For those who’ve been studying Can I Retire But? so long as I’ve, you already know there’s been no scarcity of protection on retirement calculators.

Whereas doing analysis for this submit, I dug up 22 such articles printed on the location since 2012. Amongst them, no fewer than 82 distinct retirement calculators are talked about. Of those, 20 have been vetted and reviewed completely by Chris and Darrow (one among them was birthed by none aside from Darrow himself!).

In at this time’s submit, I’ll evaluation NewRetirement’s PlannerPlus retirement calculator. I’ll examine its options to these of Constancy’s Investments’ Retirement Evaluation software (don’t fear for those who don’t have an account at Constancy–I exploit it right here solely as a foundation for comparability).

To remain true to the rigor Chris and Darrow have dropped at this matter prior to now, I’ll take a deep dive into each instruments, striving to match parameters and assumptions in such a approach as to yield an apples-to-apples comparability.

Backstory

I first realized about NewRetirement in a evaluation Chris printed proper right here again in November 2020. Intrigued by his favorable protection, and studying that NewRetirement supplied a free tier–what they name merely the Primary version–I made a decision to offer it a attempt.

Constancy’s on-line Retirement Evaluation software had been my go-to retirement calculator as much as that time. I used to be fairly happy with its options, and had no intention of buying and selling it in for one more. All the identical, the prospect of making an attempt out a brand new calculator, and evaluating its outcomes to Constancy, appeared like a great way to cross-check my assumptions.

I used to be sufficiently impressed with NewRetirement’s Primary version to drag the set off on PlannerPlus, a paid improve requiring a subscription. The associated fee was $72/yr, billed yearly, and it got here with a no-nonsense cancellation coverage (frugal client that I’m, buying one more subscription was no small feat).

I used PlannerPlus fairly extensively that first yr. However because the renewal date approached, I made a decision to cancel my subscription. Why pay for a service I used to be getting elsewhere without spending a dime?

True to their phrase, NewRetirement canceled my subscription with nary a fuss, kindly requesting solely that I inform them why. Here’s what I wrote:

Thanks in your quick response, and above all for the hassle-free cancellation…the underside line is that my retirement accounts are with Constancy, who provide an excellent retirement calculator freed from cost. It doesn’t make sense for me to pay for duplication…

NewRetirement Redux

Three years on, I’ve simply taken the newest iteration of PlannerPlus for a check drive. To say it has come a good distance since my first expertise could be an understatement.

I’m tremendous impressed with its options and capabilities, and might now say unequivocally that it’s superior to Constancy’s Retirement Evaluation software. I clarify why within the paragraphs that observe.

Primary Version

Preliminary Setup

NewRetirement is centered round a wizard-style person interface that makes coming into your info a breeze. It ought to take you not more than 5 or 10 minutes to finish the preliminary setup.

The onerous half shall be gathering your private info; stuff you may not know off the highest of your head, like account balances, bills and anticipated social safety advantages.

You’ll begin along with your account balances. The software options an choice to hook up with your exterior accounts, thereby maintaining the quantities within the software synchronized with these accounts (I desire to enter this info manually).

You’ll additionally must enter an estimate of your month-to-month bills. For those who haven’t a clue what you spend, you can begin with a tough guess. Then come again later to replace it when you could have a extra correct quantity.

You’ll even be requested to produce the social safety profit you count on to obtain at your full retirement age (for those who don’t know this quantity, it’s in all probability excessive time you discover out). For those who’re gathering social safety already, this half needs to be simple.

For the needs of this evaluation, I arrange a hypothetical portfolio consisting of liquid belongings totaling $1.5M, unfold over quite a lot of taxable and tax-advantaged accounts. I additionally embrace a $500K dwelling fairness part to spherical out the web price at $2M. Lastly, I plugged in my very own bills and social safety estimates.

Plan Wellness

By the point you full your first tour of the wizard, you’ll have a reasonably good image of your monetary outlook.

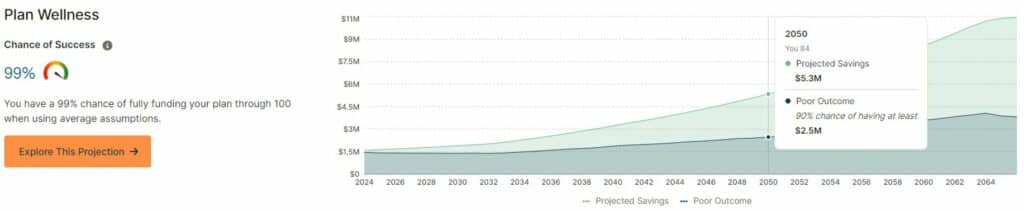

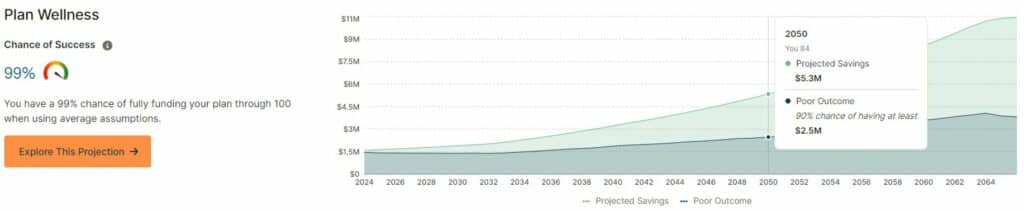

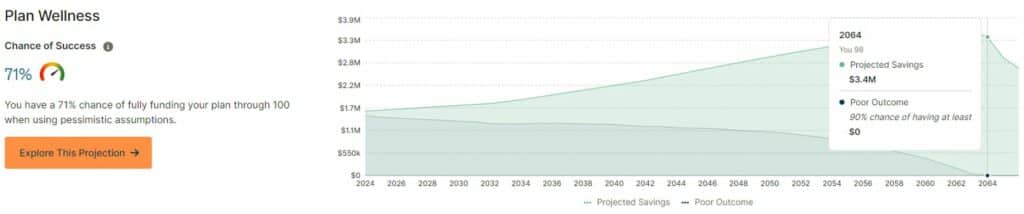

The Plan Wellness chart types the centerpiece of your individualized plan. Primarily based in your inputs, it forecasts your financial savings every year over the course of your anticipated lifetime. It additionally forecasts your total probability of success, the place success is outlined as not outliving your financial savings.

NewRetirement makes use of Monte Carlo evaluation, randomly various asset returns and inflation over many a whole lot of hypothetical trials, to mission doubtless outcomes within the Plan Wellness chart.

The highest, mild inexperienced line is an easy, linear projection of your lifetime financial savings based mostly in your market return and inflation assumptions: optimistic, pessimistic or common.

The decrease, darkish inexperienced line represents the ninetieth percentile of Monte Carlo trials based mostly in your return and inflation assumptions. Because of this 90% of the trials projected outcomes that got here in at or above this line. Conversely, 10% of the trials projected outcomes under this line.

Word that figures right here and all through the software are expressed in future, or inflation-adjusted, {dollars}.

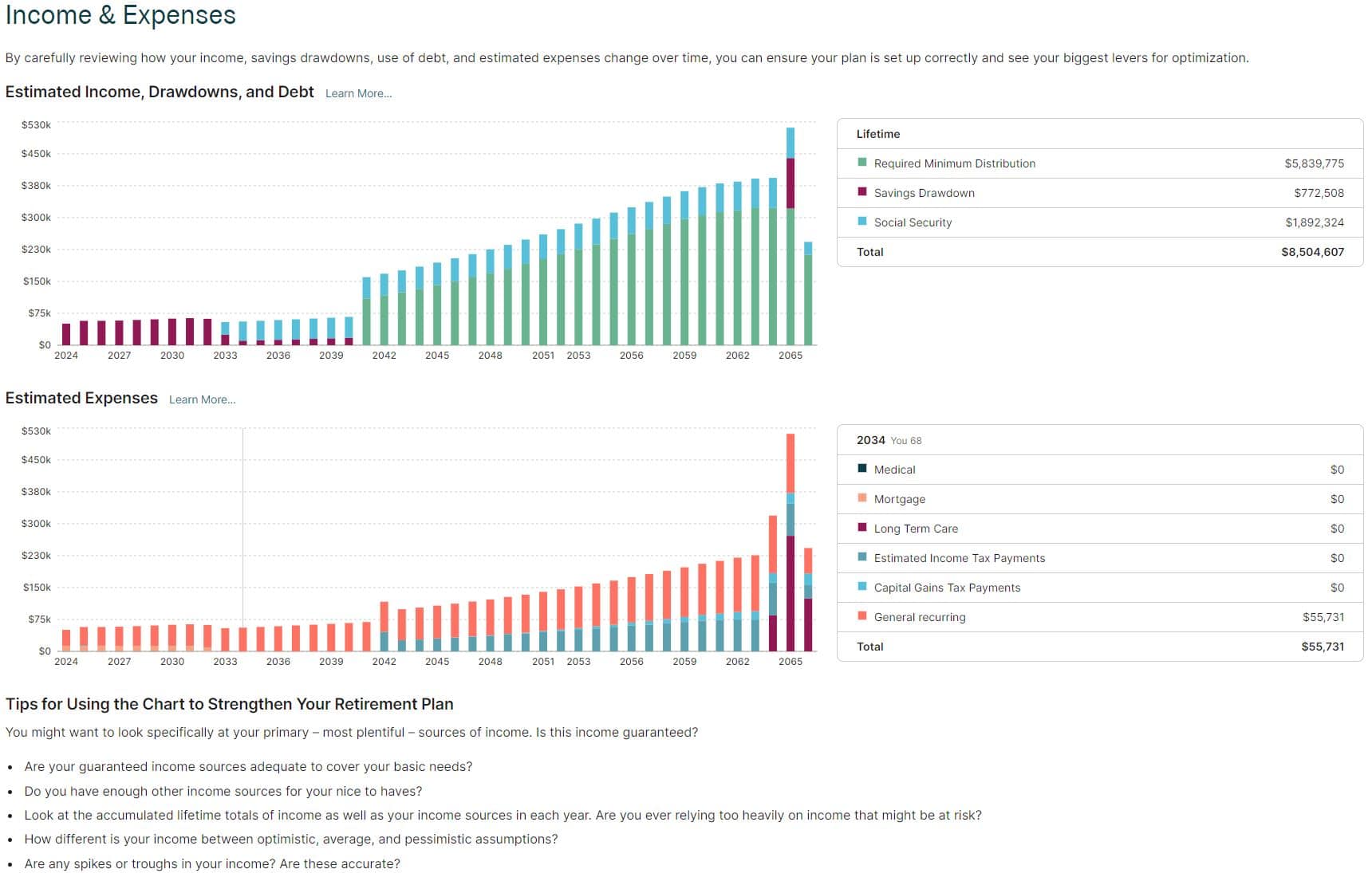

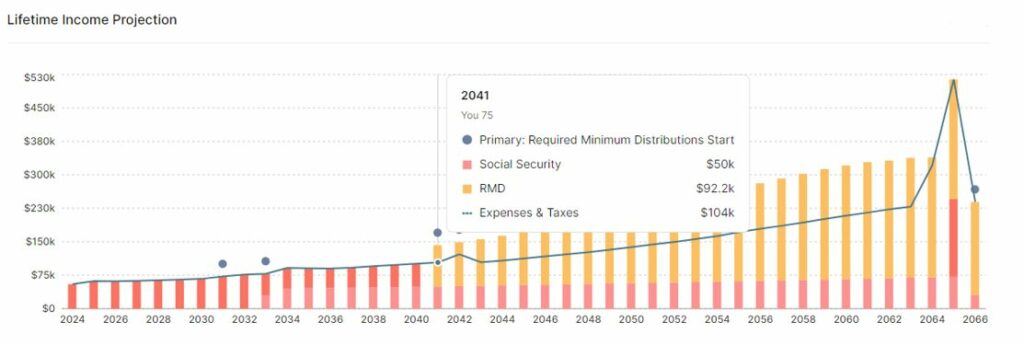

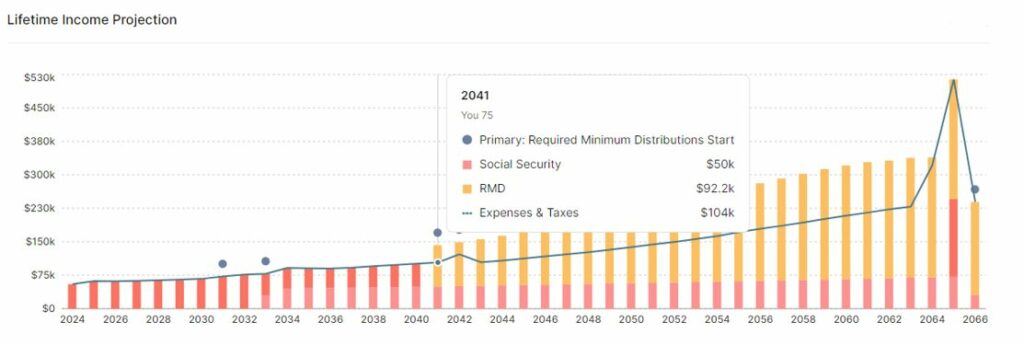

NewRetirement options dozens of insightful charts. Lots of them, just like the Lifetime Earnings Projection chart above, keep seen always on the right-hand aspect of your display, and replace in real-time to replicate any change you make to your plan.

One among my favourite options is the Plan Up to date popup, which seems any time I modify an enter or assumption. This provides me prompt suggestions on the impression of that change to my plan.

The popup above displays a change in technique for extra earnings over the course of my lifetime. Right here it exhibits me the impression of redirecting that earnings from a non-interest-bearing checking account to a brokerage account, through which the cash could be invested within the markets.

Opinionated Defaults

NewRetirement Primary comes out of the field with default, opinionated assumptions. These are for unknowns such because the magnitude and variability of market returns, inflation, social safety value of dwelling changes, tax charges, and so on.

That the assumptions are opinionated is just not a foul factor. Quite the opposite, NewRetirment’s assumptions are well-informed. However with out default assumptions, NewRetirement wouldn’t have the ability to ship the easy-to-use, streamlined person expertise that it does.

Market Returns

NewRetirement’s assumptions are conservative. For instance, it forecasts market returns starting from 2% to five% for its pessimistic and optimistic extremes, respectively. It features a center return that’s an arithmetic common of the 2.

You provide the software with a set of identified portions–your age, earnings, account balances, bills and the like–and it spits out a believable forecast of your monetary future knowledgeable by these assumptions.

NewRetirement Primary is, by design, simple to make use of. It doesn’t overwhelm you with a baffling array of knobs and dials, every of whose features you should decipher and fine-tune manually.

PlannerPlus

For those who’re like me, nonetheless, you want to show knobs and dials. You wish to check out your individual assumptions; to ask what-if inquiries to see how effectively your nest egg would possibly face up to totally different eventualities.

NewRetirement satisfies the wants of the timid and adventurous alike. If you’re within the former camp, the Primary version ought to greater than match the invoice. However if you’re within the latter, PlannerPlus provides you full management over the knobs and dials.

Portfolio Return Assumptions

Armed with the superior characteristic set of PlannerPlus, the very first thing I modified was the return assumptions on my hypothetical accounts. The default extremes–2% and 5%–are too conservative, for my part, notably for my growth-oriented portfolio allocations.

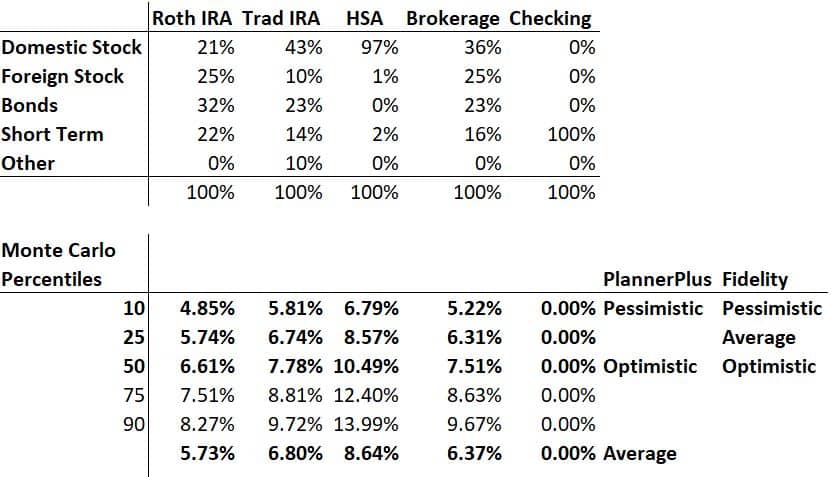

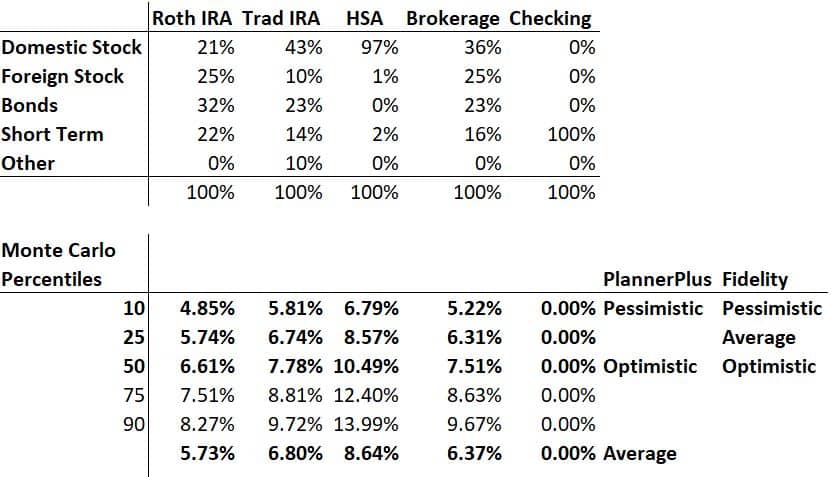

To reach at extra life like extremes, I ran a Monte Carlo evaluation on every of my accounts utilizing an impressive (and free!) on-line software referred to as PortfolioVisualizer.

Here’s a desk that summarizes the outcomes of that evaluation.

The Monte Carlo percentiles symbolize returns over a 40-year time interval, which maps fairly carefully to how for much longer I count on to dwell (God keen).

I used the tenth percentile of outcomes for my pessimistic portfolio return assumptions, and the fiftieth percentile for my optimistic return assumptions. PlannerPlus takes the center of those extremes to provide a 3rd, common forecast.

Digging Deeper

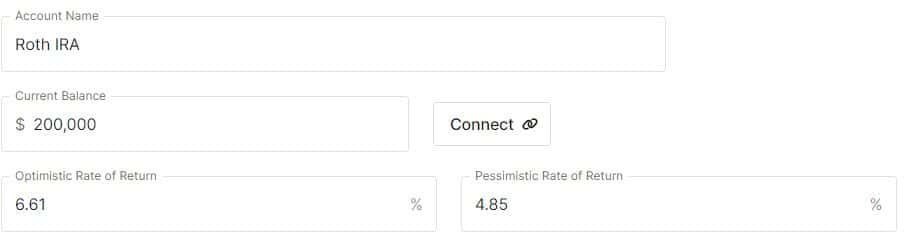

To know the values within the desk above, let’s zero in on simply the Roth IRA. Plugging within the allocation percentages for every asset class, PortfolioVisualizer ran 10,000 hypothetical trials, randomly various annual returns in every trial based mostly on the historic imply and volatility of the asset class.

The tenth percentile (pessimistic) represents the ten% of the ten,000 trials for which the return was 4.85% or decrease. The fiftieth percentile (optimistic) represents the 50% of trials for which the return was 6.61% or decrease.

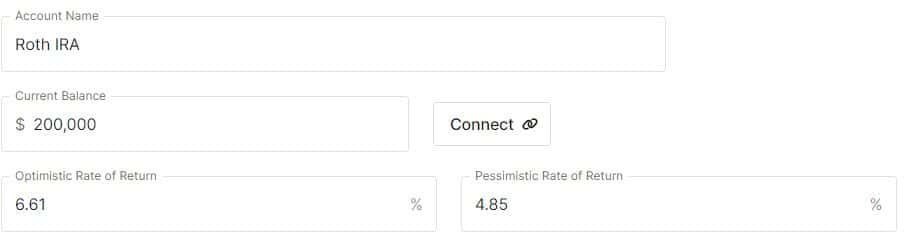

I entered these values into the information entry display for my Roth IRA in PlannerPlus.

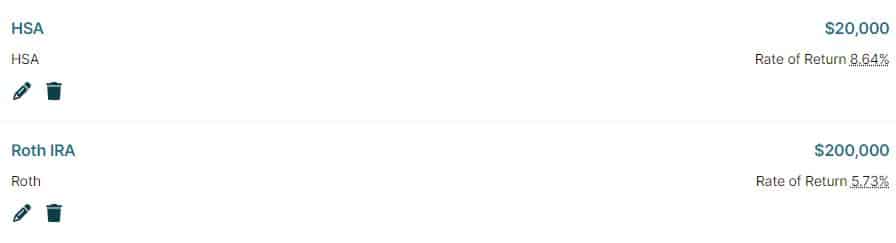

Word the speed of return on my Roth IRA within the graphic under–it’s 5.73%. That is the arithmetic common of the optimistic and pessimistic assumptions I entered above.

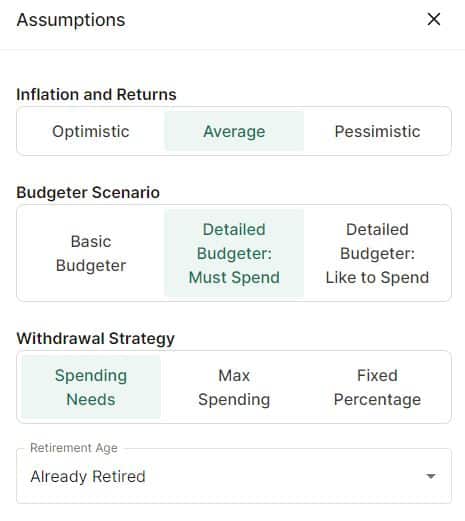

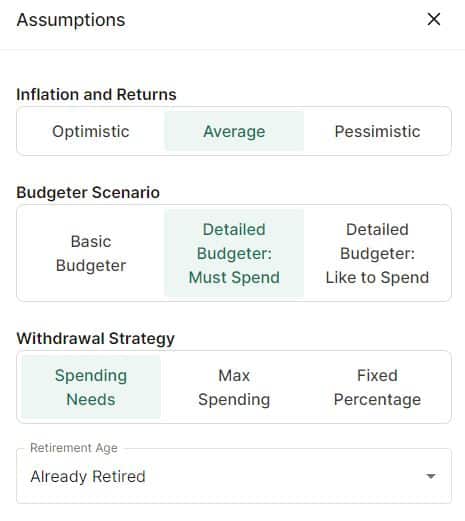

This fee of return displays my present choice for Inflation and Returns within the Assumptions management panel of PlannerPlus.

Now, with the press of a single button, I can view the impression to my monetary forecast of making use of optimistic, common or pessimistic market return assumptions.

Constancy’s Return Assumptions

How does Constancy’s Retirement Evaluation software deal with anticipated portfolio returns? I’m not solely positive. The closest I might come to answering that query got here from perusing documentation it publishes right here and right here. Neither doc solutions the query straight.

I think Constancy’s methodology is much like NewRetirement’s, or is a minimum of based mostly on sound assumptions. However I can’t ensure.

Regardless, I need a software to offer me the choice to produce my very own assumptions. NewRetirement’s PlannerPlus provides me that freedom, whereas Constancy’s Retirement Evaluation software doesn’t.

Expense Estimates

PlannerPlus handles bills like every other parameter. There’s the short and soiled Primary Budgeter that has you enter a single month-to-month quantity. Then there’s the extra nuanced Detailed Budgeter that means that you can itemize your bills. The latter extra carefully resembles the best way I exploit Constancy’s expense budgeter.

Constancy’s Retirement Evaluation software means that you can break down bills by class, and to separate every class into both important or discretionary expense buckets.

PlannerPlus permits you to break up particular person expense classes into must-spend and like-to-spend elements. This provides you finer-grained management over what falls into the important and discretionary buckets.

PlannerPlus goes a step additional. It provides you a one-click toggle between your must-spend and like-to-spend budgets, so you’ll be able to see at a look the distinction in impression belt-tightening (or loosening) will make to your monetary forecast.

If nothing else, utilizing the Detailed Budgeter forces you to take an in depth have a look at your bills, which in and of itself is a helpful train. Why? As a result of how a lot you spend in retirement is probably crucial–and underrated!–piece of the retirement puzzle.

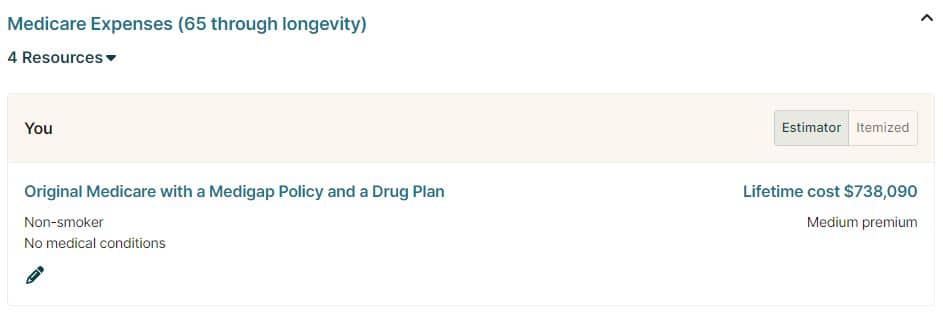

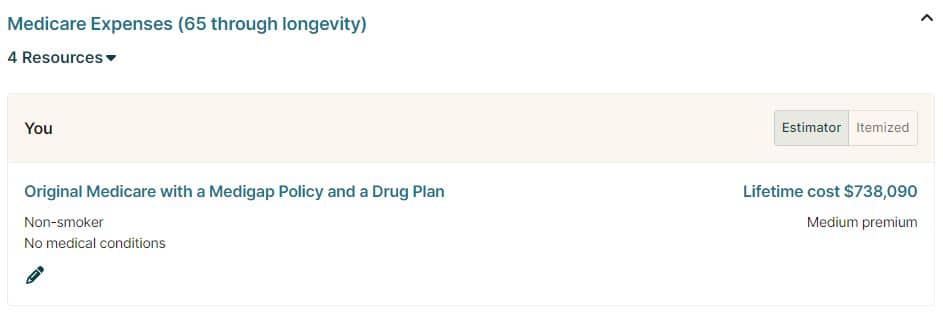

Well being Care Prices

PlannerPlus contains Medicare bills in its default assumptions, and estimates my value to be $738K over the course of my lifetime. This quantity modifications relying on the premium degree and protection kind I select–components A and B solely, Medigap, drug plan, and so on.

Constancy’s Retirement Evaluation software makes no such assumption, and merely asks me to account for Medicare prices in my detailed expense estimates–regrettably, by calculating and coming into these estimates manually.

To stability the comparability, I eliminated the Medicare estimate from PlannerPlus. Certain, I might have amortized PlannerPlus’ $738K over 35 years within the Constancy calculator, however this could have been time consuming and error susceptible.

I point out this as a result of the hypothetical forecasts offered on this evaluation omit lifetime Medicare prices, and subsequently skew extra optimistic than if I had left them in.

Within the subsequent part, I’ll present you the impact on my PlannerPlus forecast of including Medicare prices again in.

Evaluating the Outcomes

To the extent that I might, I duplicated my Constancy inputs and assumptions in PlannerPlus. How do the outcomes differ? Let’s begin with my PlannerPlus forecasts.

PlannerPlus Outcomes

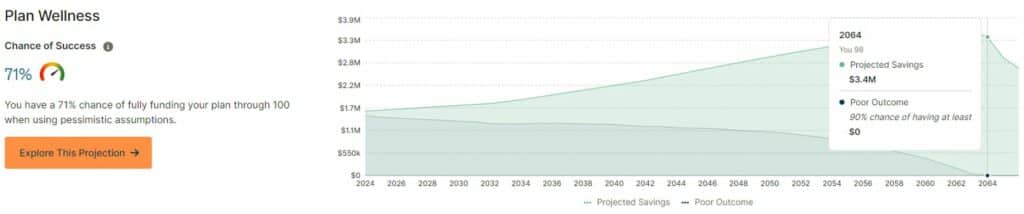

On the optimistic aspect of the ledger, PlannerPlus provides me a 99% probability of funding my retirement via age 100. So too within the common case. However on the pessimistic aspect of the ledger, it provides me only a 71% probability of not outliving my financial savings.

Even within the pessimistic case, PlannerPlus says I’ve only a 10% probability of working out of cash by the point I attain 98. To the extent that I belief the assumptions behind the forecast, I feel I can sleep at night time with these odds.

Medicare Add-Again

What occurs if I add again Medicare prices (recall that I eliminated these to remain degree with the Constancy comparability)? I’m nonetheless sitting fairly, with 99% and 98% probabilities of success within the optimistic and common circumstances, respectively.

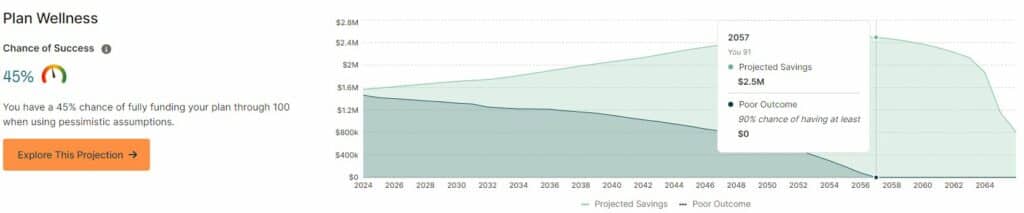

However the pessimistic case appears significantly worse.

PlannerPlus provides me only a 45% probability of success, in contrast with the 71% if I omit Medicare prices. This will likely appear dire, however I nonetheless have only a 10% probability of working out of cash by the point I’m 91, and practically even odds of constructing it to 100 given fairly pessimistic market return and inflation assumptions. I nonetheless assume I can sleep at night time with these numbers.

Constancy Retirement Evaluation Outcomes

Constancy’s software doesn’t present single, chance-of-success chances for every of its optimistic, common and pessimistic forecasts (in the event that they do, I couldn’t discover them). So on that dimension it’s inconceivable to make a direct comparability to PlannerPlus.

In Constancy’s pessimistic forecast–what they name considerably under common market situations–the worth of my portfolio shall be a minimum of $6.5M once I attain 100, and that’s on the 90% confidence interval. Because of this in 90% of Constancy’s Monte Carlo simulations, the terminal worth of my portfolio was $6.5M or better (in future {dollars}).

PlannerPlus, however, places me at breakeven (or higher) once I’m 98 on the identical confidence interval.

Takeaways

Why the large discrepancy in terminal financial savings projections? Maybe I’m misunderstanding some elementary side of 1 or the opposite, or each, instruments. Or perhaps it’s a tiny distinction buried within the weeds someplace, that when compounded over a interval of 40 years provides as much as an enormous discrepancy. Possibly it’s a flaw within the methodology in a single or the opposite software.

It’s doubtless due a minimum of partially to a distinction in market return assumptions. However Constancy doesn’t disclose its return assumptions, so I can’t ensure.

Assuming I’m not misunderstanding the software(s)–and that, regardless of the appreciable impedance mismatch between them, I’m certainly evaluating apples to apples–there is a crucial perception right here. It’s that retirement calculators are imperfect instruments, and that none can predict the longer term with absolute certainty. Even the greatest software can do no higher than mannequin an unsure future.

This final level is a crucial one. It ought to remind us that retirement calculators aren’t set-it-and-forget-it instruments.

If a retirement calculator says I’ve only a 45% probability of dwelling to 100 with out working out of cash, you’ll be able to wager I’ll be working the numbers once more subsequent yr, and the yr after that; then evaluating the forecasts to actuality and refining my assumptions accordingly.

Darrow and Chris have explored the subject of retirement calculator accuracy for years. For a visit down that rabbit gap, take a look into the curated listing right here (sorted latest to oldest).

NewRetirement Pricing

Earlier than taking the plunge on PlannerPlus, take NewRetirement Primary for a spin. For those who like what you see, then take into account an improve. The Primary version is, in fact, free. A PlannerPlus subscription will set you again $120/yr ($10/month), billed yearly.

NewRetirement provides a 3rd choice–NewRetirement Advisors–for $1,650/yr ($137.50/month). NewRetirement Advisors provides you entry to fee-for-service, complete retirement planning with a Licensed Monetary Planner (CFP), who will act in your greatest curiosity as a fiduciary.

For those who determine to buy a subscription, think about using the hyperlink right here. It should assist me, Chris and Darrow cowl the prices of sustaining the weblog, and contribute to our effort to dial again adverts on the location.

Bonus Options

PlannerPlus is chock stuffed with options I didn’t cowl within the Constancy comparability, however that however advantage a point out.

Insights

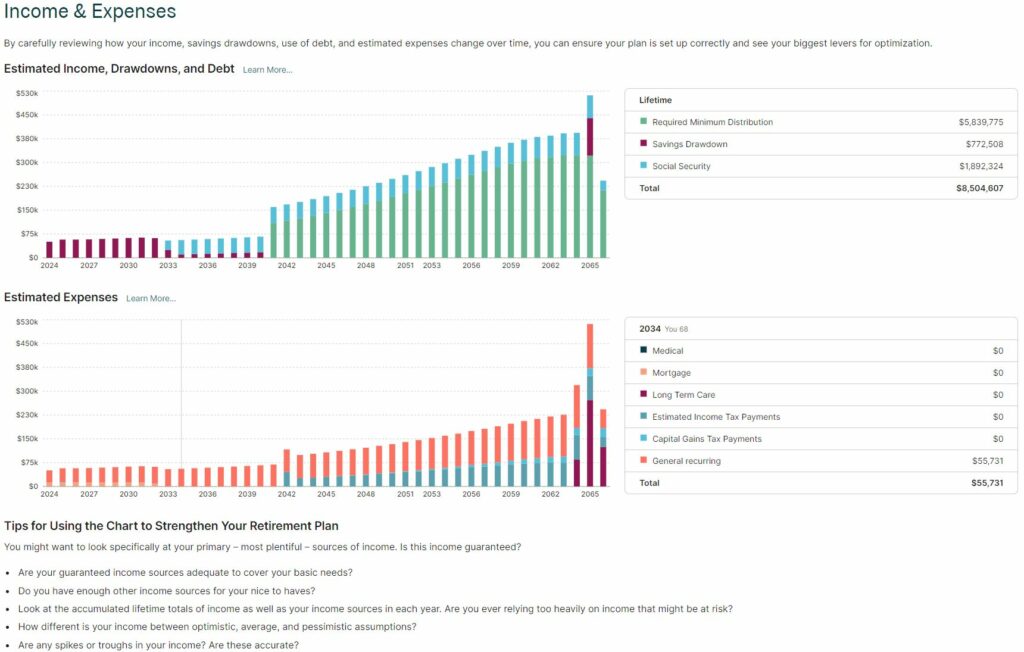

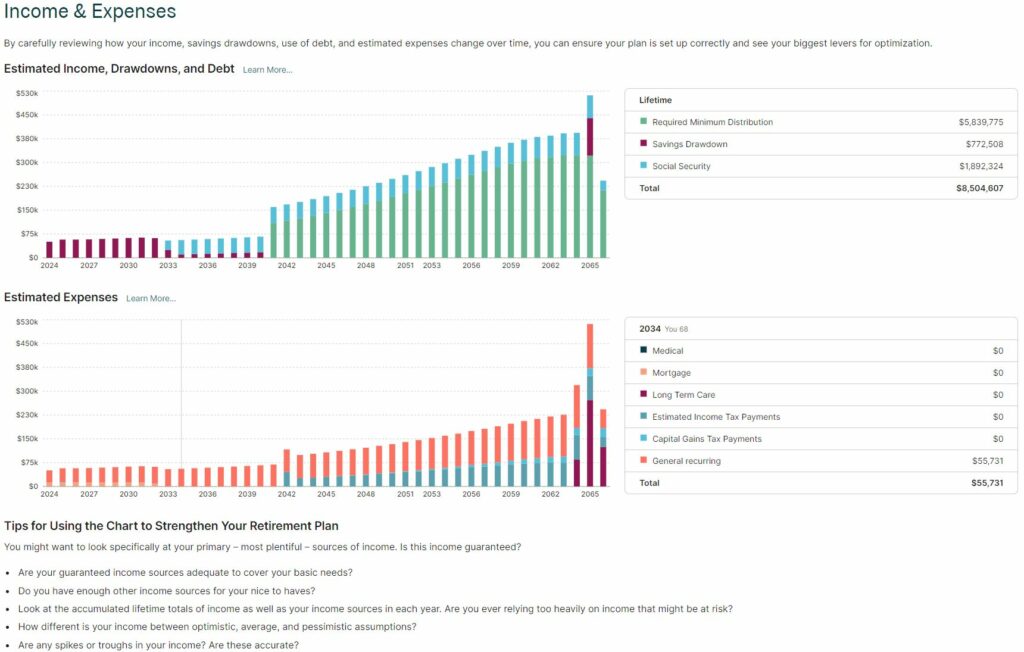

One among these is the Insights sidebar, which helps you to zoom in on myriad subjects reminiscent of web price, money stream, earnings, bills, financial savings, Medicare, taxes and lots of extra.

Every matter comprises an in depth, individually tailor-made evaluation based mostly in your inputs, and encompasses a wealthy set of charts and graphs that can assist you visualize these insights.

Right here is however one instance–the Earnings & Bills perception–to whet your urge for food:

Explorers

There’s additionally an Explorers sidebar, the place you’ll be able to run Monte Carlo evaluation in your portfolios, various parameters reminiscent of market returns, normal inflation, medical inflation and wage progress.

You can even attempt varied what-if eventualities, reminiscent of various your funding returns by a single share level, or exploring the impression of dwelling 5 years longer than anticipated. You may even discover social safety and Roth conversion eventualities.

Coach Recommendations

Lastly, there’s a Coach Recommendations sidebar. This characteristic takes a holistic view of the present state of your plan, figuring out potential bother spots and/or alternatives, and provides strategies for the way you would possibly tackle them.

Nitpicks

Though I’m fully offered on the PlannerPlus expertise, I’ll point out a few nitpicks.

First, PlannerPlus expresses all greenback figures in inflation-adjusted, or future {dollars} (Constancy’s software means that you can toggle between current and future {dollars}). This has the impact of biasing me to the upside when taking a look at forecasts, notably those who stretch far into the longer term.

My mind thinks in current {dollars}. I’d relatively not do the psychological conversion from future to current {dollars} each time I ponder a forecast.

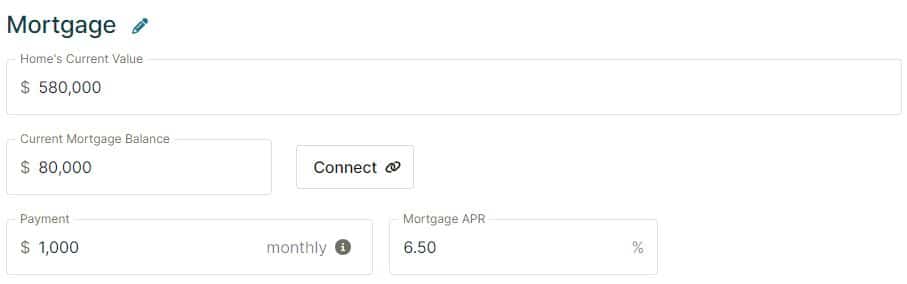

Second, for those who’re not cautious, PlannerPlus will overstate the fairness in your house. Within the knowledge entry display for Housing, it asks you to enter your private home’s present market worth. It subtracts your mortgage stability (if any), and calls the distinction your whole dwelling fairness.

After all, for those who promote your own home you’ll doubtless need to pay anyplace from 6% to 10% of its market worth in dealer charges and enhancements. You probably have an costly home, this may cut back the precise worth of your private home fairness by a substantial quantity. For those who don’t account for this, the overstatement shall be mirrored in PlannerPlus’ projected web price estimate.

This drawback is well remedied by discounting the market worth of your private home by 6% to 10%, and coming into that quantity as a substitute, within the Residence’s Present Worth entry.

Lastly, I needed to make use of the providers of a third celebration software–PortfolioVisualizer–to generate believable extremes for my optimistic and pessimistic portfolio return assumptions. It might be good if PlannerPlus built-in such a software into its personal calculator.

Maybe NewRetirement already plans so as to add this characteristic. Contemplating the variety of enhancements which have appeared within the three years since I first used PlannerPlus, I’d not be shocked to see it flip up in a future launch.

Programming Word

On the conclusion of final month’s submit, Ought to You Pay Off Your Mortgage?, I discussed that it could not be doable for me to learn and reply to your feedback. I used to be rafting the Colorado River within the Grand Canyon the week that submit was printed.

Having since learn these feedback, and spending a great deal of time ruminating on them, I’m now critically rethinking my determination not to repay my mortgage. Thanks a lot in your insights, a lot of which I had not beforehand thought of.

I’ll be in the identical church, however a unique pew, this month. I shall be mountaineering within the magnificent hills of Pink Rock Nationwide Conservation Space west of Las Vegas.

As ever, please don’t let this discourage you from leaving a remark, and/or conversing amongst yourselves. These aren’t solely priceless to me (see above), however little question different readers as effectively.

* * *

Helpful Sources

- The Finest Retirement Calculators might help you carry out detailed retirement simulations together with modeling withdrawal methods, federal and state earnings taxes, healthcare bills, and extra. Can I Retire But? companions with two of the very best.

- Free Journey or Money Again with bank card rewards and enroll bonuses.

- Monitor Your Funding Portfolio

- Join a free Empower account to realize entry to trace your asset allocation, funding efficiency, particular person account balances, web price, money stream, and funding bills.

- Our Books

* * *

[I’m David Champion. I retired from a career in software development in March 2019, just shy of my 53rd birthday. To position myself for 40+ years of worry-free retirement, I consumed all manner of early-retirement resources. Notable among these was CanIRetireYet, whose newsletters I have received in my inbox every Monday morning for the last ten years. CanIRetireYet is one of exactly two personal finance newsletters I subscribe to. Why? Because of the practical, no-nonsense advice I find here. I attribute my financial success in no small part to what I have learned from Darrow and Chris. In sharing some of my own observations on the early-retirement journey, I aim to maintain the high standard of value readers of CanIRetireYet have come to expect.]

* * *

Disclosure: Can I Retire But? has partnered with CardRatings for our protection of bank card merchandise. Can I Retire But? and CardRatings might obtain a fee from card issuers. Some or all the card provides that seem on the web site are from advertisers. Compensation might impression on how and the place card merchandise seem on the location. The location doesn’t embrace all card corporations or all obtainable card provides. Different hyperlinks on this web site, just like the Amazon, NewRetirement, Pralana, and Private Capital hyperlinks are additionally affiliate hyperlinks. As an affiliate we earn from qualifying purchases. For those who click on on one among these hyperlinks and purchase from the affiliated firm, then we obtain some compensation. The earnings helps to maintain this weblog going. Affiliate hyperlinks don’t improve your value, and we solely use them for services or products that we’re accustomed to and that we really feel might ship worth to you. In contrast, we have now restricted management over many of the show adverts on this web site. Although we do try to dam objectionable content material. Purchaser beware.