I began running a blog about private finance in 2014. Within the ensuing decade I’ve written about money financial savings in depth precisely zero occasions.

Rates of interest began low and obtained decrease for almost a decade. There wasn’t a lot to jot down about.

After the spike in rates of interest over the previous few years and newer talks about potential fee cuts, money has change into a subject of curiosity. In simply the previous few weeks I’ve acquired questions from weblog readers, household, and shoppers on the next subjects:

- The very best place to carry money reserves,

- How a lot money vs. different short-term reserves to carry heading into retirement,

- The tax effectivity of cash market accounts vs. financial savings accounts, and

- lock in present charges with rates of interest scheduled to be minimize.

In my very own private funds, I just lately encountered a scenario that prompted me to reassess when the hassle to maneuver my money to get increased returns on money is justified. It’s time to cowl this subject that I’ve managed to keep away from for thus lengthy. So let’s soar in….

Why Maintain Money?

Let’s begin with a pair foundational questions which can assist reply all the others. There are two primary targets to having money holdings.

The first function of money is to supply liquidity. Money must be held the place you may entry it while you want it rapidly and with out having to promote something at depressed costs. Having satisfactory liquidity is a key element of your monetary well being.

The secondary goal for financial savings is to earn a return in your money till you want it. This is part of your portfolio you don’t wish to topic to a lot, if any, threat. A practical aim for money holdings is to maintain tempo with inflation over time. Till you do want these financial savings, you need these {dollars} to keep up their buying energy.

This isn’t at all times attainable with threat free belongings. Alternatively, there are durations when chances are you’ll do a bit higher than inflation.

Something that proposes to do a lot better than this over lengthy durations of time must be considered with suspicion. Threat and return are inclined to go hand in hand.

How A lot Money Ought to I Have?

The amount of money you maintain depends upon your private circumstances. A suggestion of 3-6 months of bills in an emergency fund is normal recommendation.

This can be a affordable aim for most individuals of their accumulation section. Nevertheless, as I’ve written about up to now, this goal is deceptively exhausting to achieve, particularly for individuals who would profit most from attaining it. Conversely, these with steady jobs and excessive financial savings charges could not want to carry a lot, if any, money.

In my family, Kim and I created a way of life that might be supported on one in every of our incomes. We used the opposite to repay debt, make investments, and spend on uncommon splurges. My profession was very safe. So we by no means held any money all through our accumulation section apart from just a few thousand {dollars} in a checking account to satisfy regular spending wants.

On the different excessive, holding excess of 3-6 months of bills could also be prudent. Some persons are making ready to purchase a home and wish to have a big down fee or purchase the house outright. Many retirees want to carry at the very least a 12 months of bills in money.

Chances are you’ll be nearing or in retirement and concurrently be trying to purchase a house or make different massive purchases. Holding a excessive six determine sum in money could make good sense on this case.

Does It Make Sense to Pursue Greater Curiosity Charges on Money?

Most of us fall someplace between these extremes. There are just a few elements that dictate whether or not it is sensible to attempt to optimize returns on money and how one can go about doing so.

There may be one situation the place it nearly at all times is sensible. Let’s begin there.

Asleep on the Wheel

Rates of interest have risen dramatically since bottoming out on the finish of 2021. Many shoppers have benefitted with increased charges on cash markets, treasuries, and financial savings accounts. However a stunning variety of persons are not benefitting. Don’t be one in every of them!

Up to now 12 months, I’ve had my dad and a number of shoppers transfer cash from financial savings and cash market accounts to totally different increased yielding financial savings or cash market accounts. They elevated the yield on their money by about 4% on common. Extra importantly, this was attainable with out rising threat.

As famous above, this dramatic enhance in return with no simultaneous enhance in threat ought to typically increase suspicion. On this case, it was simply an instance of some establishments benefiting from people who find themselves not taking note of the dramatic shift in rates of interest.

Sub-Par Charges Persist

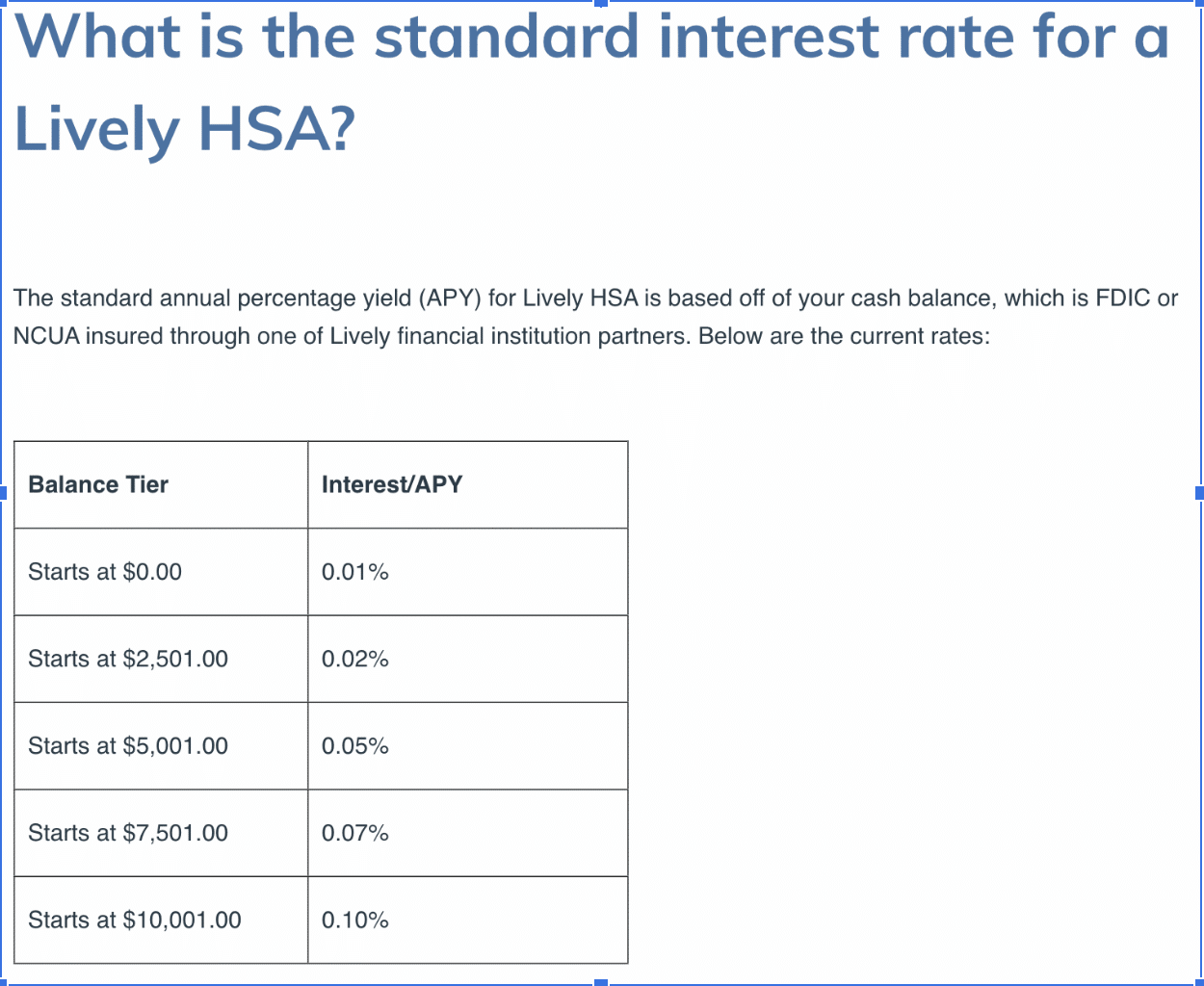

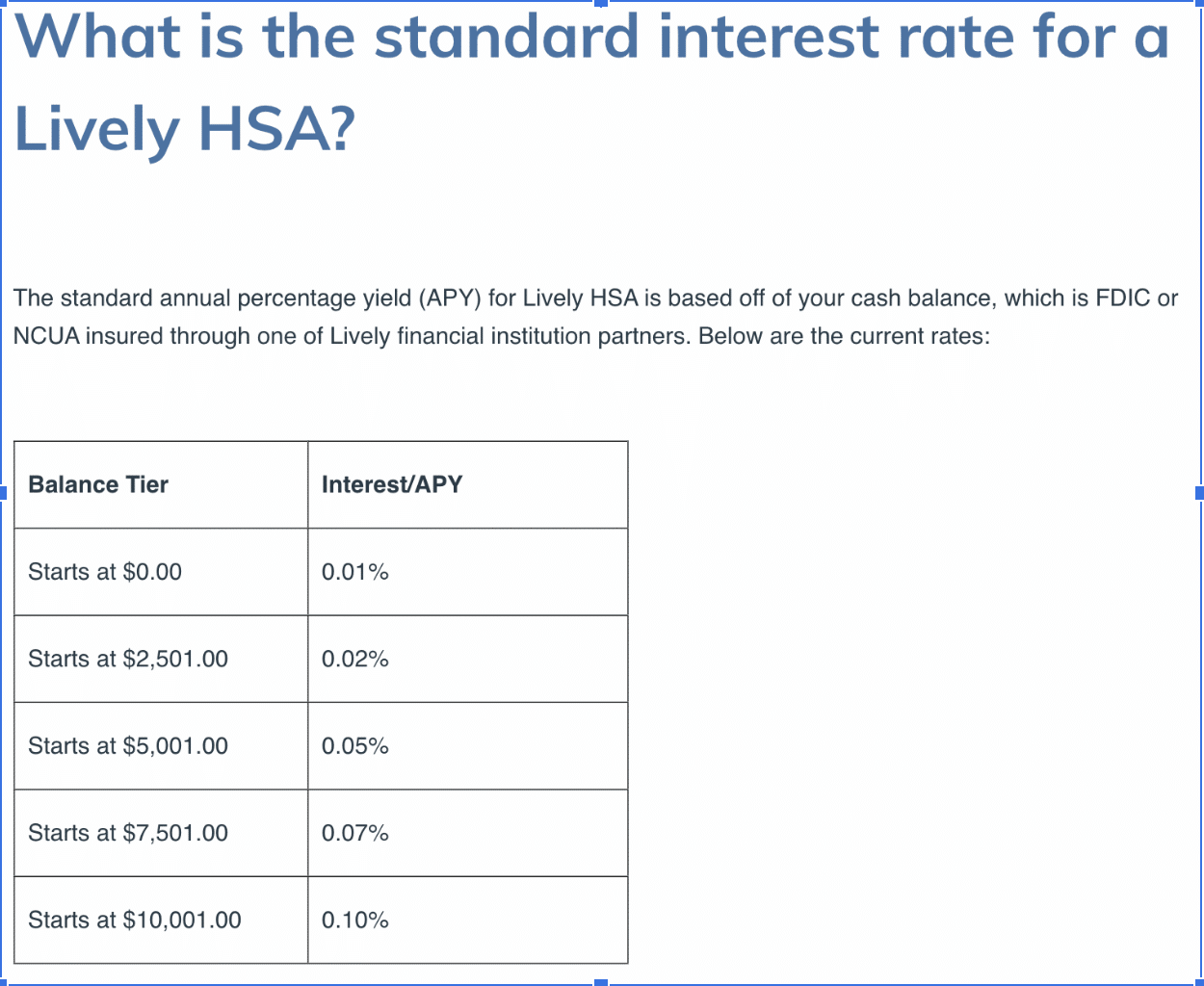

This case persists. As just lately as just a few weeks in the past I encountered this case with my HSA with Vigorous. I selected Vigorous years in the past as a result of they have been the one HSA supplier on the time that allowed first greenback investing by way of TD Ameritrade. This modified after Schwab acquired TD.

I now am required to maintain $3,000 in money financial savings or pay a $24 annual price for the privilege of investing my complete HSA account. I discovered this alteration annoying, however I now hold a few of my HSA in safer belongings anyway. So I didn’t suppose this may be an enormous deal. Then I checked the charges they’re paying on money financial savings (See screenshot under).

I discovered this appalling. My FDIC insured excessive yield financial savings account at Ally financial institution is paying 4.35% with no minimal stability.

I encourage everybody with any substantial amount of money in financial savings to verify to be sure to are getting a aggressive yield in your money in a excessive yield financial savings account or cash market. Don’t overlook money accounts at in any other case extremely advisable brokerages. Schwab, for instance, makes over half of their income from curiosity on deposits, loans, and securities.

Definitely worth the Effort to Optimize?

Shifting your money to an establishment that pays aggressive charges with out sacrificing security and comfort is a no brainer. The spreads are massive, so not doing so ends in leaving free cash on the desk. Establishments which can be paying basically no curiosity on financial savings on this setting make me doubt whether or not they have shoppers’ greatest pursuits in thoughts.

Past choosing this low hanging fruit, the good thing about optimizing returns in your money comes down to a couple elements.

- The amount of money you maintain. The good thing about getting an additional .5% curiosity on a $10,000 emergency fund is negligible ($50/12 months). The identical additional .5% for somebody with a half million {dollars} in money is substantial ($2,500/12 months).

- Your tax scenario. Some choices for money holdings might be extra tax pleasant.

- The quantity of effort you’re prepared to use (or conversely comfort you’re prepared to sacrifice) to squeeze out this additional yield.

Greatest Choices For Holding Money

Retaining in thoughts that the primary consideration for our money holding is liquidity, there are three affordable choices for holding at the very least a portion of your money:

- Excessive Yield Financial savings Accounts

- Cash Market Accounts

- Cash Market Funds

For these with bigger money financial savings which can be earmarked for a sure time interval, CDs and T-Payments could make sense. The comfort and usually increased yields of short-term bond funds make them enticing to some. I’ll additionally share why we personally are utilizing I Bonds to carry a considerable amount of our money allocation.

Financial savings Accounts

Financial savings accounts present security and liquidity. You deposit your cash and may withdraw it as wanted.

FDIC insured banks make these accounts just about threat free as much as $250,000 per proprietor per account sort per establishment (or $500,000 for a joint account). For these with bigger money holdings, it’s sensible to unfold your cash throughout a number of banks to make the most of this safety as we witnessed final 12 months when a number of banks failed.

Rates of interest on financial savings accounts can fluctuate significantly. They are typically comparatively low at native brick and mortar banks. Considerably higher phrases might be discovered at on-line banks.

A fast search of two native banks in my space (Utah) reveal that one, Zions Financial institution, gives variable charges of .16% for balances lower than $1,000 as much as a most of solely .19% for accounts over $100,000. Financial institution of Utah gives considerably higher phrases, .6% for balances lower than $10,000 as much as a most fee of two.07% for balances over $200,000.

In distinction, main on-line banks together with Ally, American Specific, and Capital One all on the time of this writing supply 4.35% curiosity with no charges and no minimums. CIT Financial institution is providing 5.05% for balances larger than $5,000. These FDIC insured banks are all established and have a popularity of providing constantly aggressive charges.

Watch out for financial savings accounts with increased introductory gives or join bonuses. These gives might be accompanied by a bait and swap to a lot decrease charges. This creates a psychological burden to maintain observe of charges and trouble to maneuver accounts.

Cash Market Accounts

Cash market accounts, like financial savings accounts, are lined by FDIC insurance coverage. Banks make investments the funds in top quality, short-term investments. These options present security and liquidity.

A characteristic that historically was enticing about cash market accounts was the power to jot down checks from these accounts. As our world is changing into extra digital, that is probably not a distinction maker for many of us.

Rates of interest could also be increased than what you may get with conventional financial savings accounts at brick and mortar banks, however will probably be decrease than what you’ll get with on-line financial savings accounts. Thus, they might present a center floor for individuals who want to financial institution regionally however are on the lookout for increased rates of interest.

Cash Market Funds

Cash market funds are mutual funds that usually spend money on top quality, short-term debt devices. Thus they have an inclination to supply the liquidity we need for money holdings mixed with aggressive yields.

Rates of interest on cash market accounts are adjusted every day, making them much less steady than rates of interest on financial savings accounts which have a tendency to maneuver extra slowly. This may work for or in opposition to you at totally different occasions as charges transfer up or down. The value of the shares of a cash market fund are typically very steady at $1.

Cash market funds usually are not lined by FDIC insurance coverage. They do have SIPC safety.

The most secure cash market funds, like Vanguard’s Treasury Cash Market Fund, as of this writing yield roughly 1% greater than excessive yield financial savings accounts. As a result of these funds make investments nearly completely in US treasuries, in addition they are exempt from state taxation. This might make them a sexy place to retailer money for these topic to state revenue tax.

There are state particular municipal cash market funds, which might be exempt from federal and state revenue tax. This will make them enticing to some. Nevertheless, this provides an elevated factor of threat that you could be not wish to take together with your money holdings.

CDs and T-Payments

With speak of rate of interest cuts on the horizon, I’ve acquired a number of questions on methods to lock in present rates of interest. I counsel warning in making any monetary strikes primarily based on predicting the long run, which is inherently troublesome.

Rate of interest cuts, nonetheless probably, usually are not assured to occur. In the event that they do, we don’t know precisely when or how far charges will fall.

That stated, it’s not unreasonable to place a few of your money into CDs or particular person Treasury payments that may assure you a fee of curiosity till they mature. CDs are backed by FDIC insurance coverage. Treasury payments are thought of threat free belongings, backed by the total religion and credit score of the U.S. authorities.

Both of those could also be fascinating in case you have a selected function on your cash and are assured when you will want it. Examples are realizing you wish to buy a house in 18 months after your youngster will end faculty or having money earmarked for subsequent 12 months’s retirement dwelling bills.

Nevertheless, when you get the good thing about locking in your return for a set time frame, these advantages include trade-offs.

You need to be assured when you will want your money. If you happen to want it earlier than a CD matures, chances are you’ll owe a penalty. If you happen to want it earlier than a T-Invoice matures, you’re topic to rate of interest threat. Thus you don’t have the liquidity usually desired for money reserves.

Locking in present charges is a double edged sword. You defend your self if charges fall. Nevertheless, you can miss out on increased charges in case your prediction was improper and charges go up or quick time period charges stay increased than long term charges.

Bond Funds

An alternative choice to particular person bonds are top quality short-term bond funds, equivalent to Vanguard’s Brief-Time period Treasury ETF (VGSH). They typically will present the next yield than different money financial savings (although that’s not the case as of this writing) whereas investing within the most secure bonds.

Nevertheless, having any bond fund introduces some volatility. You don’t know precisely how a lot your shares shall be value till you promote them. For instance, VGSH has a period of 1.9 years. Which means if rates of interest rise by one p.c, your bond values will drop by roughly 2%. This can be extra threat than you wish to incur for money like holdings.

Associated: How Low Can Your Bond Values Go?

A center floor between shopping for particular person bonds and bond funds are iShares iBonds ETFs. These ETFs allow shopping for US treasuries or TIPS that each one mature in the identical 12 months. This supplies the comfort of a bond fund with the value predictability of a person bond at maturity.

These ETFs are compelling for constructing longer bond ladders. For money reserves, one or perhaps two treasury ETFs doesn’t appear a lot simpler than shopping for just a few T-bills. The expense ratio additionally provides price that detracts out of your return.

IBonds’ TIPS ETFs do present a novel alternative to simply purchase TIPS that mature all in the identical 12 months. New TIPS are solely issued with 5, 10, or 30 12 months phrases. These funds have drawn plenty of consideration in private finance circles.

Once more, I believe these funds are fascinating for constructing longer bond ladders the place the compound impact of inflation can considerably erode buying energy over time. For shorter time durations for which I maintain money, inflation is much less of a priority.

I Bonds

I’ll suggest a remaining choice for money reserves that I haven’t heard many individuals discuss, however the place we’re at present preserving the lion’s share of our money financial savings: I Bonds. It could be a sexy choice for different readers in related conditions.

I began shopping for I Bonds after researching and writing about them in 2021. Since then, I’ve purchased the allowable allotment of $10,000 every for Kim and I every year as charges have gone up.

An I Bond bought by way of April 2024 has a hard and fast fee of 1.3%. Mixed with the inflation adjustment, that bond has a complete yield of 5.27% annualized for the following 6 months. That’s almost 1% higher than excessive yield financial savings accounts and much like cash markets. Even our outdated I bonds with 0% mounted charges are yielding 3.94% because of the inflation adjustment which is aggressive.

There are clear drawbacks to I Bonds. The annual buy restrict means it takes time to construct a large stability. And when you want the money, you may’t replenish it such as you would different money holdings. However the annual buy restrict can present a compelled technique to progressively construct up money financial savings within the years main as much as retirement.

Your cash is locked up for one 12 months after buying the bond. After that, your cash is accessible at a recognized worth (i.e. these bonds are liquid).

In our case, we’d like important money reserves. Nevertheless, we aren’t certain after we will want the money. We drive a ten 12 months outdated car, dwell in a 60 12 months outdated home, and have high-deductible medical health insurance. Kim’s revenue is tenuous. My weblog revenue is tenuous and unpredictable.

Now that we’re buying our medical health insurance by way of the trade, we don’t prefer to have any pointless taxable revenue. Limiting taxable revenue permits us to optimize our ACA premium subsidies.

I Bonds enable us to defer taxes on curiosity revenue till we redeem the bond. So every year, we’re shifting cash from our financial savings into I Bonds till we’d like the money.

What Are You Doing With Your Money?

I’m curious to listen to what you’re doing together with your money financial savings. Are you prepared to take extra threat or apply extra effort than the methods I’ve outlined? Do you could have any inventive methods like my use of I Bonds that you just use as an alternative choice to conventional money reserves?

Let’s discuss it within the feedback under.

* * *

Beneficial Sources

- The Greatest Retirement Calculators can assist you carry out detailed retirement simulations together with modeling withdrawal methods, federal and state revenue taxes, healthcare bills, and extra. Can I Retire But? companions with two of the very best.

- Free Journey or Money Again with bank card rewards and join bonuses.

- Monitor Your Funding Portfolio

- Join a free Empower account to achieve entry to trace your asset allocation, funding efficiency, particular person account balances, web value, money move, and funding bills.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire But? has partnered with CardRatings for our protection of bank card merchandise. Can I Retire But? and CardRatings could obtain a fee from card issuers. Some or all the card gives that seem on the web site are from advertisers. Compensation could influence on how and the place card merchandise seem on the positioning. The positioning doesn’t embrace all card corporations or all accessible card gives. Different hyperlinks on this web site, just like the Amazon, NewRetirement, Pralana, and Private Capital hyperlinks are additionally affiliate hyperlinks. As an affiliate we earn from qualifying purchases. If you happen to click on on one in every of these hyperlinks and purchase from the affiliated firm, then we obtain some compensation. The revenue helps to maintain this weblog going. Affiliate hyperlinks don’t enhance your price, and we solely use them for services or products that we’re accustomed to and that we really feel could ship worth to you. In contrast, we’ve restricted management over a lot of the show advertisements on this web site. Although we do try to dam objectionable content material. Purchaser beware.