The FIRE motion made the rounds in nationwide information for a couple of years and nonetheless will get a head nod right here and there.

The FIRE motion made the rounds in nationwide information for a couple of years and nonetheless will get a head nod right here and there.

The early retirement (RE) a part of FIRE at all times acquired extra criticism as a result of it’s the purpose when somebody doesn’t like their profession alternative and needs to flee.

In hindsight, this was me.

Each financially and by way of skilled success, you’re higher off discovering a profession from which you don’t need to retire.

Monetary independence (FI) is more durable to argue towards. Constructing sufficient wealth to allow daring life selections and monetary freedom is a wholesome purpose.

Get there by incomes extra, spending much less, and investing the excess.

The principle criticisms of economic independence are its accessibility and the way lengthy it takes to attain it.

Ranging from zero, it takes at the very least a decade to achieve a minimal stage of FI, and realistically longer — particularly lower-wage earners, who could by no means obtain it.

However there’s one other means to take a look at wealth and cash. One which’s accessible to everybody, doesn’t take as lengthy, and nonetheless adheres to the foundational rules of FIRE.

As a substitute of specializing in monetary independence, attempt first to strengthen your monetary confidence.

What’s Monetary Confidence?

Monetary confidence is readability in managing your funds and making knowledgeable choices on the trail to reaching long-term monetary objectives.

It’s a mix of information, emotional resilience, and planning. It empowers individuals to navigate monetary challenges and seize alternatives with out stress or hesitation.

Moreover, it’s the assumption in your skill to handle, save, and make investments your cash with out worry or uncertainty, utilizing obtainable instruments to assist monitor funds and inform choices as we speak and all through our lifetimes.

There are a number of advantages to constructing monetary confidence:

- Obtain it extra quickly than monetary independence.

- Extra confidence reduces monetary stress and anxiousness.

- Higher monetary footing improves relationships.

- Strengthens capabilities to deal with uncertainty.

- Encourages steady studying.

- Results in monetary independence and wealth.

Essentially the most vital benefit of economic confidence over monetary independence is its obtainable to everybody who’s keen to be taught and inject monetary self-discipline into their lives.

We will pursue higher-level long-term objectives and significant wealth with confidence as a basis. Monetary confidence is step one towards monetary independence.

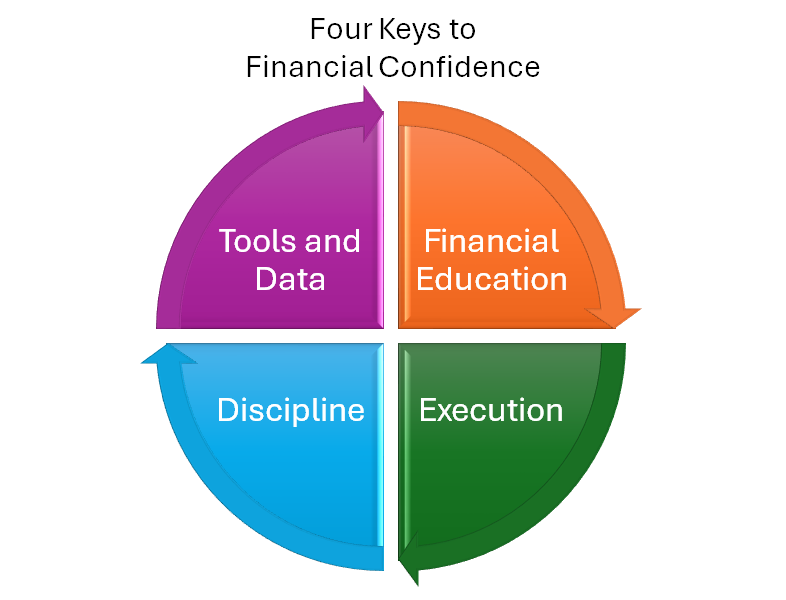

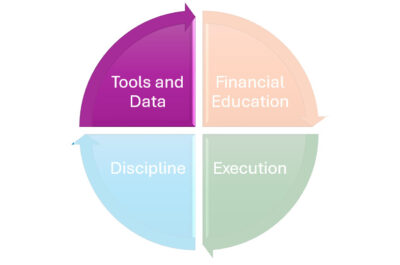

4 Keys to Monetary Confidence

Monetary confidence is more difficult to outline than monetary independence.

Monetary confidence is more difficult to outline than monetary independence.

Confidence shouldn’t be confused with conceitedness. Excessive-income earners or belief fund beneficiaries could also be assured as a result of they’re or really feel rich. That’s not what I’m speaking about on this article.

Monetary confidence is for everybody. It’s about sustaining management over your funds and feelings and eliminating worry and trepidation with information.

Those that have it keep disciplined and use information for decision-making to allow them to develop wealth and deal with adversity or uncertainty when it inevitably arrives.

Listed here are 4 keys to unlock monetary confidence.

Monetary Training

The extra you be taught and examine about cash, the extra confidently you may handle it. I take this with no consideration as a result of I used to be a pupil of finance from an early age, earned a Finance diploma, and proceed to be taught and train it as we speak.

The extra you be taught and examine about cash, the extra confidently you may handle it. I take this with no consideration as a result of I used to be a pupil of finance from an early age, earned a Finance diploma, and proceed to be taught and train it as we speak.

Mother and father who train children about cash increase extra accountable adults. However not everybody has the posh of financially savvy dad and mom.

Monetary training in our colleges has improved over the previous twenty years, but it surely’s inadequate.

Exterior teams like Junior Achievement and Scouting organizations complement the training system with real-life expertise that aren’t prioritized in public center and excessive colleges.

However into maturity, monetary training rests solely on the person.

Monetary educators share their information in books, blogs, enterprise information, group faculty programs, on-line programs, or wherever individuals devour data. Training sources are ample if we are able to focus amid life’s infiltrating distractions.

Monetary training is the inspiration of economic confidence, empowering us to execute vital choices about our wealth.

Execution

Cash-smart individuals generally know what they’re presupposed to do however hesitate to behave on what they’ve realized.

Cash-smart individuals generally know what they’re presupposed to do however hesitate to behave on what they’ve realized.

For instance, a financially savvy individual could know they need to be investing extra within the inventory market however don’t enhance their employer contributions for worry of a market crash.

Or they know they need to full an property plan however aren’t positive the place to begin, so it stays a perpetual to-do checklist merchandise.

They know {that a} lump sum of money in a low-yield checking account could be higher invested elsewhere, however deciding on the correct brokerage, ETF, or high-yield financial savings account is an amazing roadblock.

Retirees acknowledge they’ll afford to spend extra freely in retirement however can’t let go of their frugal methods.

Monetary information is simply helpful when you execute what you’ve realized. Contribute extra, end the property plan, purchase the ETF, and luxuriate in what you’ve earned. However keep away from the habits pitfalls that may derail your earlier good cash strikes.

Self-discipline

All of the information on the web can’t overcome the shortage of economic self-discipline.

All of the information on the web can’t overcome the shortage of economic self-discipline.

I not too long ago communicated with a brand new reader who mentioned he was “good at math however traditionally dumb with cash”.

His “dumb with cash” downside led to bank card debt and excessive curiosity funds, although he understands the putrid penalties behind paying 29% on an impulse buy.

Excessive earnings doesn’t assure wealth, simply as low earnings isn’t a life sentence for poverty.

Even the ultra-wealthy go bankrupt due to boastful spending or unthoughtful borrowing. Who can resist the temptation of a personal yacht when you’ve lastly made it?

Protecting what you earn and rising and preserving belongings builds long-term monetary stability and wealth.

Behavioral reactions to market fluctuations, poor spending habits, or boneheaded purchases can unravel years of fine choices or the benefits of a excessive earnings.

Monetary instruments and information might help us keep self-discipline as we navigate financial modifications and market volatility.

Instruments and Information

We should always all attempt to run our family financials like a enterprise, constructing a powerful steadiness sheet, diversifying earnings sources, and sustaining wholesome money flows.

We should always all attempt to run our family financials like a enterprise, constructing a powerful steadiness sheet, diversifying earnings sources, and sustaining wholesome money flows.

Since information informs choices in enterprise, we also needs to use it to make each day choices about our household funds.

Monetary information is available in many types, like financial institution and bank card statements and on-line entry to brokerage accounts.

Spreadsheets are the rawest and most customizable instruments.

However too typically, Frankenstein spreadsheets turn out to be a time suck after we may very well be utilizing our efforts to extract helpful insights from higher, current instruments.

I nonetheless use spreadsheets, however I’m gravitating towards solely utilizing software program instruments to make data-driven choices. These present structured enter and output codecs related to everybody’s wants and aligned with tax legal guidelines and monetary planning requirements.

Listed here are the instruments I’m utilizing and recommending now:

- Boldin (assessment) — Boldin calls itself the “monetary confidence platform” and was the inspiration for the title of this weblog put up. It’s highly effective DIY monetary planning software program to get good about your cash as we speak and into the longer term. It not too long ago rebranded from NewRetirement. Attempt it free for 14 days.

- ProjectionLab (assessment) — A DIY monetary planning platform that takes inputs and initiatives forward-looking visualizations to assist us plan and determine.

- Lunch Cash — A easy desktop budgeting app that’s higher than Mint ever was, with out all of the adverts. The primary month is free.

- Empower — Free internet price calculator and portfolio monitoring account aggregator. Nonetheless advisable, however previous its glory days.

The primary three on this checklist are paid merchandise providing full-functioning free trials of various lengths.

Boldin and ProjectionLab are related instruments with acquainted visualizations. Boldin is a extra linear expertise, whereas ProjectionLab has a extra fashionable look and freestyle method. Boldin enables you to hook up with exterior accounts, whereas ProjectionLab depends on handbook inputs (which some could choose).

Sadly, the “freemium” fashions deployed by the now-defunct Mint.com and nonetheless utilized by Empower are masked as lead turbines. Mint went below, and Empower has turn out to be irritating to make use of, proving that free is just not at all times a sustainable mannequin.

Most shoppers are accustomed to paying for providers like newspaper subscriptions to get a cleaner expertise with out turning into the product themselves.

Monetary instruments have gone in that path, too. I choose to pay a small quantity per yr to get extraordinary worth out of economic instruments.

The merchandise above price $9-$12 per thirty days, which is about the price of a flowery dinner with a partner or buddy. However these present great suggestions and information to assist drive monetary choices about spending, investing, and drawing down retirement belongings.

Use monetary instruments and information to information you and deepen your monetary know-how.

Conclusion

Monetary confidence is the brand new monetary independence.

Whereas monetary independence stays a fascinating purpose, it could actually appear distant or unattainable for a lot of. It can be elusive and are available and go because the market fluctuates.

Then again, monetary confidence is an achievable frame of mind for anybody keen to be taught, implement finest practices, and repeatedly refine their information. Although private finance could be humbling, instruments might help you keep sane and balanced alongside the best way at a fraction of the price of skilled recommendation.

It empowers people to make knowledgeable choices, deal with monetary challenges with readability, and finally construct a path towards monetary independence and sustainable wealth.

Featured photograph through DepositPhotos used below license.

Craig Stephens

Craig is a former IT skilled who left his 19-year profession to be a full-time finance author. A DIY investor since 1995, he began Retire Earlier than Dad in 2013 as a artistic outlet to share his funding portfolios. Craig studied Finance at Michigan State College and lives in Northern Virginia along with his spouse and three kids. Learn extra.

Favourite instruments and funding providers proper now:

Boldin — Spreadsheets are inadequate. Construct monetary confidence. (assessment)

Certain Dividend — Analysis dividend shares with free downloads (assessment):

Fundrise — Easy actual property and enterprise capital investing for as little as $10. (assessment)

M1 Finance — A high on-line dealer for long-term traders and dividend reinvestment. (assessment)