The temporary’s key findings are:

- State auto-IRA packages require employers and not using a retirement plan to auto-enroll their staff in an IRA.

- As individuals construct up IRA belongings, they might find yourself ineligible for means-tested Medicaid after they retire.

- The evaluation tasks that at this time’s youthful staff would find yourself with significant belongings.

- However the results on Medicaid could also be muted, as older cohorts can have decrease balances and a few youthful cohorts could “spend down” to get on Medicaid.

- Alternatively, states may adapt their Medicaid asset assessments to exclude all, or a part of, auto-IRA financial savings – a step already taken by California.

Introduction

Provided that solely about half of personal sector staff are lined by an employer-sponsored plan at any given time, 16 states have launched – or are within the strategy of launching – auto-IRA packages that require employers and not using a plan to auto-enroll their staff in a Roth IRA. Whereas these packages will assist these with out an employer-sponsored plan to build up belongings for retirement, they may additionally put individuals prone to shedding out on means-tested advantages in retirement. This danger is most incessantly mentioned by way of Medicaid, which supplies medical and long-term take care of low-income households and the place a pair’s belongings typically can not exceed $3,000.

This temporary, which relies on a latest examine, explores the extent to which low- and moderate-income households is not going to qualify for Medicaid in retirement due to their auto-IRA financial savings.1 Because the state auto-IRA packages are nonetheless too immature to look at participant outcomes immediately, this evaluation makes use of a simulation mannequin to undertaking how a lot auto-IRA financial savings future households would have if a nationwide program had launched in 2019.

The dialogue proceeds as follows. The primary part supplies background on the protection hole, state auto-IRA initiatives, and Medicaid for older households. The second part describes the simulation methodology, whereas the third part presents the outcomes. The ultimate part concludes that whereas youthful cohorts will accumulate significant belongings of their auto-IRAs, the impact on Medicaid participation will likely be muted as a result of balances for older cohorts stay low and a few youthful cohorts of auto-IRA individuals would most likely select to “spend down” to qualify for Medicaid’s long-term care advantages.

Background

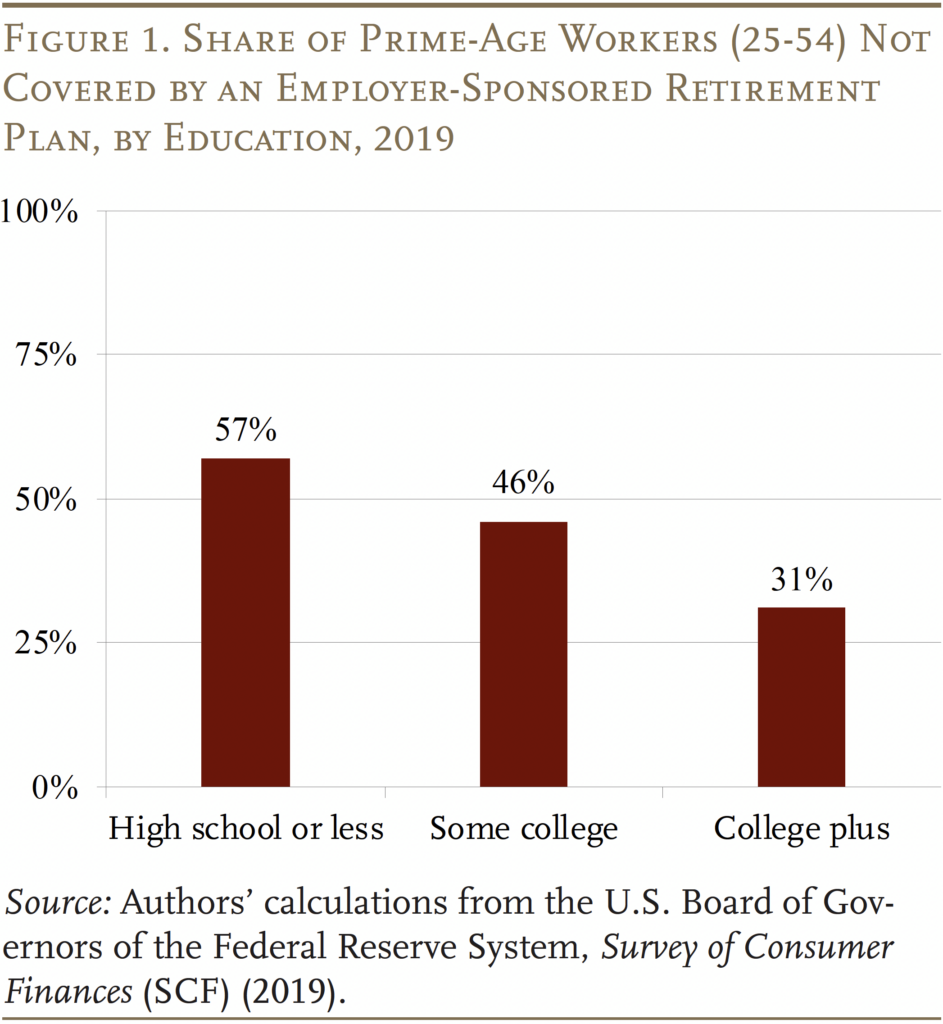

A serious impediment to boosting staff’ retirement saving is the shortage of constant entry to an employer-based plan, and this protection hole has persevered for many years. Though it notably impacts lower-wage staff and not using a faculty diploma, a considerable share of even faculty graduates lack employer protection at any given second (see Determine 1).

As repeated federal makes an attempt to shut the protection hole haven’t had a lot affect, states have began implementing auto-IRA packages. Many of the current packages observe a really related mannequin. Corporations are required to submit well timed payroll data to this system however haven’t any fiduciary or administrative duty and can’t make matching contributions. Participant contributions are initially set at 5 % with staff allowed to vary the speed or choose out at any level. The primary $1,000 of contributions is invested safely, with further contributions defaulted right into a goal date fund. And, as a result of the accounts are designed as Roths, staff can at all times withdraw their contributions with no penalty.

Though the state auto-IRAs are nonetheless of their infancy, early knowledge on participation look promising. Early research of OregonSaves, the primary program to launch, discover that participation ranged from 48 to 67 % in 2018 (relying on the therapy of lacking administrative knowledge), suggesting that many staff didn’t choose out.2 More moderen knowledge supplied by the reside packages present opt-out charges round 30 %.3

By way of withdrawals, the early Oregon research discovered that 20 % of energetic individuals made withdrawals every year, eradicating $1,000 from their accounts on common. Nonetheless, withdrawal charges and quantities throughout the reside packages are clearly rising as packages prolong their preliminary rollout to small employers and staff turn into more and more conscious of the choice.4 One other benchmark is complete withdrawals as a share of complete contributions, which is at present about 25 % within the reside packages.5 The query is, will the auto-IRA association translate to substantial new belongings in the long term?

Whereas asset accumulation is the objective of the auto-IRA initiative, it additionally raises the query whether or not auto-IRAs will have an effect on the power of older people to take part in means-tested packages. This concern is especially related to Medicaid, which incorporates an asset take a look at for these over age 65 in addition to an revenue take a look at. The principles range by state and kind of Medicaid providers, however typically monetary belongings can not exceed $2,000 for a person and $3,000 for a pair. IRA wealth is often included, and the place it’s excluded, withdrawals typically depend towards the revenue restrict.6 Auto-IRA individuals with belongings in extra of the Medicaid thresholds could both miss out on receiving means-tested advantages or be compelled to attract down their financial savings to protect entry.7

Methodology and Knowledge

To find out whether or not low- and middle-income households are prone to shedding Medicaid advantages resulting from their auto-IRA financial savings requires projecting future balances for hypothetical staff. The projections are primarily based on the idea {that a} nationwide IRA program had been applied in 2019, and the evaluation makes use of knowledge from two sources: the Survey of Shopper Funds (SCF) and administrative knowledge from the reside auto-IRA packages. The SCF is a nationally consultant triennial survey carried out by the Federal Reserve Board that gives detailed data on family belongings, liabilities, revenue, and demographics. The SCF additionally has an in depth module on retirement plan protection and participation.8 To undertaking auto-IRA balances, the evaluation additionally depends on opt-out charges, contribution charges, and withdrawal charges supplied by the reside auto-IRA packages.9

The evaluation proceeds in three steps. Step one is to undertaking lifetime employment and earnings for households within the SCF. Employment is estimated utilizing a regression equation the place the chance of being employed in future years is a perform of age, gender, training, race, and their interactions. Then employed people are assigned earnings primarily based on the median for present staff with related traits.

The second step is to find out which employed people are lined by employer-sponsored plans, resembling 401(okay)s. Because the outcomes become fairly delicate to this dedication, the evaluation is carried out below two assumptions. The primary strategy assigns people’ 401(okay) protection randomly every year, primarily based on age-specific chances that adjust in keeping with gender, training, and race (the “intermittent protection situation”). Intuitively, this strategy assumes that people change jobs yearly and have some likelihood of acquiring employer protection at every job change.10 In distinction, a second strategy assigns people’ lifetime 401(okay) protection randomly, at first of 1’s working life, primarily based on the common protection fee for prime-age staff of comparable gender, training, and race (the “steady protection situation”). Conceptually, this strategy assumes that some staff at all times have an employer plan whereas others at all times lack one and are as an alternative in an auto-IRA.11

The third step is to calculate auto-IRA balances. The evaluation assumes that every particular person who will not be lined by an employer plan is eligible for the auto-IRA, and makes a one-off determination to remain auto-enrolled or to choose out. The chance of opting out is about at 30 %, reflecting basic expertise from the reside auto-IRAs. The worker contribution fee is about at 5 % of earnings. Members make withdrawals with a chance of 20 % every year. When individuals make a withdrawal, they take away $2,000 from their account, in line with habits within the reside packages.12 The primary $1,000 of contributions is held in money; quantities in extra of $1,000 are invested in a goal date fund.13

Outcomes

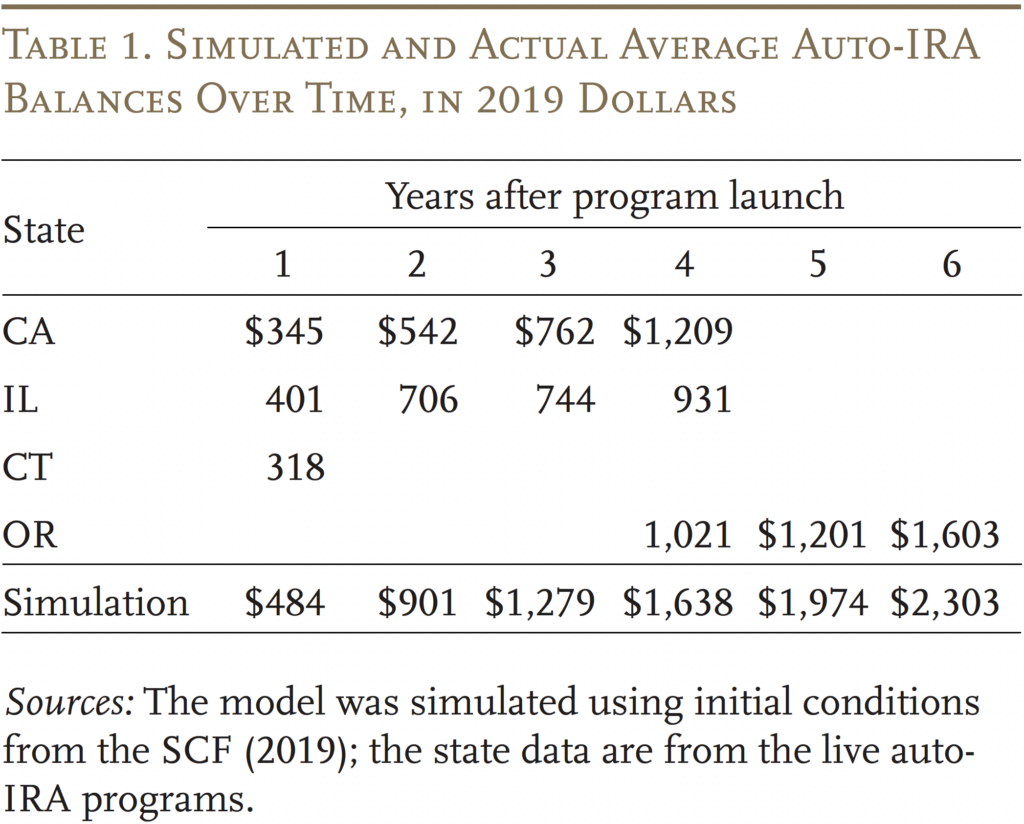

To examine that the mannequin produces cheap outcomes, Desk 1 compares common auto-IRA account balances within the first few years of the projection in opposition to common balances noticed within the first few years of the reside packages. Reassuringly, the mannequin appears moderately near real-world expertise. Any deviation will be defined by the truth that we explicitly selected to not incorporate real-world problems, resembling employer delays in submitting payroll data and higher-than-normal withdrawals throughout the COVID-19 pandemic.14

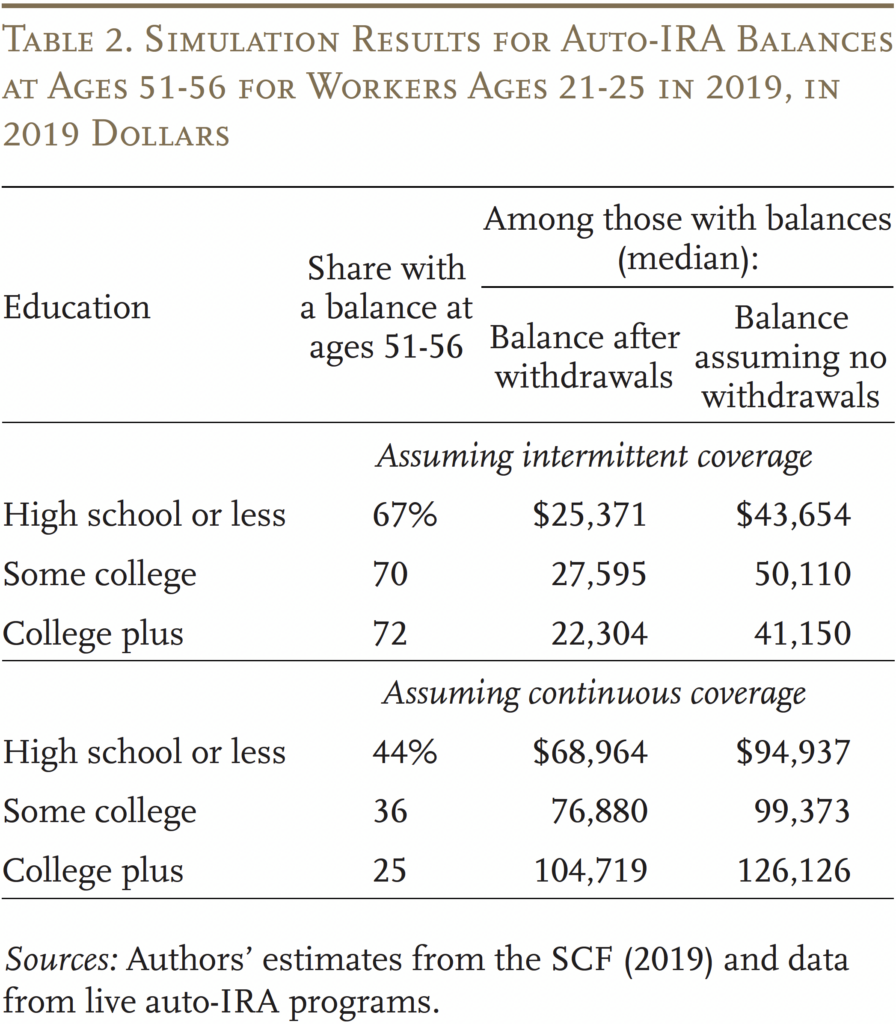

Turning to the principle findings, the highest panel of Desk 2 reveals simulation outcomes from the “intermittent protection” situation at ages 51-56 for a cohort of youthful staff (ages 21-25 in 2019). Since we assume that auto-IRA laws is enacted in 2019, outcomes for this cohort characterize the very best doable balances in our mannequin. The primary column reveals that about 70 % of staff will in the end find yourself with a constructive auto-IRA stability. Nonetheless, as a result of individuals cycle in-and-out of this system, median ending balances are reasonable: $25,371 for these with not more than a highschool diploma, $27,595 for these with some faculty, and $22,304 for these with a university diploma (column 2). The final column reveals that the balances can be bigger if individuals weren’t additionally utilizing the accounts for precautionary financial savings all through their work lives.

The story is totally different within the “steady protection” situation (the underside panel of Desk 2). Right here, fewer staff find yourself with constructive balances – 44 % of these with a highschool diploma or much less, 36 % of these with some faculty, and solely 25 % of faculty graduates. But, as a result of individuals spend their full careers in this system, they accumulate sizeable balances: $68,964 for people with a highschool diploma or much less, $76,880 for these with some faculty, and $104,719 for college-educated staff. In fact, each the intermittent and steady protection situations are primarily based on excessive assumptions – “intermittent protection” underestimates the persistence of employer protection over the work life, whereas “steady protection” overestimates it – so the almost certainly quantities would fall someplace between the 2.

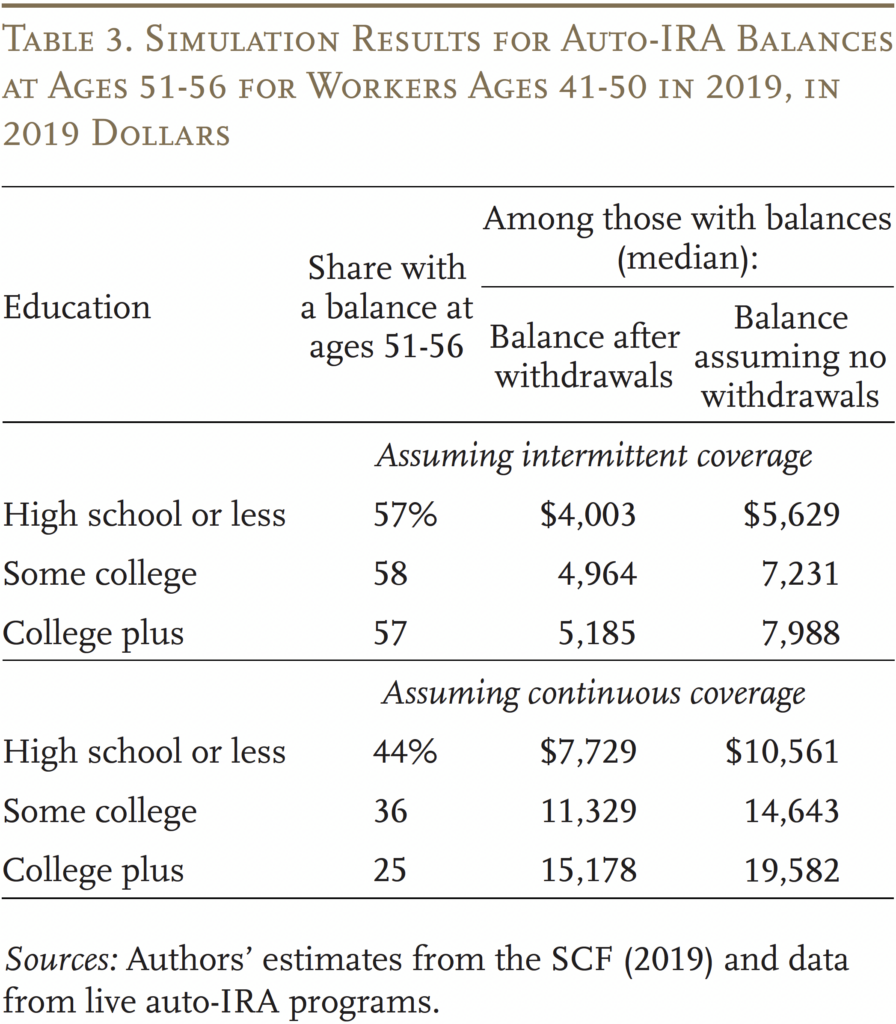

In the meantime, Desk 3 replicates this evaluation for a cohort of older staff (ages 41-50 in 2019). The share of people with a constructive auto-IRA stability at ages 51-56 falls within the “intermittent protection” situation as a result of older staff usually tend to have employer-plan protection to start with. Furthermore, since most of those staff have comparatively few years earlier than retirement to build up auto-IRA financial savings, they find yourself with a lot smaller balances in each situations. Particularly, median balances after withdrawals are $4,000 to $5,000 within the “intermittent protection” situation, and solely $8,000 to $15,000 within the “steady protection” situation.

Total, these findings recommend that, in the long term, staff accumulate vital new financial savings within the auto-IRA. But, simulated balances stay low for a few years whereas the hypothetical program matures.

Finally, assessing whether or not these new financial savings will induce individuals to delay or forgo Medicaid is a judgement name past the mechanics of the mannequin, because it is dependent upon individuals’ post-retirement drawdown habits and the character of their care wants. People will weigh the relative worth of spending down their auto-IRA to qualify for Medicaid in opposition to preserving their balances and paying for his or her medical care out-of-pocket. Those that would have relied on Medicaid to subsidize their Medicare premiums or cowl comparatively low depth take care of a yr or so will most likely pay out of pocket. Those that require excessive depth take care of numerous years will most likely spend down their very own sources after which qualify for Medicaid. Not all of the adjustment should come from people, nevertheless, as states may additionally change their eligibility necessities. As of January 2024, California – a state with a serious auto-IRA program (CalSavers) – eradicated the asset take a look at for older households.

Conclusion

State auto-IRA packages goal to assist low and reasonable earners with out an employer retirement plan construct financial savings. Nonetheless, the packages’ interplay with means-tested safety-net packages, resembling Medicaid, has not been mentioned. This examine begins the dialog by projecting what households might need saved in an auto-IRA had a nationwide program launched in 2019. Though the outcomes are delicate to underlying assumptions, the evaluation means that in the long term, staff almost certainly to make the most of security web packages would accumulate significant new financial savings over the course of their working lives.

Finally, assessing whether or not this new financial savings will trigger households to delay or forgo Medicaid is a judgement name past the mechanics of the mannequin. Youthful cohorts of staff who’ve time to construct up sizeable auto-IRA balances may delay Medicaid recipiency for a interval. However, below present Medicaid coverage, older cohorts with smaller balances can have a robust incentive to spend down their financial savings to qualify.

Alternatively, states may adapt their Medicaid asset assessments to ignore all, or some portion of, auto-IRA financial savings. Past offering well being advantages, this sort of disregard may additionally encourage households to avoid wasting extra within the auto-IRA to start with. California has already adopted such a coverage, eliminating the asset take a look at fully for these 65 and over.

References

Arapakis, Karolos and Laura D. Quinby. 2024. “Will Auto-IRA Packages Have an effect on Medicaid Enrollment?” Working Paper 2024-14. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Aubry, Jean Pierre. 2024. “A Massachusetts Auto-IRA Program.” Particular Report. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Belbase, Anek, Laura D. Quinby, and Geoffrey T. Sanzenbacher. 2020. “Auto-IRA Rollout Steadily Rushing Up.” Situation in Temporary 20-5. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

California State Treasurer. 2023. “CalSavers 2023 Stories.” Sacramento, CA: CalSavers Retirement Financial savings Board.

Chalmers, John, Olivia S. Mitchell, Jonathan Reuter, and Mingli Zhong. 2022. “Do State-Sponsored Retirement Plans Enhance Retirement Saving?” AEA Papers and Proceedings 112: 142-146.

Chetty, Raj, John N. Friedman, and Emmanuel Saez. 2013. “Utilizing Variations in Information Throughout Neighborhoods to Uncover the Impacts of the EITC on Earnings.” American Financial Evaluation 103(7): 2683-2721.

Georgetown Heart for Retirement Initiatives. 2024. “State Program Efficiency Knowledge – Present Yr.” Washington, DC.

Harris, Timothy F., Kenneth Troske, and Aaron Yelowitz. 2018. “How Will State-Run Auto-IRAs Have an effect on Employees?” Journal of Retirement 6(2): 27-33.

Illinois State Treasurer. 2023. “Safe Alternative Efficiency Dashboards.” Springfield, IL.

Musumeci, MaryBeth, Priya Chidambaram, and Molly O’Malley Watts. 2019. “Implications of the Expiration of Medicaid Lengthy-Time period Care Spousal Impoverishment Guidelines for Neighborhood Integration.” Situation Temporary. San Francisco, CA: KFF.

Oregon Retirement Financial savings Board. 2023. “Month-to-month OregonSaves Program Knowledge Stories.” Salem, OR: Oregon State Treasury.

Quinby, Laura D., Alicia H. Munnell, Wenliang Hou, Anek Belbase, and Geoffrey T. Sanzenbacher. 2020. “Participation and Pre-Retirement Withdrawals in Oregon’s Auto-IRA.” Journal of Retirement (Summer season 2020): 1-13.

Sabelhaus, John. 2022. “The Present State of U.S. Office Retirement Plan Protection.” Working Paper No. 2022-07. Philadelphia, PA: Wharton Pension Analysis Council.

Saez, Emmanuel. 2010. “Do Taxpayers Bunch at Kink Factors?” American Financial Journal: Financial Coverage 2(3): 180-212.

Scott, John and Andrew Blevins. 2020. “Oregon State Retirement Program Rising Throughout Pandemic – Regardless of Some Employee Withdrawals: Program Belongings and Participation by Staff and Employers Proceed to Rise.” Washington, DC: The Pew Charitable Trusts.

U.S. Board of Governors of the Federal Reserve System. Survey of Shopper Funds, 2019. Washington, DC.