Low-income retired {couples} with lower than $3,000 in belongings can get Medicaid to complement their Medicare insurance coverage or pay for a nursing residence. This asset cap, set by state governments, primarily applies to monetary accounts and excludes the worth of a house and automobile.

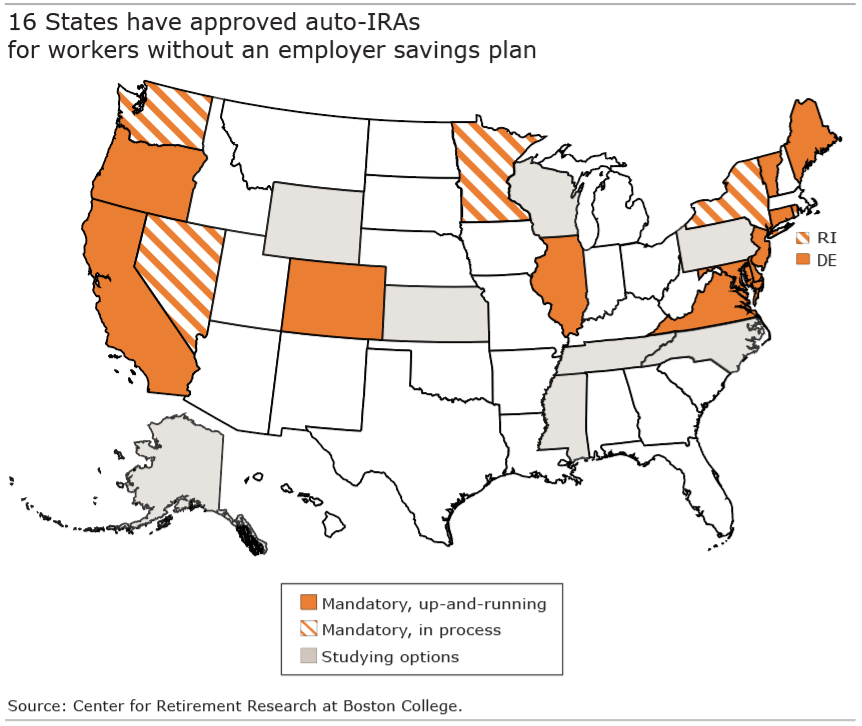

However Medicaid protection in previous age may battle with auto-IRA initiatives in a rising variety of states – 16 to this point – which might be designed to assist staff with out an employer 401(okay) save for retirement.

The substantial financial savings staff will construct up in these auto-IRAs may make some ineligible for the additional medical insurance protection as soon as they retire, even when their earnings meets this system’s earnings cap, in accordance with a new examine by the Middle for Retirement Analysis.

Typical staff who begin saving of their early 20s would have $25,000 in an auto-IRA by their early 50s – this estimate, on the low finish, is for a lower-paid employee who didn’t attend school and was enrolled intermittently in an auto-IRA. However account balances may go as excessive $105,000 – probably the most optimistic situation – for a college-educated employee who lacks an employer 401(okay) and saves frequently in an auto-IRA.

Over a decades-long profession, “staff accumulate important new financial savings within the auto-IRA,” the researchers concluded from their estimates, which had been based mostly on knowledge on U.S. staff’ earnings and a mannequin that assumes a nationwide auto-IRA program was adopted in 2019.

The researchers selected to tally the employees’ auto-IRA balances at ages 51-56. Though people who don’t retire untill 65 may have collected much more financial savings, that’s not the case for a lot of low-income staff. They are usually weak to growing disabilities that require them to scale back their work hours or cease working prematurely and apply for incapacity advantages. They may be compelled to take cash out of the Roth auto-IRAs – tax-free – to complement their earnings or meet the Medicaid asset take a look at.

Future Medicaid protection would even be affected amongst staff who begin saving later – of their 40s – however the influence can be extra muted than it’s for youthful savers. The older staff on this examine would have saved an estimated $22,000 to $25,000 by their early 50s. Even these comparatively small balances would possibly make some ineligible for Medicaid, offering an incentive in retirement to spend their financial savings shortly to get the low-cost medical insurance or long-term care protection they want.

States may get rid of the battle between two monetary targets – saving for retirement and containing healthcare bills in previous age – by following the lead of California’s Medicaid program, Medi-Cal. Low-income retirees making use of for Medi-Cal to complement their Medicare now not face an asset restrict. It was eradicated on Jan. 1, 2024.

However with out related laws in different states, staff and retirees with auto-IRA accounts may face powerful selections about the right way to reconcile their monetary wants with their well being care wants.

To learn this temporary by Karolos Arapakis and Laura Quinby, see “Will Auto-IRA Packages Have an effect on Medicaid Enrollment.”

The analysis reported herein was carried out pursuant to a grant from the U.S. Social Safety Administration (SSA) funded as a part of the Retirement and Incapacity Analysis Consortium. The opinions and conclusions expressed are solely these of the authors and don’t symbolize the opinions or coverage of SSA or any company of the Federal Authorities. Neither the US Authorities nor any company thereof, nor any of their workers, makes any guarantee, categorical or implied, or assumes any authorized legal responsibility or accountability for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any particular business product, course of or service by commerce identify, trademark, producer, or in any other case doesn’t essentially represent or suggest endorsement, suggestion or favoring by the US Authorities or any company thereof.