Amazon earnings highlights

Share costs had been up 5% in after-hours buying and selling on Thursday after the sturdy earnings beat.

- Amazon (AMZN/NASDAQ): Earnings per share of $1.43 (versus $0.14 predicted) and revenues of $134.4 billion (versus $131.5 billion predicted).

Amazon Net Providers (AWS) stays the golden goose, although only a few of Amazon’s retail clients comprehend it exists. Revenues climbed 19% in the course of the quarter, and totalled $27.4 billion. Amazon’s promoting revenues had been one other highlighted space of the report, as they had been up 19%. General working income grew 56% yr over yr to $17.4 billion, principally credited to the 27,000 jobs reduce by the corporate since 2022.

Founder, government chairman and former president and CEO of Amazon, Jeff Bezos was within the headlines this week in his function as proprietor of the Washington Submit. He refused to permit the Submit’s editorial workforce to print their endorsement of Kamala Harris for president, and it was met with widespread outrage from Submit readers. As of Tuesday, greater than 250,000 subscriptions had been cancelled consequently.

Fortuitously for Bezos, he bought the Washington Submit (one of many world’s premier information manufacturers) for “chump change”—$250 million (roughly a mere 1.2% of his web value). So, if he drives it into the bottom, I don’t assume he’ll shed tears.

Little doubt co-founder and CEO of Tesla, Elon Musk, is making related calculations along with his luxurious buy two years in the past of Twitter (which he rebranded as X). Critics say he has turned the social platform into an echo chamber for Republican presidential candidate Donald Trump. What are the billions for, if an individual can’t even take pleasure in themselves by shopping for slightly media, am I proper? (That’s sarcasm.)

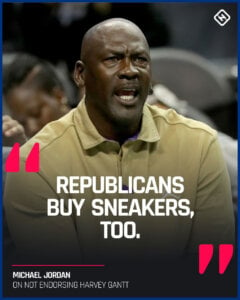

To this point we’ve but to see evaluation to point out Bezos’ editorial choice affecting Amazon’s share value or income numbers. Apparently Republicans purchase Amazon Prime, too.

Canada’s finest dividend shares

Microsoft, Meta and Google: Predictably unbelievable earnings

Without having fairly as massive a market cap as Nvidia and Apple, different mega tech shares within the U.S. are not any slouches. For instance, Microsoft can be as priceless because the entirety of Canada’s inventory exchanges at $3.2 trillion. Alphabet and Meta clock in at $2.1 trillion and $1.5 trillion respectively. (All figures on this part are in U.S. {dollars}.)

Different Huge Tech inventory information highlights

Right here’s what these firms introduced this week.

- Alphabet (GOOGL/NASDAQ): Earnings per share got here in at $2.12 (versus $1.51 predicted) on revenues of $88.27 billion (versus $86.30 billion predicted).

- Microsoft (MSFT/NASDAQ): Earnings per share of $3.30 (versus $3.10 predicted), and revenues of $65.59 billion (versus $64.51 predicted).

- Meta (META/NASDAQ): Earnings per share coming in at $6.03 (versus $5.25 predicted) and revenues of $40.59 billion (versus $40.29 predicted).

All three firms crushed incomes estimates throughout the board. Nevertheless, shareholders’ reactions to those earnings beats had been nonetheless muted. Meta shares had been down 2.5% in after-hours buying and selling on Wednesday, and it was an identical scenario for Microsoft. Alphabet fared higher as its shares had been up 3%.

It’s exhausting to place these numbers into the huge context into which they belong, as a result of the world has by no means seen something like these firms earlier than. Listed here are highlights from the earnings calls. (Scroll the chart left to proper along with your fingers or press shift, as you employ scroll wheel in your mouse to learn.)