Significant balances require steady protection and for that we want a nationwide mandate.

It’s at all times fascinating to take a look at Vanguard’s most up-to-date version of “How America Saves.” And it’s notably fascinating to get the numbers for 2023 – a very good yr for each the economic system and the inventory market. Certainly, participation price, contribution charges, and median and common balances are near an all-time excessive.

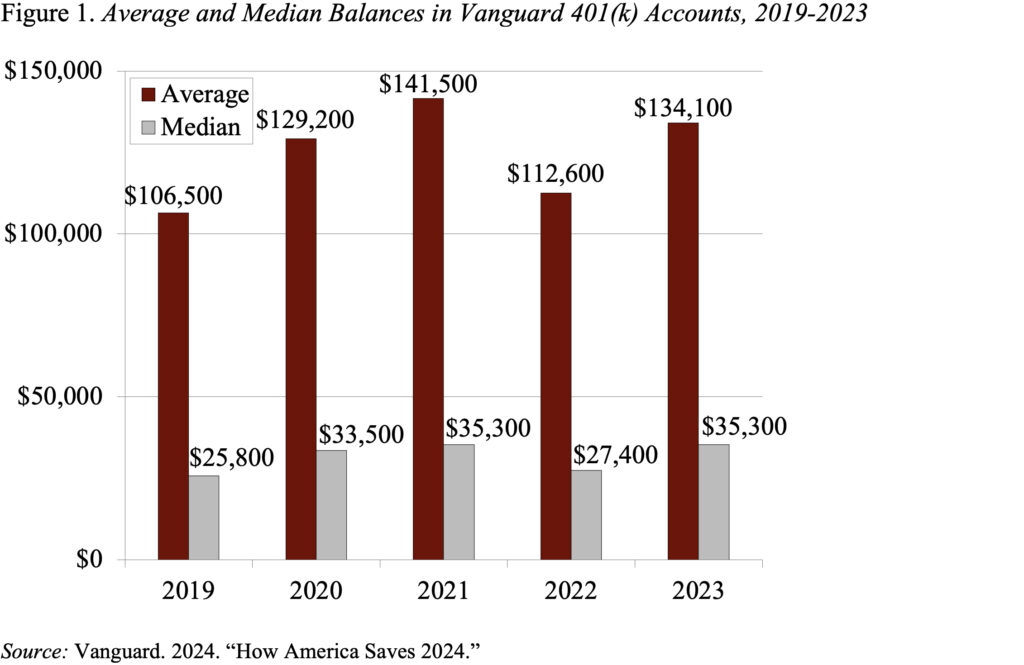

Common balances rose from $112,600 in 2022 – a horrible yr for the inventory market – to $134,100 in 2023, and median balances from $27,400 in 2022 to $35,300 in 2023 (see Determine 1). The large distinction between the median and the common is because of a small variety of accounts which have actually large balances. Common balances are extra typical of long-tenured, extra prosperous members, whereas the median represents the everyday participant.

The great efficiency of all the symptoms in 2023, nevertheless, doesn’t imply all is properly. Balances are literally fairly puny. Think about the holdings of these approaching retirement – ages 55-64. As one would count on, these balances are a lot bigger than these for the total participant inhabitants. However nonetheless, the median is just $87,600, which signifies that half of members have lower than this quantity and half have extra. Furthermore, Vanguard tends to manage bigger plans, so the plans are higher designed than common and members have greater incomes. In different phrases, it presents the perfect face of the 401(ok) system.

Then again, the balances at any single firm don’t present a whole image of retirement preparedness. First, when members change jobs, their 401(ok) accounts could stay with their outdated employer, so people could have multiple 401(ok) account. Second, 401(ok) balances are sometimes rolled over to an IRA, and monetary companies firms can’t monitor mixed 401(ok)/IRA holdings. Third, by necessity, balances are supplied on a person, fairly than a family, foundation. Whereas a whole image solely emerges from family surveys, the Vanguard report at all times offers fascinating data on traits.

And the traits ought to be good, as a result of a variety of adjustments have improved the functioning of 401(ok) plans. Virtually 60 p.c of the Vanguard plans now have auto-enrollment; target-date funds at the moment are just about the common default funding; and costs have declined markedly. Regardless of these enhancements, nevertheless, the longer-term image just isn’t encouraging – notably as soon as one accounts for inflation.

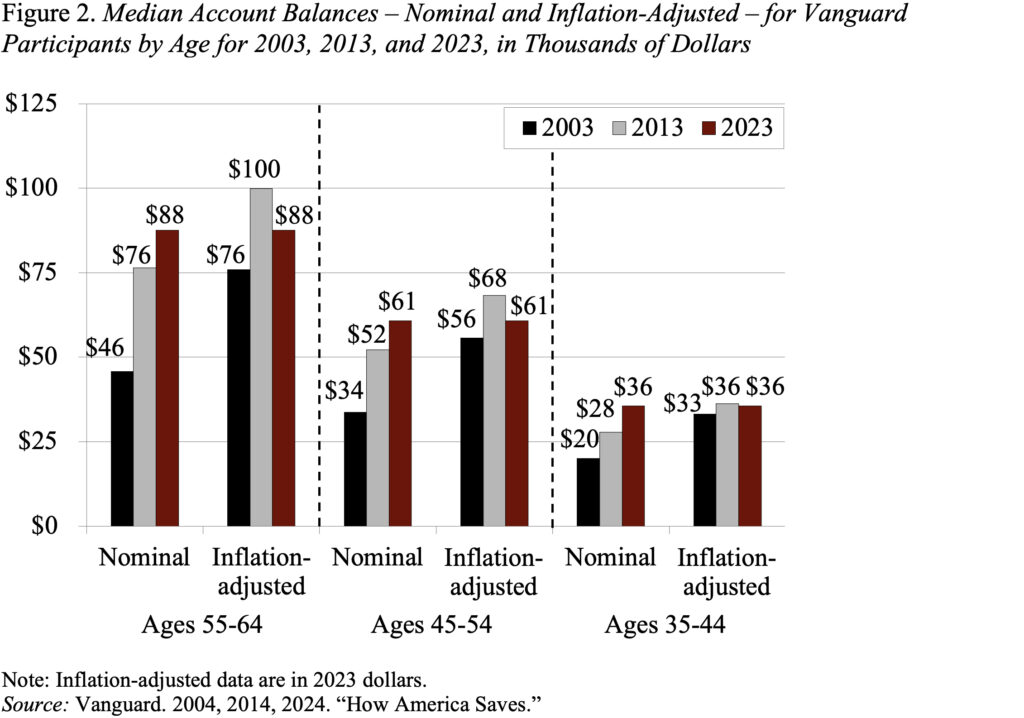

Determine 2 exhibits balances by age for 3 years – 2003, 2013, and 2023 – for 3 completely different age teams – 55-64, 45-54, and 35-44. Beginning first with the pre-retirees – in nominal phrases, 2023 balances of $88,000 had been greater than balances in 2013 and virtually double these in 2003. However taking inflation into consideration produces a fairly completely different image – 2023 balances had been solely barely greater than these in 2003 and truly decrease than the 2013 quantity. The sample for youthful teams is comparable – rising nominal balances over time, however roughly flat balances as soon as the numbers are adjusted for inflation.

For my part, the trade and policymakers have performed all the things they will to make the 401(ok) system work as successfully as doable. In consequence, people who find themselves constantly lined by 401(ok) plans can and do amass substantial quantities of cash. However the typical employee, who strikes out and in of protection, can’t. In actual phrases – adjusted for inflation – 2023 balances for the everyday participant in every age group are beneath what they had been in 2013. No system can work successfully with out steady protection, and that aim will solely be achieved with a nationwide mandate that gives for computerized office financial savings for everybody.