Opponents shouldn’t block 403(b)s from buying collective funding trusts.

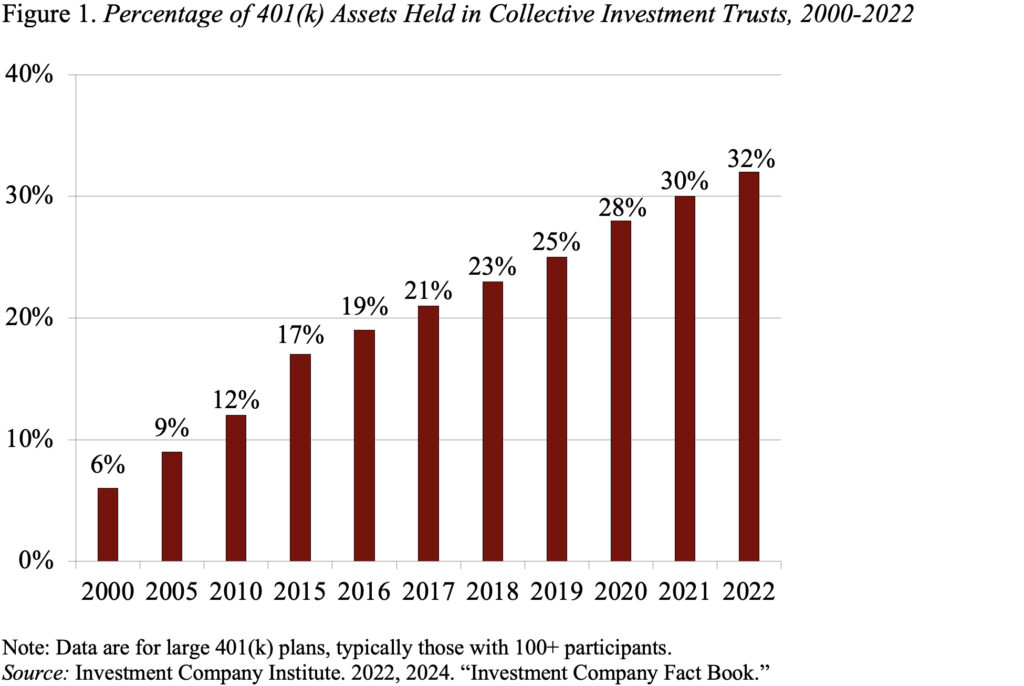

Anybody involved about charges in retirement plans needs to be delighted that the usage of collective funding trusts (CITs) that put money into the identical belongings as mutual funds has been growing amongst 401(okay) plans (see Determine 1) and that the SECURE 2.0 laws permits 403(b) plans to put money into CITs. (403(b) plans are retirement financial savings plans sponsored by public instructional establishments, 501(c)(3) tax-exempt organizations, and different non-profits.)

Sadly, a gaggle of organizations desires to dam CITs from 403(b)s. (For you lawyerly varieties, whereas SECURE 2.0 amended the Inside Income Code to permit 403(b) funding in CITs, the securities legal guidelines additionally have to be amended. Such an modification seems in Part 205 of the Empowering Primary Avenue in America Act of 2024, which is at the moment into consideration by the Senate.)

My sense is that nobody disagrees that CITs price lower than mutual funds for the very same bundle of securities. My buddy Francis Vitagliano made me take a more in-depth have a look at this problem about two years in the past. His competition was that 401(okay) plans have been paying mutual funds about $1 billion in switch agent charges for providers they already obtain by way of their recordkeeper.

How might that occur? Right here’s what 401(okay) recordkeepers do for plans:

- Preserve particular person accounts – settle for contributions and course of withdrawals.

- Calculate and report the steadiness in every participant’s account day by day.

- Facilitate required plan disclosures, similar to on Type 5500.

- Preserve web site and carry out all kinds of participant communications.

Switch agent duties for particular person traders at mutual funds contain capabilities #1 and #2 above – sustaining the account and calculating the day by day steadiness. Since 401(okay) plans have one omnibus account at every mutual fund firm, the switch agent performs capabilities #1 and #2 for the plan as a complete, whereas all of the processing for particular person individuals is completed by the 401(okay)’s recordkeeper. On the time, my estimate was that mutual funds have been overpaying $2 billion in switch agent charges – increased than Francis’ quantity! CITs pay not one of the redundant switch agent charges.

CITs are additionally cheaper than mutual funds as a result of – being bought solely to retirement plans and different refined traders – they don’t seem to be required to register beneath the federal securities legal guidelines and thereby keep away from most of the regulatory prices related to merchandise provided to most people.

CITs’ standing beneath the securities legal guidelines doesn’t imply that they’re “unregistered monetary merchandise,” as claimed by opponents. CITs are maintained by banks and subsequently are topic to banking rules governing CIT trustees. They’re additionally topic to widespread regulation rules of fiduciary obligation.

Extra attention-grabbing, if a retirement plan coated by ERISA invests in a CIT, the supervisor of the CIT is topic to ERISA fiduciary obligations. In different phrases, so long as one of many traders within the CIT is an ERISA plan, all of the CIT belongings will probably be managed in accordance with the ERISA fiduciary commonplace. That implies that if a 403(b) plan not coated by ERISA (similar to these for public faculty lecturers) invested in a CIT, that portion of the plan’s belongings would profit from ERISA protections. In brief, CITs not solely decrease funding prices for retirement saving, but in addition can unfold ERISA’s fiduciary protections to uncovered plans. Opponents merely haven’t any case for attempting to dam 403(b)s from buying CIT belongings. In actual fact, possibly we must also open up IRAs to CITs as a option to get ERISA protections for a minimum of a number of the belongings in these high-fee preparations.