The transient’s key findings are:

- Most individuals consider Medicare – not Medicaid – because the well being program for older People, however Medicare doesn’t cowl long-term care providers (LTSS).

- Medicaid does pay for LTSS for these with low incomes and likewise helps cowl their Medicare out-of-pocket prices.

- Consequently, these ages 65+ account for 10 p.c of complete Medicaid enrollees and 20 p.c of its spending.

- Trying forward, Medicaid might not hold tempo with rising demand for LTSS, so a heavier burden might fall on household caregivers or extra wants might go unmet.

Introduction

Most individuals consider Medicare – not Medicaid – when contemplating authorities well being look after older People. Nonetheless, Medicaid, this system that covers the medical bills of the poor, spends over $132 billion a 12 months – 20 p.c of its funds – on people ages 65 and over. Aged beneficiaries embrace each these with low incomes all through their retirement and people who turn into “medically needy” – that’s, fulfill Medicaid’s means assessments after incurring excessive well being care bills.

This transient summarizes the character and quantity of Medicaid spending on People ages 65+ – that’s, the inhabitants already receiving advantages below Medicare – paperwork the way it has modified over time, and examines projections of future ranges of spending and the implications for each authorities budgets and the well-being of older households.

The dialogue proceeds as follows. The primary part describes the origins and evolution of Medicaid and compares its beneficiaries to these lined by Medicare. The second part describes the pathways by which older People can entry Medicaid advantages. The third part speculates about the way forward for Medicaid and the advantages accessible to older People going ahead. The ultimate part concludes that Medicaid is an important part of the nation’s well being care system offering important advantages for low- and middle-income elders, however authorities projections recommend that Medicaid outlays might not hold tempo with the growing long-term care wants of an growing old inhabitants.

A Transient Historical past of Medicaid

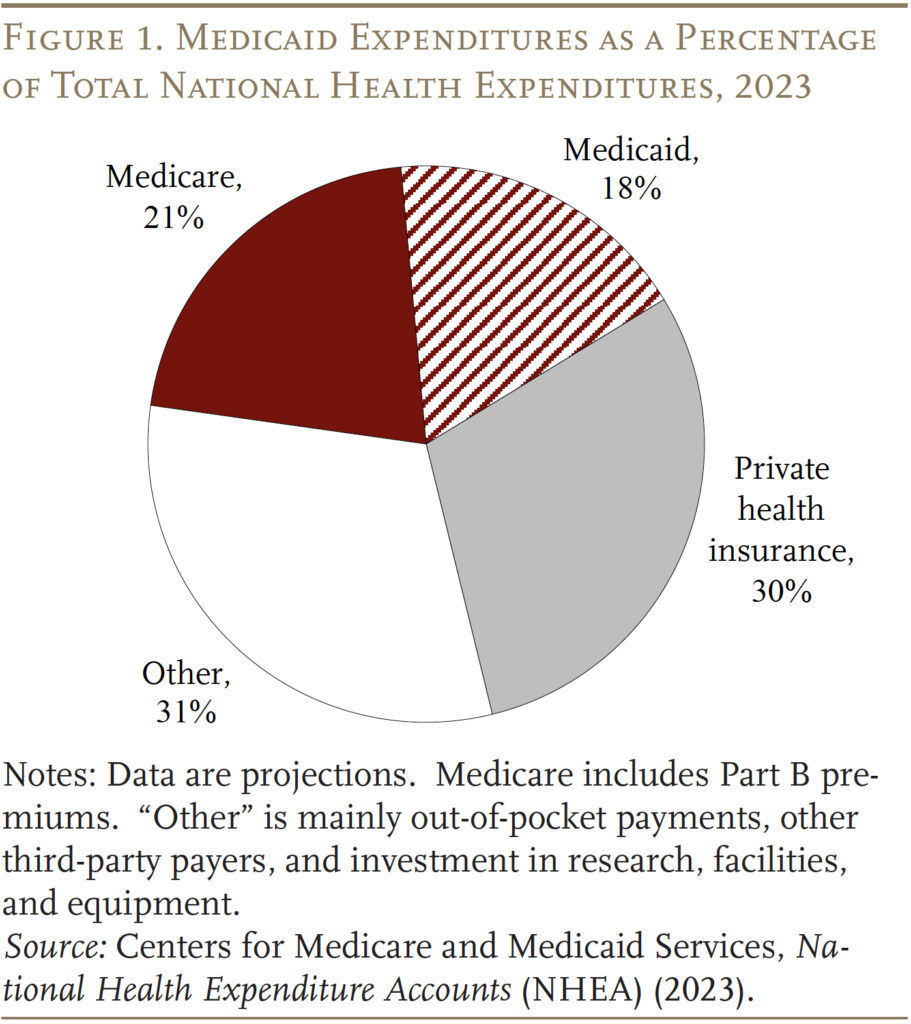

Medicaid was enacted in 1965 as a part of the identical regulation that created Medicare. Whereas Medicare covers all individuals 65 and older and individuals who obtain federal incapacity insurance coverage, Medicaid was designed to assist low-income households who traditionally couldn’t afford non-public medical health insurance and to supply long-term care providers for the aged poor. In 2023, Medicare and Medicaid spending collectively accounted for 39 p.c of the nation’s complete outlays for well being care (see Determine 1).

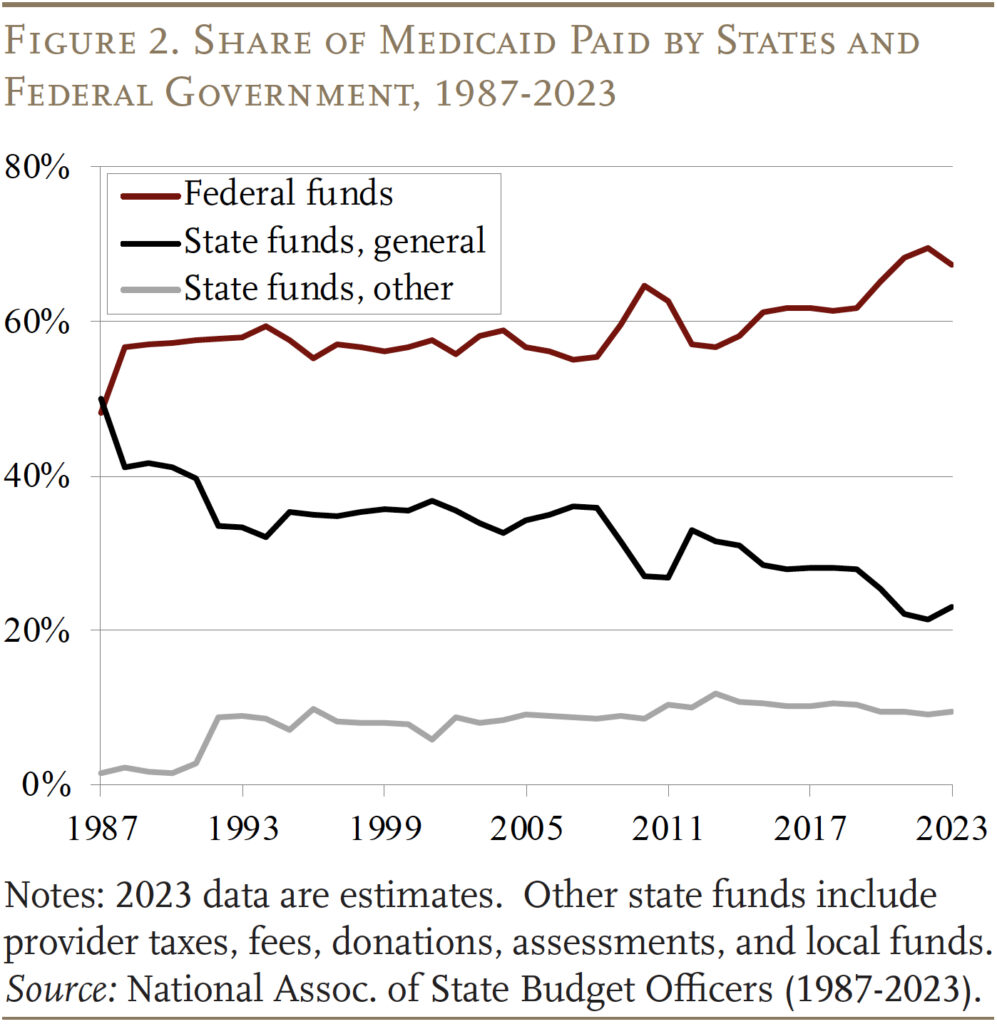

Medicaid is financed collectively by the federal authorities and the states. The federal authorities ensures matching {dollars} and not using a cap for certified providers, primarily based on a state’s revenue stage. That’s, the federal authorities supplies increased reimbursement charges to states with decrease per capita incomes, with the vary various from a ground of fifty p.c to a ceiling of 83 p.c.1 Traditionally the federal authorities has paid for 60 p.c of complete Medicaid prices, albeit this share spiked briefly to 70 p.c in 2022 because of laws enacted in the course of the pandemic (see Determine 2).

State participation in Medicaid is voluntary, however to qualify for matching funds states should comply with broad federal guidelines for advantages and protection. (By 1980, all states had opted in.) Medicaid protection was traditionally tied to receipt of money help – both by the previous Support to Households with Dependent Youngsters (AFDC) program or the Supplemental Safety Revenue (SSI) program, which supplies advantages to kids and adults with disabilities and to these ages 65 and over.2 Over time, Congress expanded federal minimal necessities for state participation and offered new protection necessities and choices for states, particularly for kids, pregnant ladies, and other people with disabilities. As well as, states typically present protection that exceeds the minimal ranges set by Congress or federal guidelines.3

Furthermore, in 2010, the Reasonably priced Care Act expanded Medicaid to incorporate non-elderly adults with out dependent kids, who had historically been excluded from protection, with incomes as much as 138 p.c of the federal poverty line ($20,780 for a person in 2024). Whereas the Medicaid enlargement was successfully optionally available, as of 2024, 41 states and Washington, DC have opted in. These states obtain a better federal match price for these lined below this expanded eligibility possibility.

Lastly, COVID-19 additionally had a giant impact on Medicaid spending and enrollment. Initially of the pandemic, Congress required Medicaid applications to maintain folks repeatedly enrolled – quite than requiring reenrollment (usually yearly) – in alternate for enhanced federal funding. Consequently, enrollment grew considerably between 2019 and 2023. These provisions began to unwind in April 2023, which has diminished the Medicaid rolls by 13 million from the pandemic peak.4

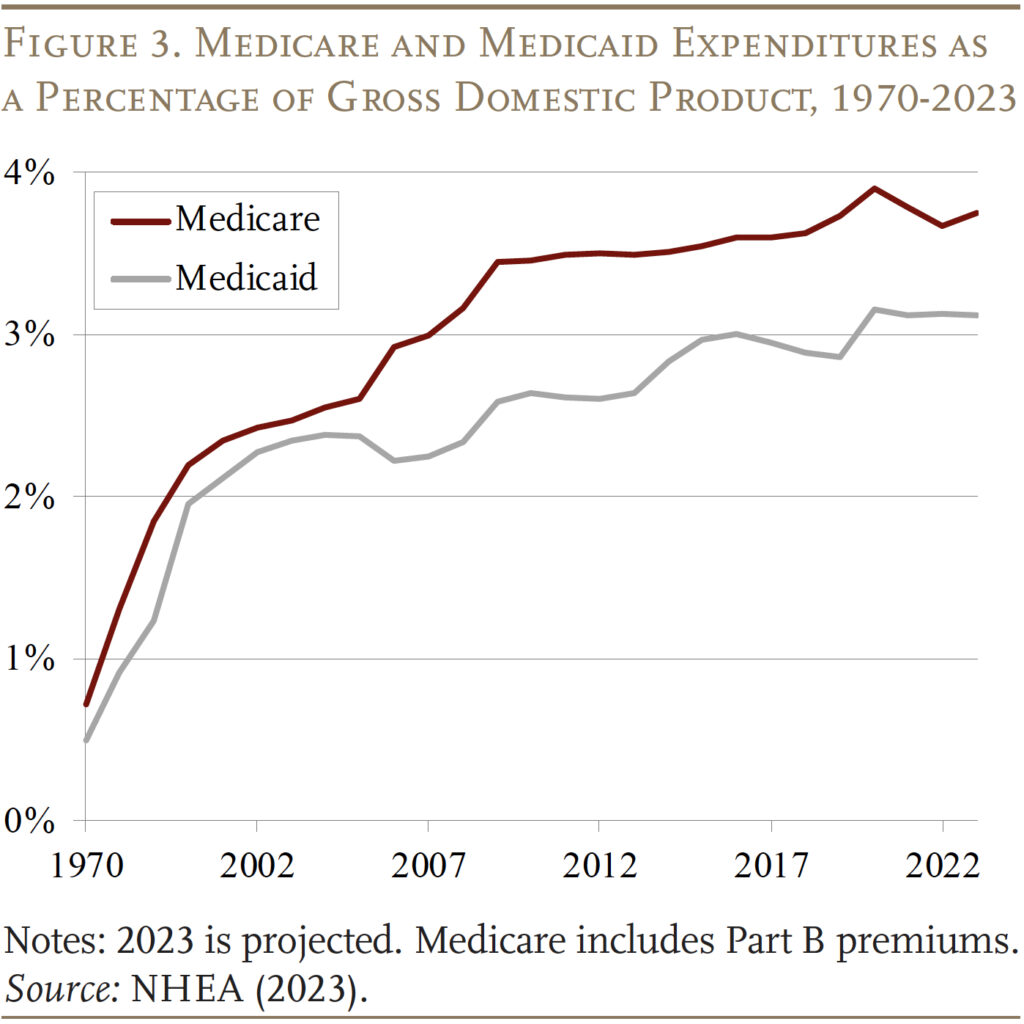

On account of the enlargement of the teams lined and rising well being care prices, Medicaid expenditures have now grown to three.1 p.c of GDP, however progress has slowed for the reason that 2010s. Medicaid expenditures are actually effectively beneath Medicare expenditures, which started to rise sharply because the Child Growth began to retire (see Determine 3).

Medicaid for “the Aged”

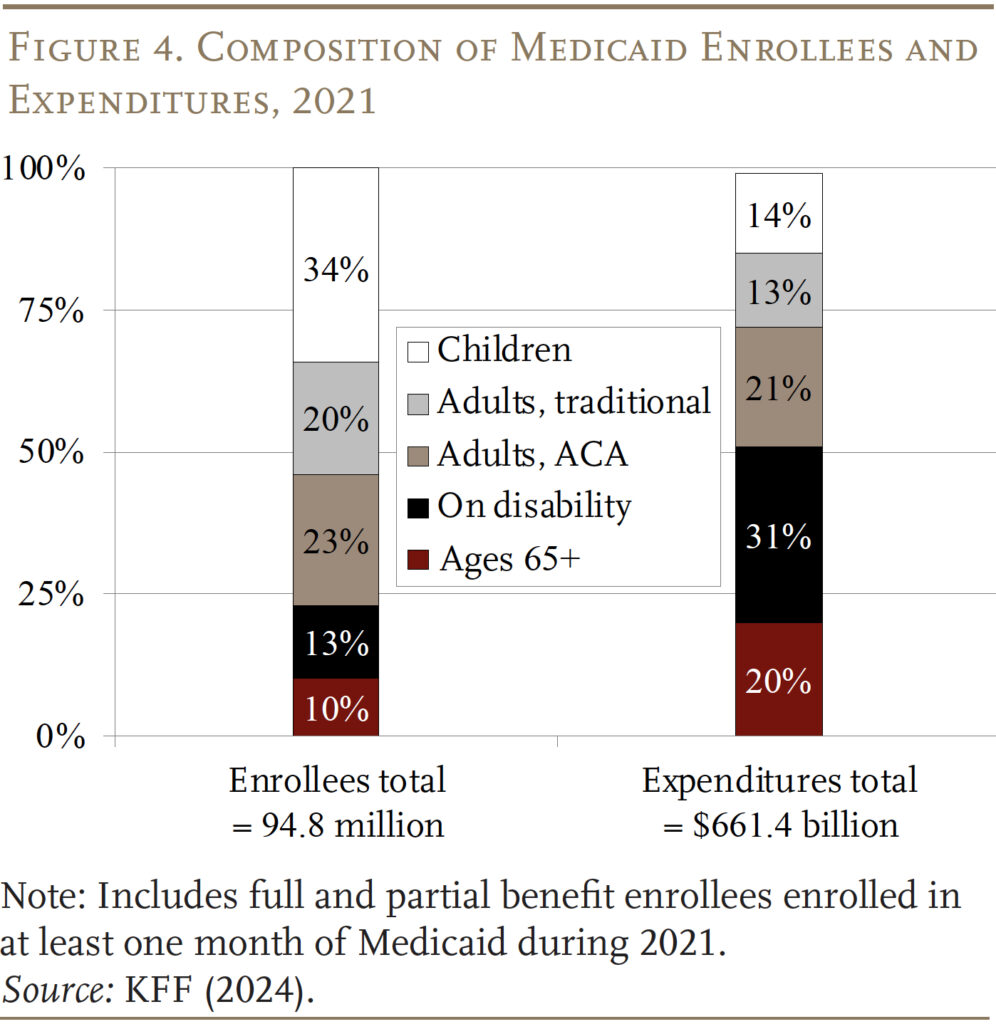

Medicaid supplies advantages for 5 fundamental teams of low-income people – kids, adults (below 65) in households, adults (below 65) with out kids included below the Reasonably priced Care Act (ACA), people with disabilities, and people who qualify primarily based on age (65+). In response to the newest information accessible – 2021 – the aged 65+ group accounted for 10 p.c of beneficiaries and 20 p.c of spending (see Determine 4).

Inside the Age 65+ group, Medicaid beneficiaries will be labeled as “categorically needy” and “medically needy.” Most Medicaid beneficiaries are enrolled by categorically needy applications.5

Categorically Needy

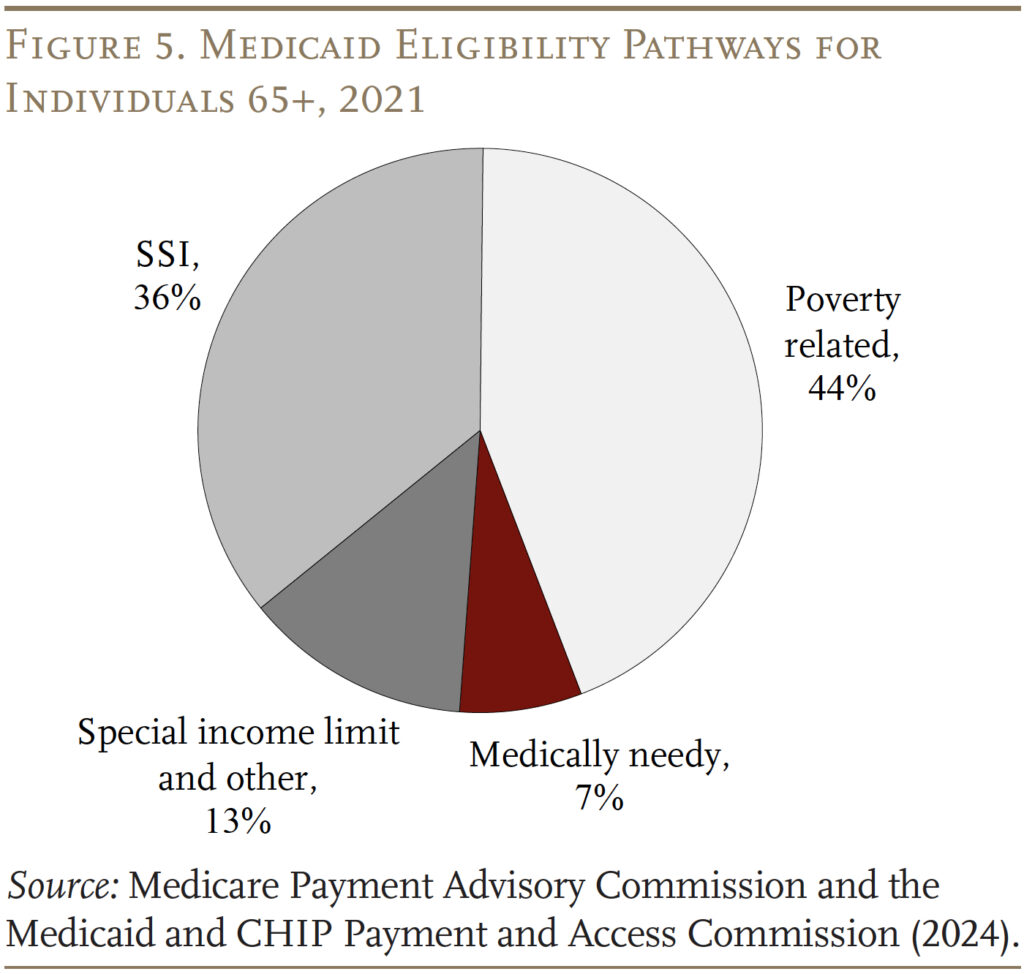

SSI Individuals. As famous above, traditionally, eligibility for Medicaid advantages has been tied to applications that present money advantages to low-income households. Within the case of these 65+, the money advantages have been offered by the SSI program. This pathway has declined in significance over time, nonetheless, for the reason that SSI revenue and asset necessities haven’t been up to date in a long time. In 2024, the utmost month-to-month SSI profit is $943 per thirty days for a person and $1,415 for a pair, which is 75 p.c of the federal poverty stage. SSI beneficiaries are additionally topic to an asset restrict of $2,000 for a person and $3,000 for a pair. Not surprisingly, the share of the 65+ inhabitants receiving SSI has dropped from 9.3 p.c in 1974 to three.7 p.c in 2024. At present, SSI members account for less than 36 p.c of Medicaid 65+ beneficiaries (see Determine 5).

Poverty Associated. Thankfully, over 40 p.c of states have elected to increase Medicaid to seniors whose revenue exceeds the SSI restrict however is beneath the federal poverty stage. The majority of those states set the revenue restrict at one hundred pc of the federal poverty line, the federal most for this pathway.

For each these eligible by SSI and the poverty-related path, states should supply Medicare Financial savings Applications (MSPs) by which low-income Medicare beneficiaries obtain Medicaid help with some or all of their Medicare out-of-pocket prices. Medicare’s out-of-pocket prices will be excessive. In 2024, Medicare Half A, which covers inpatient hospital providers, has an annual deductible of $1,632; Half B, which covers outpatient providers, requires an annual premium for many beneficiaries of $2,100 in addition to a 20-percent co-pay for providers. For Medicare beneficiaries with incomes as much as the federal poverty line, Medicaid pays Medicare Elements A and B premiums and cost-sharing. For these with barely increased incomes (100-120 p.c of poverty), Medicaid solely covers the premiums. Poverty-related standards account for the majority – 44 p.c – of complete 65+ Medicaid beneficiaries.

Particular Revenue Rule. Lastly, states are allowed to supply protection particularly for individuals who want long-term providers and helps (LTSS), together with nursing house care. One pathway to those advantages – supplied by 42 states – is the “particular revenue rule,” which permits people with revenue as much as 300 p.c of the SSI limits to qualify for advantages. About 13 p.c of Medicaid beneficiaries qualify by this pathway.

Medically Needy

Some states additionally prolong Medicaid to “medically needy” people. Recipients should once more have belongings beneath limits that modify by state however, below the fundamental guidelines, are usually much like the SSI asset limits. The revenue check, nonetheless, is revenue web of out-of-pocket medical bills. After paying their medical payments, recipients should have incomes beneath their state’s “medically needy revenue restrict,” which tends to be beneath the SSI revenue restrict.6 Not all states supply this pathway, and medically needy people account for less than 7 p.c of Medicaid beneficiaries ages 65+. Traditionally, the most typical impoverishing expense has been nursing house care. Certainly, long-term care may be very costly – in 2023, the median annual prices had been $116,800 for a non-public room in a nursing house, $64,200 for an assisted dwelling facility, and $75,500 for house well being aides.7

Overlap of Medicare and Medicaid

In fact, nearly all folks 65+ have Medicare, which covers hospital care, doctor providers, and prescribed drugs. Many mistakenly imagine that Medicare covers long-term care providers, which it doesn’t. One attainable supply of confusion could also be that Medicare covers as much as 100 days of care in a talented nursing facility, after a hospital keep of not less than three days. Nonetheless, over half of Medicare-covered expert nursing facility stays are for 20 days or much less, and 90 p.c for 60 days or much less.8 Equally, Medicare additionally covers some house well being care providers for as much as 21 days and supplies hospice care. Total, nonetheless, a lot of the care lined by Medicare is medical, short-term, and related to an acute or terminal occasion.

Medicaid is the first payer for long-term care, which incorporates not solely nursing house care but additionally private help at house for actions of each day dwelling, equivalent to consuming, bathing, and dressing, and care offered in assisted dwelling settings. In recent times, the setting for such care has shifted away from institutional care in nursing houses and moved towards home-and-community-based providers (HCBS), which embrace care offered in folks’s houses, grownup day care facilities, assisted dwelling preparations, and group houses.9 The shift displays the preferences of the beneficiaries and necessities for states to supply providers within the least restrictive setting attainable.10 It might additionally hold fiscal prices in test each by avoiding cost for the room-and-board part of institutional care and by growing reliance on unpaid household care.

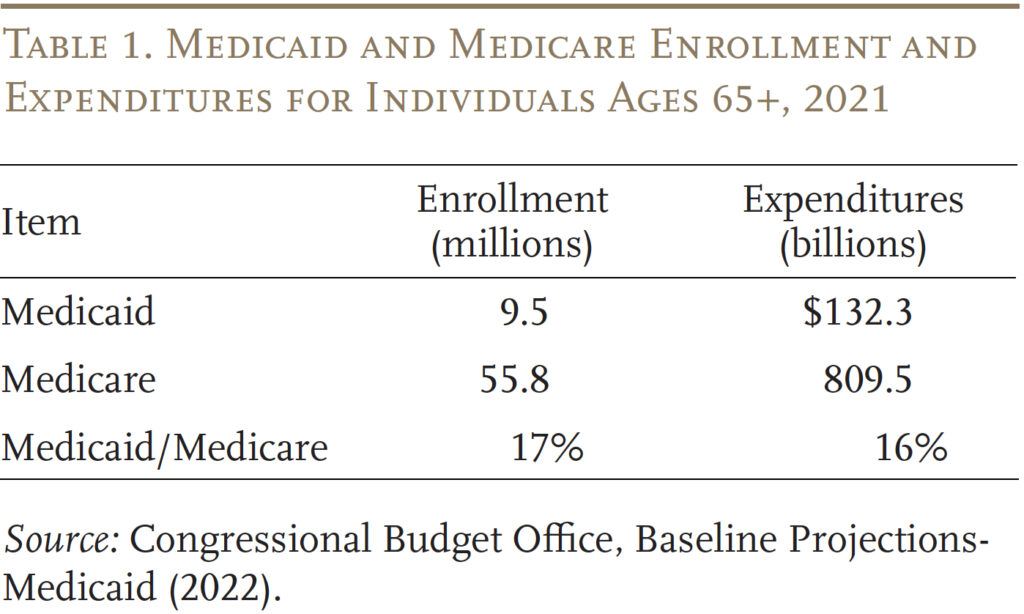

To get some thought of the significance of Medicaid to retirees, Desk 1 compares enrollees and expenditures for these 65+ below each Medicaid and Medicare. By way of each metrics, Medicaid accounts for 16-17 p.c of the Medicare determine.

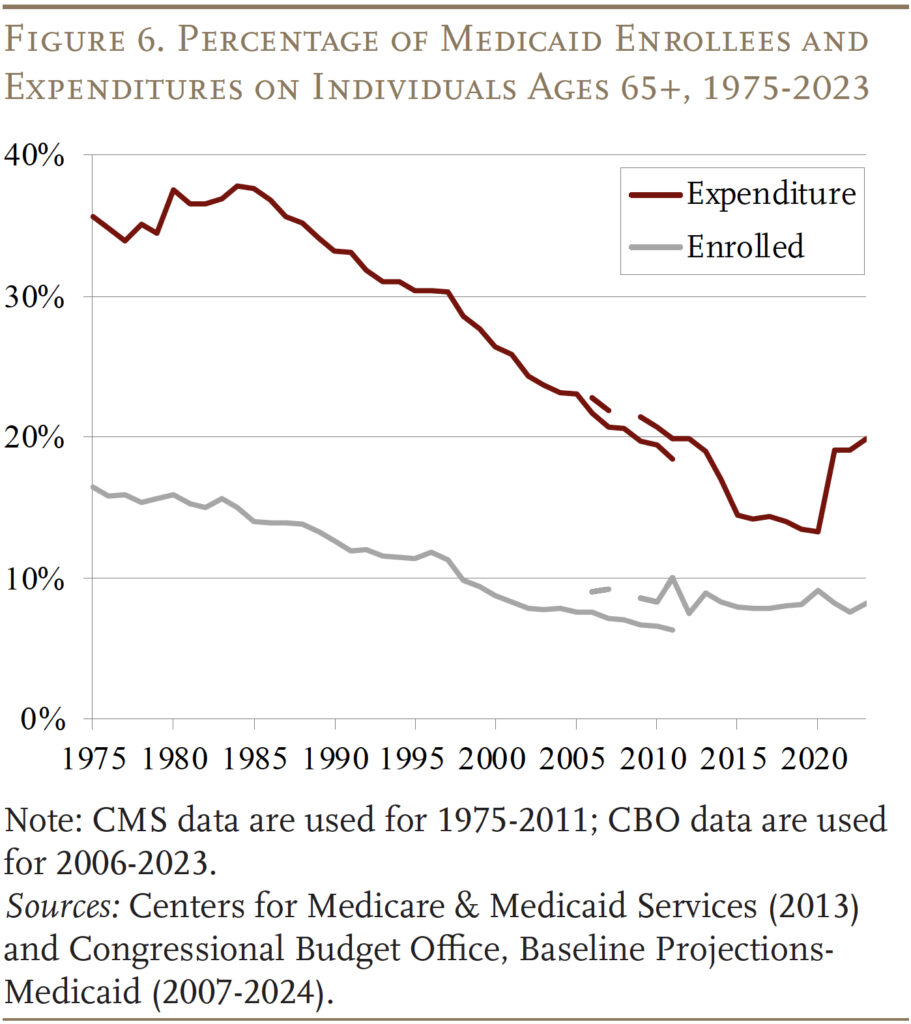

Curiously, whereas nonetheless important, the share of Medicaid advantages going to these 65+ has declined sharply for the reason that inception of this system (see Determine 6). This sample displays the decline within the share of these 65+ receiving SSI plus a deliberate enlargement of Medicaid by each the federal authorities and the states to cowl kids and working-age adults.

Future Medicaid Spending

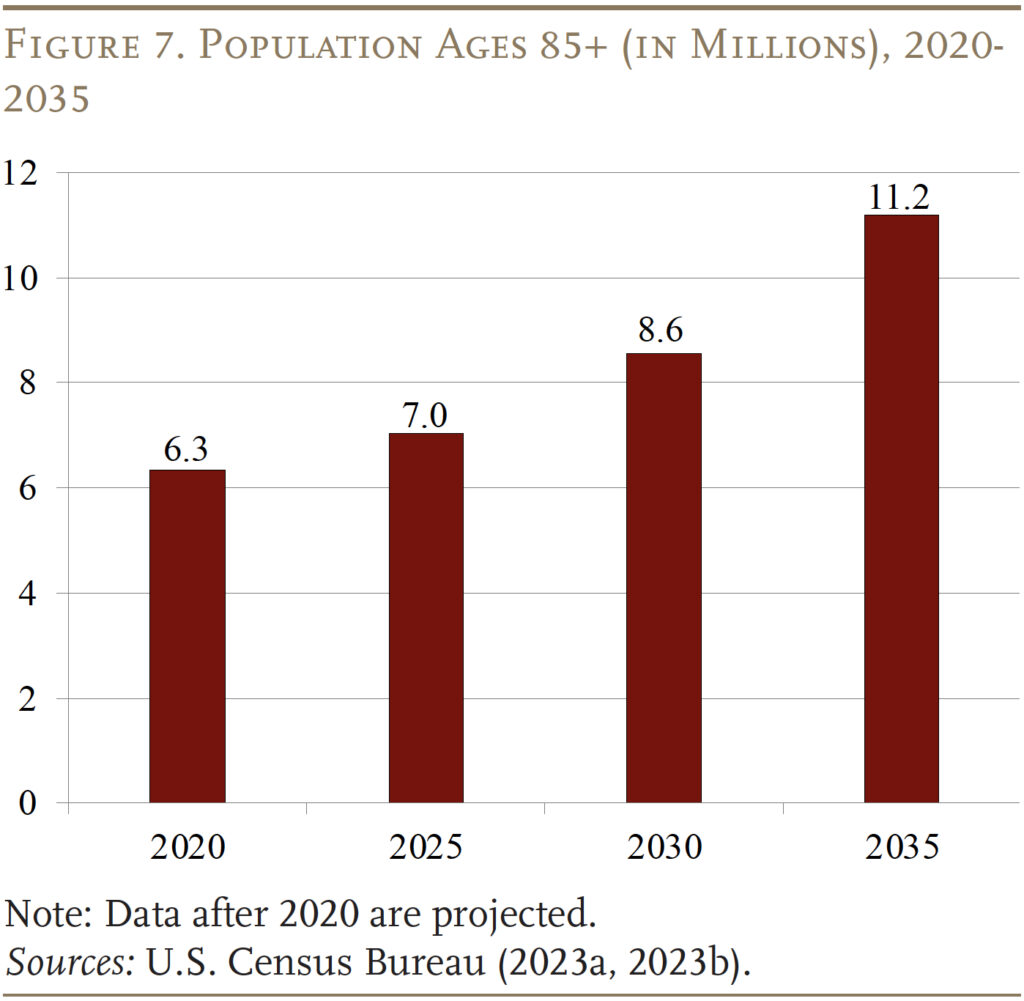

The extra essential query is what does future Medicaid spending seem like for these 65+, given the growing old of the U.S. inhabitants. Certainly, the variety of folks 85+ – a bunch with substantial wants for long-term care – is projected to extend from about 7 million right this moment to 11 million in 2035 (see Determine 7). Will future Medicaid spending replicate this elevated demand for lengthy term-care? And what are the implications of future Medicaid spending for presidency budgets and the well-being of older households?

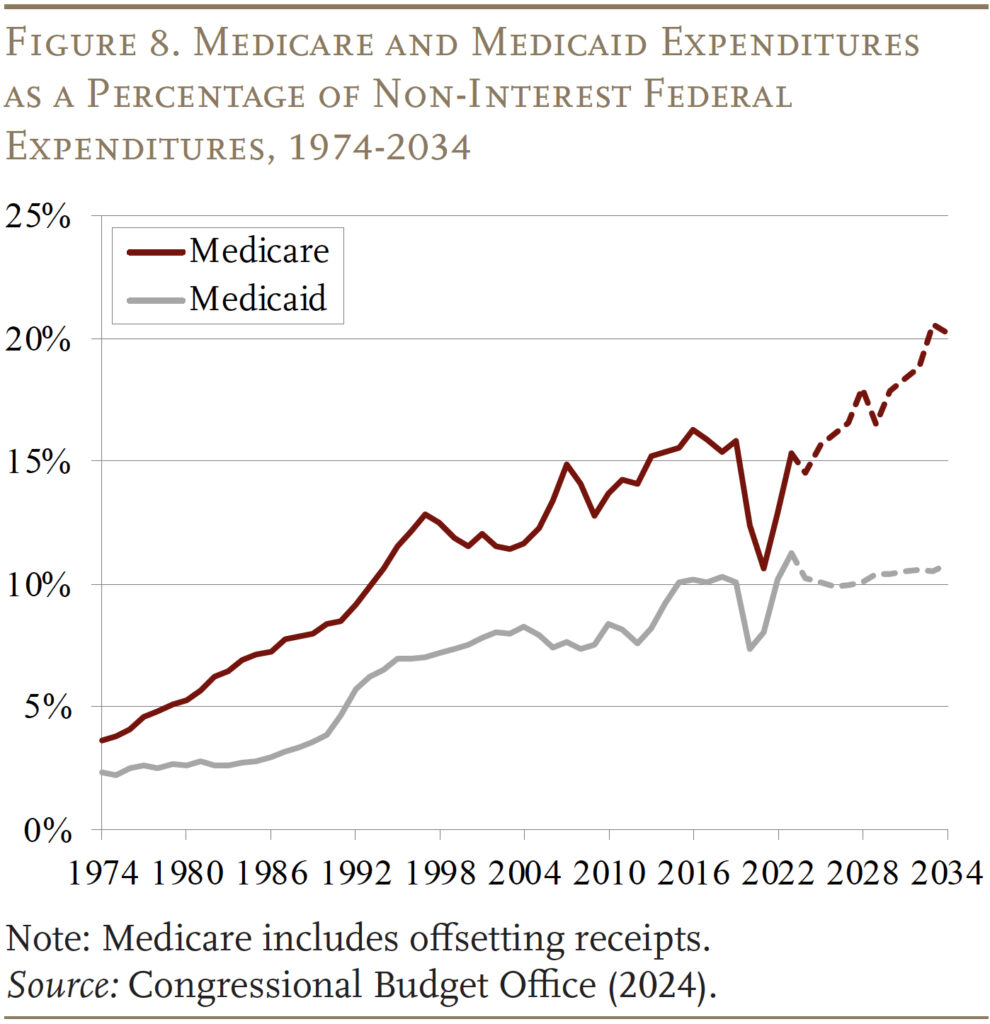

The Congressional Finances Workplace initiatives well being care spending as a share of the federal funds by 2034, which reveals that the federal share of Medicaid is scheduled to carry regular at 10 p.c of non-interest federal spending (see Determine 8). This projection differs sharply from that for Medicare, the place expenditures over the identical interval improve from 15 to twenty p.c of non-interest funds outlays – reflecting each the growing old of the inhabitants and medical inflation.

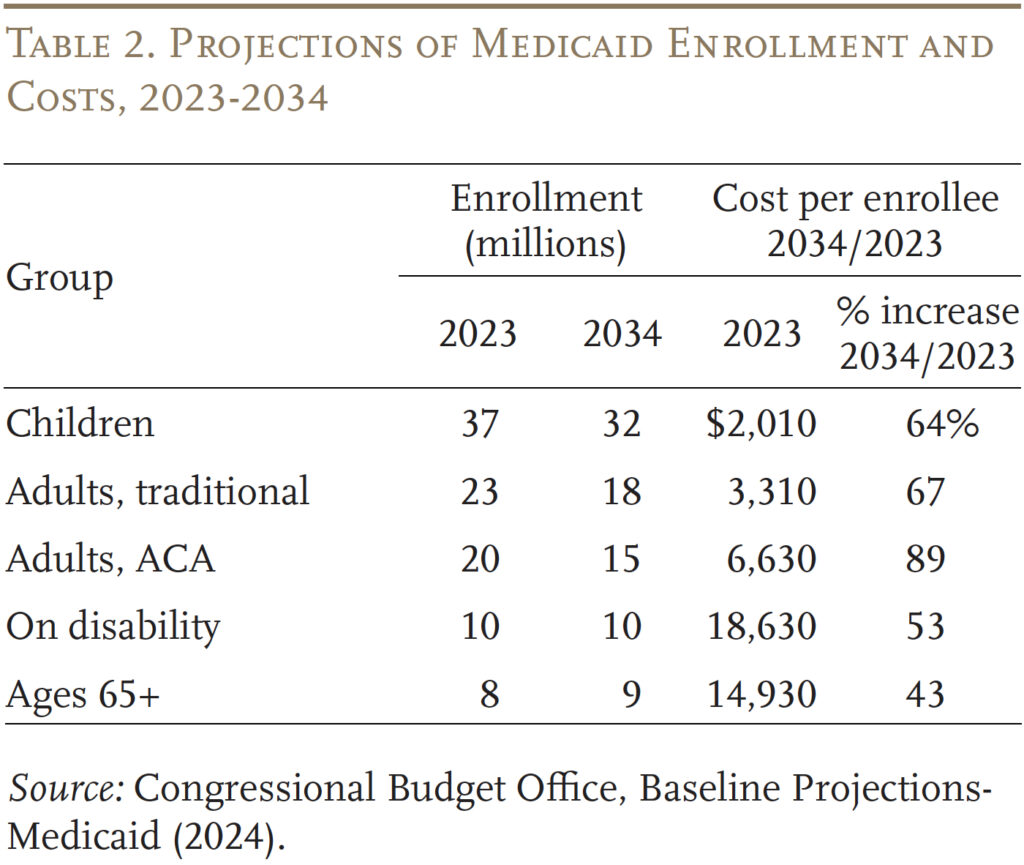

Trying below the hood supplies some insights into the CBO projections. Whole Medicaid enrollment is projected to say no from 97 million to 85 million, led by the unwinding of the pandemic-related steady enrollment provision, which had briefly elevated enrollment. Moreover, decrease start charges are contributing to fewer baby beneficiaries, and the variety of adults – in each the standard eligibility classes and people eligible by the ACA – is anticipated to say no (see Desk 2). The age 65+ class is the one group the place enrollment is projected to extend, albeit by only one million in comparison with 4 million within the 85+ inhabitants.

Turning to prices, the aged and people with disabilities are the 2 most costly teams, however the ones with the smallest will increase in common value. The slower improve in prices possible displays each the shift away from nursing amenities to home-and-community-based care and the belief that whereas well being care prices develop with medical inflation, different long-term care prices develop according to wages. Furthermore, many staff offering long-term care have much less medical training and supply extra hands-on providers than medical professionals. Conversely, the prices for kids and adults are projected to extend sharply, however their value stage is kind of low and, as famous, their numbers are projected to say no. The underside line is that – regardless of the growing old of the inhabitants – Medicaid shouldn’t be projected to play a bigger function sooner or later than it does right this moment.

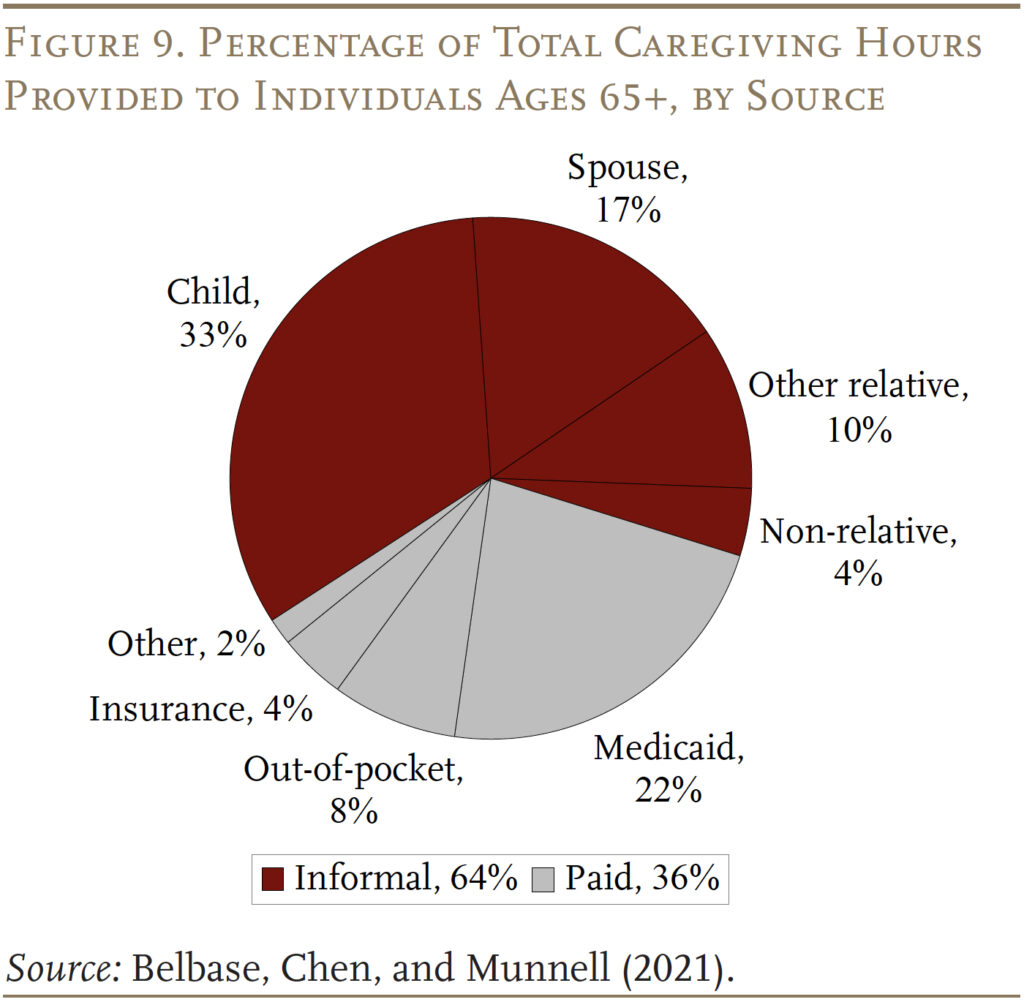

The flipside of fiscal restraint could also be unmet wants or a bigger burden on households. As proven in Determine 9, whereas Medicaid is the foremost payer for paid care, it covers solely 22 p.c of the hours required to look after these 65+ over their lifetimes. The extra widespread supply of assist is unpaid casual care offered by relations – primarily spouses and youngsters. Going ahead, declines in fertility and the rise in divorce will diminish the provision of casual caregivers.11 And, the share of retirees with prolonged household or different group assist programs has been declining for 3 a long time.12 With out expanded assist from Medicaid, the tip end result will likely be that many may have care wants that merely go unmet.

Conclusion

Medicaid is the nation’s publicly financed well being and long-term care program for low-income folks. It was initially established to supply advantages to these receiving money help or “welfare.” Through the years, nonetheless, Congress and the states have expanded Medicaid to achieve a broad array of uninsured People dwelling close to or beneath the poverty stage. Medicaid is financed collectively by state and native governments. The federal authorities units some fundamental necessities, however states have the pliability to design their very own variations of Medicaid throughout the federal statute’s fundamental framework. Spending on Medicaid has grown considerably over time as a share of GDP and as a share of federal and state budgets.

Surprisingly, Medicaid is essential for older People. Though most individuals over 65 have Medicare, it doesn’t present long-term care providers and helps, solely restricted house well being care and post-acute care in a talented nursing facility after a hospital keep. Furthermore, Medicare itself is pricey with important premiums and deductibles. Low-income older folks require assist for each these wants. At this level, these 65+ account for 10 p.c of Medicaid enrollees and 20 p.c of Medicaid expenditures.

With the projected progress within the oldest previous – these 85+ – the demand for long-term care providers will improve. Finances projections, nonetheless, recommend that Medicaid is unlikely to increase past its present function. How will the elevated demand be addressed – extra care from household or unmet wants?

References

Belbase, Anek, Anqi Chen, and Alicia H. Munnell. 2021. “What Assets Do Retirees Have for Lengthy-Time period Companies & Helps?” Difficulty in Transient 21-16. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Brown, Susan L. and Matthew R. Wright. 2017. “Marriage, Cohabitation, and Divorce in Later Life.” Innovation in Growing older 1(2): 1-11.

Burns, Alice, Maiss Mohamed, Molly O’Malley Watts, and Bradley Corallo. 2024. “Medicaid Eligibility and Enrollment Insurance policies for Seniors and Folks with Disabilities (Non-MAGI) Through the Unwinding.” San Francisco, CA: KFF.

Facilities for Medicare and Medicaid Companies. 2013. “Medicare and Medicaid Statistical Complement, Desk 13.4 and Desk 13.10.” Washington, DC.

Facilities for Medicare and Medicaid Companies. 2023. Nationwide Well being Expenditure Accounts. Washington, DC: U.S. Division of Well being and Human Companies.

Congressional Finances Workplace. 2024. “Finances and Financial Knowledge, Historic Finances Knowledge.” Washington, DC.

Congressional Finances Workplace. “Baseline Projections-Medicaid: 2007-2024.” Washington, DC.

KFF. 2024. “Medicaid 101.” San Francisco, CA.

Komisar, Harriet. 2013. “Medicare Does Not Pay for Lengthy-Time period Care.” AARP: Washington, DC.

Genworth Monetary, Inc. 2023. “Price of Care Survey.” Richmond, VA.

Medicare Fee Advisory Fee and the Medicaid and CHIP Fee and Entry Fee. 2024. “Beneficiaries Dually Eligible for Medicare and Medicaid.” Knowledge Ebook. Washington, DC.

Nationwide Affiliation of State Finances Officers. State Expenditure Report, 1987-2023. Washington, DC.

Olmstead v. L.C. 1999. 527 U.S. 581. Washington, DC: U.S. Supreme Court docket.

Tolbert, Jennifer and Bradley Corallo. 2024. “An Examination of Medicaid Renewal Outcomes and Enrollment Modifications on the Finish of the Unwinding.” San Francisco, CA: KFF.

Wettstein, Gal and Alice Zulkarnain. 2019. “Will Fewer Youngsters Increase Demand for Formal Caregiving?” Working Paper 2019-6. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

U.S. Census Bureau. 2023a. “Projected Inhabitants by Age Group and Intercourse for america, Desk 1.” Washington, DC.

U.S. Census Bureau. 2023b. “The Older Inhabitants: 2020.” Report No. C2020BR-07. Washington, DC.

U.S. Congress Joint Financial Committee. 2019. “An Invisible Tsunami: ‘Growing older Alone’ and Its Impact on Older People, Households, and Taxpayers.” (January 24). Washington, DC.