We all know what we’re coping with, and might take steps to handle it.

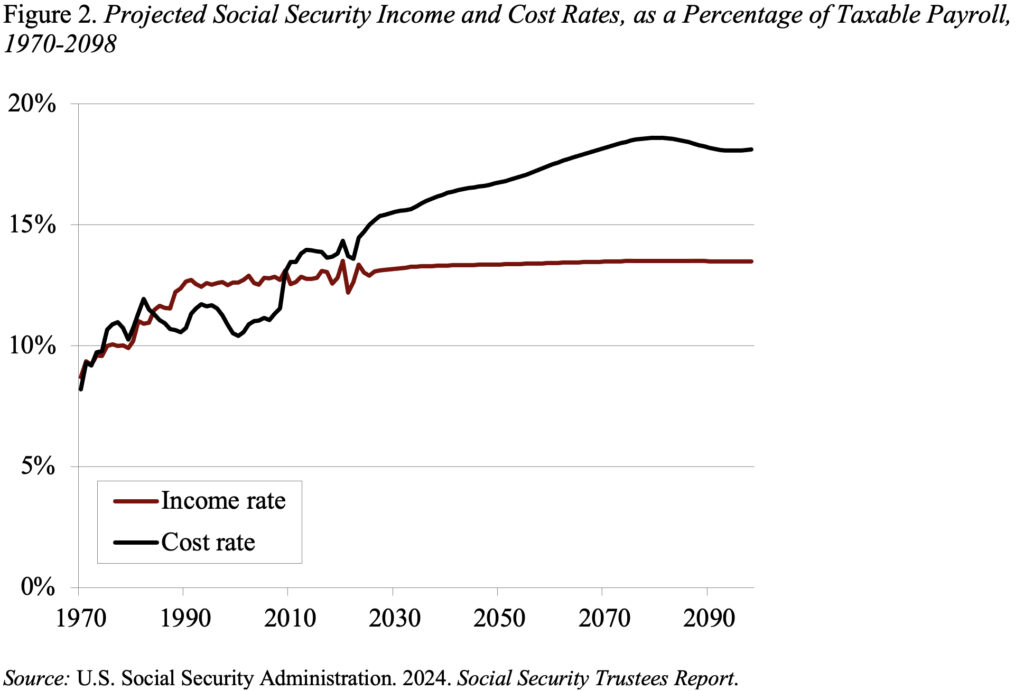

The important thing metric used to summarize Social Safety’s monetary standing is the 75-year deficit. This quantity is the current discounted worth of scheduled taxes (plus the prevailing belief fund) minus the current discounted worth of scheduled advantages divided by the current discounted worth of future payrolls. In 2024, the Social Safety Trustees had an estimated deficit equal to 3.50 % of taxable payroll. That determine implies that if payroll taxes had been raised instantly by 3.50 proportion factors – 1.75 proportion factors every for the worker and the employer – the federal government would have the ability to pay the present package deal of advantages for everybody who reaches retirement age not less than by 2098.

However the story is a bit more difficult for 2 causes. First, the Congressional Funds Workplace additionally estimates the 75-year deficit, and that company’s quantity is noticeably larger. Second, deficits that may happen on the finish of the 75-year interval must also be thought of.

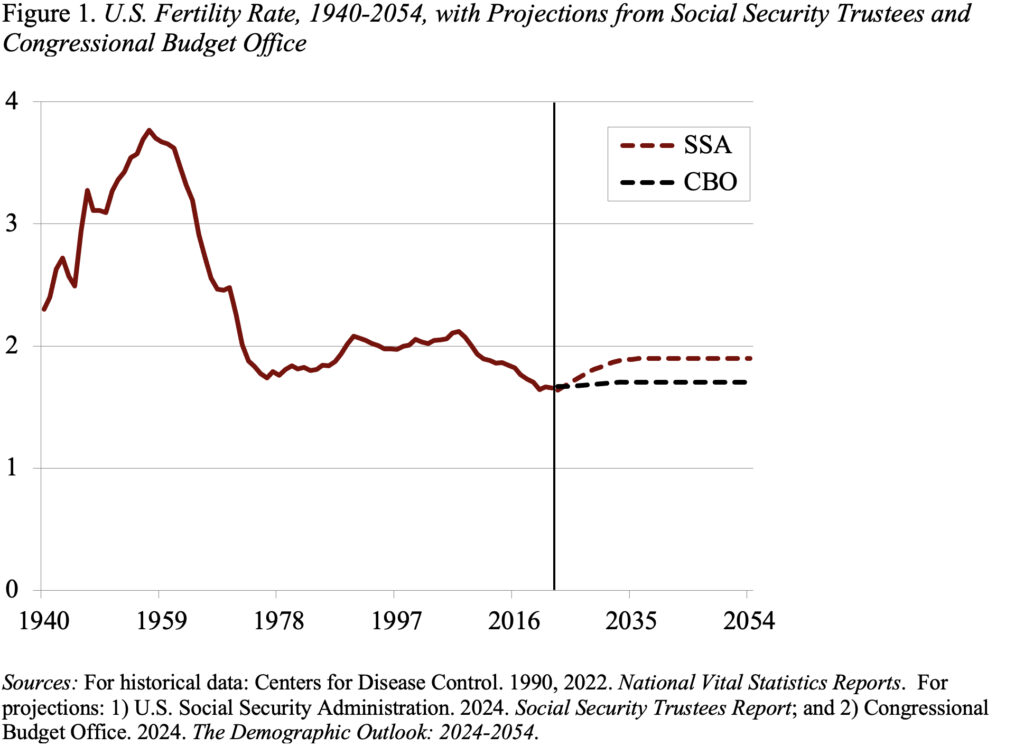

CBO initiatives a 75-year deficit of 4.4 % of taxable payrolls, in comparison with Social Safety’s 3.5 %. The primary cause for the distinction is an assumption in regards to the final whole fertility charge – the variety of kids a girl can be anticipated to have over her childbearing years. Demographics are a central consider any pay-as-you-go system. The rise in Social Safety prices has been pushed by the drop within the whole fertility charge after the Child Growth. Ladies of childbearing age in 1964 had a mean of three.2 kids; by 1974 that quantity had dropped to 1.8. The mixed results of the retirement of Child Boomers and a slow-growing labor pressure as a result of decline in fertility scale back the ratio of employees to retirees from about 3:1 to 2:1 and lift prices commensurately.

Though the U.S. fertility charge rebounded within the Nineteen Nineties to over 2 kids, it declined sharply through the Nice Recession and, regardless of expectations of a second rebound, clocked in at 1.66 in 2022 (see Determine 1). In response to the persistent decline, Social Safety lowered its final assumption to 1.9 in 2024, whereas CBO moved to 1.7. Since fertility charges are low worldwide and present little signal of reverting to earlier ranges, the CBO assumption could also be proper. In that case, the Social Safety actuaries’ sensitivity evaluation means that the 75-year deficit might be nearer to 4 % of taxable payrolls relatively than 3.5 %.

The second challenge has all the time been round. At this time limit, fixing the 75-year funding drawback isn’t the tip of the story by way of required tax will increase. Sooner or later, as soon as the ratio of retirees to employees stabilizes and prices stay comparatively fixed as a proportion of payroll, any answer that solves the issue for 75 years will kind of clear up the issue completely. However, throughout this era of transition, any package deal of coverage modifications that restores stability just for the following 75 years will present a deficit within the following yr because the projection interval picks up a yr with a big damaging stability (see Determine 2). Thus, eliminating the 75-year shortfall ought to be seen as step one towards “sustainable solvency.”

One solution to keep away from repeated crises such because the one we’re presently experiencing and to revive confidence within the monetary stability of the Social Safety program is for any package deal of options to incorporate a mechanism that routinely adjusts revenues or advantages when shortfalls emerge sooner or later. The Canadians have such a backstop association. If the Chief Actuary’s triennial report reveals a financing shortfall over the following 75 years and policymakers can not agree on an answer, the cost-of-living adjustment is frozen and contribution charges are elevated. We don’t must undertake the specifics of the Canadian mechanism, however some computerized adjustment ought to be a part of any package deal to unravel Social Safety’s financing issues.

The underside line is that we’ve a deal with on the longer term prices of the Social Safety program, however recognizing the uncertainty concerned in any projections over a interval of 75 years ought to be an integral a part of the method.