In response to Darrow’s current put up on inheriting an annuity, I acquired the next remark, which I edited for readability:

I’ve a variable annuity by way of Constancy. It’s the results of a 1035 conversion of a complete life insurance coverage product I want I hadn’t purchased in my late 30’s…..I pay .1% (for a) Constancy VIP Index plus .25% annual annuity cost for a complete of .35%…..For comparability FXAIX (Constancy’s S&P 500 index) prices .015% or .335% lower than the annuity model. Thus it’s $335 dearer per 12 months per $100,000 invested.

The variable annuity is best than the entire life product! I’m glad I used to be in a position to flip lemons into lemonade.

Would I purchase it once more by itself deserves? Sure!….I’m certain I’m lacking one thing as a result of everybody else is so adverse on them.

This remark highlights a wonderful technique for individuals who have been offered annuity and insurance coverage merchandise they remorse shopping for, the 1035 change. On a much less constructive observe, the concept of shopping for an annuity by itself deserves highlights the misunderstanding of annuity charges and taxation that I think are the explanation so many individuals find yourself with these merchandise that they later remorse. Let’s discover….

1035 Exchanges

Let’s begin with the a part of this remark that I really like, the 1035 change. Part 1035 is a piece of the IRS code that enables a tax-free change of 1 insurance coverage contract for an additional.

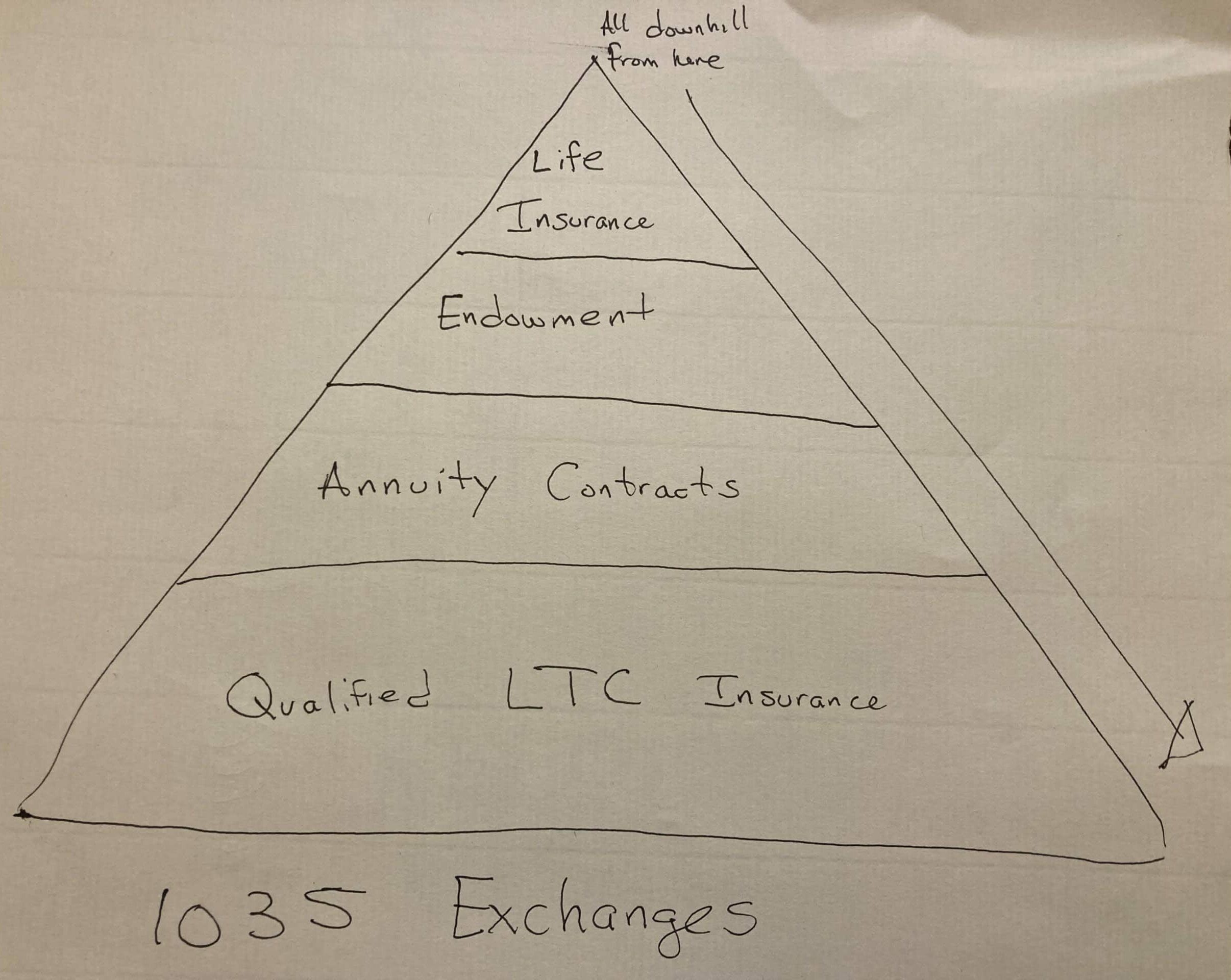

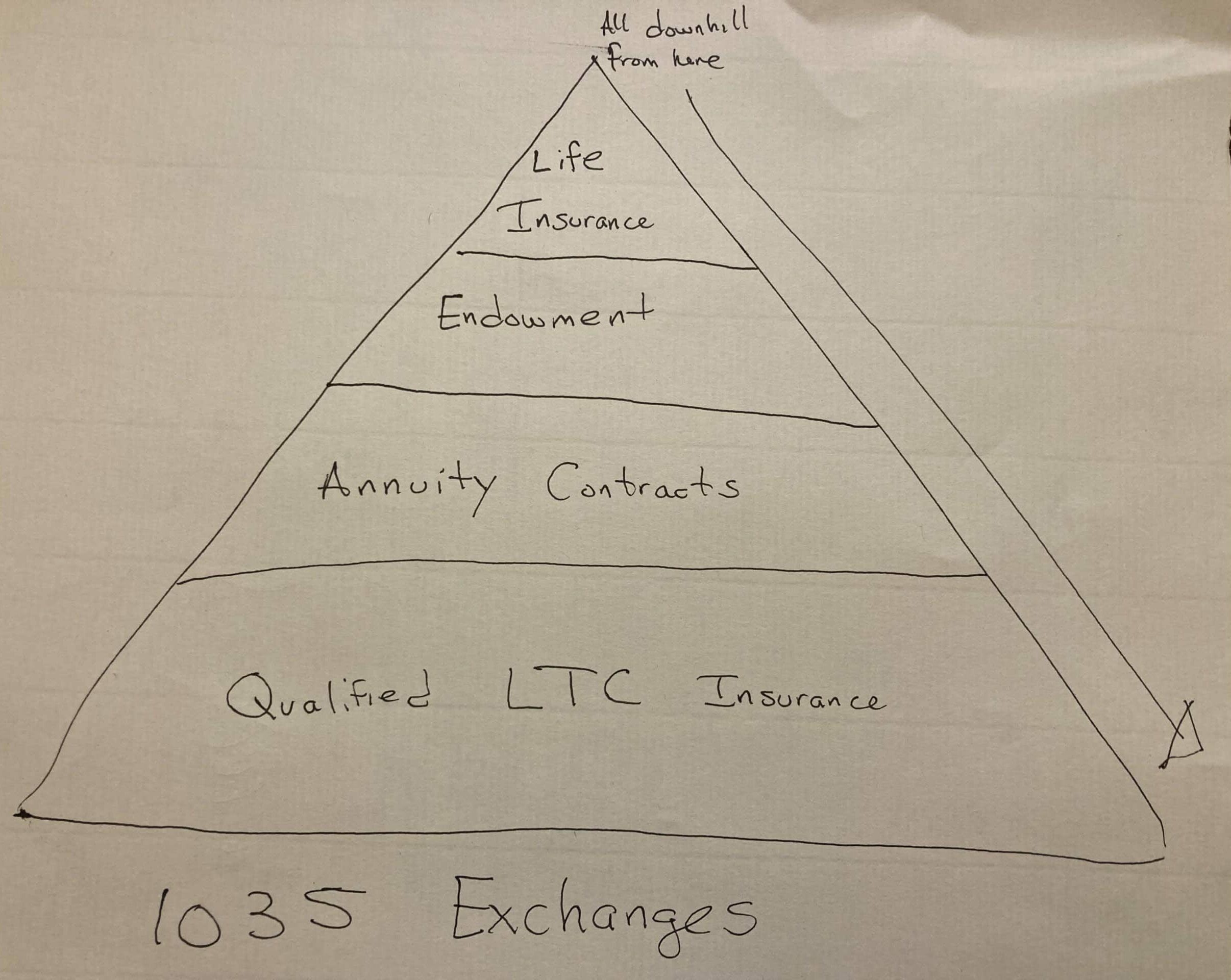

Part 1035 applies to life insurance coverage, endowments, and certified long-term care insurance coverage (LTC) insurance policies, in addition to annuities. I realized the mnemonic machine beneath that helped me when getting ready for my CFP examination:

Any of those insurance policies could be exchanged for a like sort of coverage. Life insurance coverage insurance policies, on the prime of the pyramid, could be exchanged into one other life insurance coverage coverage or for any of the opposite coverage varieties beneath it on the pyramid. On the different excessive, LTC insurance policies, on the base of the pyramid, cannot be exchanged for something aside from one other LTC coverage.

Annuities, being close to the underside of the pyramid, are a well-liked place to change undesirable, however generally offered, life insurance coverage merchandise or annuities. As such, there are merchandise typically termed “rescue annuities” as a result of they’re designed for the aim of rescuing shoppers from suboptimal merchandise they have been offered.

Vanguard used to supply a product for this which I exchanged my dad and mom’ annuities into years in the past. They not supply these merchandise. To my information, the Constancy annuity product referenced within the remark is the most suitable choice at present accessible.

When to Contemplate a 1035 Change

1035 exchanges work finest with an insurance coverage contract that you just have been offered years or a long time in the past outdoors of a certified account. On this state of affairs, you’re sometimes out of any give up interval that will forestall you from exiting the contract.

Nevertheless, you will have amassed substantial taxable positive aspects. These positive aspects would make surrendering the contract in a single lump sum undesirable as a consequence of tax penalties.

A 1035 change to a extra favorable contract supplies an affordable resolution. You’ll be able to decrease your charges. Additionally, you will purchase time to proceed deferring taxation and to find out a extra tax environment friendly technique to get cash out of the annuity quite than taking a lump sum multi functional 12 months.

Selecting an Annuity?

A 1035 change generally is a good resolution to “make lemons out of lemonade” with an outdated annuity or life insurance coverage product you have been offered. However do these low-cost annuities need to be thought-about on their very own deserves? Typically, no.

There are two key causes for this: annuity charges and taxation of annuities.

Annuity Charges

Let’s take a better have a look at the charges on the annuity talked about. It is likely one of the lowest charge variable annuity merchandise in the marketplace, if not the bottom.

The commenter astutely factors this out, noting the distinction of .35% all-in for the variable annuity vs. .015% for a similar funding bought outdoors of the annuity. The commenter additionally appropriately factors out that the distinction of .335% equates to a distinction of $335 per 12 months on a $100,000 funding.

Nevertheless, this overlooks (I imagine unintentionally) the identical factor that those who promote these contracts don’t clarify (I’m not as beneficiant in assuming it’s unintentional on their elements). That neglected element is the compounding of charges!

Let’s take into account the distinction between two in any other case equivalent $100,000 investments. Every compound at 8% per 12 months minus their respective charges for twenty years.

A $335 annual charge for twenty years could be $6,700. However charges aren’t linear. They compound. Figuring out the precise affect of this charge distinction requires a few time worth of cash calculations.

The cash invested within the variable annuity with all in charges of .35% would compound to $436,798. This similar amount of cash invested with all in charges of .015% would compound to $464,803.

The results of this seemingly small distinction in charges leads to ending with $28,005 much less after the twenty 12 months interval, all else being equal. If we compound the distinction out 30 years, the distinction grows to $89,186!

Anybody promoting annuities will likely be fast to level out that this isn’t a sound apples to apples comparability. Annuities are taxed in another way than taxable investments.

That is true! Nevertheless, most often taxation is another excuse to keep away from annuities quite than a motive to decide on them.

Taxation of Annuities

Funding positive aspects in an annuity are shielded from annual taxation. That is the largest tax benefit offered by an annuity.

In change for this profit, positive aspects on investments contained in the annuity lose favorable capital positive aspects tax remedy. Any positive aspects inside an annuity are in the end taxed as peculiar earnings when a withdrawal is taken, much like a non-deductible IRA. Additionally much like a retirement account, annuity withdrawals are topic to a ten% penalty on the positive aspects if taken earlier than age 59 ½.

As well as, annuity withdrawals are taxed on a last-in, first-out foundation. Which means that 100% of each greenback you’re taking from an annuity is taxed as peculiar earnings (and topic to early withdrawal penalties) till all the positive aspects are exhausted. At that time, the rest is a tax-free return of your principal.

Should you elect to annuitize funds, taxation is a extra difficult formulation the place every cost consists partially of taxable acquire and partially tax-free return of principal in your calculated life expectancy. Should you outlive your life expectancy, funds turn out to be 100% taxable as peculiar earnings.

Annuities vs. Different Tax-Advantaged Accounts

Annuity positive aspects are taxed as peculiar earnings like a tax-deferred retirement account. Annuities include early withdrawal penalties much like certified retirement accounts. They don’t include the upfront tax deductions of conventional retirement accounts or tax-free withdrawals of Roth accounts.

Due to this fact, there may be little motive to ever take into account shopping for an annuity if you’re not first maxing out all different tax-advantaged choices (work sponsored plans, IRAs, HSAs, and so forth.). They supply superior tax advantages, much less complexity, and usually decrease charges.

There’s additionally no motive to ever purchase an annuity inside a certified account for tax advantages. The tax advantages of the retirement account are already superior to these of an annuity.

In case you are an excellent saver who maxes out all of your tax-advantaged accounts, annuities can present some extra tax advantaged area to protect your investments from the annual tax drag created by taxation of earnings produced inside a taxable account. Nevertheless, the worth of this tax profit comes with trade-offs that make this profit questionable at finest.

Annuities vs. Taxable Accounts

How useful is utilizing an annuity to remove annual tax drag? The worth relies on a number of elements.

The primary is what you intend to spend money on. In case you are following the primary rule of thumb of using all of your accessible tax-advantaged accounts, they are going to present area to carry your least tax-efficient investments. You could possibly use a taxable account to carry solely tax-efficient investments like an S&P 500 index fund as talked about within the remark.

On this case, most of your positive aspects will come within the type of capital positive aspects. Thus you’ve gotten tax-deferral on the biggest portion of your funding acquire till you promote the funding. Extra importantly, you get this profit freed from cost and with out the complexity of annuity contracts!

Tax-efficient investments like broad primarily based index funds generate little to no annual capital positive aspects or non-qualified dividends. That by definition is why they’re tax-efficient. This leaves you with solely certified dividends that are taxed at favorable charges of 0%, 15%, or 20%.

The second issue when figuring out the tax advantage of an annuity vs. a taxable account is your private tax charge and the way it will change over time. In case you are saving aggressively in direction of early or semi-retirement, you could very nicely pay 0% tax on taxable accounts in your decrease earnings years.

Associated: Understanding the Advantages and Drawbacks of Taxable Accounts

Earlier than contemplating an annuity for tax advantages, be sure you perceive the trade-offs this entails. You’ll be giving up favorable tax charges, probably 0%, on long-term capital positive aspects and certified dividends in a taxable account to in the end pay peculiar earnings charges on any annuity positive aspects. You additionally need to weigh the adverse affect of annuity charges vs. any potential tax advantages the annuity supplies.

Ought to You Purchase an Annuity on Its Personal Deserves?

Few individuals purchase complicated annuities like variable or fairness listed merchandise. Most frequently these contracts are offered by brokers who’re paid handsomely to take action.

These salespeople play on fears to focus on options like “market-like progress” with restricted draw back and tax sheltered funding earnings. They downplay or outright omit discussing the affect of excessive annuity charges. They misrepresent the truth that in lots of instances there isn’t any precise tax profit. In reality, you could pay extra tax by using an annuity!

Like this commenter you could end up in possession of one among these contracts. You wouldn’t make an knowledgeable resolution to purchase this product immediately. In that case, using a 1035 change is a viable choice to start out contemporary in a extra favorable contract and permit for future tax planning.

Nevertheless, there may be hardly ever a motive to purchase even the bottom value variations of those merchandise on their very own deserves.

Associated: Annuities – The Good, The Unhealthy & The Ugly

* * *

Worthwhile Assets

- The Greatest Retirement Calculators might help you carry out detailed retirement simulations together with modeling withdrawal methods, federal and state earnings taxes, healthcare bills, and extra. Can I Retire But? companions with two of the perfect.

- Free Journey or Money Again with bank card rewards and join bonuses.

- Monitor Your Funding Portfolio

- Join a free Empower account to achieve entry to trace your asset allocation, funding efficiency, particular person account balances, web value, money movement, and funding bills.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire But? has partnered with CardRatings for our protection of bank card merchandise. Can I Retire But? and CardRatings might obtain a fee from card issuers. Some or all the card provides that seem on the web site are from advertisers. Compensation might affect on how and the place card merchandise seem on the positioning. The location doesn’t embrace all card firms or all accessible card provides. Different hyperlinks on this website, just like the Amazon, NewRetirement, Pralana, and Private Capital hyperlinks are additionally affiliate hyperlinks. As an affiliate we earn from qualifying purchases. Should you click on on one among these hyperlinks and purchase from the affiliated firm, then we obtain some compensation. The earnings helps to maintain this weblog going. Affiliate hyperlinks don’t improve your value, and we solely use them for services or products that we’re aware of and that we really feel might ship worth to you. In contrast, we have now restricted management over a lot of the show adverts on this website. Although we do try to dam objectionable content material. Purchaser beware.