However courts block effort to curtail conflicts of curiosity.

In October 2023, President Biden introduced that the Division of Labor (DOL) would suggest a brand new rule to guard individuals saving for retirement in opposition to conflicted recommendation.

Underneath the present state of play, DOL rules relating to recommendation to employer-sponsored plans are ruled by ERISA’s fiduciary rule, which requires suggestions to be in the very best curiosity of the shopper. With the shift from outlined profit plans to 401(ok)s, the shopper has develop into the person. Within the case of IRA rollovers, IRS rules merely require that fiduciaries not “self deal.” When it comes to the Securities and Change Fee (SEC), which regulates broker-dealers, in 2019 the company imposed a brand new normal of conduct that went past the “suitability” normal to require that broker-dealers act within the “finest curiosity” of their clients.

Regardless of the progress, necessary loopholes stay. The proposed rule would do three issues:

- Broaden the vary of merchandise topic to the “finest curiosity” requirement to incorporate commodities and insurance coverage merchandise equivalent to annuities, which aren’t presently lined by the SEC’s best-interest regulation.

- Cowl all recommendation to roll over property from employer-sponsored plans to IRAs. Underneath ERISA, recommendation supplied on a one-time foundation, equivalent to that pertaining to a rollover, shouldn’t be presently required to be within the saver’s finest curiosity.

- Cowl recommendation to plan sponsors relating to funding choices. At the moment, such suggestions to plan sponsors, together with small employers, are usually not lined by the SEC’s best-interest regulation.

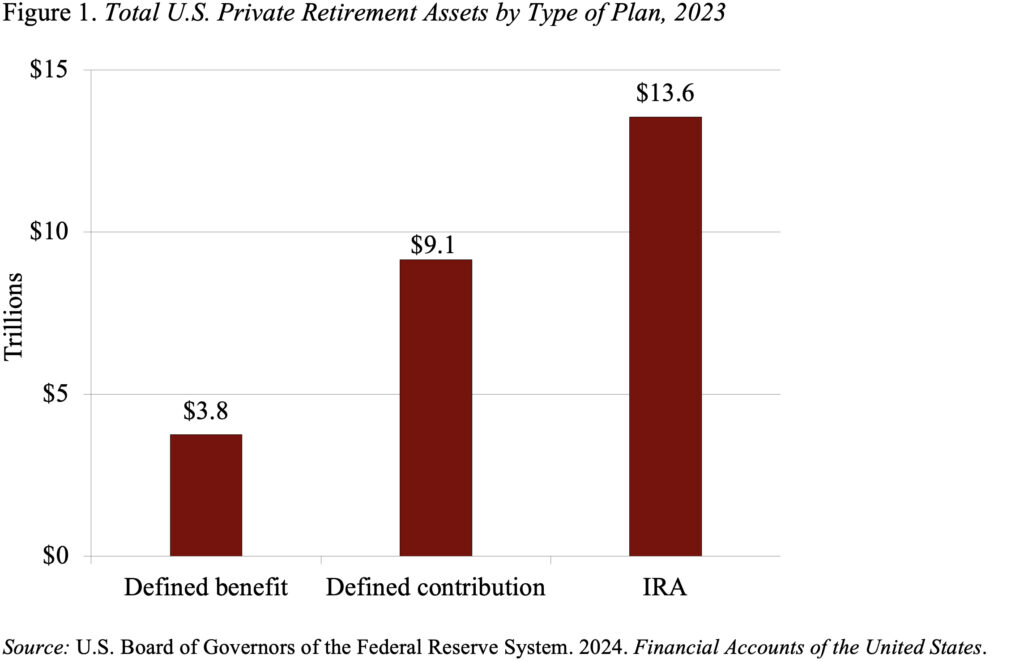

In April 2024, the DOL finalized the rule and scheduled implementation for September. From the start, nonetheless, monetary service companies and insurance coverage corporations pushed again in Congress and the courts. They’ve been fairly profitable. Congress is transferring in direction of invalidating the rule, and two courts in Texas’ fifth circuit have blocked the proposed implementation. Whereas insurance coverage corporations led the opposition, an important safety in my opinion is the one governing rollovers from 401(ok) plans to IRAs. The rollover enterprise is large. 401(ok)s have basically was a set mechanism for retirement financial savings, and the majority of the cash is rolled over into IRAs. On the finish of 2023, IRA property exceeded these in 401(ok)s by 50 % – $13.6 trillion in comparison with $9.1 trillion (see Determine 1).

The rollover of balances from 401(ok)s to IRAs is extraordinary provided that individuals are usually passive of their interactions with their 401(ok) plans. They hardly ever change their contribution price or rebalance their portfolios in response to market fluctuations. Thus, one would assume that the pressure of inertia would lead individuals to go away their balances of their 401(ok)s. The truth that they really take the difficulty to maneuver their funds suggests a robust motivating pressure. Some households could also be attracted by the chance to acquire a wider menu of funding choices or to consolidate their account holdings. However others could also be seduced by commercials from monetary service companies urging individuals to maneuver their funds out of their “outdated,” “drained” 401(ok) plan into a brand new IRA.

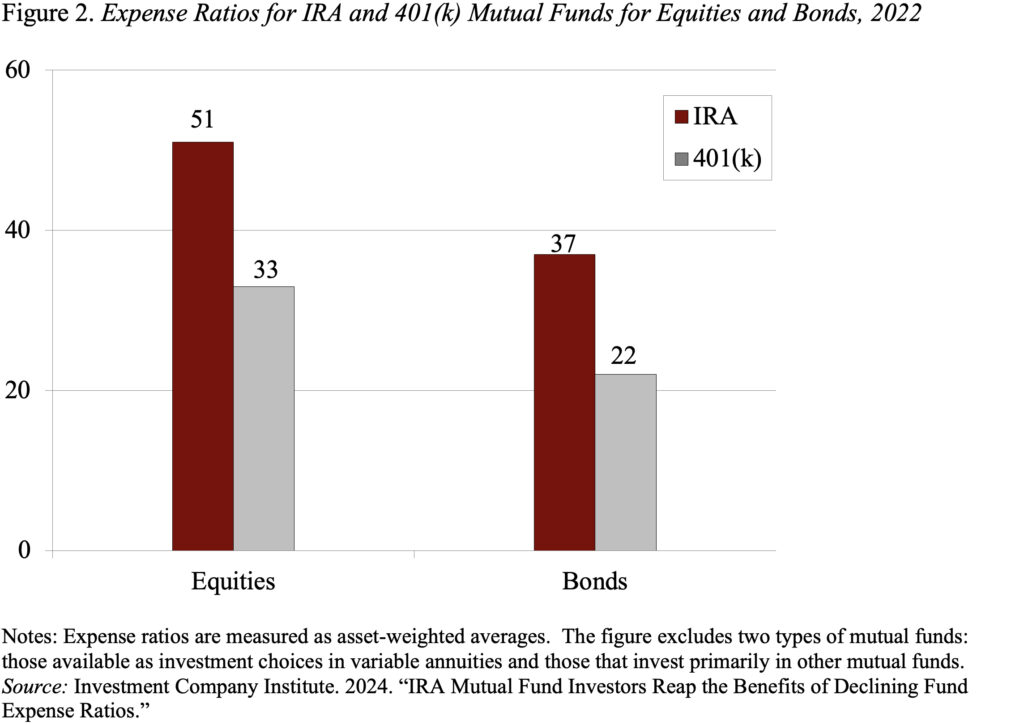

The idea by individuals have to be that the companies promoting rollovers are working within the individuals’ curiosity, however, the truth is, individuals fairly often are transferring from fiduciary safety and low-fees into an unprotected area the place their property can be invested in high-fee mutual funds. Sponsors of IRAs are usually not required to report the property in these plans nor the charges charged, however knowledge from the Funding Firm Institute present that the asset-weighted charges for fairness and bond mutual funds are considerably greater for IRAs than for 401(ok)s (see Determine 2).

The underside line is that protections clearly are required for rollovers. If a fiduciary normal is suitable when funds are in 401(ok) plans, then such a safeguard continues to be acceptable when individuals are considering transferring these funds to an IRA.