The best way again to “affordability” isn’t for costs to drop however for wages to rise, and so they have.

The general public dialogue concerning the financial system appears to confuse “inflation” with “excessive costs.” The inflation drawback is basically solved, however the value drawback stays – making many really feel that issues are not inexpensive. The very fact is that costs are usually not going to fall to pre-inflation ranges – nor would that be a good sign for the financial system. As an alternative, the way in which again to affordability is rising wages. Right here, we’ve got made quite a bit progress, however nonetheless have a solution to go.

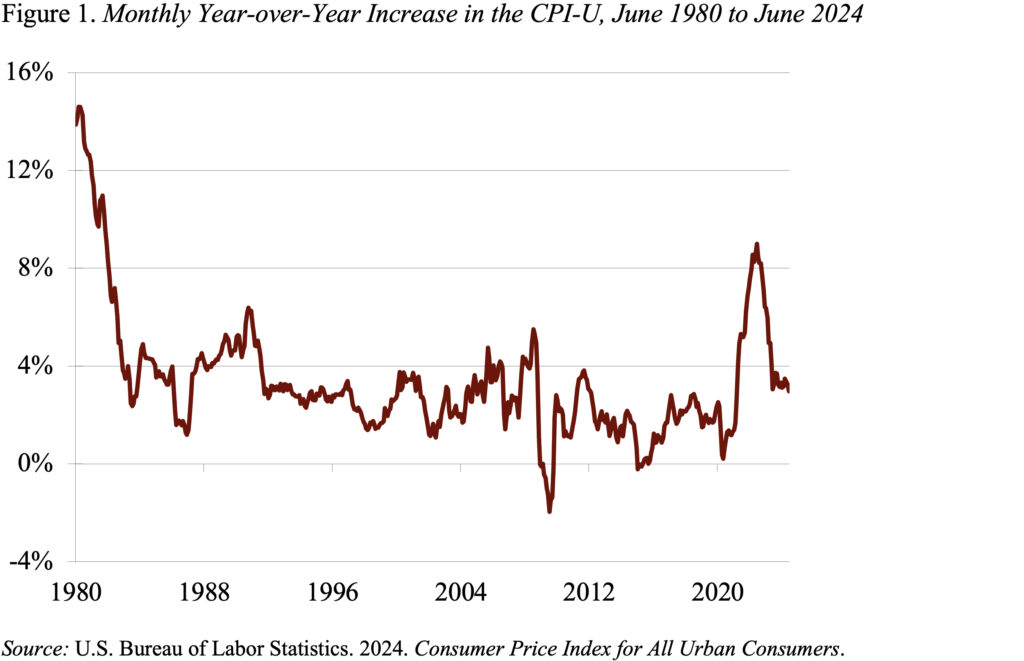

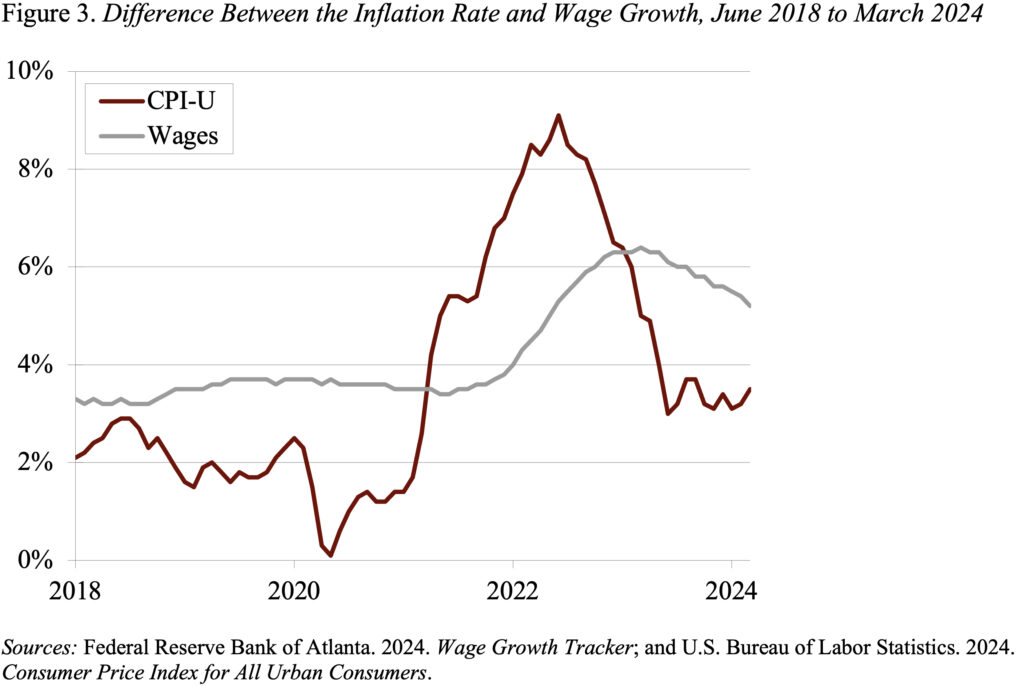

Inflation is a course of that entails rising costs and wages, and the inflation fee is the share change in items and companies over a time period. Whereas consultants have a look at a wide range of inflation measures, the most typical is the Client Value Index for all City Shoppers (CPI-U). Inflation, after 4 a long time of comparatively regular costs, took off in mid-2021 and hit a peak of 9 p.c in June 2022 (see Determine 1). Since then, nevertheless, the speed of inflation has declined sharply, and in the latest report stood at 2.9 p.c. Whereas this fee continues to be greater than the Fed’s 2-pecent goal, we’re conquering inflation.

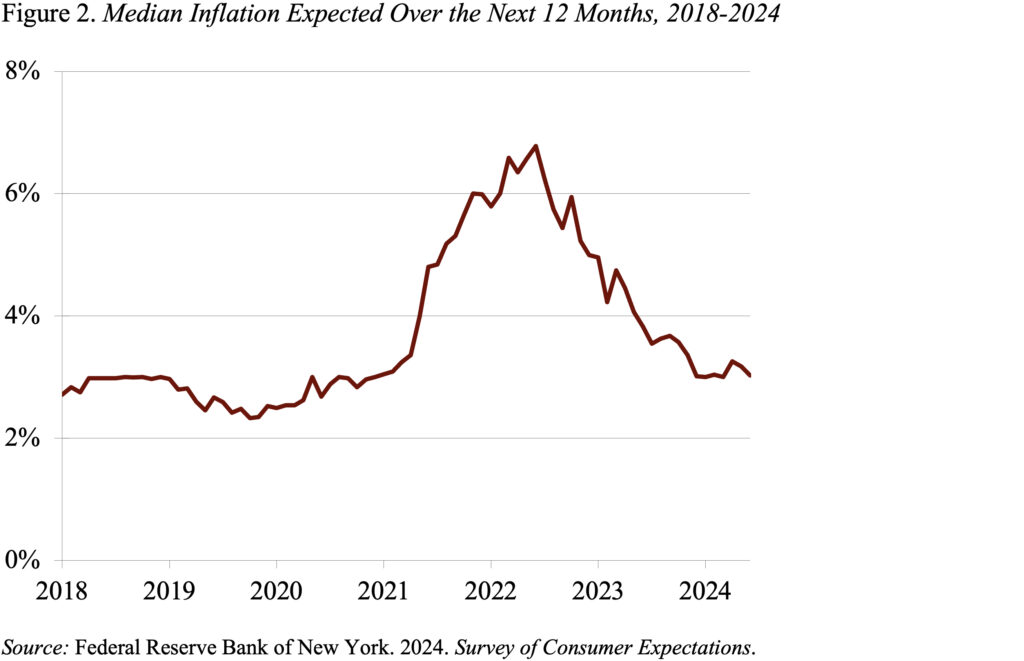

And People do acknowledge the speed of inflation has declined. Surveys present that expectations of future value will increase are virtually again to what they have been earlier than the latest spurt (see Determine 2).

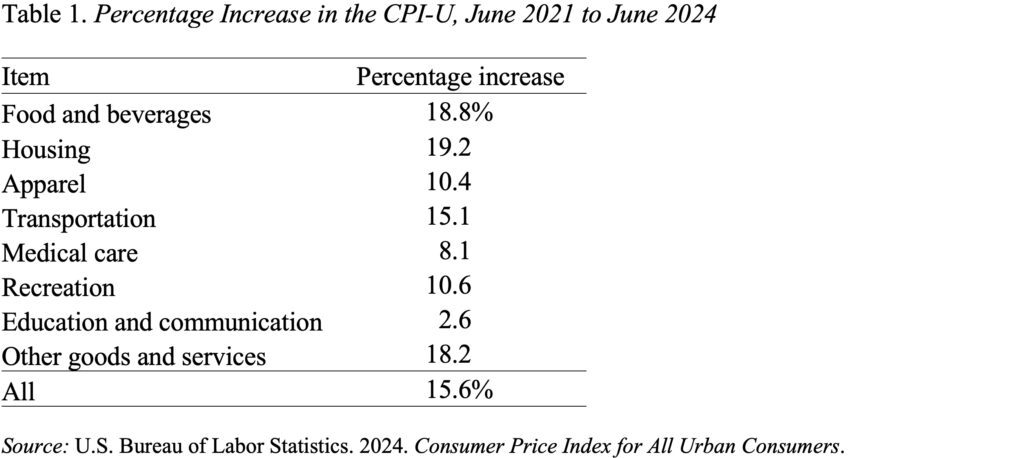

However figuring out that the inflation fee has declined doesn’t compensate for the truth that the costs have ended up significantly greater than they have been earlier than the spurt in inflation. Desk 1 exhibits that the expenditure-weighted improve in costs between June 2021 and June 2024 was about 16 p.c.

As famous, costs are usually not going to go down. The primary motive is {that a} massive fall in costs requires an enormous decline in wages and employers are very reluctant to chop wages. They consider that chopping wages would harm morale and that the price of that harm would exceed any financial savings in wage expenditures.

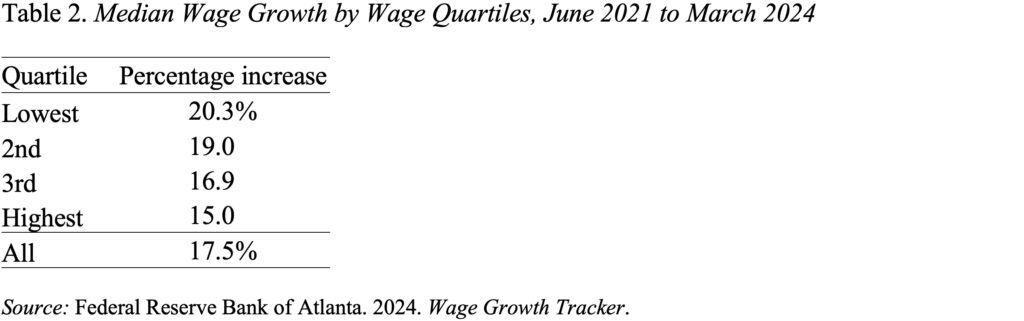

Since costs are usually not going again down, the one method for issues to turn out to be inexpensive once more is for wages to extend. That’s, if – over the interval June 2021-June 2024 – the value of meals, housing, transportation, and so forth. has gone up 16 p.c, wages want to extend by 16 p.c for households to duplicate previous spending patterns. Information from the Atlanta Fed recommend that wages throughout the board have grown greater than 17 p.c, with the best beneficial properties for the bottom paid (see Desk 2).

With wage beneficial properties exceeding value will increase, individuals, on common, ought to have the ability to duplicate their previous spending patterns. However standing nonetheless isn’t sufficient; most want to see their lifestyle enhance over a three-year span. Right here too the outlook is sweet. Whereas wage beneficial properties sometimes lag inflation early within the cycle, they’ve now pulled forward (see Determine 3). Now most individuals ought to begin to expertise enhancements of their lifestyle.

However this entire story looks as if a tough promote.