I used to be lately invited to talk on the EconoMe convention in regards to the course of of making extra correct retirement projections. In getting ready for my speak, I reviewed Darrow’s in depth work on retirement calculators on this weblog.

I need to develop upon an idea he’s written about: calculator constancy. Understanding it is step one in choosing the proper retirement calculator to fulfill your wants.

Calculator Constancy

In our itemizing of The Finest Retirement Calculators, a method Darrow allowed sorting is by “constancy.” Right here is how he described this idea:

“Credit score goes to Stuart Matthews of Pralana Consulting (affiliate hyperlink) for this useful idea. By constancy we’re referring to how effectively every calculator can probably reproduce actuality — the realism of its simulation.

In a nutshell, to do a greater modeling job, a calculator might want to acquire extra information, and extra correct information, from you. So, “constancy” can also be a tough measure of accelerating complexity:

- Low-Constancy — these calculators will function only a dozen enter fields or much less, and often carry out solely a easy fastened charge/common return calculation. They function ease of use, and customarily would require lower than 5 minutes of your time to provide solutions.

- Medium-Constancy — these calculators add further fields, often dealing with a number of accounts with totally different asset allocations, and arbitrary monetary “occasions” akin to irregular future revenue or bills. Usually they could require 10-20 minutes of your time to provide solutions.

- Excessive-Constancy — these calculators will add much more enter fields, the power to match eventualities, and sometimes Social Safety and tax calculations. Usually they may require not less than 30-60 minutes of your time to provide solutions. And so they might simply require a number of hours to know all of the choices, and acquire and enter all the information to take full benefit of their capabilities. However these calculators have the potential to be most correct, assuming you are taking the time to enter good information, and assuming your guesses in regards to the future maintain true.”

Completely different Instruments for Completely different Functions

I discover this idea of calculator constancy extraordinarily useful in understanding these instruments and selecting one of the best one on your wants. Nevertheless, it understates simply how totally different they’re, which is “greatest,” and thus which you must select.

In my presentation, I used an analogy of a steak knife and a chainsaw to distinction the magnitude of distinction between low and high-fidelity calculators. At their core, a steak knife or a chainsaw is a reducing system. Every serves a objective.

Should you order a pleasant filet mignon, a steak knife is clearly the “greatest” reducing software. But when a wind storm takes down a tree in your yard, the steak knife is ineffective. You need the chainsaw.

That is much like the magnitude of distinction between high and low constancy retirement calculators. They’re each calculators at their core. However they’re very totally different instruments serving totally different functions.

This could greatest be demonstrated with a case research run on a number of of one of the best calculators of their class.

Case Research Parameters

I created a comparatively easy case research to showcase calculators at totally different constancy ranges. The parameters are as follows:

- A married 50 12 months outdated couple at or close to early retirement

- Anticipated life expectancy is 90 years of age (i.e. 40 12 months retirement time-frame)

- Bills of $80,000 12 months

- Plus funding bills of .25% of their portfolio worth

- $2 million portfolio

- Allocation: 60% inventory/ 35% bonds/ 5% money

- Tax Allocation: 50% tax-deferred, 30% taxable, 20% Roth

- Inflation assumption of three.5%

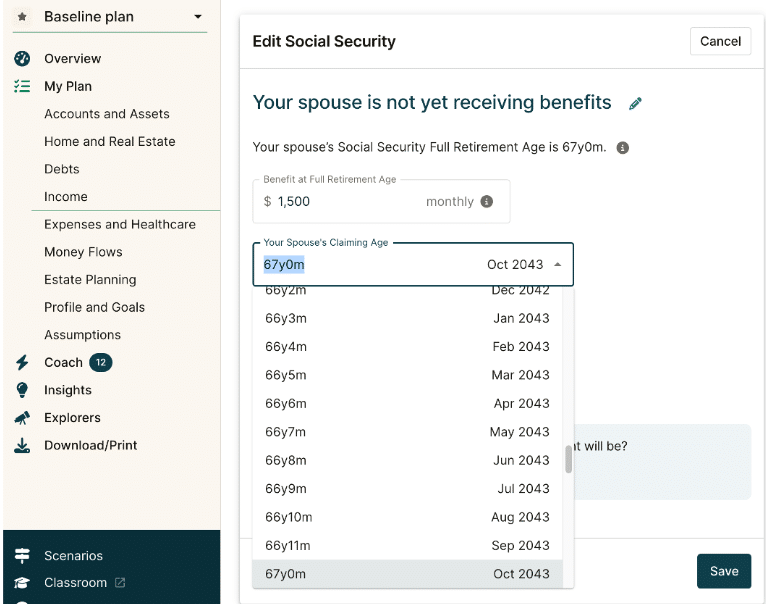

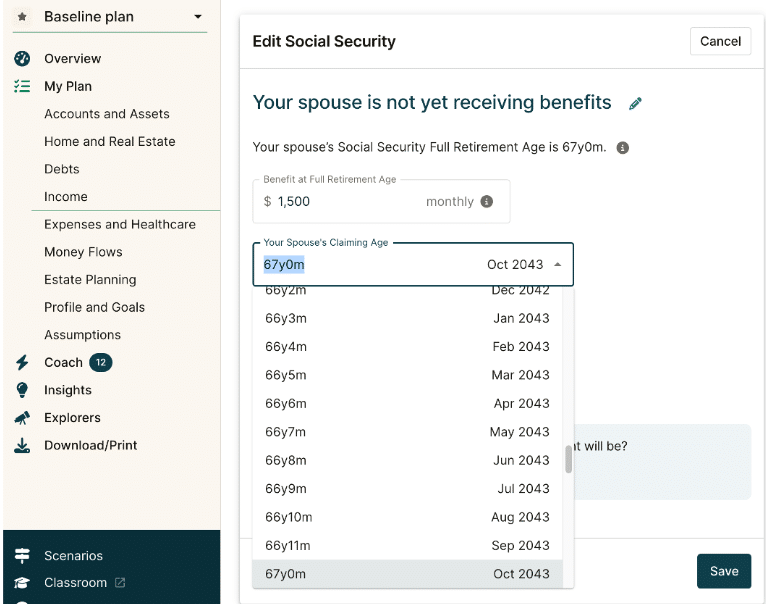

- Equivalent Social Safety advantages of $1,500 every at their full retirement age (67 y/o)

This case was purposefully simplified for ease of knowledge entry and readability of demonstration. I selected a number of calculators that I had used previously, so I had some preexisting data. Nevertheless, I hadn’t used any of those calculators usually for not less than two years whereas I used to be targeted on different points. This allowed me to have a look at these instruments by means of new eyes.

I additionally examine how calculators obtainable to most of the people examine to skilled monetary planning software program I exploit with my planning purchasers.

Low Constancy

I began by operating this situation on two low constancy calculators:

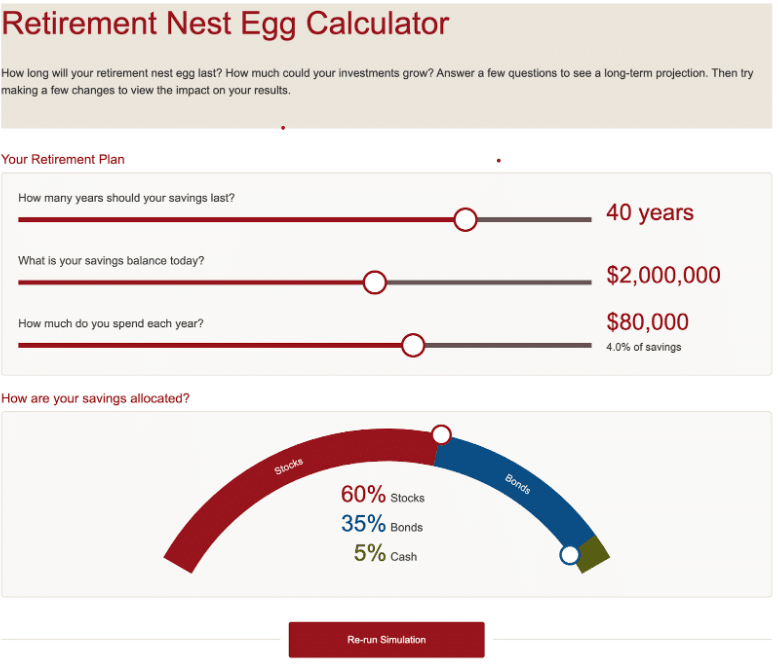

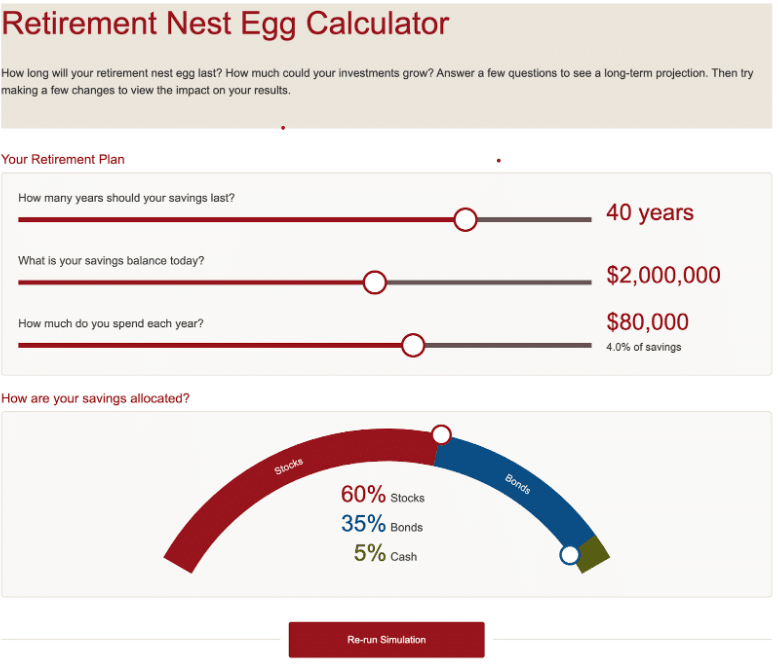

Vanguard

The Vanguard calculator provided solely 4 inputs:

- How lengthy financial savings ought to final

- At this time’s steadiness

- Annual spending

- Asset allocation (% every to shares, bonds, and money)

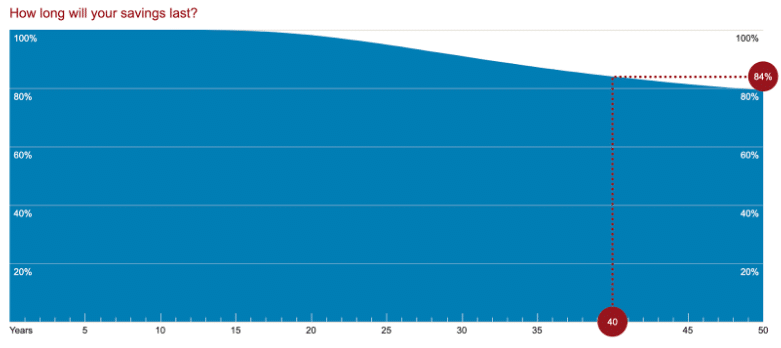

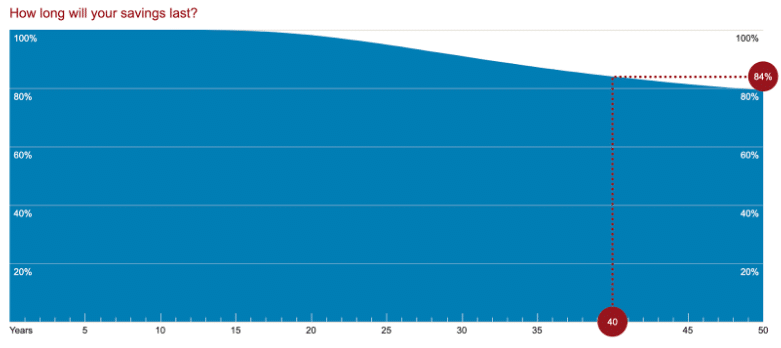

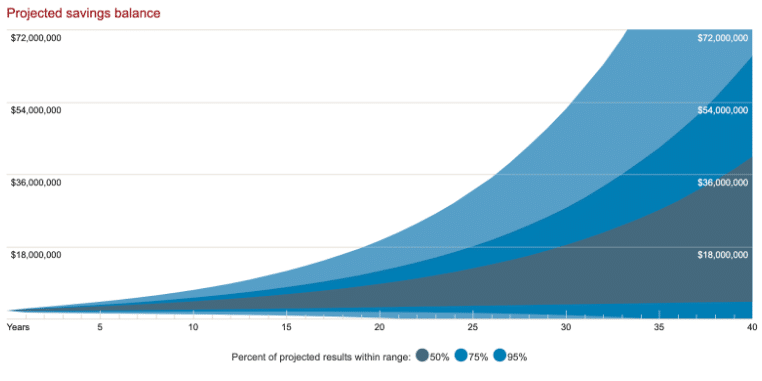

The calculator then carried out a Monte Carlo evaluation of 1,000 eventualities and produced two outputs in graphical type:

- How Lengthy Your Financial savings Will Final

- Projected Financial savings Stability

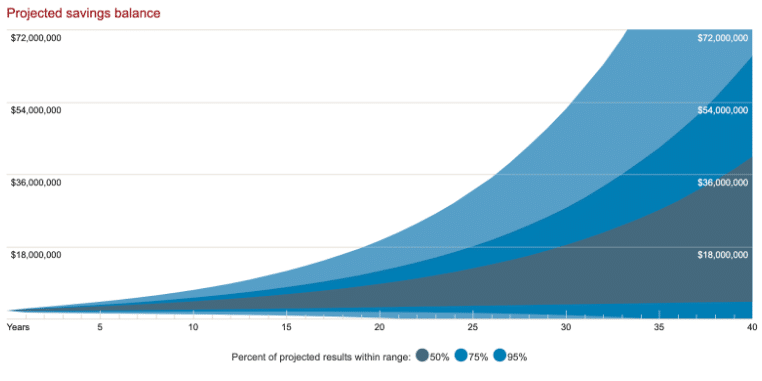

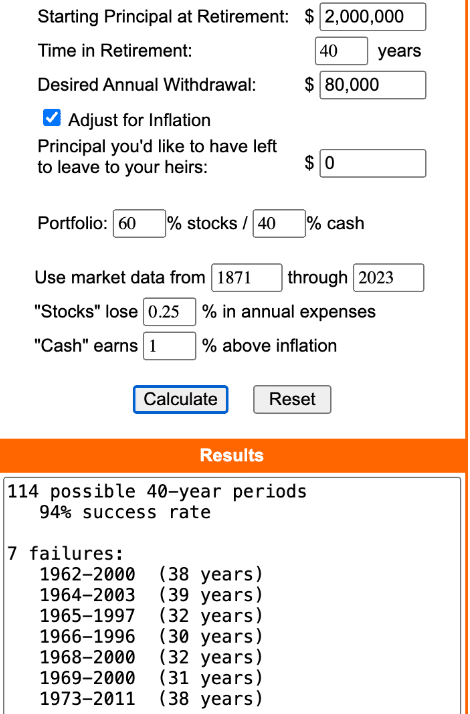

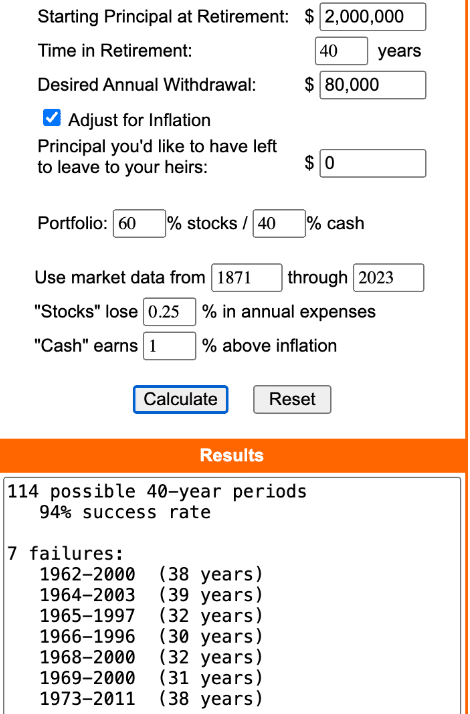

Moneychimp

Moneychimp’s retirement calculator provided a equally easy to make use of and straightforward to know interface.

Inputs embrace:

- Beginning principal

- Time in retirement

- Desired annual spend (with skill to regulate for inflation)

- Desired terminal account steadiness

- Asset allocation (% shares and money with skill to mannequin money returns as % above inflation)

- Funding bills

Moneychimp’s calculations are primarily based on historic inventory returns mixed with a person chosen actual (above inflation) charge of “money” return.

Inputs and outputs had been in a position to be captured in a single screenshot. This calculator additionally features a good clarification of strategies and a few ideas to assist interpret the information.

Low-Constancy Cons

Clearly, low-fidelity calculators have limitations. Neither was in a position to account for even a single enter for Social Safety. Vanguard couldn’t account for funding charges in my easy case.

Neither contemplate if somebody is on monitor to retire, account for various retirement dates for spouses, or are in a position to mannequin irregular revenue or bills (sale of a house, buy of autos, working part-time for five years of retirement, and so on.). There isn’t a accounting for taxes.

Low-Constancy Execs

That doesn’t imply these instruments are with out worth. Their simplicity makes it simple to get began. I spent lower than 5 minutes with each between touchdown on the internet web page and getting helpful output.

This may be immensely useful for somebody who’s simply beginning and attempting to get a grasp on the important thing variables that decide success or failure in retirement calculations. The affect of small modifications that circulation by means of and compound over a multi-decade plan usually are not intuitive for most individuals.

You’ll be able to check variables shortly:

- What in case your burn charge was a half a % decrease? Or increased?

- Do 1% advisor charges added to your portfolio actually matter?

- How does a extra (or much less) inventory heavy allocation affect outcomes?

- What if my retirement lasts 30 years as an alternative of 40? Or 50?

As a result of the calculations are fast, easy, and crude, it’s clear that you simply don’t need to make main life altering selections primarily based on one, and even a number of of those low-fidelity calculators. However they are often useful for somebody within the early levels of planning to get within the ballpark and get a really feel for retirement calculations with out turning into overwhelmed. For the precise individual on the proper time, low constancy calculators are a wonderful software.

Medium Constancy

Subsequent, I ran my situation by means of two medium constancy calculators:

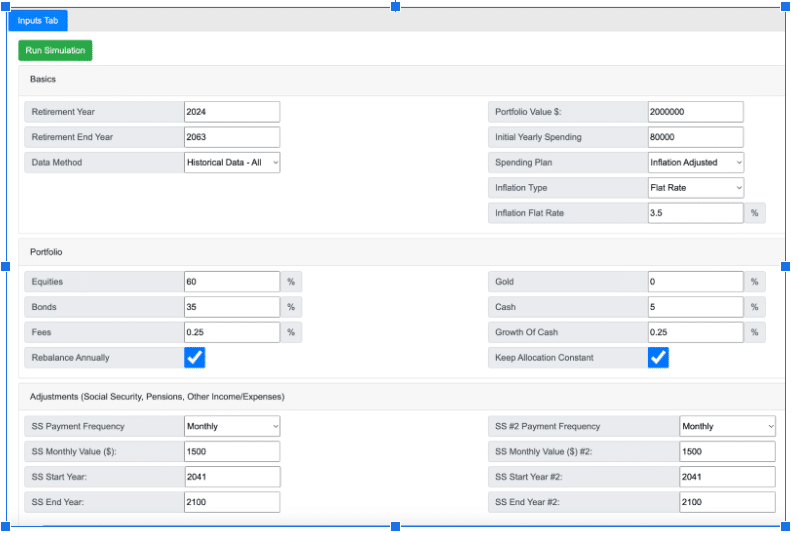

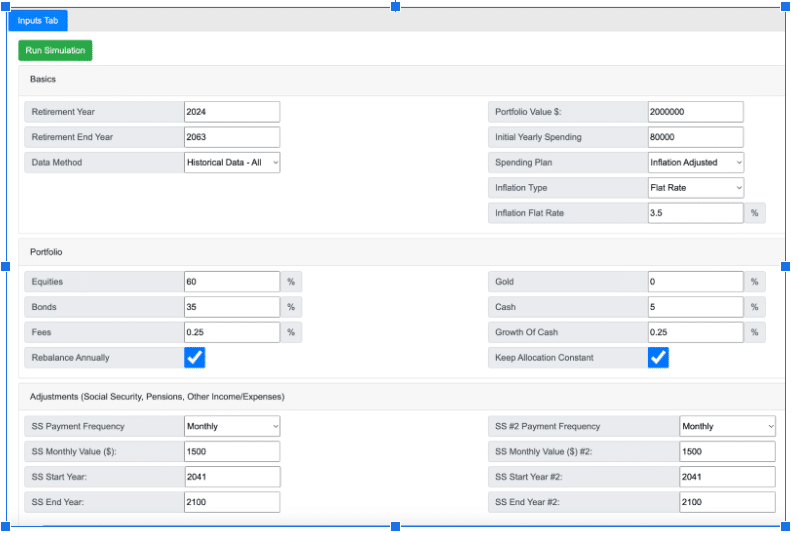

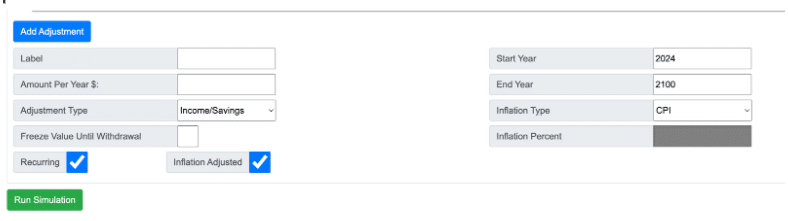

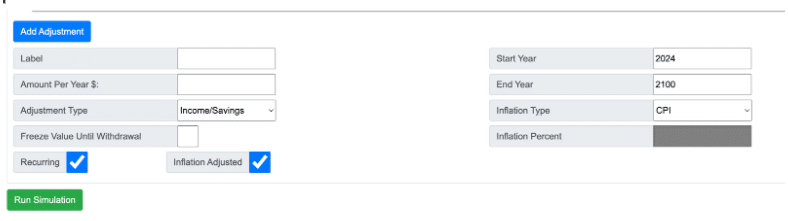

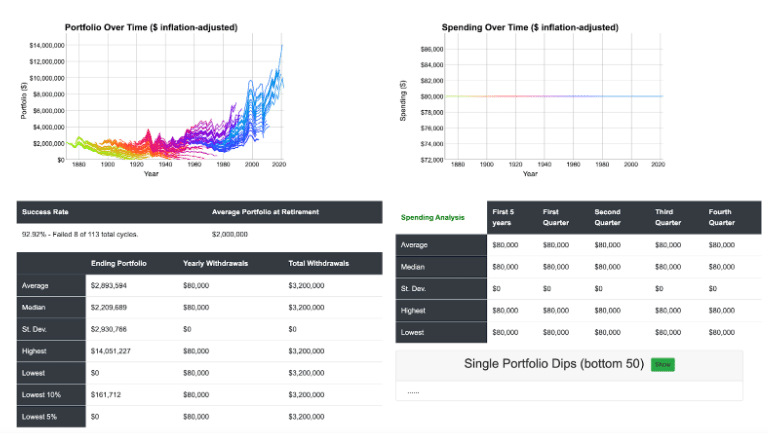

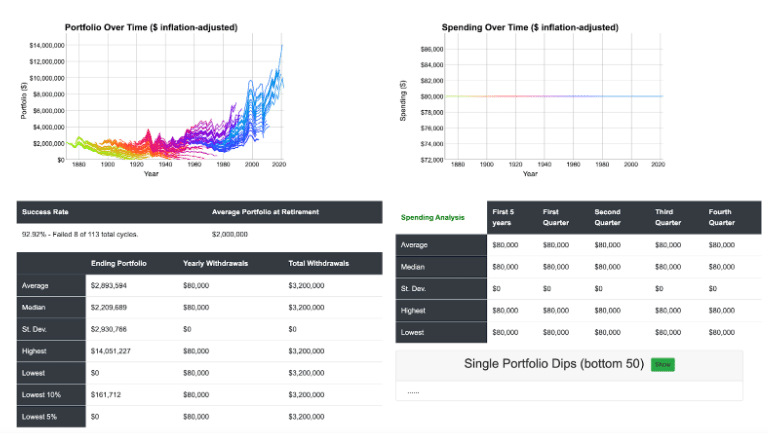

cFIREsim

cFIREsim simply dealt with the entire variables in my easy situation besides one. It couldn’t account for various taxation of tax-deferred, taxable, and Roth accounts. Along with taking over the remainder of the variables, it had the capability to deal with significantly extra modeling complexity.

The inputs I wanted had been all captured on one screenshot (when undefined by my case, I went with calculator defaults):

This software can also mannequin irregular revenue, saving, and spending occasions:

cFIREsim offers concise graphical and tabular outputs. In my case, I chosen modeling historic returns. As you’ll be able to see, the precise aspect of the outputs had been pointless for my easy situation, demonstrating the power of this software to deal with extra advanced modeling.

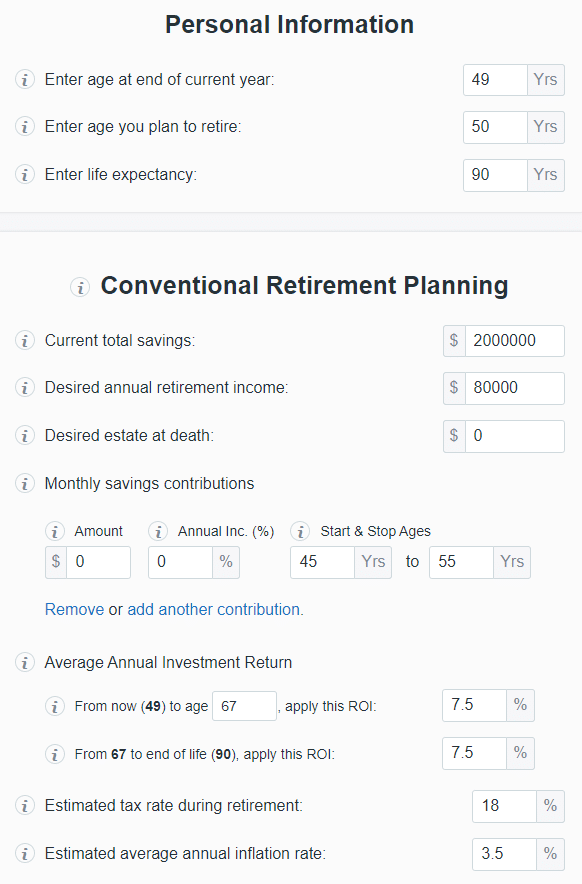

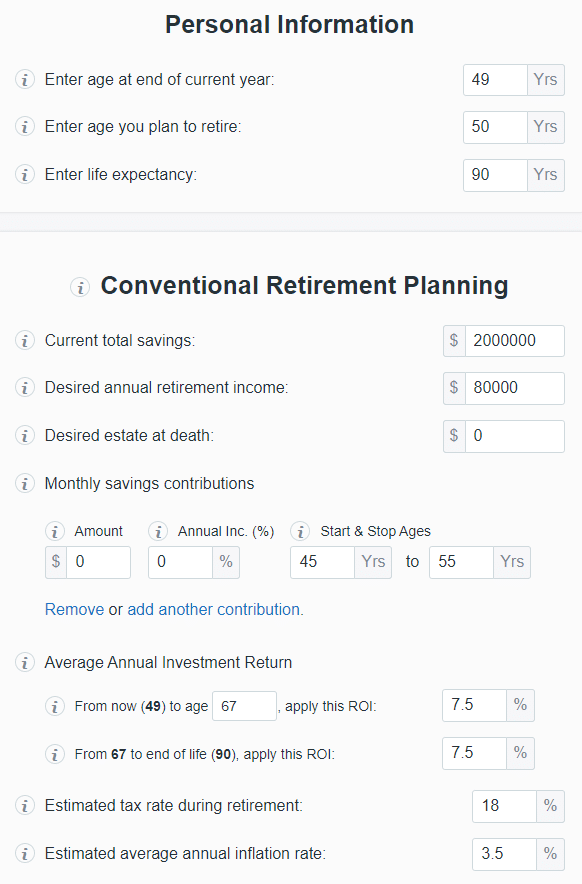

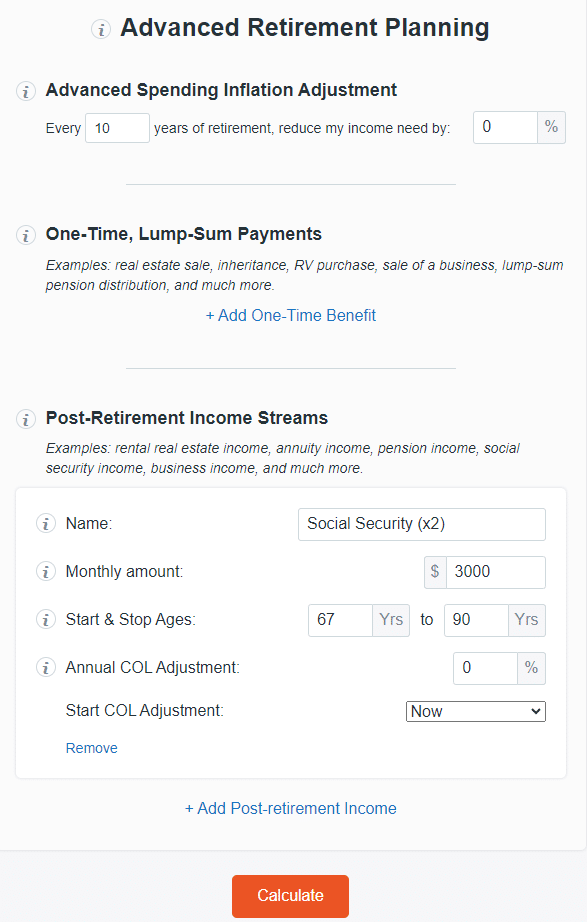

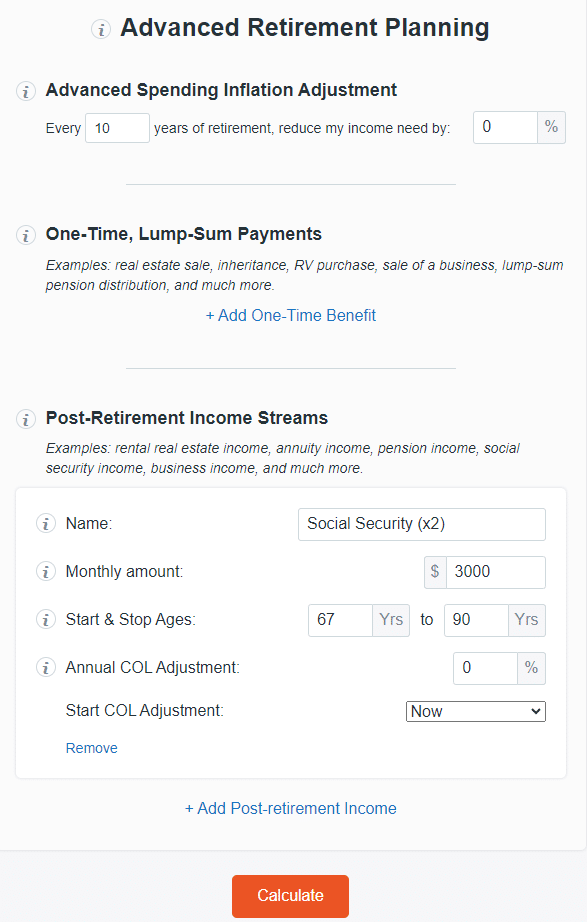

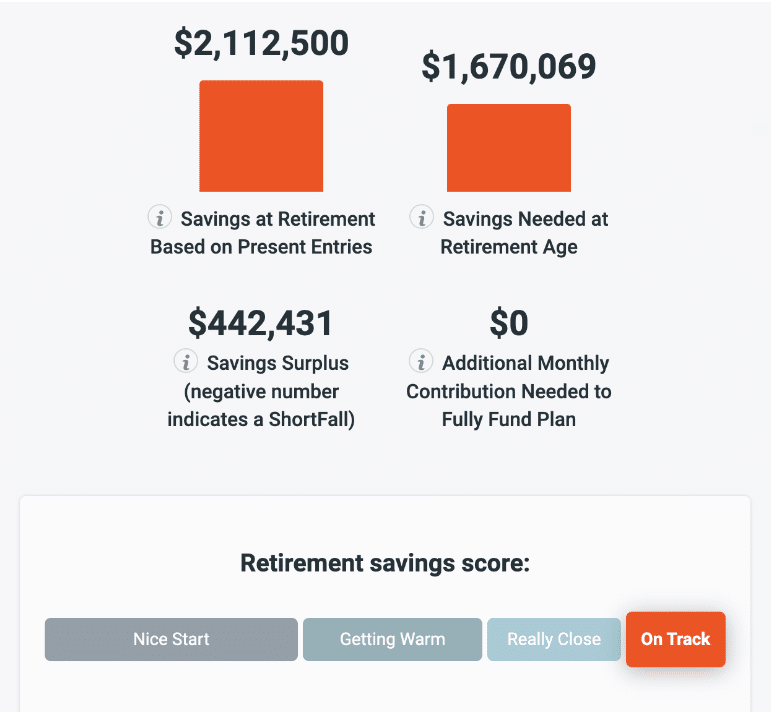

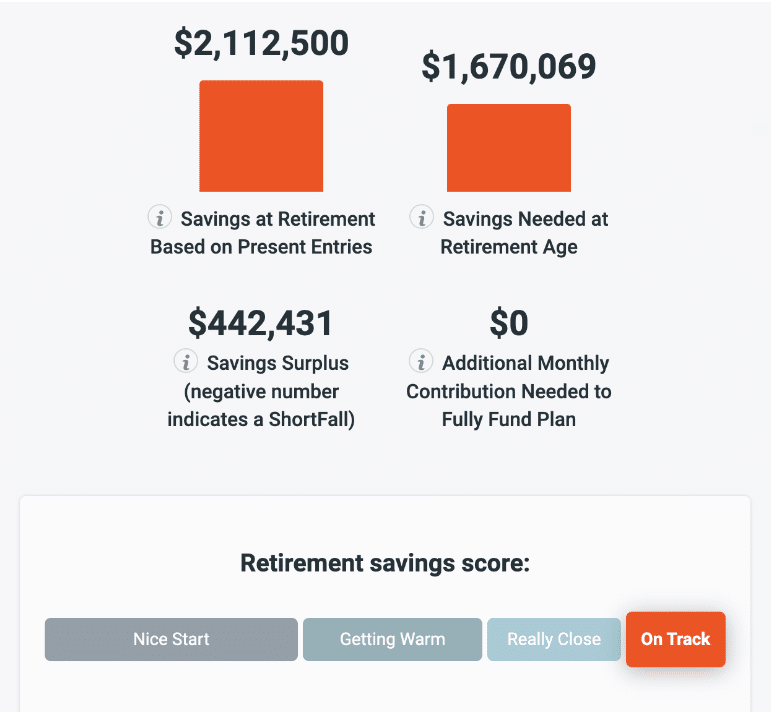

Monetary Mentor

This medium constancy software additionally dealt with a lot of the variables from my easy case. Like cFIREsim, it had the capability to deal with significantly extra modeling complexity than my easy case research introduced. Nevertheless, it additionally didn’t account for taxation of various account sorts. This specific software additionally doesn’t have a immediate to account for funding bills.

The Monetary Mentor calculator runs projections primarily based on a gentle charge of return all through the calculations, leading to a unique feel and look with the outputs. This specific calculator additionally offers tabular output (not proven) with 12 months by 12 months starting and ending balances in addition to the account progress, additions, and spending that lead from one to the opposite.

Medium Constancy Cons

The most important weak spot of this class of calculators is the shortcoming to supply a lot help to the person relating to taxes. The Monetary Mentor software explicitly requires you to estimate a tax-rate which runs by means of your whole situation. It does present a default. Nevertheless it could significantly over or underestimate your tax burden by means of your life cycle.

Taxes are addressed by cFIREsim on this single sentence in a tutorial on the location: “Vital Word: You must finances for some quantity of “taxes” in your spending. cFIREsim doesn’t take note of taxes in any approach.” No additional steering is supplied.

Darrow has written why taxes are one retirement quantity you’ll be able to’t afford to get incorrect. I’ve proven how wildly individuals can misestimate their retirement tax charge and the way a lot it will possibly differ from 12 months to 12 months primarily based in your particular person circumstances. After studying these two posts, you’ll get a way of the significance of this variable and why you need to do higher than guessing at it.

The opposite weak spot widespread to medium constancy instruments is that in holding the inputs easy, it’s not at all times intuitive how one variable will affect others. For instance, you’ll be able to mannequin promoting a house by coming into the proceeds as non-recurring revenue.

However will you then pay hire? If shopping for, will you pay money or get a mortgage? Will you progress to a brand new state with a unique tax code? It’s important to keep in mind to account for these variables and others by yourself with out intuitive prompts.

Medium Constancy Execs

These instruments each supply appreciable will increase in performance, management, and customization of variables, and talent to mannequin extra advanced eventualities in comparison with low constancy calculators. On the similar time, the inputs and outputs are easy sufficient that they don’t seem to be overwhelming. I used to be in a position to enter my inputs and get helpful output from every in about 10 minutes apiece.

These calculators permit for fast if/then situation evaluation of the identical variables that low constancy calculators do. Calculators on this class might also mannequin elements akin to:

- Irregular giant purchases (automobile buy, bucket listing journeys, house remodels, and so on.)

- Irregular revenue (part-time retirement work, promoting an asset, staggered retirement dates for a pair, and so on.)

- Actual property methods (upsizing, downsizing, rental revenue, and so on.)

- Altering asset allocations over time.

Medium constancy instruments supply a big step up in performance and helpful insights which you could’t get from a low constancy software. That performance comes with out the largest disadvantage of excessive constancy calculators….complexity.

Excessive Constancy

Lastly, I ran my case research by means of our affiliated excessive constancy calculators, NewRetirement PlannerPlus and Pralana Gold.

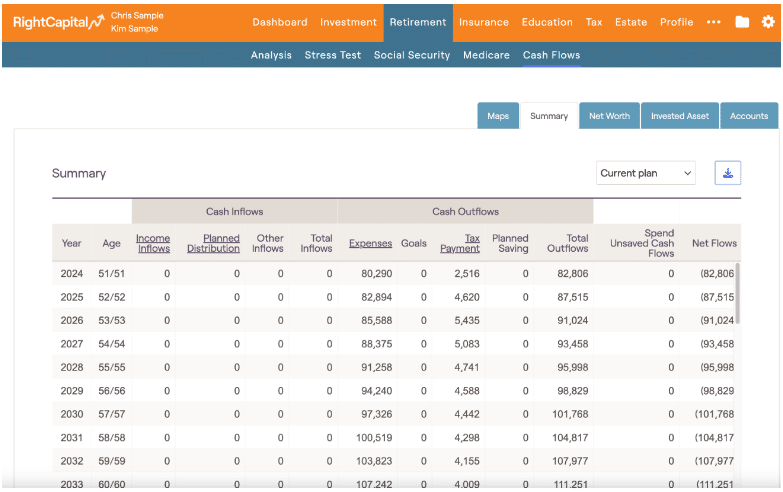

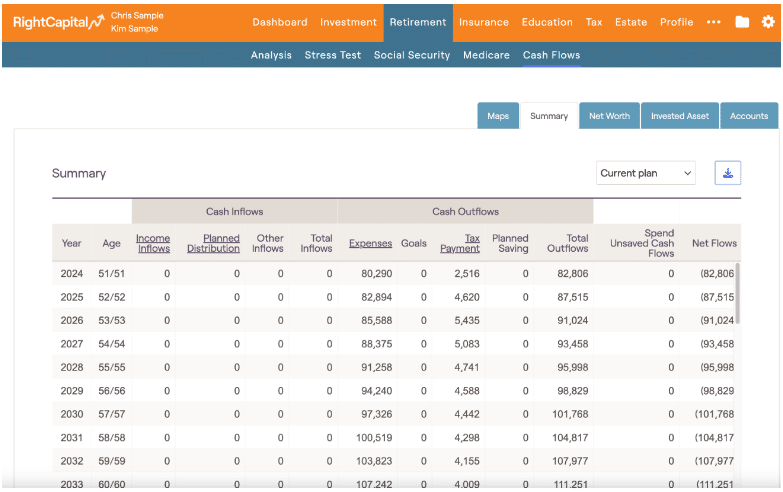

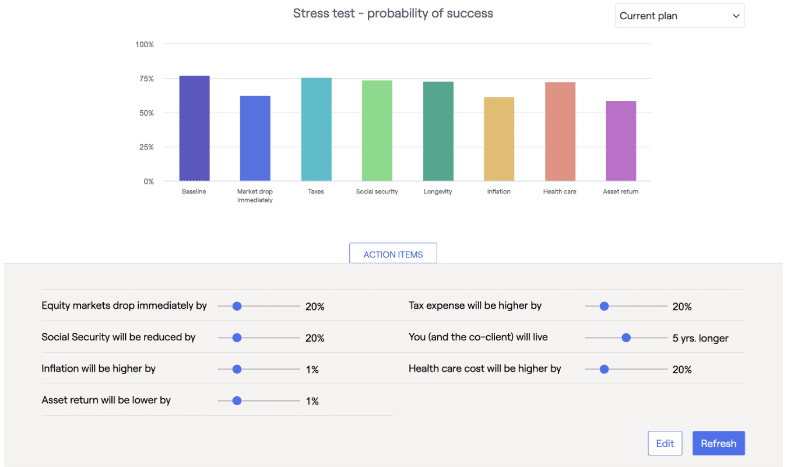

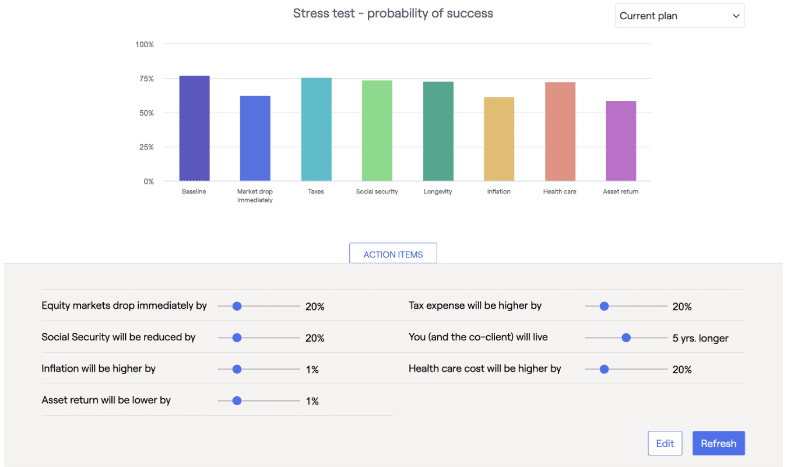

I additionally ran the situation in RightCapital, the skilled planning software program I exploit with monetary planning purchasers.

My hope is which you could get a way of the same performance between these excessive constancy calculators {and professional} software program. Additionally, you will shortly see the calls for on the person when utilizing these excessive constancy calculators in comparison with decrease constancy instruments.

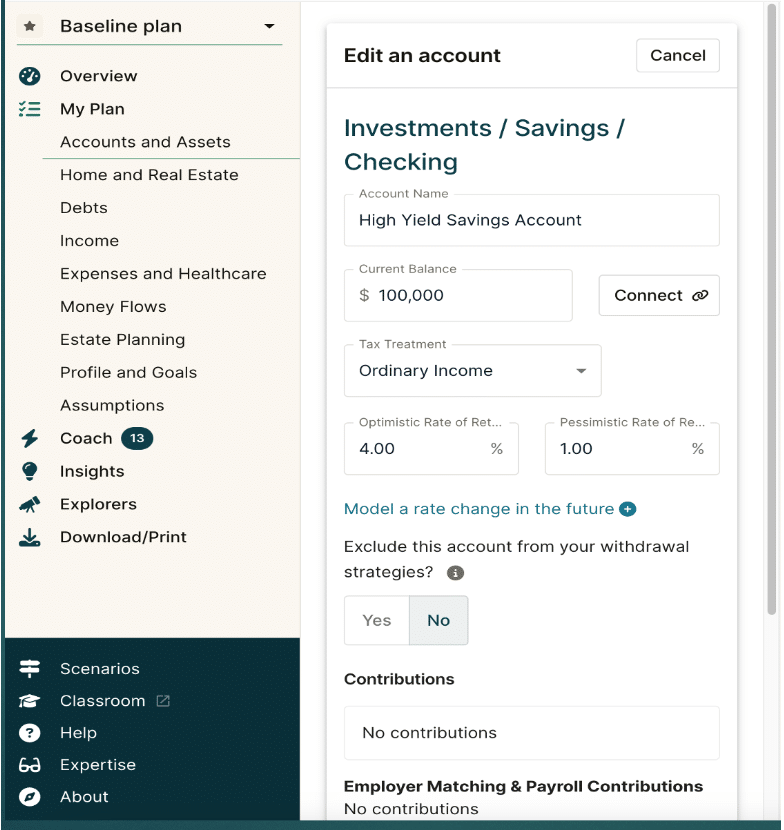

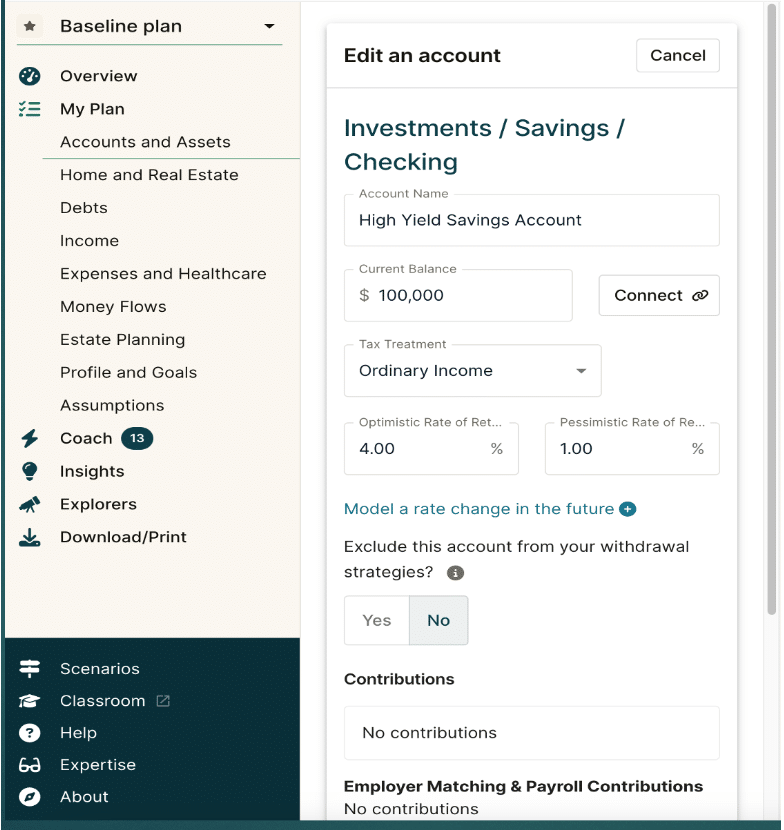

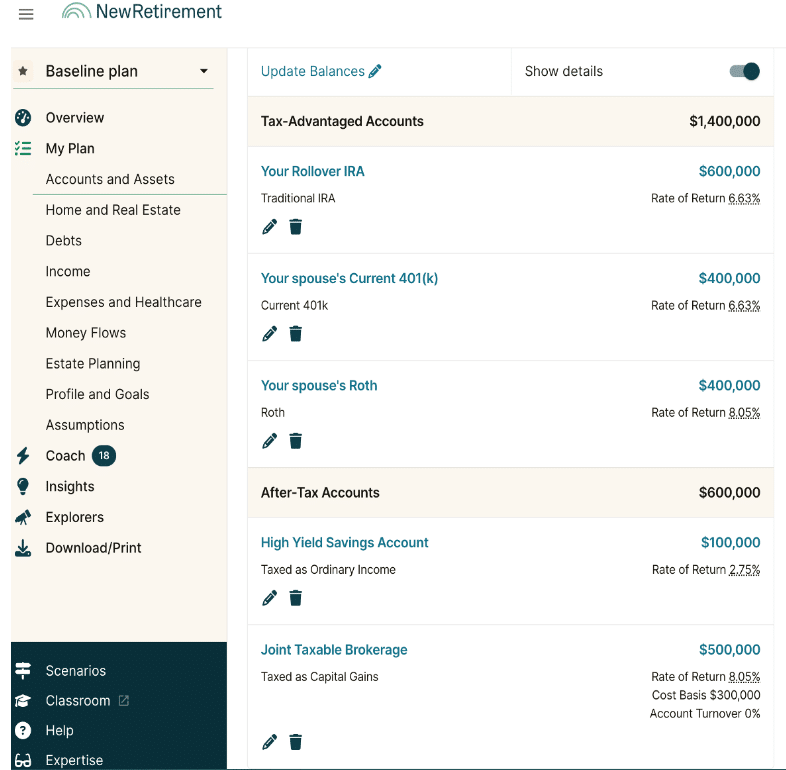

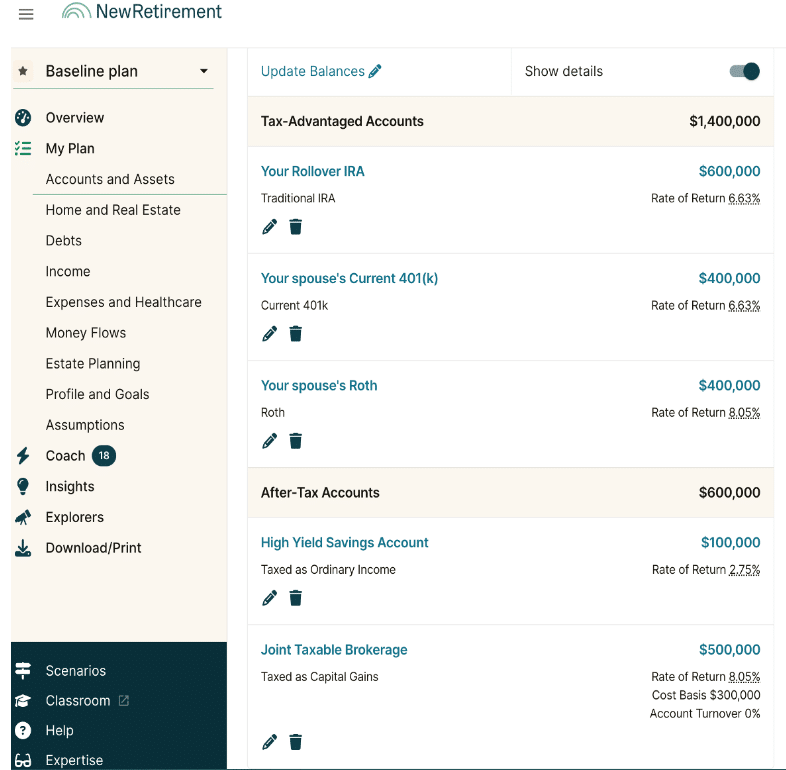

NewRetirement First Inputs

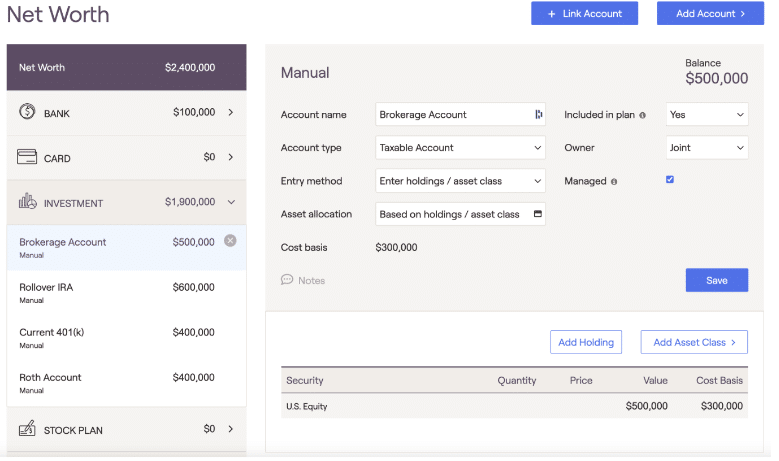

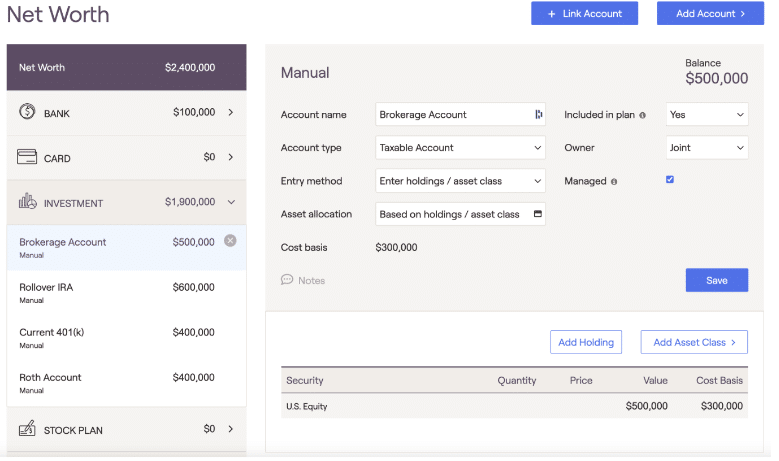

From the phrase go, the distinction between these excessive constancy instruments and decrease constancy calculators is obvious. The primary enter in NewRetirement was to begin including accounts. The straightforward act of coming into my money required figuring out the tax therapy of this holding and coming into optimistic and pessimistic charges of return. It additionally requires understanding whether or not I’m to enter nominal (what you see in your statements) vs. actual (inflation adjusted) returns.

This single, seemingly easy, enter took me longer to enter than operating my situation from begin to end on a low constancy calculator.

I then needed to enter every account individually and estimate each an optimistic and pessimistic charge of return primarily based on the allocation of that individual account in addition to deciding on the suitable tax therapy and price foundation primarily based on the holdings in taxable accounts.

Associated: The Advantages and Drawbacks of Taxable Accounts

Pralana First Inputs

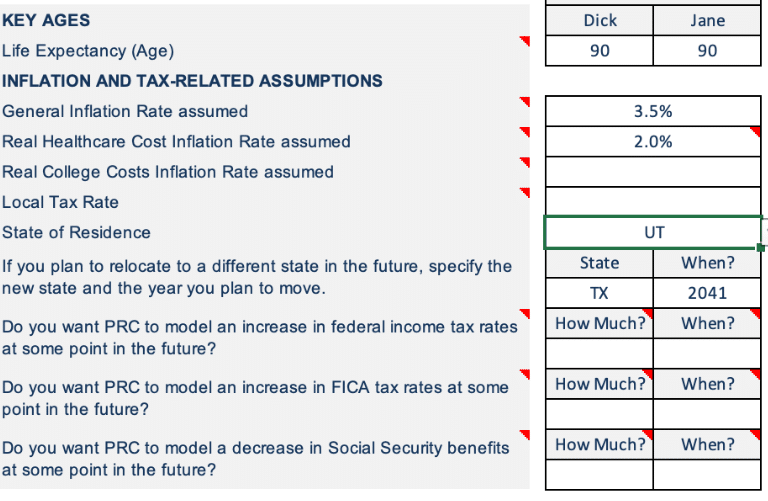

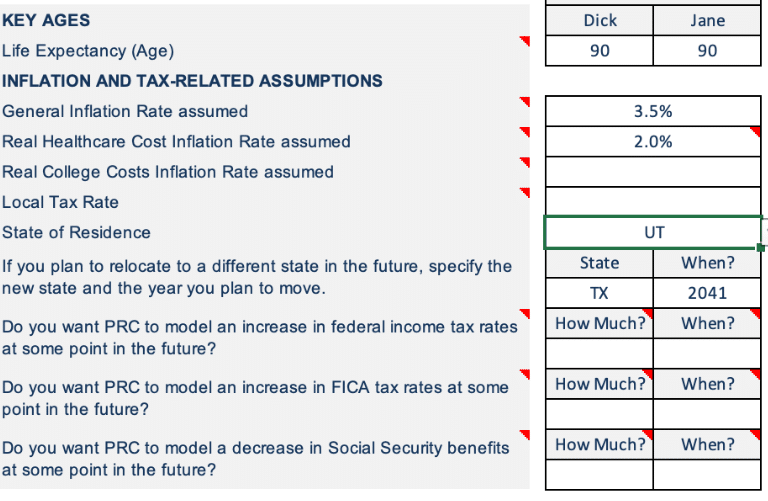

Pralana Gold equally permits detailed inputs. Pralana not solely means that you can create your individual inflation assumption, it will get you serious about totally different charges of inflation (healthcare and schooling) and permits totally different assumptions on for every on the primary enter web page. It not solely means that you can mannequin Social Safety and tax projections, it asks whether or not you need to mannequin modifications in charges and advantages sooner or later.

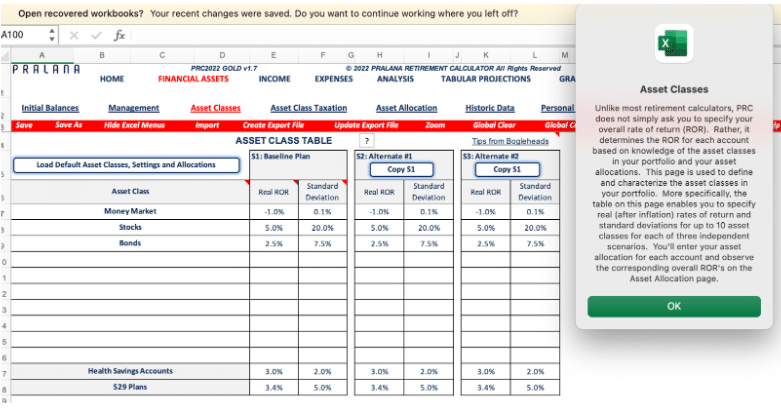

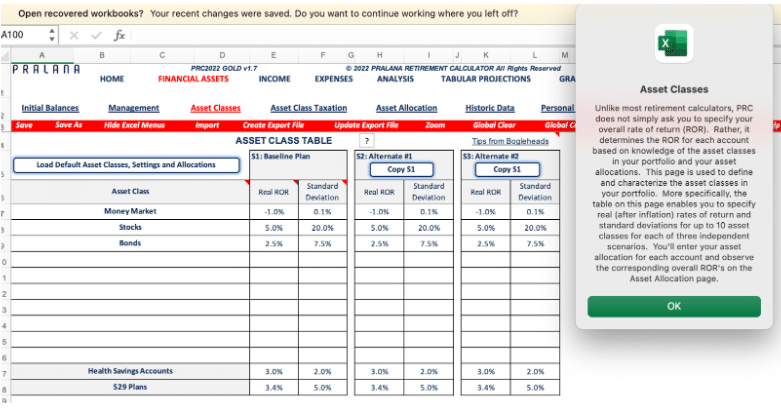

Like NewRetirement, Pralana requires you to decide on the speed of return on totally different asset lessons. On this case, your inputs are in actual (inflation adjusted) phrases.

All of that is clearly defined and sources are provided to help you. Even so, this can be a appreciable demand on a brand new person of the software, and will shortly be overwhelming for somebody simply familiarizing themselves with retirement calculations.

Different Excessive Constancy Inputs

I’ll spotlight a number of different inputs, using NewRetirement PlannerPlus, as a result of the person interface offers for higher screenshots to share. The variety of inputs and outputs obtainable on both software are far too many to go over each one on this weblog publish. I’ll spotlight only a few.

Word: We do have in depth opinions of each Pralana Gold and NewRetirement PlannerPlus on the location.

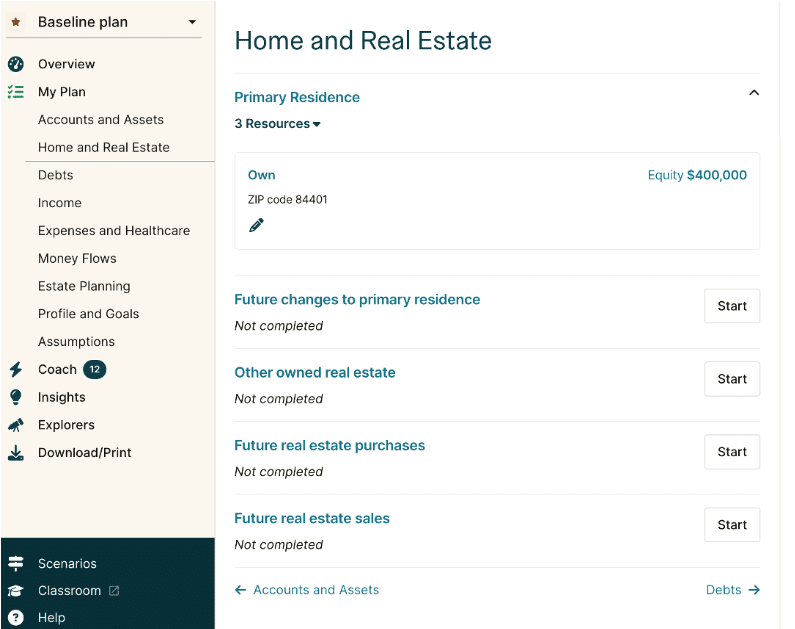

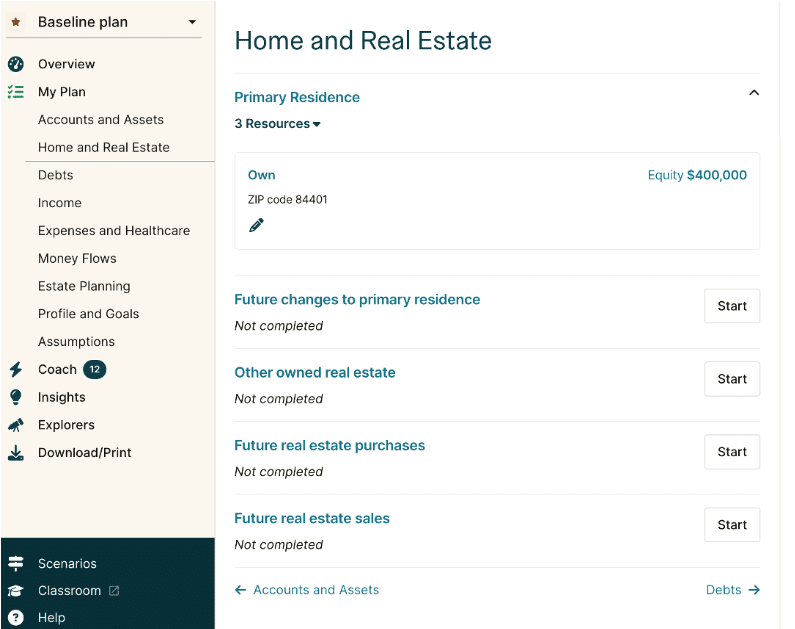

These instruments permit modeling actual property modifications (downsizing, relocating to a unique state, switching from proprietor to renter or vice versa, and so on.) in addition to modeling rental revenue.

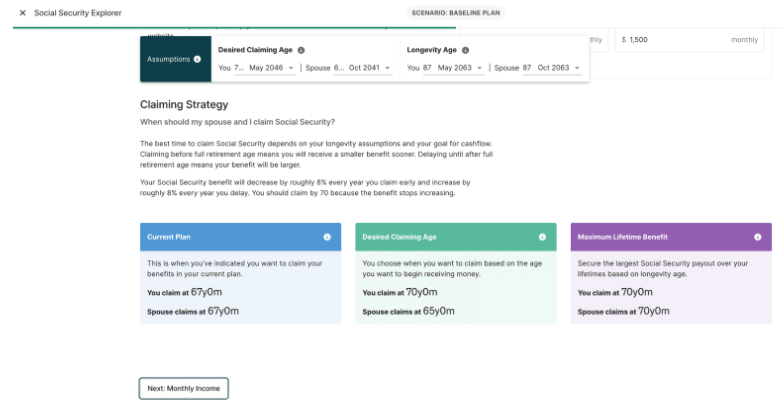

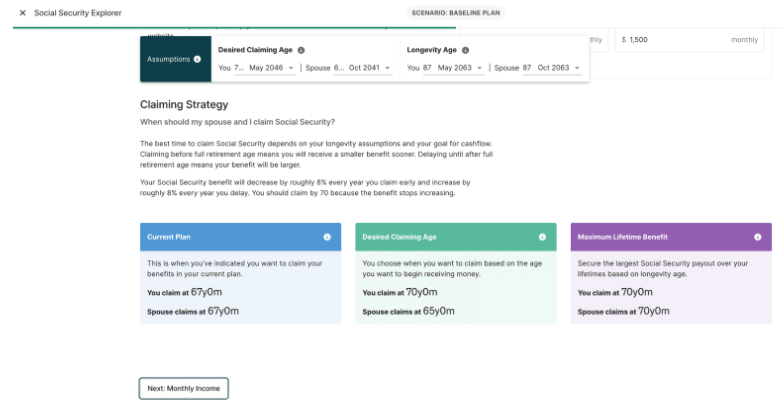

These instruments not solely allow coming into Social Safety values, however allow modeling totally different claiming methods with nice specificity.

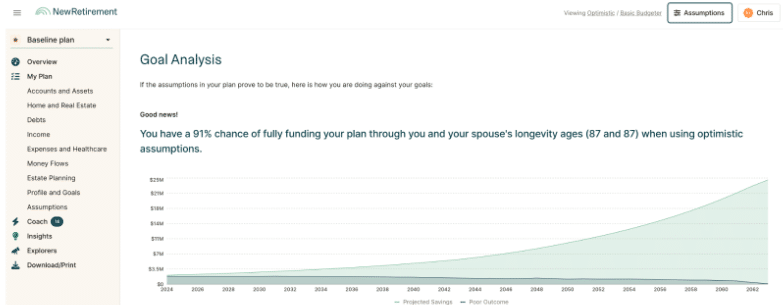

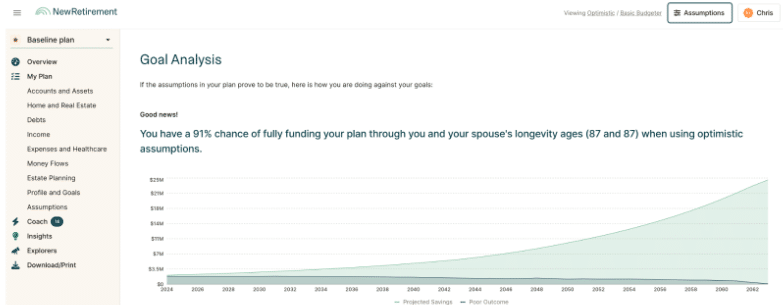

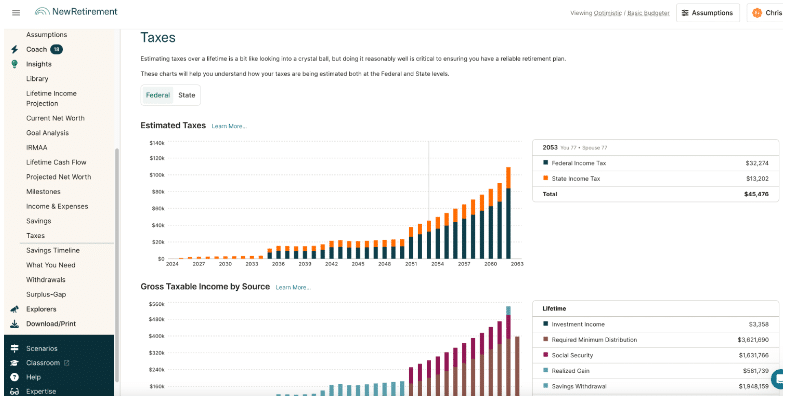

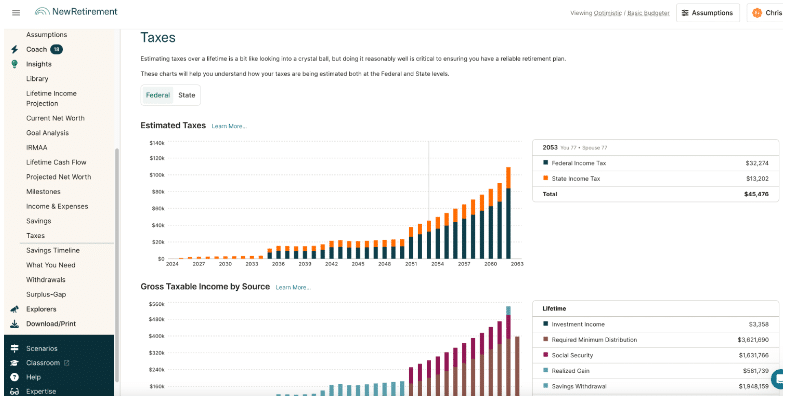

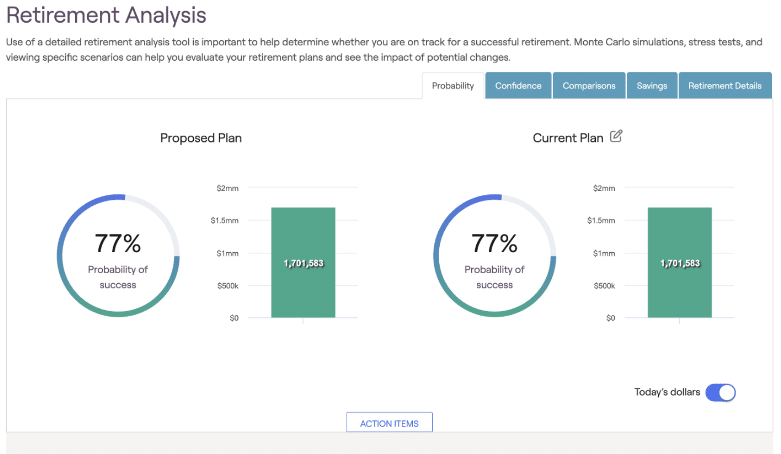

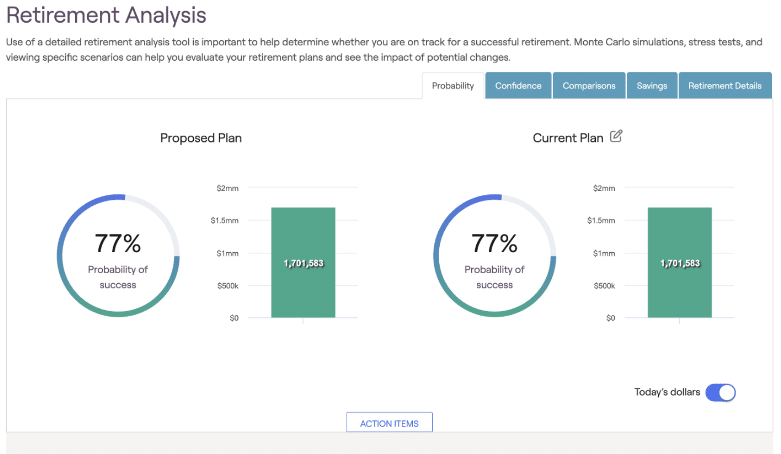

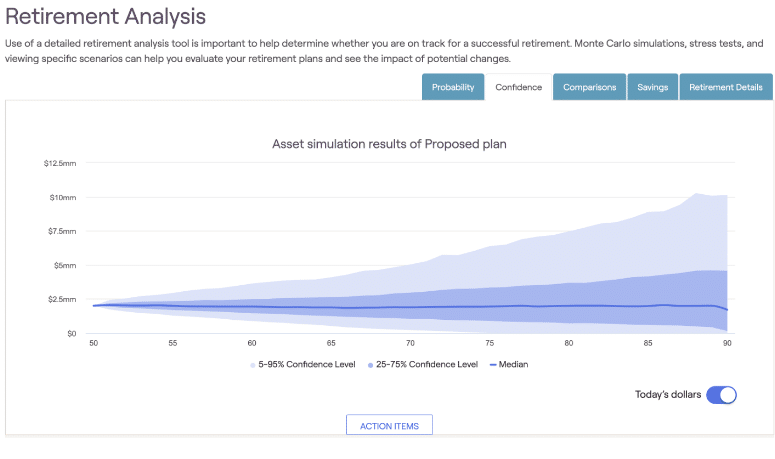

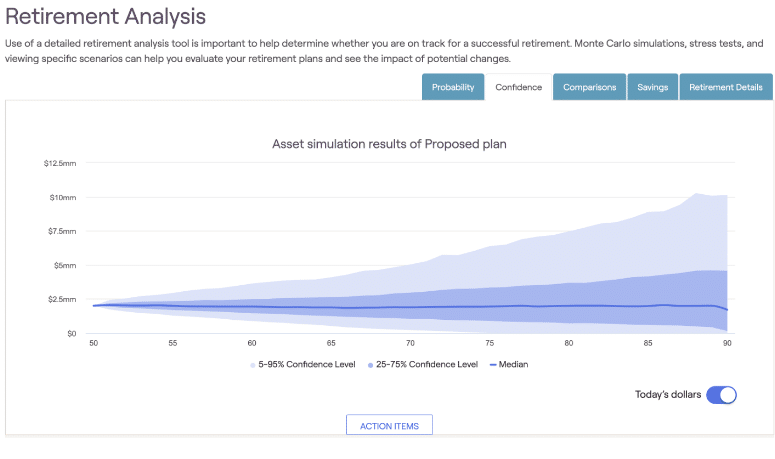

Excessive Constancy Outputs

Very like low and medium constancy instruments, excessive constancy instruments finally will provide you with a chance of retirement success sometimes expressed as a likelihood and median terminal account steadiness.

Nevertheless, the outcomes are rather more sturdy in comparison with low constancy instruments. They embrace detailed tax projections 12 months by 12 months at each the federal and state ranges.

These instruments additionally present insights into actions like selecting one of the best Social Safety claiming technique and exploring the affect of Roth conversions.

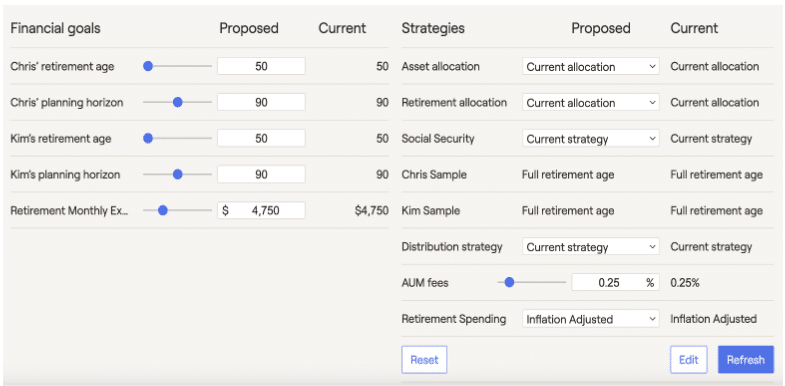

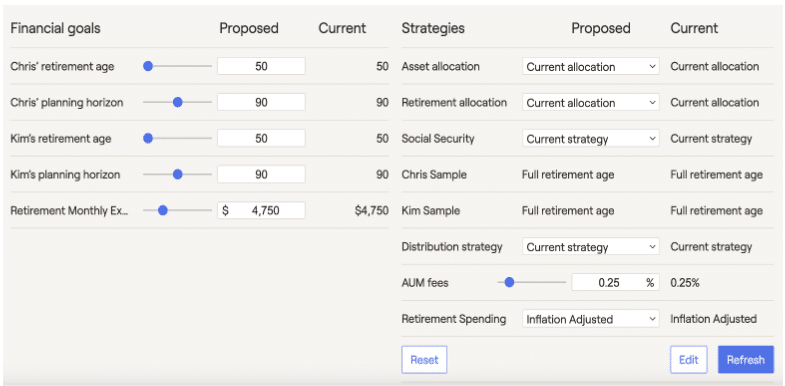

Skilled Software program Inputs and Outputs

Lastly, I’ll share what my case appears to be like like when run by means of skilled software program. The person interface, the best way the information is entered, and the exact approach information is analyzed and introduced in output differs from software to software. Every software has options that you could be like kind of than the opposite.

The take house message I hope to supply is that there is no such thing as a “secret components” that skilled software program has in comparison with excessive constancy client grade retirement calculators. The secret’s studying the software you finally select in and out. This manner, you’ll be able to place an applicable stage of belief within the outcomes so it’s helpful in bettering resolution making.

Excessive Constancy Strengths

A excessive constancy calculator is on par with skilled grade software program on the subject of the eventualities it is ready to mannequin and the standard of the output it offers. To reiterate, every software has barely totally different options, person interface, and so on. which will make you want one higher than the opposite. As a category, these are highly effective instruments able to detailed modeling. They might help you make extra knowledgeable information pushed selections.

Excessive Constancy Weaknesses

This isn’t to say that these instruments are with out weaknesses. They shouldn’t be neglected.

The primary is that these instruments could be difficult to navigate, even for many who have a agency grasp on the fundamentals of compounding, funding returns, inflation, their present spending, and so on. Somebody beginning out might shortly be overwhelmed and throw their arms up if beginning with excessive constancy calculators earlier than mastering fundamentals.

Second, not like low constancy calculators, excessive constancy instruments require some funding. The monetary price is minimal, round $100. The time funding is important.

Count on to spend not less than an hour getting a really feel for the software and coming into sufficient information to get any significant output. The very best use of those instruments is an iterative course of the place you achieve mastery of the software program and your individual state of affairs over time.

Third, each calculator is making assumptions. Some are made by the software. Others are left as much as the person. It’s good to have the ability to select the way you need to mannequin future funding returns, inflation charges, and modifications to legal guidelines and social packages you assume will materialize. However do you acknowledge your biases and the challenges of predicting the long run?

A crude easy software received’t doubtless encourage nice confidence. Having a excessive constancy software that’s so highly effective and detailed can result in overconfidence in your outcomes. Even one of the best software with a educated person can’t predict the long run.

The important thing variables that decide the result to retirement calculations are lifespan, bills (together with taxes and well being care prices), funding returns, and inflation. All are unknowable. Humility is required.

Selecting the Proper Calculator

There isn’t a single “greatest” retirement calculator for everybody. Every provides totally different options and has its personal strengths and weaknesses. Calculator constancy is a superb first filter to discovering the precise software to fulfill your wants.

Calling each low constancy and excessive constancy instruments “retirement calculators” is akin to calling steak knives and chainsaws “reducing units.” On the most elementary stage, that is true. In observe, they’re vastly totally different instruments. Select properly.

* * *

Precious Assets

- The Finest Retirement Calculators might help you carry out detailed retirement simulations together with modeling withdrawal methods, federal and state revenue taxes, healthcare bills, and extra. Can I Retire But? companions with two of one of the best.

- Free Journey or Money Again with bank card rewards and enroll bonuses.

- Monitor Your Funding Portfolio

- Join a free Empower account to realize entry to trace your asset allocation, funding efficiency, particular person account balances, web value, money circulation, and funding bills.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire But? has partnered with CardRatings for our protection of bank card merchandise. Can I Retire But? and CardRatings might obtain a fee from card issuers. Some or the entire card provides that seem on the web site are from advertisers. Compensation might affect on how and the place card merchandise seem on the location. The positioning doesn’t embrace all card corporations or all obtainable card provides. Different hyperlinks on this web site, just like the Amazon, NewRetirement, Pralana, and Private Capital hyperlinks are additionally affiliate hyperlinks. As an affiliate we earn from qualifying purchases. Should you click on on one in all these hyperlinks and purchase from the affiliated firm, then we obtain some compensation. The revenue helps to maintain this weblog going. Affiliate hyperlinks don’t improve your price, and we solely use them for services or products that we’re conversant in and that we really feel might ship worth to you. In contrast, we’ve got restricted management over a lot of the show adverts on this web site. Although we do try to dam objectionable content material. Purchaser beware.