability makes it a wonderful alternative for companies anticipating important progress or these requiring extra complicated accounting options.

Quickbooks Professionals & Cons ‣

Professionals:

- In depth characteristic set together with stock and challenge profitability monitoring

- Massive variety of third-party app integrations (over 700)

- Constructed-in mileage monitoring

- Choice to work with a stay bookkeeper for extra help

Cons:

- Steeper studying curve in comparison with different instruments

- Costlier, particularly after promotional interval ends

- Can not improve from Self-Employed plan to different plans

- Restricted variety of customers even on higher-tier plans

Sq. Invoicing

Simplify invoicing with customizable templates, seamless fee acceptance, and real-time monitoring. Ship invoices, estimates, and contracts effortlessly, receives a commission sooner, and handle what you are promoting effectively with Sq.’s complete invoicing instruments.

Why we like Sq. Invoicing ‣

Sq. Invoices is the unsung hero of the small enterprise world, making the dreaded job of billing as painless as doable. It is like having a tiny, tireless accountant in your pocket, able to whip up professional-looking invoices in minutes. What actually units it aside is the way it performs good with Sq.’s different instruments, making a {smooth} circulation from sale to paid bill. The cherry on high? It is user-friendly sufficient that even probably the most tech-phobic enterprise proprietor can grasp it shortly. For small companies and freelancers seeking to receives a commission with out the trouble, Sq. Invoices would possibly simply be the key weapon you’ve got been looking for.

Sq. Invoicing Professionals & Cons ‣

Professionals:

- Tremendous simple to make use of, with a fast studying curve

- Seamless integration with different Sq. merchandise

- Skilled-looking, customizable invoices

- Quick fee processing with a number of fee choices

- Computerized fee reminders and monitoring

Cons:

- Greater transaction charges for invoices in comparison with in-person funds

- Occasional points with emails going to spam folders

- Restricted choices for dealing with cut up funds

- Some customers discover extra superior options missing for bigger companies

- Preliminary account setup and verification could be time-consuming for some customers

Harpoon

A forward-looking time-tracking and invoicing software program to plan and forecast a worthwhile future. Will your freelance enterprise be worthwhile 12 months from now? Meet Harpoon.

Why we like Harpoon ‣

Harpoon is not simply one other time-tracking device; it is the monetary GPS for artistic professionals navigating the uneven waters of project-based work. Image a lighthouse that not solely guides you safely to shore but in addition plots your course for future voyages. That is Harpoon in motion. It is like having a seasoned captain on the helm of what you are promoting ship, maintaining a tally of your present place whereas charting a course for treasure-filled waters forward. For freelancers and small groups bored with drifting aimlessly from challenge to challenge, Harpoon presents a strategy to steer what you are promoting with objective. It transforms the customarily murky world of challenge funds into a transparent, navigable map, serving to you keep away from the rocks of unprofitability and sail easily in direction of your monetary objectives. With Harpoon, you are not simply monitoring time – you are mastering it.

Harpoon Professionals & Cons ‣

Professionals:

- Complete challenge administration with finances monitoring and profitability evaluation

- Built-in time monitoring with each timer and guide entry choices

- Versatile staff collaboration options, ultimate for distant work

- Helps 20 totally different currencies for world companies

- Forecasting instruments to assist plan for a worthwhile future

Cons:

- No cellular app (although accessible by way of cellular net browser)

- Pricing mannequin primarily based on variety of customers, which may get costly for bigger groups

- No free tier accessible (solely a 14-day trial)

- Could also be overkill for companies not centered on project-based work

- Restricted to three purchasers on the starter package deal

Operating my very own small enterprise, I work with freelancers and contractors on a regular basis. And I’m continually shocked at what number of new freelancers don’t perceive freelancer invoicing fundamentals, like the best way to ship an bill or make it simple for purchasers to pay you to your work.

I assume I shouldn’t be stunned, most freelancers went to high school to be entrepreneurs, designers, writers, or work in another specialty.

Freelancer invoicing simply wasn’t in any of their class curriculums.

So earlier than wrapping up, I’d like to supply my very own “class” on freelancer invoicing: a easy but efficient information to invoicing as a freelancer.

We’ll begin with the fundamentals of freelancer invoicing after which transfer to extra superior suggestions and strategies that can assist you ship invoices shortly and receives a commission on-time, or you will get paid early if who to ask.

We’ve additionally obtained tons of different freelancer invoicing assets on the weblog together with

However in the event you’re simply getting began with freelancer invoicing, all of that may wait till later. You’re most likely asking your self some fairly primary questions (but, irritating in the event you’ve by no means finished it earlier than) corresponding to:

- How do I make my very own bill? or

- What do you have to placed on an bill?

So let’s dive into this information and make some severe progress in your freelancing. That is Freelancer Invoicing 101.

5 Massive Questions About The Finest Freelancer Invoicing Apps (FAQ)

To start out, I need to reply a number of the largest questions you may need about invoicing as a freelancer. This can permit us to begin with a standard basis for the rest of this freelancer invoicing information.

How do I make my very own bill?

Making an bill could be so simple as opening a phrase doc and typing a number of particulars together with enterprise identify, providers rendered, value of providers, and phrases of fee. Many individuals select to use invoicing software program to make the method simpler.

How do I write a easy bill?

Writing a easy bill is fairly simple and also you’ve obtained a number of choices. You possibly can obtain and use a free bill template or you’ll be able to fill out the fields of an bill generator which can then mechanically create your bill.

The secret is to maintain your course of quick and easy since you usually can’t invoice a great deal of hours to creating invoices (extra on that later).

What do you have to placed on an bill?

For those who’re unsure what needs to be included on a freelancer bill, you’re not alone. It’s actually fairly easy. At a minimal, it’s best to embrace the next when invoicing as a freelancer:

1. The phrase “INVOICE”

I do know this appears apparent, however your bill is extra more likely to receives a commission in the event you embrace the phrase “Bill” someplace giant, daring, and on the high of the web page. This alerts to folks they’ve a invoice due they usually’re extra more likely to course of it shortly.

2. Your small business identify

Each bill ought to embrace your personal identify. For those who’re a solo freelancer, this could merely be your private identify. When you have a enterprise identify or work on a staff, this needs to be your organization identify.

3. Your shopper’s enterprise identify

For those who’re doing work for an organization, embrace the complete firm identify when invoicing. For those who’re doing work for a person, simply use their very own private identify on the bill.

4. Description of providers rendered

In the principle space of the bill, present an itemized record (use a desk or bullet factors) of providers you’ve rendered to your shopper to stipulate precisely what the bill is for.

5. Value of providers rendered

Subsequent to every merchandise on the record of providers, embrace how a lot it value. Alternatively, you’ll be able to simply embrace the overall value for all providers in the event you don’t need to get away every merchandise.

6. Fee phrases (when and the best way to pay)

Prominently characteristic fee phrases (corresponding to “Due on Receipt” or “Web 30”) in your bill in addition to clear directions on the best way to pay. Utilizing a device like Freshbooks or Bonsai will take away any confusion on how and the place to pay your bill.

BONUS: Moreover it’s possible you’ll need to take into account placing the next in your bill:

7. Enterprise addresses, emails, cellphone numbers, and many others.

Some purchasers require that you just embrace sure contact info for each their firm and yours in your bill. These can embrace e-mail addresses, bodily addresses (simply use your property deal with in the event you do business from home) and even tax identification info.

8. Bill quantity

Whereas not essentially required, including an bill quantity to your bill may help referencing invoices later. As an alternative of looking for “my final bill” in your data and even “the bill you despatched on Oct 12”, you’ll be able to simply check with the bill as “bill #1234” when speaking along with your shopper.

Newbie tip: if that is your first bill, don’t make the quantity “0001” as it’ll give away simply how new you’re to freelancing. As an alternative, make up a quantity after which simply add +1 to the quantity every time you create a brand new bill.

9. A considerate notice

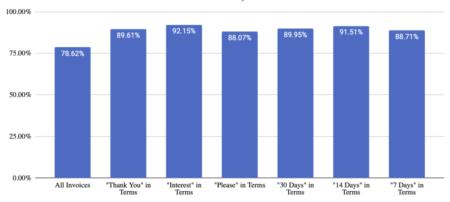

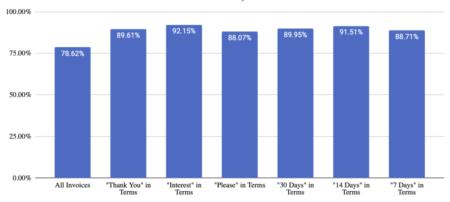

Chances are you’ll need to take into account including a considerate, customized notice to your bill as effectively. Not solely can these assist solidify your relationship with every shopper, one examine confirmed together with “please” or “thanks” in your bill can enhance your probability to receives a commission on time.

How do I bill as a freelancer?

Okay, now that you just’ve obtained a well-written bill with all of the necessary particulars, it’s time to truly ship the bill. Additionally recognized merely as “invoicing.”

So how do you bill as a freelancer?

Easy. You simply ship the bill to the shopper and make it apparent that’s what you’re sending. Listed below are the most typical methods to bill as a freelancer:

1. Ship your bill by way of the bodily mail

Relying in your shopper’s preferences and your personal enterprise practices, it’s possible you’ll need to ship your bill within the mail. This reduces the possibilities of an e-mail getting misplaced, forgotten, or ignored by your shopper. Nevertheless, it additionally will increase prices and time to get an bill despatched.

2. Ship your bill by way of e-mail

Whereas traditionally many invoices have been despatched by bodily mail, nearly all of invoices at present are despatched by way of e-mail. Fortunate for you, this typically results in faster processing and sooner fee to your work.

When sending an bill by way of e-mail overview these finest topic strains for freelancer invoicing—they’ll enhance your possibilities of getting paid on time.

3. Ship your bill with software program

In fact, the ultimate choice is what most trendy employees use (and anticipate) for freelancer invoicing—that’s, to ship your bill utilizing invoicing software program.

Do you invoice for invoicing time?

Now that you just perceive the fundamentals of freelancer invoicing, there are a number of extra superior questions we have to get to. For instance: do you have to invoice your purchasers for the time it takes to create an bill?

For those who’ve already constructed these prices into your authentic bid or have made your shopper conscious of it, billing for invoicing time is completely fantastic. Some select to easily cut up administrative prices up between their purchasers, which might additionally maintain the hours you spend managing invoices.

In fact, this turns into much less of a problem in the event you select to make use of a software program like Freshbooks the place you’ll be able to create invoices in lower than 60 seconds after which the know-how follows-up with purchasers and manages the invoices for you, dramatically reducing down on billable hours wasted on invoicing time.

The identical goes when invoicing for conferences and different miscellaneous duties. If the shopper agreed to it otherwise you’ve made them conscious of it, nice. If not, you shouldn’t invoice for it.

The true trick to profitable freelancer invoicing

Now that you just’ve obtained a primary understanding of what it takes to create and ship a contract bill that may receives a commission, it’s time to get again to the work you like probably the most (and the work purchasers pay you for).

The true trick to profitable freelancer invoicing is to make it as seamless as doable—working it into your course of so effectively that it occurs virtually on autopilot (tech helps with this).

That manner, you’re not losing a number of hours each week creating invoices, chasing down invoices, and doing different freelancer invoicing duties that take you away out of your most necessary work.

Preserve the dialog going…

Over 10,000 of us are having every day conversations over in our free Fb group and we would like to see you there. Be part of us!